DIpil Das

[caption id="attachment_89031" align="aligncenter" width="720"] All figures are statutory

All figures are statutory

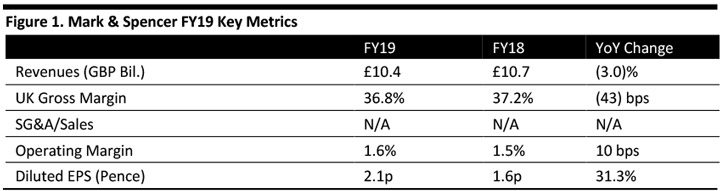

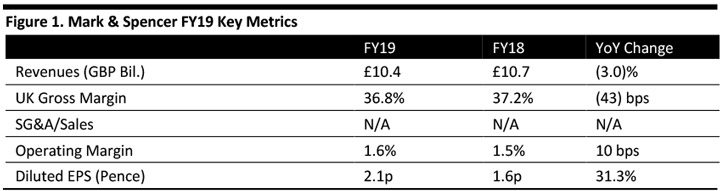

Source: Company reports/Coresight Research [/caption] FY19 Results Mark & Spencer reported FY19 results with sales in line with consensus estimates while adjusted EPS was ahead of the consensus. The highlights are as follows:

All figures are statutory

All figures are statutory Source: Company reports/Coresight Research [/caption] FY19 Results Mark & Spencer reported FY19 results with sales in line with consensus estimates while adjusted EPS was ahead of the consensus. The highlights are as follows:

- Mark & Spencer’s sales declined 3% to £10.4 billion, roughly in-line with the consensus estimate by StreetAccount.

- UK gross margin contracted 43 basis points (bps) year over year to 36.8%.

- Operating margin expanded 10 bps year over year to 1.6%. Stripping out one-off costs, the operating margin contracted 48 bps to 5.8%. One-off expenses of £438.6 million included a charge of £222.1 million related to accelerated depreciation, impairment of assets and other closure costs pertaining to its UK store closure program.

- The company reported statutory pretax profit of £84.6 million, up 26.6% year over year. Stripping out one-off costs, pretax profit came in at £523.2 million, down 9.9% year over year.

- The company reported diluted EPS of 2.1 pence, up 31.3% year over year, mainly due to lower one-off expenses in the current year. After adjusting for one-offs, diluted EPS was down 8.6% year over year to 25.4 pence, beating the consensus estimate of 24.8 pence.

- In food, revenues fell 0.6% year over year to £5.9 billion. Comparable sales fell 2.3%. the revenue decline reflected the effects of price investment and a change in product mix as the company reduced promotions. However, during the second half, M&S saw an improving trend with volumes up 1.8% in the fourth quarter, adjusted for Easter. Gross margin was down 15 bps year over year at 31.1%, ahead of the consensus of 33 bps.

- In clothing & home, revenues fell 3.6% year over year to £3.54 billion due to the store closure program. Same-store sales fell 1.6%. Discounted sales decreased as a result of the planned reduction in stock-into-sale. UK clothing & home online revenue grew 9.8%, faster than the broader clothing market, with strong growth in womenswear, as the company made improvements to its website and delivery proposition and focused on key categories. Gross margin expanded 20 bps to 57.1%, below the consensus of 35 bps expansion recorded by StreetAccount.

- Total UK sales fell 1.8% year over year to £9.44 billion. UK comparable sales fell 2.0%.

- International sales fell 13.9% year over year to £936.6 million.

- The company’s 4Q19 revenue declined 1.6% at constant currency, compared to a 3.9% decline in the previous quarter, due to the increasing pace of closures in its UK store estate and the negative impact of Easter timing on comps of about 1.9% in food and close to 0.4% in clothing & home.

- In UK food, comparable sales fell 1.5%, compared to a 2.1% decline in the previous quarter but ahead of the consensus estimate of a 3% decline. Total UK Food revenues declined 0.8%.

- In UK clothing and home, comparable sales fell 1.3%, compared to a 2.4% decline in the previous quarter and below the consensus of a 1.1% revenue decline. Total UK clothing and home revenues declined 3.9% year over year, compared to a 4.8% decline in the previous quarter.

