Web Developers

In its latest interim results for the period through August 2, the UK’s fourth-biggest grocer, Morrisons, reported a slew of disappointing metrics:

Aldi and Lidl, but in a way that rewards shoppers with points, and the restrictions on granting and redeeming points could confuse analysts, never mind the general public looking for simple, low prices. Crucially, we think this kind of program goes against the trend toward simpler, EDLP retailing in UK grocery. We would welcome the abandonment of Match & More in favor of straightforward price investment.

Aldi and Lidl, but in a way that rewards shoppers with points, and the restrictions on granting and redeeming points could confuse analysts, never mind the general public looking for simple, low prices. Crucially, we think this kind of program goes against the trend toward simpler, EDLP retailing in UK grocery. We would welcome the abandonment of Match & More in favor of straightforward price investment.

The deal with Ocado was another of the contentious decisions made by Morrisons’ previous management. For Morrisons, the terms of the agreement make it look like a costly, and perhaps unnecessarily long-term, deal.

Online is here to stay—indeed, we view it as a key weapon for traditional grocers battling against the discounters, whose business models make online grocery retailing impractical. So, we do not expect Morrisons to retreat from this channel, but we are sure we are not alone in wondering if its agreement with Ocado will be unraveled in the medium term.

The deal with Ocado was another of the contentious decisions made by Morrisons’ previous management. For Morrisons, the terms of the agreement make it look like a costly, and perhaps unnecessarily long-term, deal.

Online is here to stay—indeed, we view it as a key weapon for traditional grocers battling against the discounters, whose business models make online grocery retailing impractical. So, we do not expect Morrisons to retreat from this channel, but we are sure we are not alone in wondering if its agreement with Ocado will be unraveled in the medium term.

The sale or closure of loss-making stores will contribute to improvements in the bottom line, but regaining sales momentum is a more important factor. In its interim presentation, Morrisons pledged improvements to three operational levers to grow profits: sales volumes, margins and asset intensity. “The rebuilding will start with more customers and more volume growth,” promised Trevor Stain, the company’s Chief Financial Officer.

Volumes may well grow, but converting this to value growth will be hard in a deflationary market. Moreover, we think margin gains on comparable products will be tough to achieve, given the ongoing price investment that competition is likely to make a necessity.

The sale or closure of loss-making stores will contribute to improvements in the bottom line, but regaining sales momentum is a more important factor. In its interim presentation, Morrisons pledged improvements to three operational levers to grow profits: sales volumes, margins and asset intensity. “The rebuilding will start with more customers and more volume growth,” promised Trevor Stain, the company’s Chief Financial Officer.

Volumes may well grow, but converting this to value growth will be hard in a deflationary market. Moreover, we think margin gains on comparable products will be tough to achieve, given the ongoing price investment that competition is likely to make a necessity.

