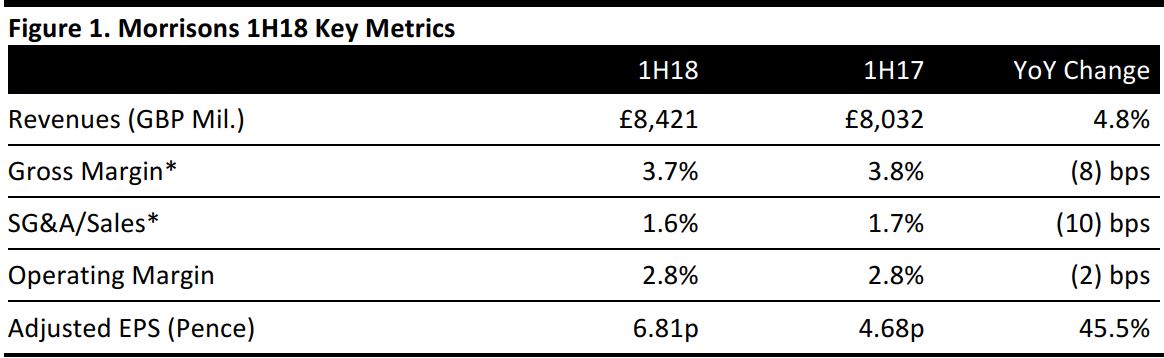

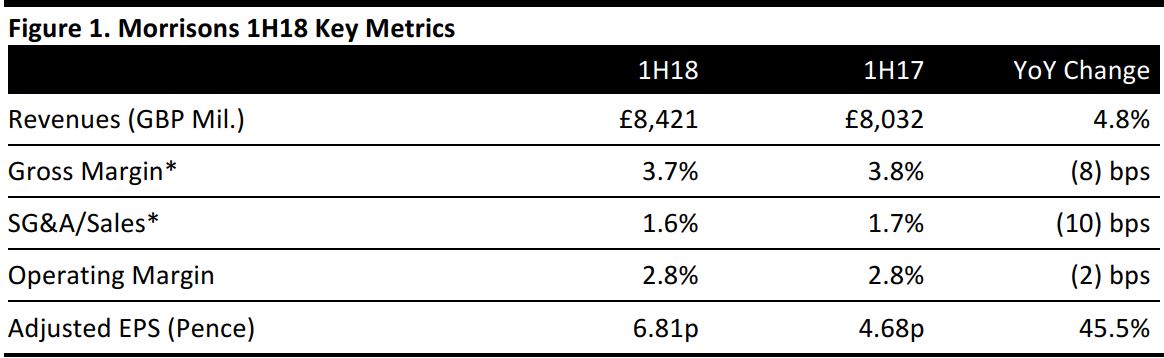

*Like a number of other UK grocery retailers, Morrisons allocates some operating costs, such as store depreciation, store overhead costs and store-based employee costs, to cost of sales, so these expenses impact gross margin rather than SG&A/sales.

Source: Company reports/FGRT

1H18 Results

The UK’s fourth-largest grocery retailer, Morrisons, announced continued strong performance in comparable sales growth. In 1H18, group comps excluding fuel were up 3.0%; they were up 3.4% in 1Q18 and up 2.6% in 2Q18. This growth exceeded the comparable sales rates most recently reported by Morrisons’ major rivals, Tesco, Sainsbury’s and Asda.

Morrisons wholesales via Amazon and to convenience stores. Excluding revenues from wholesaling, comps were up 2.5% in 1H18. In 2Q18, this measure slowed a little, to 2.1%, from 3.0% in 1Q18.

Total revenue growth of nearly 5% trickled down to a 4.0% increase in operating profit and a 40% surge in pretax profit.

Revenue, underlying EBIT and underlying pretax profit were in line with consensus.

Management noted that the company delivered an incremental £14 million profit from wholesale, services, interest and e-commerce in 1H18.

Outlook

Management noted the following expectations:

- Net debt is expected to remain below £1 billion for the rest of FY18. In 1H18, the company reduced its net debt by £262 million, to £932 million, which is below its year-end £1 billion target.

- Total annualized wholesale revenues are expected to exceed £700 million by the end of FY18, and wholesale is expected to generate £1 billion in sales “in due course.”

- Total, medium-term incremental profits from wholesale, services, interest and e-commerce are now expected to be £75–£125 million, versus previous expectations of £50–£100 million.

For FY18, which ends in January 2018, analysts expect Morrisons to grow revenue by 4%, EBIT by 4.6% and pretax profit by 17.5%. These estimates were collated before the latest results announcement.