Highlights from NACS Convenience Summit Europe 2018

The Coresight Research team attended day one of the NACS Convenience Summit Europe 2018 on June 6.The conference focuses on the global convenience and fuel retail industry and is taking place in LondonJune6–8. Coresight Research Analyst Filippo Battaini opened the general session on the first day of the conference with a presentation on how technology will impact the future of c-stores.

Below are our key takeaways from day one of the event.

1. Battaini said that technology will play a key role in the future of c-stores.In digitalized stores, human employees will be assisted by computer vision and AI designed to enhance the shopping experience—but human interaction will remain important. Battaini said that retailers and manufacturers of fast-moving consumer goods (FMCGs) will use unstaffed, automated c-stores to complement, rather than replace, staffed c-stores as part of their multichannel strategies. He also expects more retailers to use unstaffed c-stores to reach under served areas with lower traffic, where the cost of running a staffed c-store would be economically unviable.

2. Jan-Willem Dockheer, General Manager at Dutch c-store retailer Albert Heijn to Go (AH to Go), talked about the innovation strategies the company is adopting. C-stores need to meet the expectations of an increasingly curious, demanding and impatient consumer base, Dockheer said. AH to Go is not classifying shoppers in target groups, but as individuals, he said, and the company aims to target shoppers with a personalized approach.

Dockheer also noted that c-stores are increasingly turning into food-service locations where shoppers eat meals.He said that AH to Go uses technology—for instance, digital screens showing different meal options depending on the time of the day—to help adapt stores throughout the day. The screens provide different looks for breakfast, lunch and dinner times.