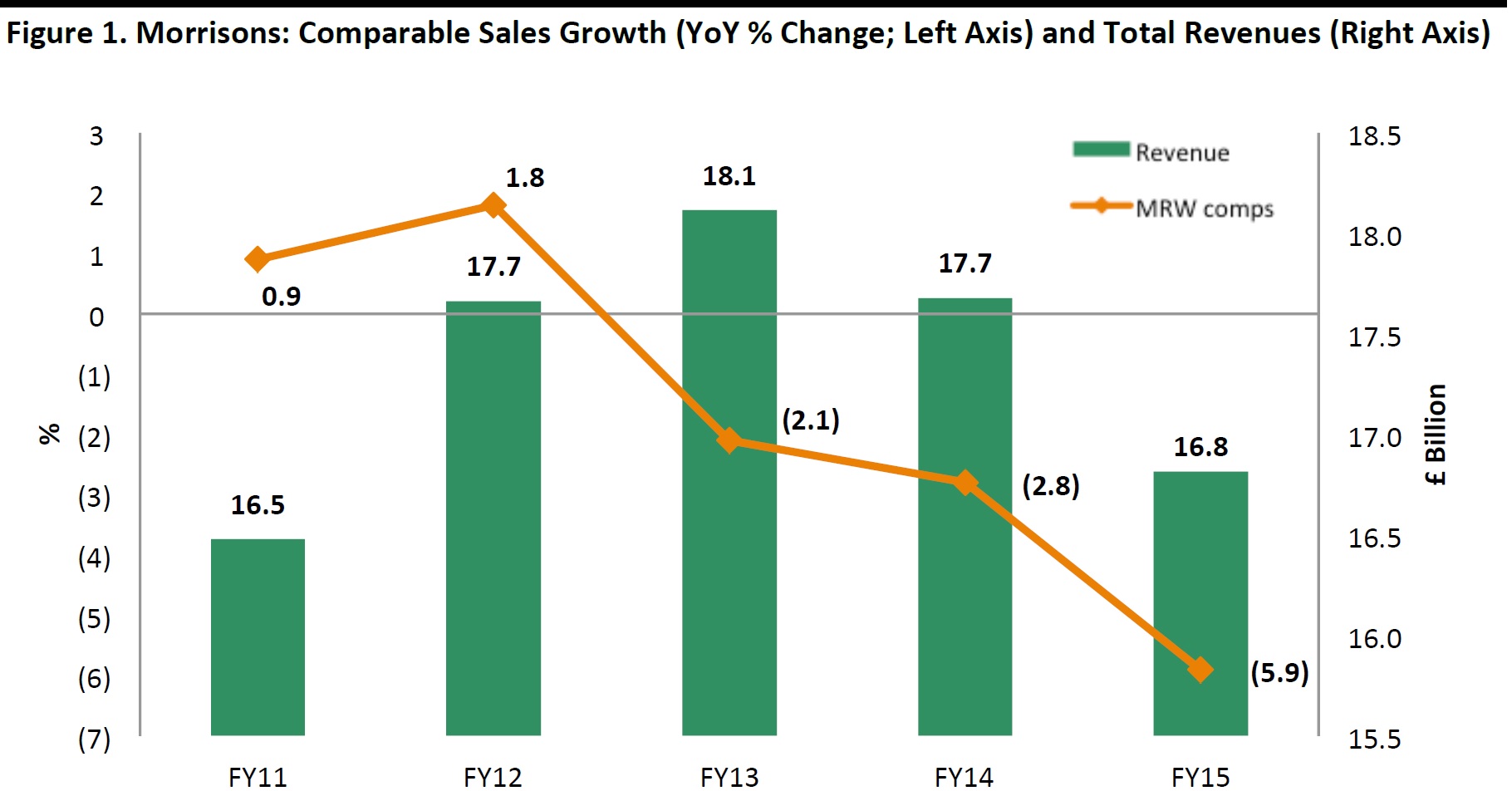

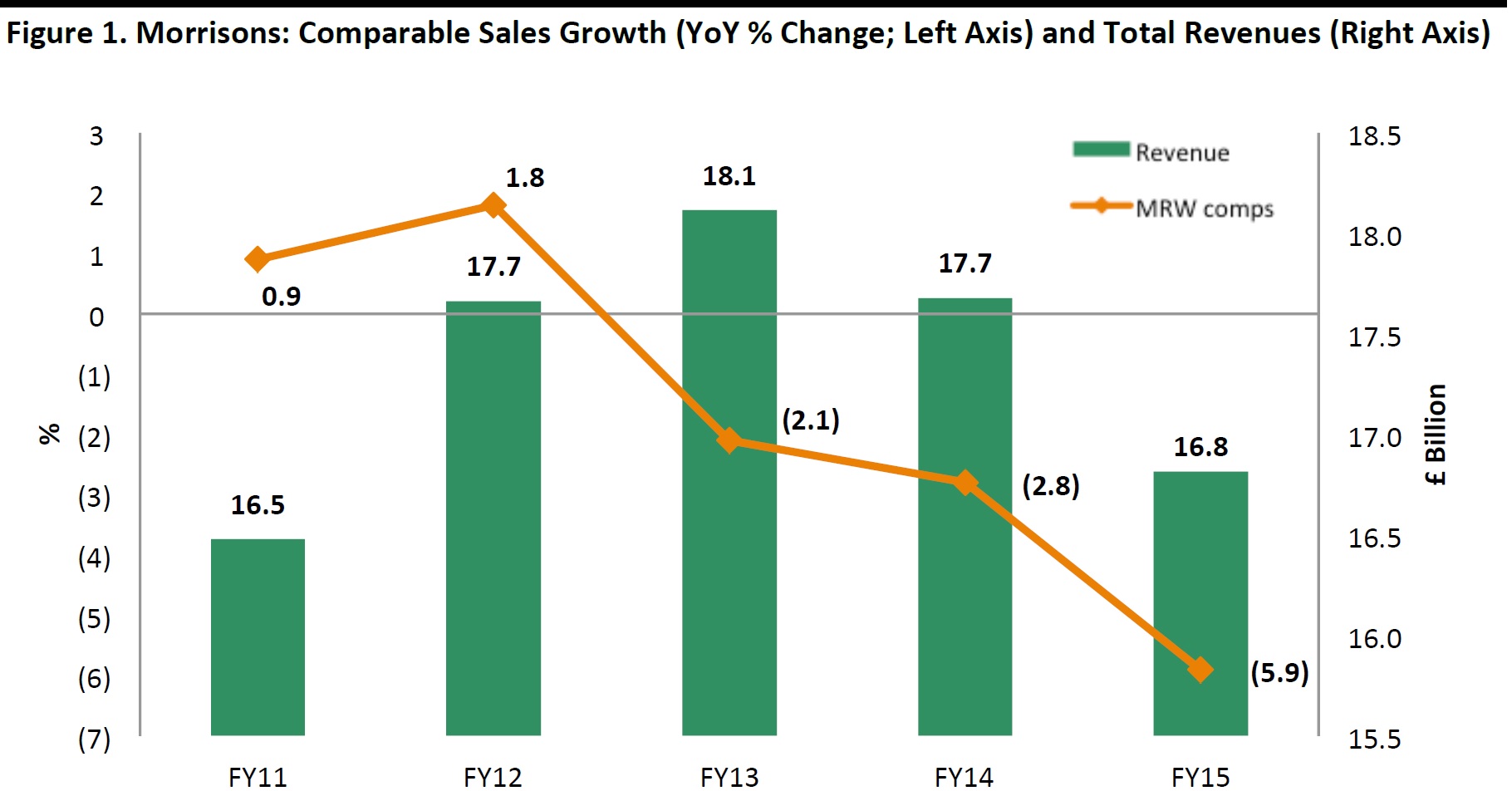

- Comps ex fuel were down 2.7%, and total revenues were down 5.1%, to £8.1 billion (US$12.3 billion).

