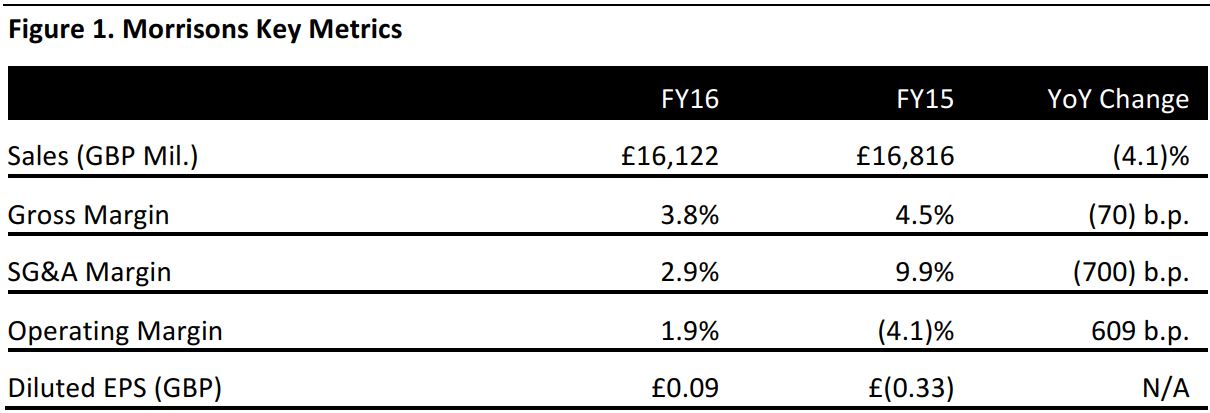

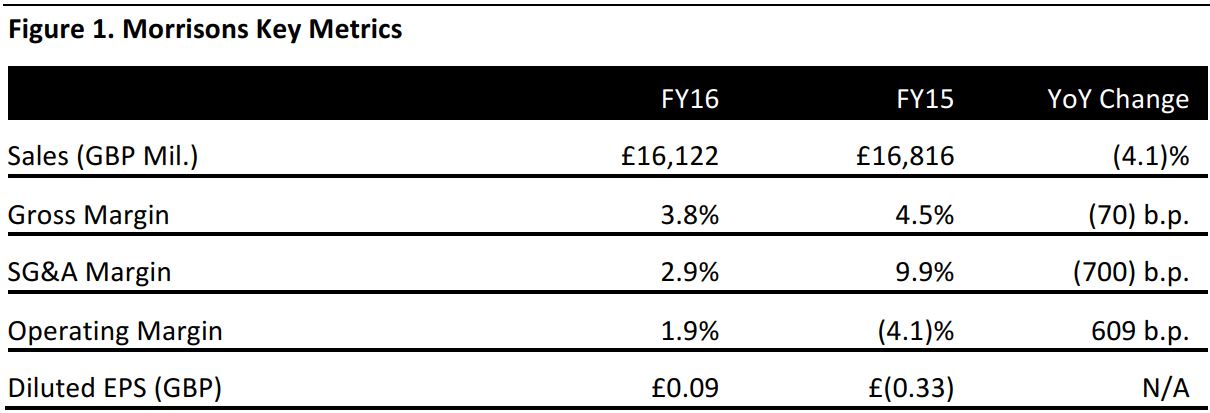

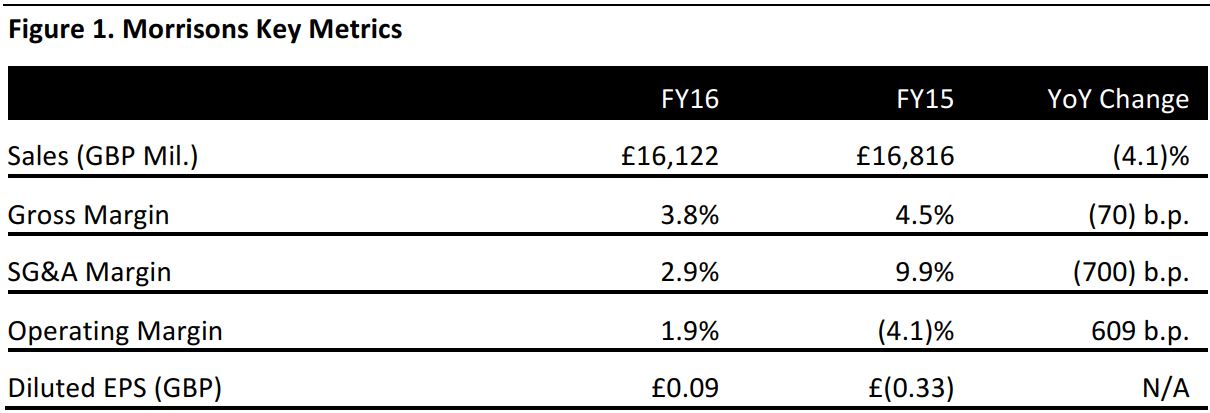

Fiscal years end January 31.

Source: Company reports

FY15 RESULTS

Britain’s fourth-biggest grocery retailer, Morrisons, reported a 4.1% slide in full-year revenues, to £16.12 billion; the company missed consensus of £16.16 billion. On a comparable-store basis, sales excluding fuel fell by 2.0%.

Gross margin contracted by 70 basis points, but the SG&A margin was slashed by 700 basis points; the prior year’s SG&A included substantial impairment charges. This resulted in a swing from a net loss of £761 million in FY15 to a net profit of £222 million in FY16, versus consensus of £212.81 million.

As a result, earnings per share returned to positive territory, meeting consensus at 9 pence.

CUTTING COSTS, CLOSING STORES

Cost cuts are core to Morrisons’ turnaround. In his presentation to analysts on Thursday, CEO David Potts noted that the company is on track to strip out £1 billion of costs in the three years to FY17. He said recent cost cuts had included the removal of 800 staff positions from Morrisons’ head office, the closure of 21 supermarkets (with seven more to follow) and the sale of the M Local convenience-store chain. But it is “more than just cost-cutting,” Potts said, noting that these cuts are “creating a stronger, leaner business” that is “more responsive to customers.”

Capex fell from £520 million in FY15 to £365 million in FY16, while net debt fell from £2,340 million in FY15 to £1,746 million in FY16.

4Q16 SALES IMPROVEMENT