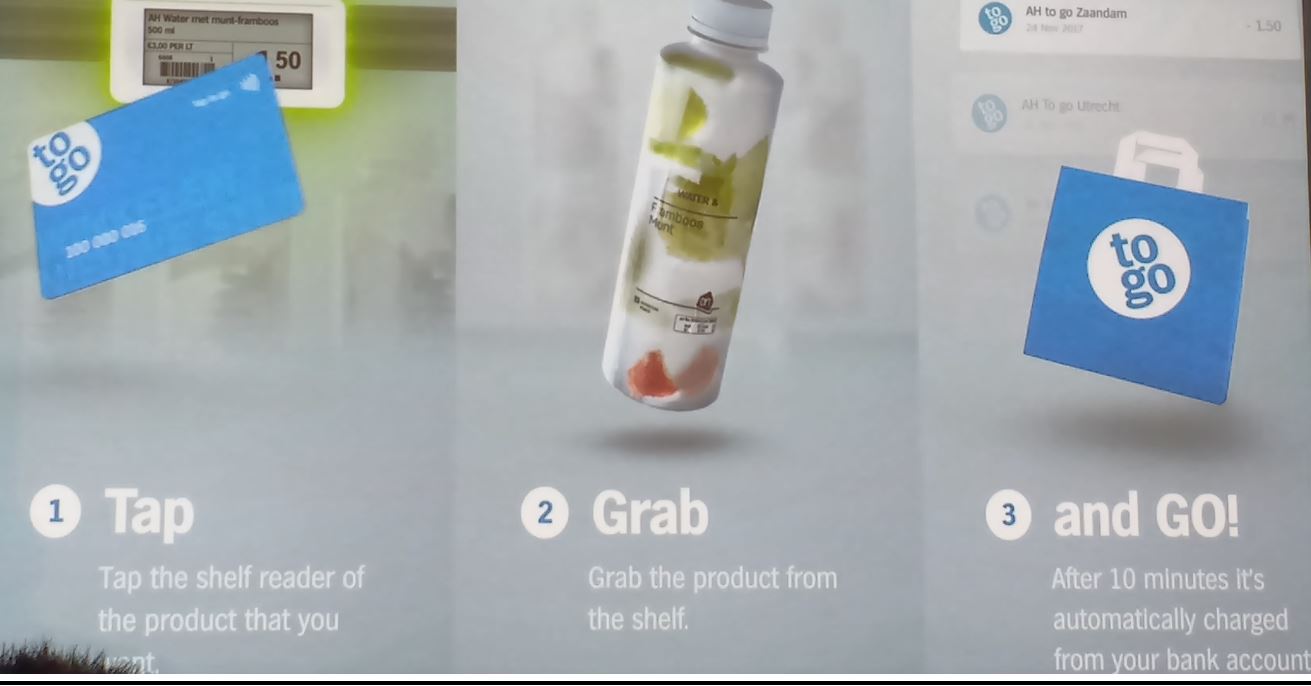

Presentation showing AH to Go’s Tap to Go in-store payment system

Source: Coresight Research

Presentation showing AH to Go’s Tap to Go in-store payment system

Source: Coresight Research

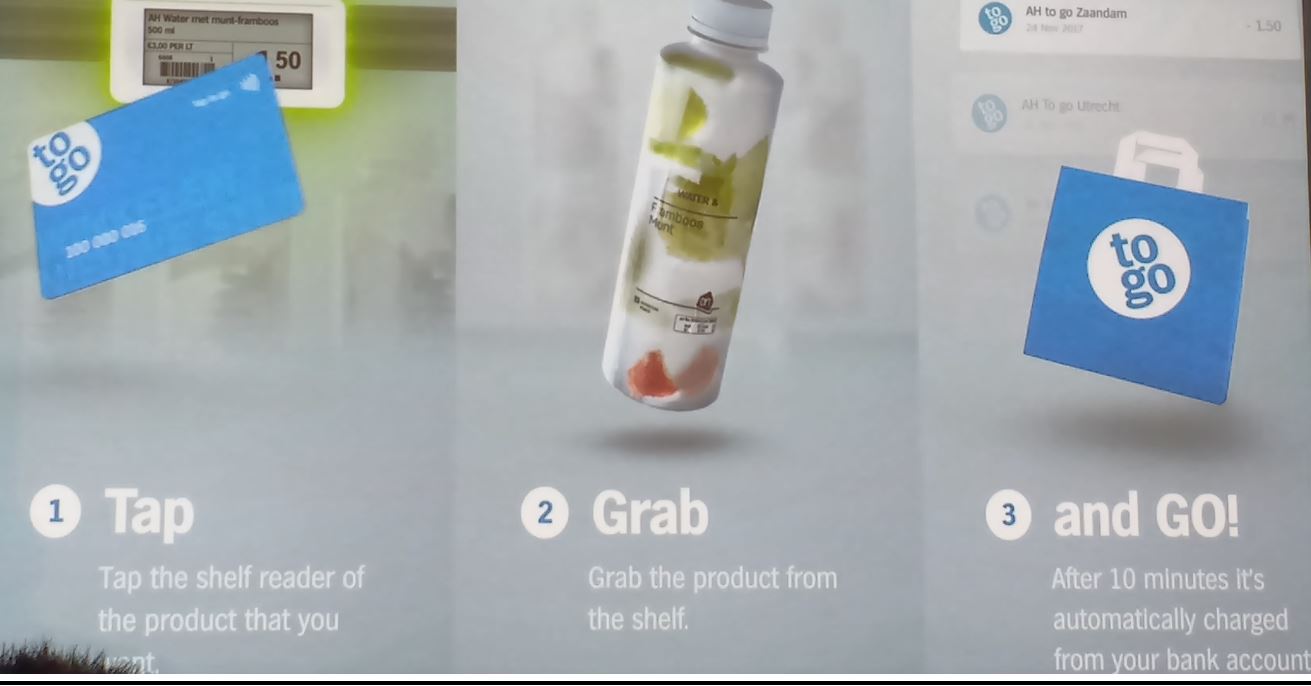

AH to Go’s management thinks that new technologies should be adopted to help improve the shopper journey. The retailer developed its strategy based on the idea that the c-store customer wants speed.According to the company, 30% of visitors to c-stores located in public transportation hubs have only two minutes for shopping. To better serve these rushed consumers, AH to Go has developed “Tap to Go,”a new, faster payment system.Shoppers tap an electronic card or an app on their phone on a product’s electronic shelf label to pay for the item without having to scan it at the checkout. The technology has been tested at an AH to Go store located in the support office of Ahold Delhaize in in Zaandam, Netherlands (Ahold Delhaize is AH to Go’s parent organization). Tap to Go will be rolled out to other AH to Go stores in the Netherlands in June 2018.

AH to Go has also replaced staffed checkouts with self-checkouts, and 75% of in-store transactions are currently self-made by customers without staff intervention. Finally, Dockheer mentioned how technology helps c-stores focus on expanding their fresh food offerings and become more sustainable. For example, smart product price tags can be used to detect when a fresh product is near its expiration and can automatically adjust the price to encourage purchase.

3. Boris Planer, Chief Economist at research firm Planet Retail, talked through the economic and demographic factors that shape the c-store market in Europe. An aging population, smaller homes, lower car ownership rates and increasing urbanization are all factors driving the need for convenience and proximity, which favors c-store retailing, he said. Shopping habits have changed and, so, too, have consumer expectations. For example, consumers expect a speedy visit and options such as mobile payment when shopping in c-stores. Planer also noted that the weaker outlook in the grocery market in Europe versus other world regions encourages retailers to find alternative drivers for revenue growth beyond grocery retailing. He said that retailers can provide experiences and social spaces in stores, for instance, by enhancing their food-service offering.

4. Mike Watkins, Head of Retailer and Business Insight at market research firm Nielsen, provided a macro overview of the retail landscape in Western Europe. Europe’s consumer confidence is the lowest worldwide, Watkins said, but the good news is that FMCG sales are projected to outgrow GDP in most European markets. In terms of the competitive environment in European retailing, the growth of discounters presents a threat to c-stores, he said.Discounters compete with c-stores by providing proximity shopping, and they contribute to the growth of private labels, whereas c-stores still rely extensively on brand promotion as a driver for growth. Watkins said that shopper behavior is changing as consumers visit stores more often, and that this trend favors c-stores. To ensure future growth, c-stores should focus on fresh food,he said, noting that fresh food overtook tobacco in 2017 as the channel’s largest category, accounting for 19% of total sales. Fresh food is also one of the fastest-growing categories in the channel, with 5% growth last year.

5. Gray Taylor, Executive Director at nonprofit organization Conexxus, shared some interesting insights on technology. Taylor said that we are in “Retail 4.0,” a stage of retail technology development characterized by information and personalization. The key technologies in Retail 4.0 are big data, the Internet of Things (IoT) and AI. The IoT exponentially boosts data availability and collection, and AI helps retailers make use of the data. From the consumer’s perspective, AI is a technology that can reduce friction in the shopping experience. Taylor said that, according to research from Oxford University and Yale University,there is a 50% probability that AI will be sophisticated enough to completely replace human sales associates by 2030 and a 100% probability that this will be possible by 2048.

Presentation showing AH to Go’s Tap to Go in-store payment system

Source: Coresight Research

Presentation showing AH to Go’s Tap to Go in-store payment system

Source: Coresight Research