- Total UK sales fell 1.9% year over year, compared to a 2.7% decline in the previous quarter. Comparable sales fell 1.4%, compared to a 2.2% decline in the previous quarter.

- International revenue grew 1.8%, and revenue at M&S.com grew 0.2%, reflecting planned reductions in promotional activity in its Ffod business, with solid underlying growth in clothing orders.

We are deep into the first phase of our transformation program and continue to make good progress restoring the basics and fixing many of the legacy issues we face. Whilst there are green shoots, we have not been consistent in our delivery in a number of areas of the business. M&S is changing faster than at any time in my career — substantial changes across the business to our processes, ranges and operations and this has constrained this year’s performance, particularly in clothing & home. However, we remain on track with our transformation and are now well on the road to making M&S special again.

Management noted following:- In November 2016, the group launched a strategic program to transform the UK store estate. During fiscal 2018, the group announced it will expand this program to grow the online share of sales, as well as optimize store presence through store closure, relocation and opening of new stores.

- The objective is to create a profitable, growing family of businesses within three to five years. The first phase of the program is to restore the basics: getting the organisation and infrastructure of the business fit for the future and address operating weaknesses.

- In the food segment, the company’s strategy is to protect the brand, driven by its unique quality, freshness, and innovation while also reshaping the store estate, infrastructure, operating systems, cost management and supply relationships.

- The company looks to reshape its ranges and customer profile in clothing & home; M&S noted that the size ratios have been historically not in line with the profile of the contemporary family age it targets. However, M&S has introduced slimmer fits and more mid sizes, and has received strong response from customers. With the new ranges, M&S will aim to shift to a ‘first price, right price’ trading philosophy, and decrease the percentage of clothing & home sold at discount.

- In the digital space, improvements in site speed, a redesigned homepage, enhanced product imagery, a simpler check-out and an improved delivery proposition have together contributed to over nine percent improvement in the conversion of website traffic to customer purchases. Online accounted for about 22% of UK clothing and home revenue compared with 19% last year.

- The company hopes to boost its international business. During the fiscal year, M&S implemented the ‘market-right pricing’ program across markets in clothing & home. The program’s cumulative performance since implementation has improved sales 8% and volumes 20%, following a net 10% reduction in selling prices. In the year, M&S opened 37 stores and modernised a further 56. M&S continues to localise its ranges.

- UK store portfolio reshaping is on track: The company closed 26 full-line stores and opened 48 new stores in fiscal 2019. M&S expanded the program and initiated larger store redevelopment planning. It expects to close a further 85 full-line stores and 25 Simply Food stores as a part of its strategic retail space transformation program.

- M&S plans to reshape the store portfolio by tackling legacy issues, opening new full-line stores as well as food stores. As part of its food strategy, it will concentrate on higher volume stores with good access and parking. M&S also plans to relocate or rationalise low-volume, higher cost Simply Food stores, mostly on short-leases.

- M&S delivered cost savings of £100 million, in addition to the operating cost savings from the stores which have been closed. By fiscal 2021, M&S plans for cost savings of £350 million.

- M&S announced a joint venture (JV) with Ocado on February 2019 to drive the growth in food.

- Under the JV, M&S will acquire a 50% share of Ocado’s UK retail business, which will be supported by Ocado technology, for an initial consideration of £562.5 million and deferred consideration of up to £187.5 million, plus interest.

- The Ocado JV is expected to be recognised by M&S as an associate applying the equity method of accounting, reflecting the significant influence that M&S will have over the entity.

- M&S estimates synergies for M&S of at least £70 million by the third full financial year following completion through increased buying scale, and improved efficiencies on new product development.

- In food, M&S expects net store closures to reduce sales by about 1% as the accelerated store closure program is not fully offset by new Simply Food and full-line stores. It expects gross margin to change by (25) bps to 25 bps.

- In clothing & home, M&S expects net store closures to reduce sales by about 3%, and gross margin to change by (25) bps to 25 bps.

- It expects UK operating costs to decrease by about 1%, led by continued cost efficiencies, store closures and lower depreciation.

- M&S plans for higher capital expenditure in the range of £350 million and £400 million, due to increased investment in store environment, new store trials and C&H logistics capacity.