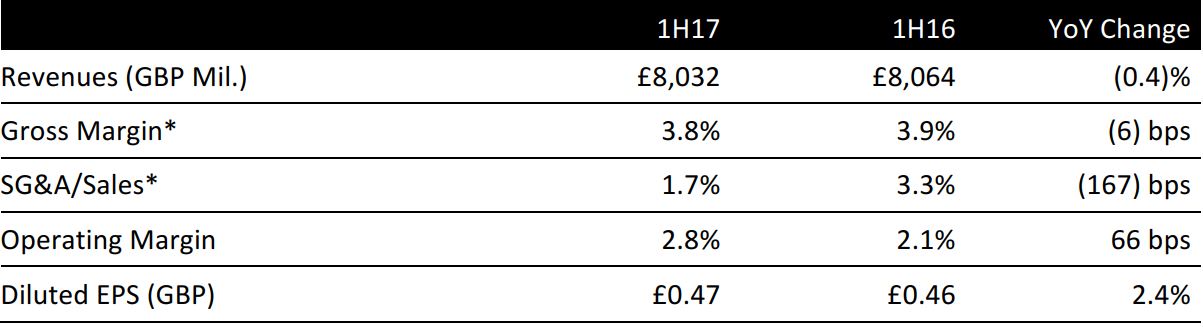

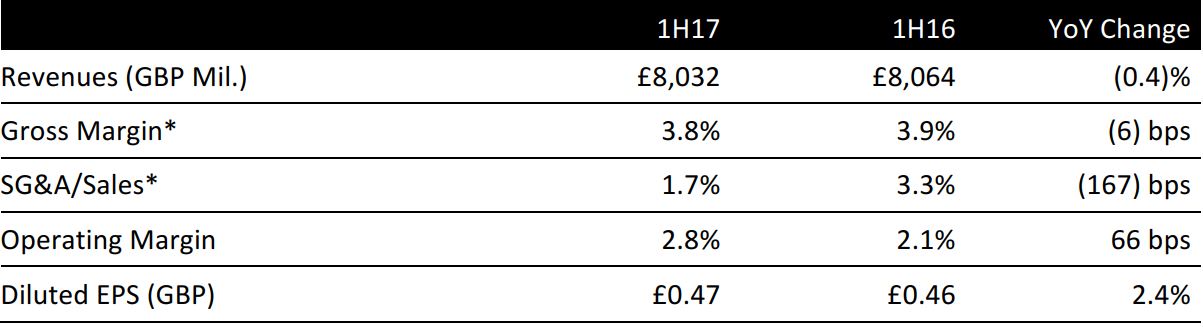

*Morrisons allocates store depreciation, store overheads and store-based employee costs to Cost of Sales, so these operating expenses impact on the gross margin rather than on SG&A/sales.

Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

Morrisons’s top line was broadly flat, but this was impacted by a contracting store base. Comparable sales growth improved sequentially, with 1H17 coming in at 1.4%, split 0.7% for 1Q17 and 2% for 2Q17. This marked the third consecutive quarter of positive comp growth for long-struggling Morrisons.

Revenues of £8,032 million were fractionally ahead of consensus of £7,994 million.

Morrisons has been executing a three-year plan to save £1 billion in costs. The company said it stripped out £189 million in costs in 1H17 and now expects to exceed its £1 billion target by the end of this fiscal year.

Morrisons aims to drive additional profits from new opportunities across wholesale, services, interest and e-commerce. In 1H17, the company booked £5 million of its £50-to-£100 million medium-term target. It announced partnerships with Amazon and Timpson to install services in Morrisons stores. The company also announced the sale of its stake in US e-commerce retailer, Fresh Direct.

These achievements fed a 66-basis-points increase in the operating margin, a 13.5% boost to PBT and a 2.4% rise in diluted EPS. The latter metric was in line with consensus.

NONFINANCIAL METRICS

The company reported the following:

- Comparable items per basket fell 2.8% in 1Q17 and fell 5% in 2Q17.

- Comparable transaction numbers grew 3.1% in 1Q17 and grew 4.3% in 2Q17.

STRATEGY UPDATE

Morrisons updated on its six priorities:

- To be more competitive. In 1H17, the company continued to lower prices and implemented category resets and new product ranges.

- To serve customers better. Morrisons cut queues in stores and installed separate customer service desks in 200 of them.

- Find local solutions. Its new local solutions team is working to improve local ranging, events and communication.

- Develop popular and useful services. In 1H17, Morrisons announced a partnership with Timpson for dry cleaning, photo processing and shoe repair services. It is also partnering with Amazon, Doddle and InPost to offer in-store collection.

- To simplify and speed up the organization. This includes reducing the complexity around the number and types of commercial income. In-store initiatives such as self-scan are yielding productivity savings.

- To make core supermarkets strong again. In 1H17, the company completed 51 store refits, with a run rate of 100 refits per annum until the end of fiscal 2019.

Morrisons noted it recently finalized an agreement with its online service provider, Ocado, to allow Morrisons to develop a store-picking solution that will serve areas not covered by Ocado distribution centers. The renegotiated deal with Ocado also removes a profit-share clause and reduces the research and development fee Morrison says to Ocado.

OUTLOOK

The company said it has identified further productivity opportunities beyond FY17. As noted above, the company stated it is ahead of target on its plan to save £1 billion in costs. Morrisons has seen no negative impact on customer sentiment or behavior from the result of the EU referendum.

For FY17, the consensus among analysts is for total revenues to decline 1.3%, EBIT to rise 3% and PBT to jump 41.9%. The consensus for GAAP EPS is 10.1 pence, versus 9.5 pence in FY16.