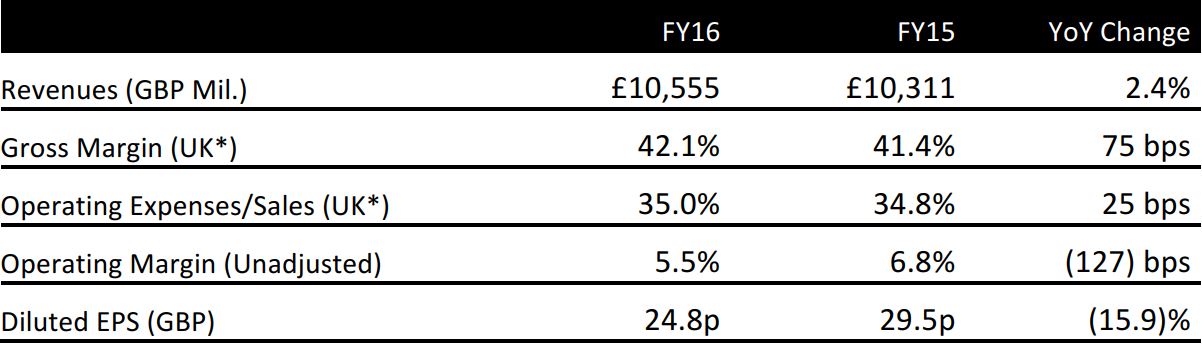

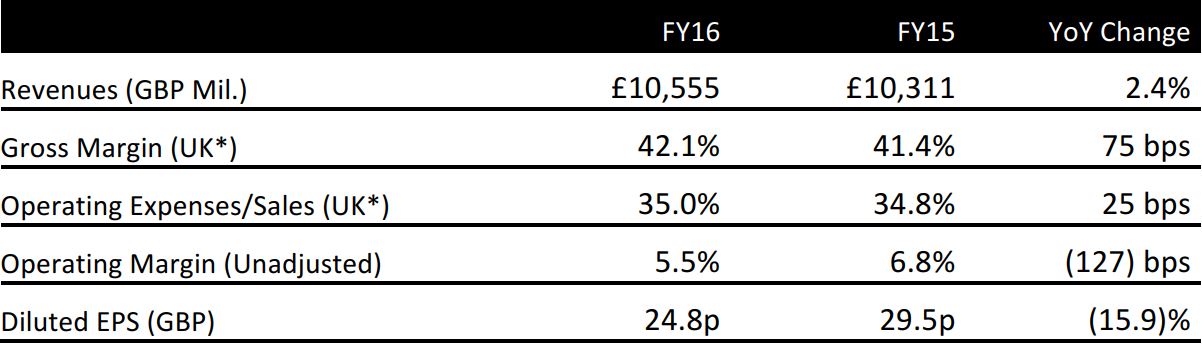

FY16 was 53 weeks ended April 2, 2016; FY15 was 52 weeks ended March 26, 2015.

*Gross profit and SG&A are not disclosed at group level.

Source: Company reports/Fung Global Retail & Technology

FY16 RESULTS

UK clothing-and-food giant M&S reported total revenue growth of 2.4% for the 53 weeks ended April 2, 2016. Group revenues of £10,555 million beat the consensus estimate of £10,393 million recorded by S&P Capital IQ. On a 52-week basis, group revenue crept up by 0.8%.

The UK gross margin grew by 75 basis points, helped by a gain of 245basispoints in the Clothing and Home gross margin, which was a result of sourcing initiatives. Gross margin in the Food segment was flat. However, operating margins contracted due to mis-selling provisions for M&S Bank, one-off impairments within the International segment, UK store review costs and IT asset write-offs. As a result, net profit fell by 16% and diluted EPS fell by 15.9%.Net profit and EPS both missed consensus; diluted EPS of 24.8 pence missed the consensus estimate of 30 pence.

On an underlying basis and in terms of comparable 52-week periods, M&S grew operating profit by 2.0% and basic EPS by 5.1%.

SEGMENT PERFORMANCE

FY16 sales growth was weak at best across all segments. On a 52-week basis:

- UK Food comps were up 0.2%.

- UK Clothing and Home comps were down 2.9%.

- Total UK comps were down 1.1%.

- International sales were up 1.3% at constant currency.

- Total online sales (which are accounted for within the segments noted above) were up 23.4%.

NEW CEO’S STRATEGY

Steve Rowe took the reins of M&S at the start of April. The previous CEO, Mark Bolland, had struggled to drive top-line growth in the UK Clothing division, although he oversaw a period of robust growth in Food and bolstered gross margins in apparel.

In today’s update, Rowe outlined key planks of his strategy to grow sales in UK Clothing:

- Everyday lower prices and fewer promotions.

- Better product availability and more in-store staff.

- Making M&S easier to shop, with fewer ranges and improved in-store merchandising.

- A focus on “unrivaled quality through fabric, fit and finish.”

- A renewed emphasis on “wearable contemporary style” and “wardrobe essentials” versus chasing fashions.

A number of these elements—notably the focus on stylish everyday essentials and improved quality—play to M&S’s heritage. We think sharpening prices is long overdue, and that M&S has been undercompetitive on pricing for some time: too few of the cost savings made by greater direct sourcing under the previous CEO found their way to the price tags on products.

Rowe said the company will address the issue of its UK store estate and its international presence in the autumn. Some commentators have suggested that M&S has too many UK stores. We argue that a greater problem is that M&S’s UK full-range stores are too large, and that its clothing ranges have too often expanded to fill the space available, at the expense of desirability.

OUTLOOK

M&S said it expects to see “a similar sales trend” in FY17 to that seen in FY16. It expects Clothing and Home gross margins to grow by around 50–100 basis points, which is much lower than the 245-basis-point gain the division saw in FY16 (and which took the segment’s gross margin to 55.1%). Clothing and Home gross margins will be bolstered by increased direct sourcing, but the company expects a currency headwind of around 70 basis points in FY17. Operating costs are expected to rise by 3.5%. Rowe said that investment in lower prices “will have an adverse effect on profit in the short term,” which prompted M&S’s share price to fall sharply after this morning’s announcement.

Food gross margin is expected to remain level withFY16’s 32.8%.