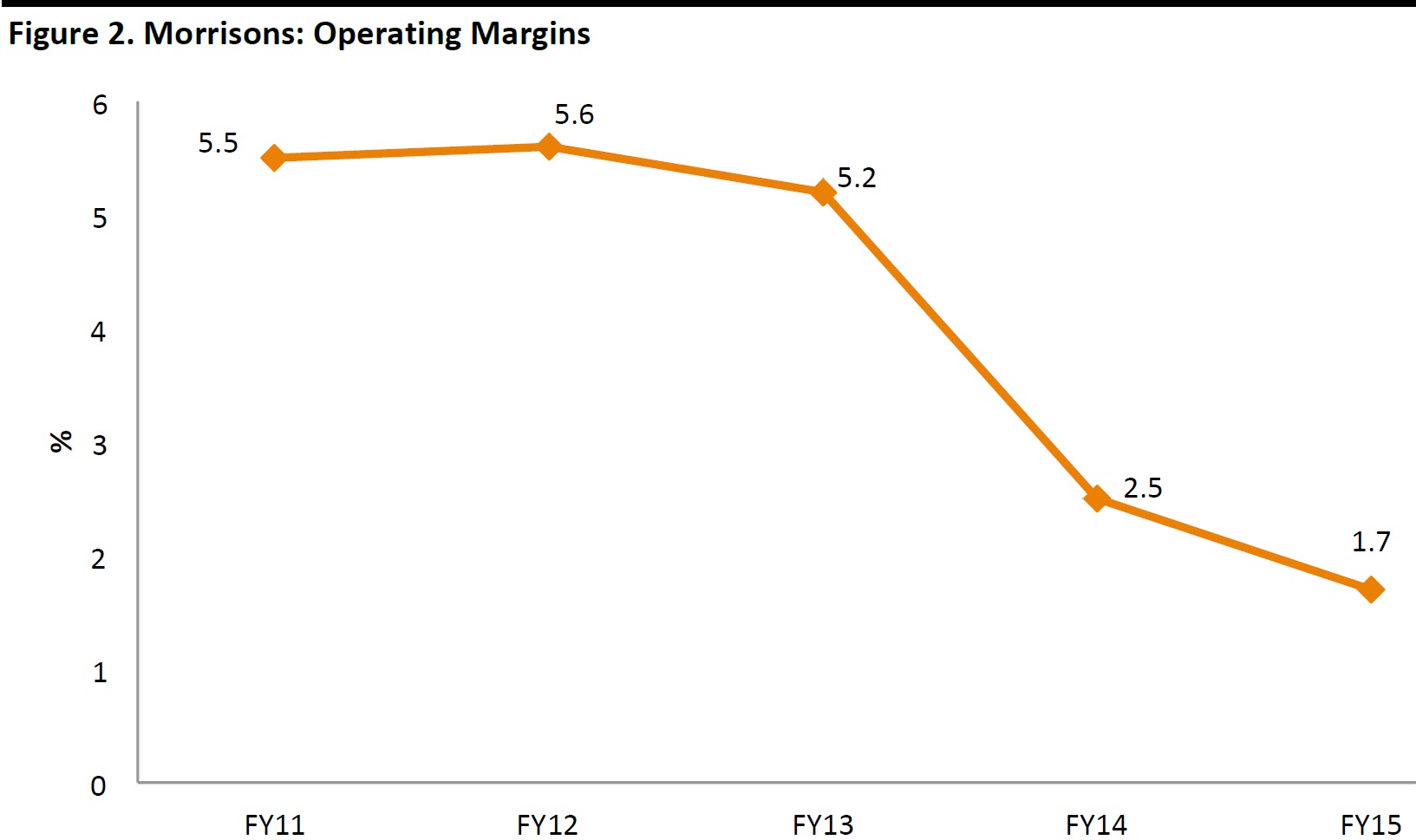

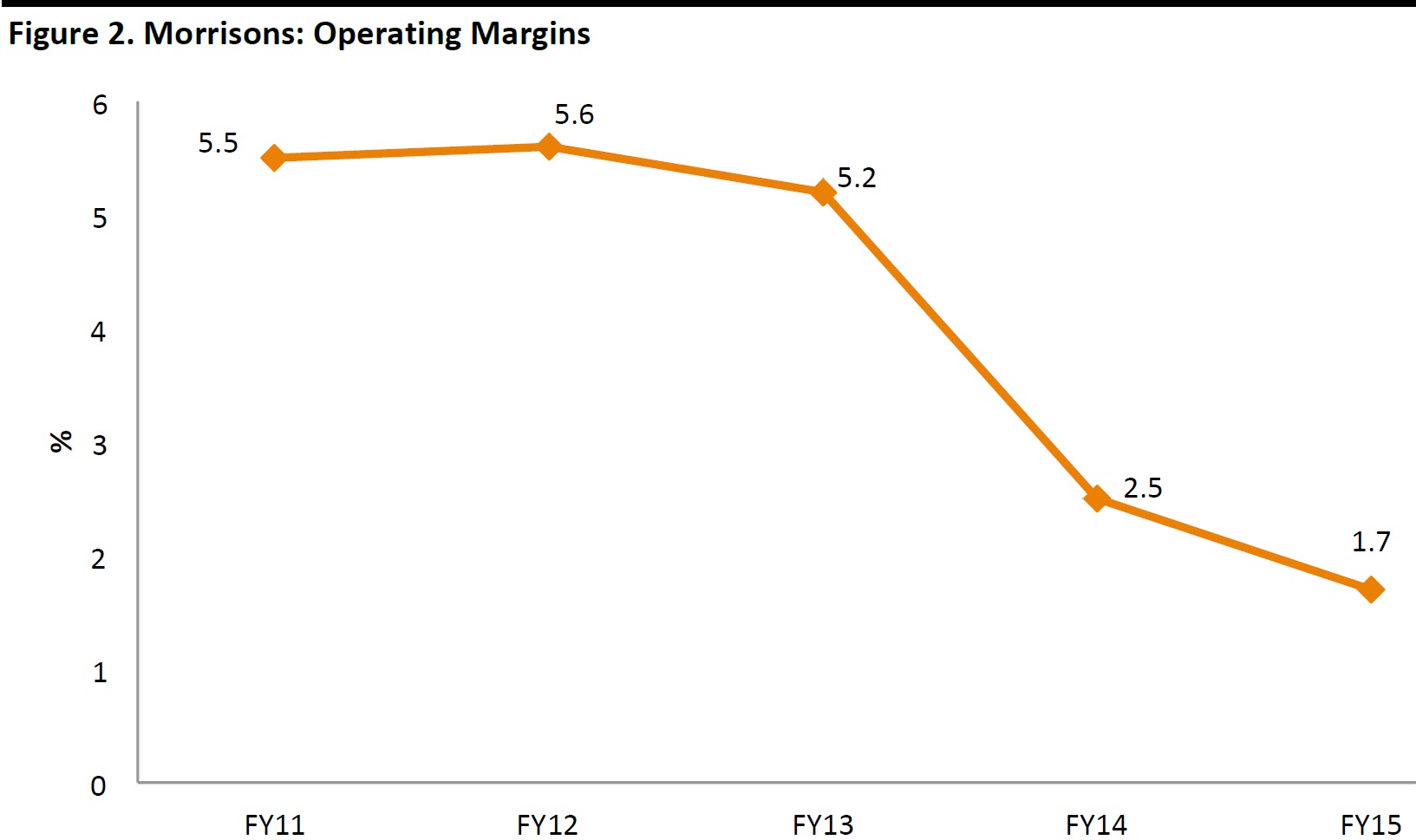

- Operating profit was down 40%, and the operating margin was 2.1% versus historical full-year rates of 5% plus.

- Underlying profit before taxes was down 35%, to £117 million ($179 million).

- Underlying EPS was down 35%, to 3.73p, in line with consensus.

A Retailer in Trouble

Morrisons is a retailer that is in trouble. It has been hit badly by the growth of discounters Aldi and Lidl, and its previous management spent on convenience stores, grocery e-commerce and smartening up its supermarkets—while its shoppers were looking more keenly for value for money. Following a sustained period of falling sales, however, we are seeing signs of improvement. Comparable sales are still negative, but they are less negative than they were: in the first quarter of fiscal year 2016, comps were down 2.9%, but in the second quarter, this improved to a drop of 2.4%. For the full fiscal year 2015, Morrisons saw comps of (5.9)%.

Source: S&P Capital IQ/company reports

Margin depletion has been substantial, although Morrisons is not alone among UK grocers in seeing margin attrition as price competition has heightened.

Source: S&P Capital IQ

Why the Faltering?

In recent years, analysts queued up to state that Morrisons’ performance was being pulled down by its absence from the growth channels of convenience and online. They argued that it must push into these channels in order to regain top-line momentum. We disagreed then, and we think we have been proven correct since: Morrisons’ strongly negative comps persisted even after it moved into convenience and grocery e-commerce. But the company did indeed lag its competitors in moving beyond core supermarkets (the same core supermarkets that are now its renewed focus) to tap alternative growth channels:- It began opening convenience stores only in 2011, a full 17 years after Tesco moved into the sector.

- It launched an online grocery service in late 2013, again fully 17 years after Tesco.

