Nitheesh NH

[caption id="attachment_96224" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1H20 Results

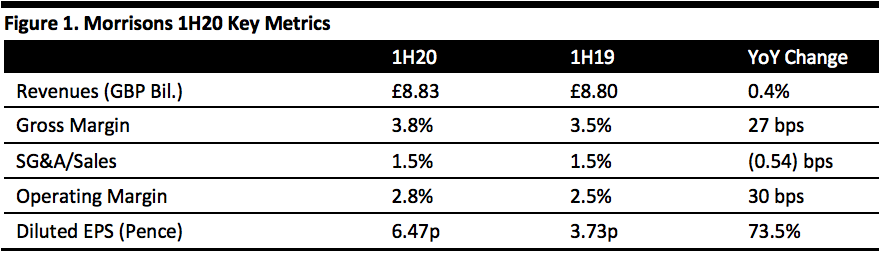

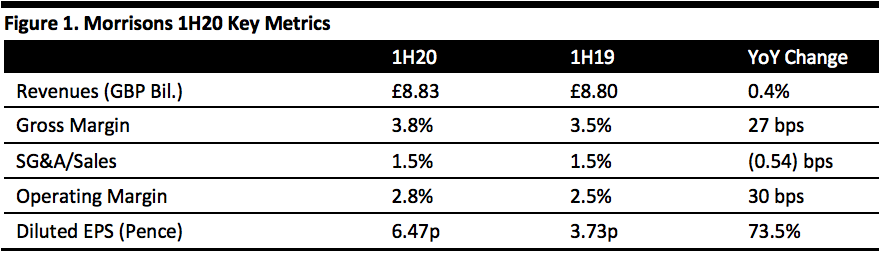

Morrisons reported 1H20 revenues of £8.83 billion, up slightly year over year and above the consensus estimate of £8.8 billion recorded by StreetAccount. Group comparable sales were up 0.2% year over year in 1H20, 2.3% in 1Q20 and (1.9)% in 2Q20.

In 1H20, retail contributed (1.1)% to group comps while wholesale contributed 1.3%. The retail segment saw a sharp downturn in the second quarter: Its contribution to group comps fell from 0.2% in 1Q20 to (2.4)% in 2Q20. Management pointed to demanding comparatives from the summer of 2018 as the reason, due to more favorable weather and events last year. Management says it is planning for retail comp growth to improve.

Gross margin increased 27 basis points (bps) year over year to 3.8%.

Operating margin grew 30 bps year over year to 2.8%.

The company reported diluted EPS of 6.47 pence in 1H20, up 73.5% year over year. Adjusted EPS was up 4.1% to 6.38 pence.

Details from the Half-Year

Management said it is focused on following its Fix, Rebuild and Grow strategy.

Source: Company reports/Coresight Research[/caption]

1H20 Results

Morrisons reported 1H20 revenues of £8.83 billion, up slightly year over year and above the consensus estimate of £8.8 billion recorded by StreetAccount. Group comparable sales were up 0.2% year over year in 1H20, 2.3% in 1Q20 and (1.9)% in 2Q20.

In 1H20, retail contributed (1.1)% to group comps while wholesale contributed 1.3%. The retail segment saw a sharp downturn in the second quarter: Its contribution to group comps fell from 0.2% in 1Q20 to (2.4)% in 2Q20. Management pointed to demanding comparatives from the summer of 2018 as the reason, due to more favorable weather and events last year. Management says it is planning for retail comp growth to improve.

Gross margin increased 27 basis points (bps) year over year to 3.8%.

Operating margin grew 30 bps year over year to 2.8%.

The company reported diluted EPS of 6.47 pence in 1H20, up 73.5% year over year. Adjusted EPS was up 4.1% to 6.38 pence.

Details from the Half-Year

Management said it is focused on following its Fix, Rebuild and Grow strategy.

Source: Company reports/Coresight Research[/caption]

1H20 Results

Morrisons reported 1H20 revenues of £8.83 billion, up slightly year over year and above the consensus estimate of £8.8 billion recorded by StreetAccount. Group comparable sales were up 0.2% year over year in 1H20, 2.3% in 1Q20 and (1.9)% in 2Q20.

In 1H20, retail contributed (1.1)% to group comps while wholesale contributed 1.3%. The retail segment saw a sharp downturn in the second quarter: Its contribution to group comps fell from 0.2% in 1Q20 to (2.4)% in 2Q20. Management pointed to demanding comparatives from the summer of 2018 as the reason, due to more favorable weather and events last year. Management says it is planning for retail comp growth to improve.

Gross margin increased 27 basis points (bps) year over year to 3.8%.

Operating margin grew 30 bps year over year to 2.8%.

The company reported diluted EPS of 6.47 pence in 1H20, up 73.5% year over year. Adjusted EPS was up 4.1% to 6.38 pence.

Details from the Half-Year

Management said it is focused on following its Fix, Rebuild and Grow strategy.

Source: Company reports/Coresight Research[/caption]

1H20 Results

Morrisons reported 1H20 revenues of £8.83 billion, up slightly year over year and above the consensus estimate of £8.8 billion recorded by StreetAccount. Group comparable sales were up 0.2% year over year in 1H20, 2.3% in 1Q20 and (1.9)% in 2Q20.

In 1H20, retail contributed (1.1)% to group comps while wholesale contributed 1.3%. The retail segment saw a sharp downturn in the second quarter: Its contribution to group comps fell from 0.2% in 1Q20 to (2.4)% in 2Q20. Management pointed to demanding comparatives from the summer of 2018 as the reason, due to more favorable weather and events last year. Management says it is planning for retail comp growth to improve.

Gross margin increased 27 basis points (bps) year over year to 3.8%.

Operating margin grew 30 bps year over year to 2.8%.

The company reported diluted EPS of 6.47 pence in 1H20, up 73.5% year over year. Adjusted EPS was up 4.1% to 6.38 pence.

Details from the Half-Year

Management said it is focused on following its Fix, Rebuild and Grow strategy.

- The company announced four new or extended wholesale supply initiatives — with Amazon, Rontec, Harvest Energy and, in the Middle East, LuLu.

- The company will expand the Morrisons store on Amazon Prime Now to further cities across the UK starting 3Q20.

- Operating profit before exceptional items was up 2.4% to £252m as compared to £246m in 1H18, with margin up 6 basis points year over year to 2.9%. EBITDA margin before exceptional items was 5.8%, up 20 basis points.

- Exceptional items included £10 million net pension interest income and £6 million in exceptional costs.

- Administrative expenses were flat at £135 million in the first half.

- Profit before tax and exceptional items was up 5.3% to £198 million.

- Net incremental profit before tax from wholesale, services, interest and online was £7 million, bringing the total cumulative profit to £61 million. Management remains confident in its medium-term target of £75-125 million in incremental profit from these four areas.

- The company proposed a special interim dividend of 2.0 pence per share, which will increase the total interim dividend to 3.93 pence, up 2.1%. These dividends will be paid in November 2019.

- The company said wholesale’s contribution to comps fell slightly due to the closure of 40 McColl’s stores during the first half of the year.

- Annualized wholesale supply sales target of £1 billion.

- Incremental profit of £7 million from wholesale, services, interest, and online.