DIpil Das

[caption id="attachment_86769" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

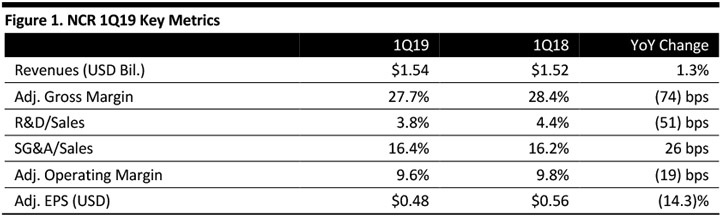

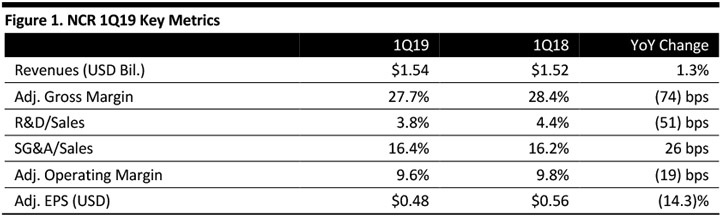

NCR reported 1Q19 revenues of $1.54 billion, up 1.3% and slightly ahead of the consensus estimate. Foreign currency hurt revenues by 3%. Recurring revenue increased 6% year over year.

The decline in the gross margin was primarily due to decreases in Retail and Hospitality revenue, partially offset by an increase in the Banking segment.

Adjusted EPS was $0.48, down 14.3% and in line with the consensus estimate.

Adjusted EBITDA was $218 million flat with $217 million in the year-ago quarter.

Results by Segment

By Vertical:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

NCR reported 1Q19 revenues of $1.54 billion, up 1.3% and slightly ahead of the consensus estimate. Foreign currency hurt revenues by 3%. Recurring revenue increased 6% year over year.

The decline in the gross margin was primarily due to decreases in Retail and Hospitality revenue, partially offset by an increase in the Banking segment.

Adjusted EPS was $0.48, down 14.3% and in line with the consensus estimate.

Adjusted EBITDA was $218 million flat with $217 million in the year-ago quarter.

Results by Segment

By Vertical:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

NCR reported 1Q19 revenues of $1.54 billion, up 1.3% and slightly ahead of the consensus estimate. Foreign currency hurt revenues by 3%. Recurring revenue increased 6% year over year.

The decline in the gross margin was primarily due to decreases in Retail and Hospitality revenue, partially offset by an increase in the Banking segment.

Adjusted EPS was $0.48, down 14.3% and in line with the consensus estimate.

Adjusted EBITDA was $218 million flat with $217 million in the year-ago quarter.

Results by Segment

By Vertical:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

NCR reported 1Q19 revenues of $1.54 billion, up 1.3% and slightly ahead of the consensus estimate. Foreign currency hurt revenues by 3%. Recurring revenue increased 6% year over year.

The decline in the gross margin was primarily due to decreases in Retail and Hospitality revenue, partially offset by an increase in the Banking segment.

Adjusted EPS was $0.48, down 14.3% and in line with the consensus estimate.

Adjusted EBITDA was $218 million flat with $217 million in the year-ago quarter.

Results by Segment

By Vertical:

- Banking revenues were $758 million, up 5.1% due to 21% growth in ATM revenue driven by high backlog conversion. Revenue growth was strong in North America, and currency hurt revenues by 4%.

- Retail revenues were $511 million, down 1.9% due to a difficult comparison with a large service implementation project in the year-ago quarter, somewhat offset by higher revenue from payment processing and strong self-checkout revenue. Currency hurt revenues by 3%.

- Hospitality revenues were $193 million, down 5.4% due to lower hardware revenue, partially offset by higher cloud and payment revenue. Currency hurt revenues by 1%. Within the segment,

- Software revenues were $467 million, up 1.5% as reported and up 3% at constant currency due to a more favorable mix of cloud and payment revenue.

- Service revenues were $585 million, down 2.7% as reported and up 1% at constant currency due to higher recurring revenue offset by the large implementation services project in the year-ago quarter.

- Hardware revenues were $484 million, up 6.1% as reported and up 9% at constant currency, driven by 21% growth in ATM revenue, partially offset by a 5.0% decline in SCO/POS (self-checkout/point of sale).

- Digital-first banking

- Digital-first restaurant

- Digital-first retail

- Digital connected services

- Digital convenience and fuel

- Digital small-business essentials

- Service transformation—Including a service performance and productivity initiative to drive revenue and margin expansion.

- Hardware network—Manufacturing transformation initiatives are largely complete, and the company is on track to reduce gross loss by more than 50% versus 2018, with an improved price and mix.

- Spend optimization—The company is on track to achieve $100 million in savings, which will offset higher real estate and personal costs. About 80% of the targeted actions have been completed.

- 1%-2% revenue growth, to approximately $6.5 billion.

- Adjusted EPS of $2.75-$2.85 (up 5%-9%), in line with the $2.81 consensus estimate.

- Adjusted EBITDA of $1.04-$1.08 billion (up 9%-13%).

- Delivering profitable growth.

- Shifting the revenue mix towards software, services and recurring revenue.

- Allocating capital to the highest-growth and return opportunities.

- Driving the generation of cash flow.