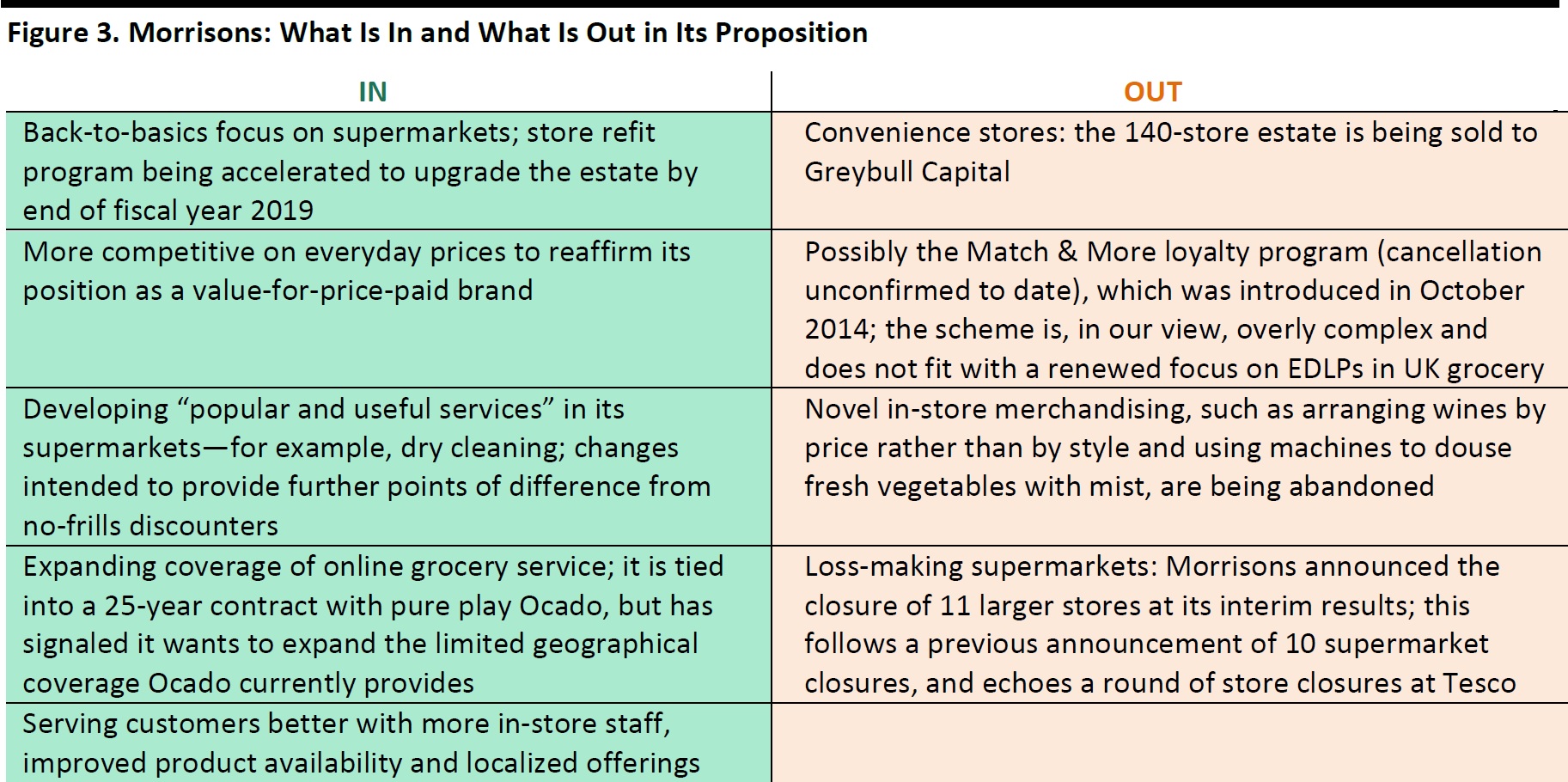

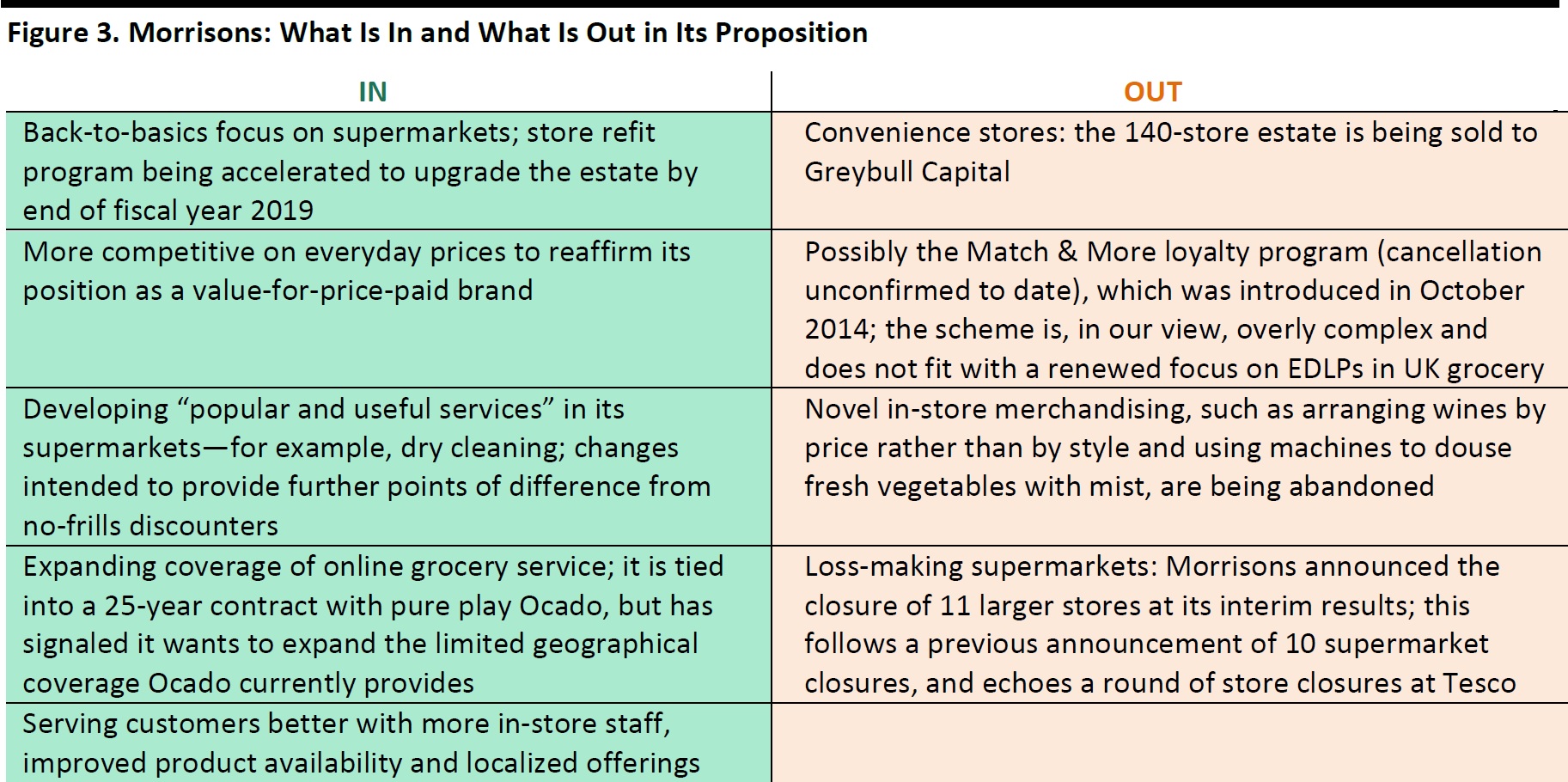

What Is In and What Is Out

“This business is a value retailer,” CEO David Potts said at the interim presentation, reaffirming Morrisons’ traditional positioning. At Morrisons—and indeed across the UK grocery sector—we are seeing moves toward simpler propositions based on everyday low prices (EDLPs) instead of high/low prices, and a refocusing on core retail elements such as availability and local ranging instead of frills such as loyalty programs and diversions into alternative channels or markets.

