DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

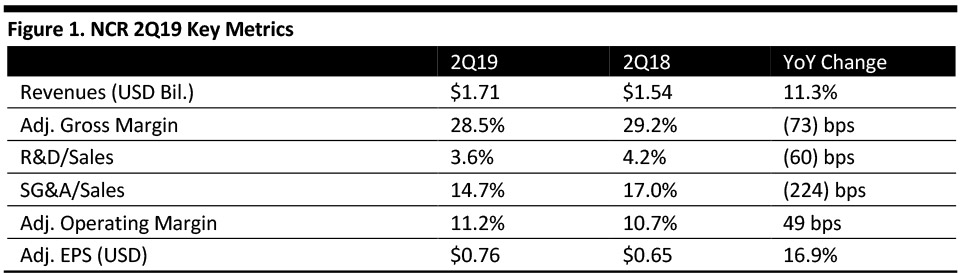

NCR reported 2Q19 revenues of $1.71 billion, up 11.3% and ahead of the $1.58 billion consensus estimate. Foreign currency hurt revenues by 3%.

The decline in adjusted gross margin was primarily due to product mix with an increase in hardware revenue.

Adjusted EPS was $0.76, up 16.9% and beating the $0.67 consensus estimate. GAAP EPS was $0.58, compared to $(1.33) in the year-ago quarter.

Adjusted EBITDA was $263 million, up from $235 million in the year-ago quarter.

Management characterized performance in the quarter as led by the banking segment, driven by strong ATM revenue growth. Management’s focus remains directed on prioritizing investment in strategic growth platforms, advancing the rollout of the integrated payments platform and pursuing targeted acquisitions as part of its digital first and recurring revenue strategy.

Results by Segment By vertical:- Banking revenues were $868 million, up 19.7%, driven by ATM hardware revenue growth of 78% in constant currency and related software and services revenue growth.

- Retail revenues were $558 million, up 3.9%, driven by payments, self-checkout and services revenue.

- Hospitality revenues were $202 million, up 2.0%, driven by increases in cloud and payment revenue.

- Software revenues were $496 million, up 5.5% as reported and 7% in constant currency due to higher ATM-related software revenue plus an increase in cloud and payment revenue.

- Service revenues were $622 million, up 2.0% as reported and up 5% in constant currency due to higher recurring revenue.

- Hardware revenues were $592 million, up 29.5% as reported and up 33% in constant currency, driven by 78% growth in ATM revenue in constant currency and 3% growth in SCO/POS (self-checkout/point of sale) revenue in constant currency.

Details from the Quarter

NCR is targeting six strategic growth platforms to shift towards higher-margin software and services revenue and accelerate growth. These platforms are:

- Digital first banking: Continues to see improved organic growth. The company recently shifted eight products from perpetual licensing to recurring, continuing the journey to becoming a recurring software and services-led company. NCR also acquired D3 Technology earlier this month, which extends the reach of its digital banking solutions.

- Digital first restaurant: NCR recently launched Aloha Essentials, which bundles software, services, hardware and payment and has received positive customer feedback. The company has also been making steady progress migrating Aloha to the cloud, with general availability targeted for early next year.

- Digital first retail: Emerald, the company’s next generation cloud-based retail point-of-sale solution, is currently in pilot testing and on track for general availability later this year. NCR believes it includes all the essentials required to run a grocery retail environment, including point-of-sale, loyalty, payments and a frictionless shopping component.

- Digital connected services: NCR continues to expand its customer base. A top US bank recently selected NCR's digital connected services capability for multivendor service for the bank's fleet of more than 12,000 ATMs. The digital connected services include a portfolio of managed and support services that will help the bank reduce total cost of ownership, drive higher ATM availability and enhance the customer experience.

- Digital convenience and fuel: The company has created a package that bundles software, services and manages the hiring process needed to run a convenience and fuel retail chain.

- Digital small-business essentials: The company launched NCR Silver 1, an all-in-one point-of-sale solution that integrates payment processing with NCR Silver in a monthly subscription package.

Implications for Retail

NCR is innovating its product offerings for retail, with several key new product platforms for retail currently in the pipeline: Aloha Essentials for restaurants, its Emerald product for grocery and the new fuel station product. The company’s segment is benefiting from current retail trends such as payments and self-checkout, and NCR is reigniting growth by focusing on services and recurring revenue.

Outlook

NCR raised 2019 revenue guidance to up 3-4% from 1-2% previously.

The company reaffirmed 2019 earnings guidance:

- Adjusted EPS of $2.75-2.85 (up 5-9%).

- Adjusted EBITDA of $1.04-1.08 billion (up 9-13%).