Morrisons noted an improving trend in comparable-store sales, with comps excluding fuel turning positive, to 0.1%, in the fourth quarter. Comps had declined by 2.6% in the third quarter. Total sales including fuel in 4Q16 remained slightly negative, at (0.2)%, compared to (5.1)% in 3Q16.

PROFIT OPPORTUNITIES

In his presentation, Potts identified £50–£100 million in annual opportunities for underlying profit before tax in five areas: the recently announced extension of Morrisons’ online coverage; wholesaling to third parties, including the new deal to supply food to Amazon UK for its Prime Now and Pantry services; improving the range of foods Morrisons produces in its own manufacturing facilities; developing more popular and useful services, such as rolling out Timpson shoe-repair concessions, and lower interest as a result of lower debt.

The £50–£100 million annual profit opportunity is identified as a medium-term gain: CFO Trevor Strain noted that these gains would not be yielded in full in FY17.

GUIDANCE

The company reiterated its expectation to realize in FY17the remainder of the £1 billion in cost savings it had planned to achieve over three years. Morrisons expects to exceed its three-year, £1-billion target for property disposals, with £330 million more disposals due in the year ahead; the company upped its target to £1.1 billion.

FY17 year-end net debt is expected to be £1.4– £1.5 billion.

Strain noted that FY17 sales will see a (2.0)%–(2.5)% impact from the annualization of store closures and disposals.

Analysts estimate that Morrisons will generate £16.03 billion in net sales, £416 million in EBIT and £251 million in net income before exceptional in FY17. EPS is expected to rise to 11 pence.