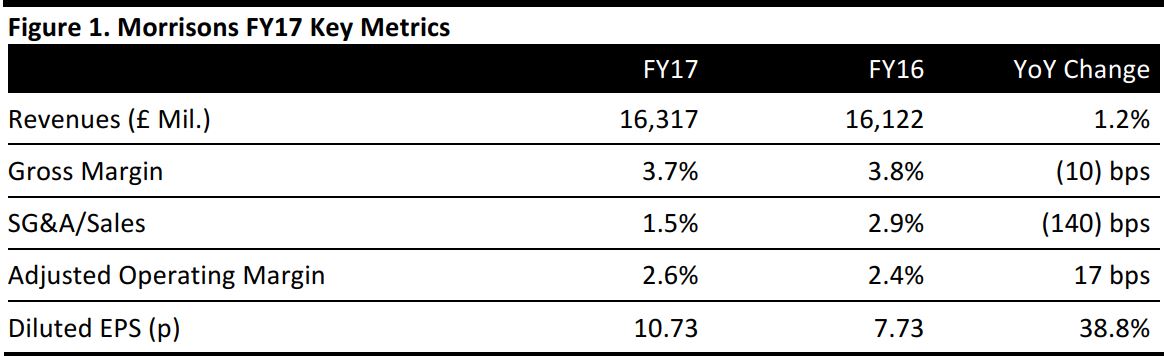

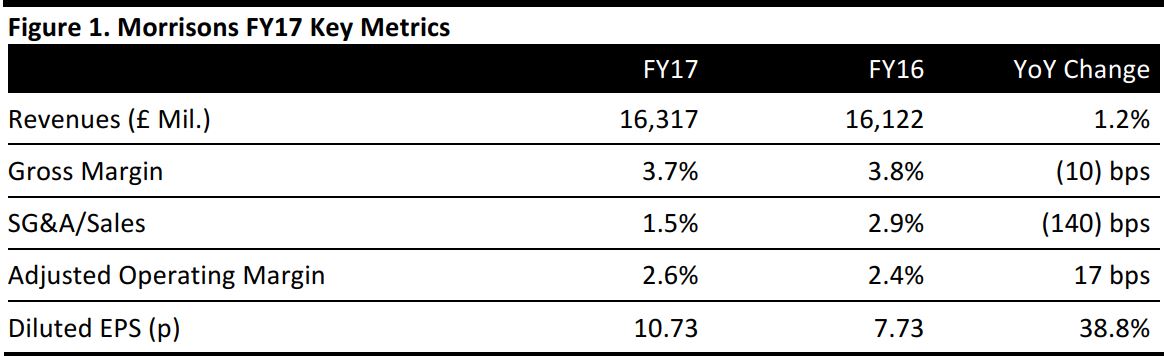

Morrisons allocates store depreciation, store overhead and store-based employee costs to cost of sales, so these operating expenses impact gross margin rather than SG&A/sales.

Source: Company reports/Fung Global Retail & Technology

FY17 Results

Morrisons reported an improved top-line trend despite net store closures during the fiscal year. Revenues of £16,317 million were slightly ahead of the consensus estimate of £16,219 million.

Comparable sales growth improved sequentially, coming in at 1.7% for FY17 and at 2.5% for 4Q17. This marked the fifth consecutive quarter of positive comp growth.

Morrisons successfully completed a three-year cost savings plan of £1 billion, and the company has identified further cost-saving opportunities.

Cost-saving achievements contributed to an expansion of 17 basis points in the operating margin, an 11.6% increase in profit before tax and a 38.8% jump in diluted EPS.

Nonfinancial Metrics

The company reported the following:

- Comparable items per basket at stores (not including online sales and convenience stores) declined by 4.6% in FY17 and declined by 5.3% in 4Q17.

- Comparable transaction numbers at stores (not including online sales and convenience stores) grew by 4.0% in FY17 and increased by 4.6% in 4Q17.

Strategy Update

Morrisons provided an update on its six priorities:

- Be more competitive: In FY17, the company continued to lower prices. “As we notch down price, we notch up quality,” CEO David Potts told analysts.

- Serve customers better: Morrisons introduced a new automated ordering system into all stores in grocery and many fresh food categories. It is rolling the system out to all categories, excluding clothing, this year.

- Find local solutions: The new local solutions team is working to improve local ranging.

- Develop popular and useful services: In FY17, Morrisons announced a partnership with Timpson to provide dry-cleaning, photo-processing and shoe repair services. It also partnered with Amazon, Doddle and InPost to offer in-store collection. Potts said the company will look to use some of its customer car parks for “small complementary retail developments.”

- Simplify and speed up the organization: The new automated ordering system is improving efficiency and speed. Morrisons has also worked on enhancing and simplifying distribution between manufacturing and retail, and on digitizing existing in-store administration.

- Make core supermarkets strong again: In FY17, the company completed 100 “Fresh Look” store refits.

Outlook

The company has identified further cost saving opportunities beyond the £1 billion already achieved in ordering, distribution between manufacturing and retail, as well as in-store administration.

In its results presentation, management would not state definitely the extent to which higher input prices would be passed on to customers, nor what impact higher costs are expected to have on the company’s gross margin in the coming year.

Analysts expect the company’s FY18 revenues to increase by 1.0% year over year, to £16,486 million, although estimates are likely to increase following today’s earnings release. Consensus expects FY18 EBIT of £450 million, implying an operating margin of 2.7%, and normalized EPS of 12p.