Nitheesh NH

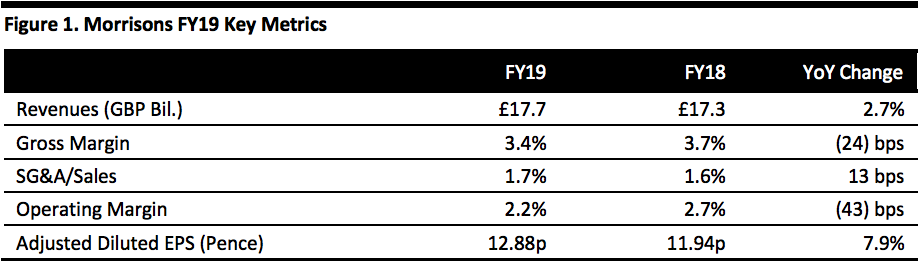

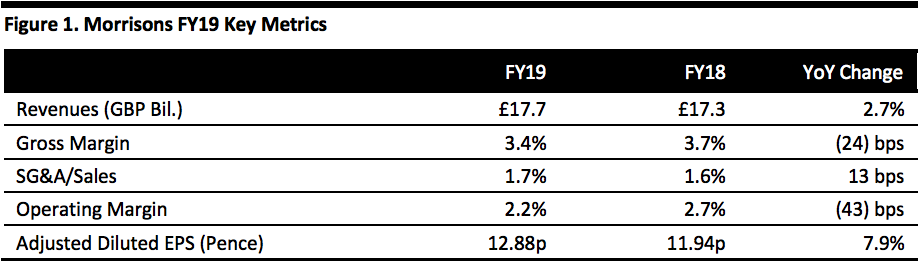

[caption id="attachment_80291" align="aligncenter" width="620"] Source: Company reports/Coresight Research[/caption]

FY19 Results

Morrisons reported FY19 results with both top-line and EPS slightly missing the consensus but otherwise showing strong growth. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Morrisons reported FY19 results with both top-line and EPS slightly missing the consensus but otherwise showing strong growth. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Morrisons reported FY19 results with both top-line and EPS slightly missing the consensus but otherwise showing strong growth. The highlights are as follows:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Morrisons reported FY19 results with both top-line and EPS slightly missing the consensus but otherwise showing strong growth. The highlights are as follows:

- Morrisons grew total sales 2.7% year over year to £7 billion (growth was 4.7% on 52-week basis after adjusting for previous year’s 53 week). The 52-week ex-fuel revenue growth was 5.1%.

- The company grew same-store sales 4.8% year over year ex fuel and VAT, ahead of consensus of 4.5%, retail and wholesale contributing 1.5% and 3.3%, respectively.

- The gross margin contracted 24 basis points (bps) year over year to 3.4%.

- Operating margin contracted 43 bps year over year to 2.2%.

- The company reported diluted EPS of 10.11 pence, down 22.4% year over year. After adjusting for exceptional items, diluted EPS was 12.88 pence, up 7.9% year over year but below the consensus of 13.1 pence recorded by StreetAccount.

- Major exceptional items include costs associated with the early repayment of borrowing facilities and other refinancing activities (£33 million), costs associated with closing pension plans (£19 million), increased stock provisioning (£28 million) and a one-off costs associated with improvements to the group’s distribution network (£12 million).

- The company noted its annualised wholesale supply sales were £700 million in 2018, ahead of initial guidance.

- The company highlighted the original disposal program was achieved with disposal proceeds of £22 million in the current year (compared to £108 million in 2017), bringing the total to £1.02 billion since the program started.

- The company expects to start supplying McColl’s remaining 300 convenience stores towards the end of 2019, and expects £1 billion of annualised wholesale supply sales in fiscal 2020.

- It expects £12 million incremental profit from wholesale, services, interest and online, taking the cumulative total to £54 million. The company believes it is on track to achieve its £75-125 million target.

- The company expect to achieve a £1.1 billion target in disposal proceeds.