Convenience

In dissecting Morrisons’ sale of its entire convenience operation, a number of commentators have speculated that this is due in part to a difficulty in finding good locations. We think, however, that the ongoing expansion of rivals—including Tesco, Sainsbury’s, Marks & Spencer and Waitrose—into convenience suggests that plenty of good locations are still available. Our view is that Morrisons has been pushed into the sale by an inability to invest further in the channel and a need to rid itself of some loss-making stores. In its interim results presentation, management stated that the convenience store operation was a “distraction” that it was “ “unable to scale.”Loyalty Program

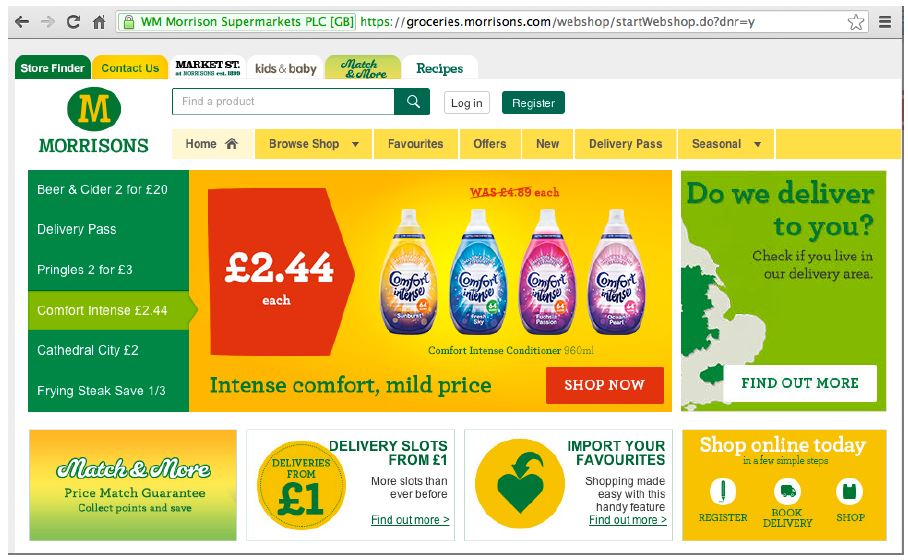

Morrisons Match & More loyalty scheme has always struck us as unnecessarily complex. It aims to match the prices of Aldi and Lidl, but in a way that rewards shoppers with points, and the restrictions on granting and redeeming points could confuse analysts, never mind the general public looking for simple, low prices. Crucially, we think this kind of program goes against the trend toward simpler, EDLP retailing in UK grocery. We would welcome the abandonment of Match & More in favor of straightforward price investment.

Aldi and Lidl, but in a way that rewards shoppers with points, and the restrictions on granting and redeeming points could confuse analysts, never mind the general public looking for simple, low prices. Crucially, we think this kind of program goes against the trend toward simpler, EDLP retailing in UK grocery. We would welcome the abandonment of Match & More in favor of straightforward price investment.

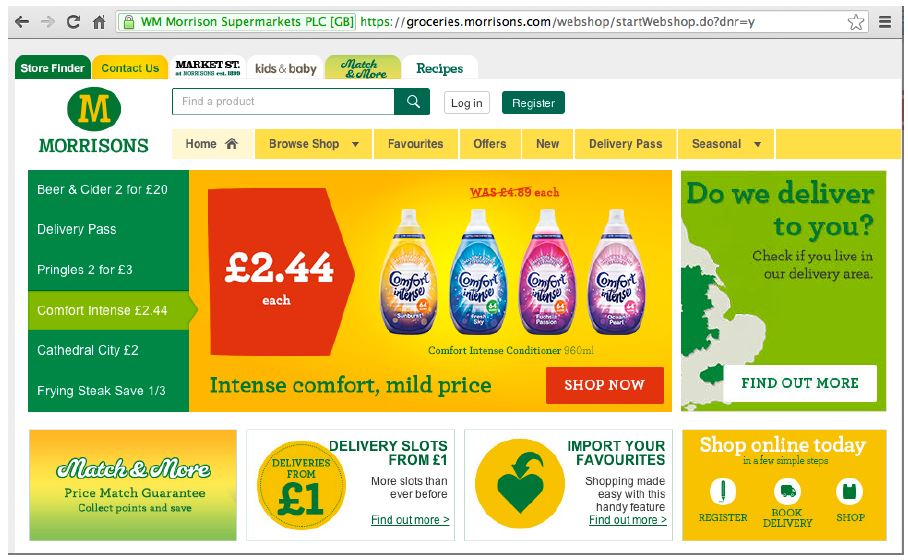

Online

At the interim results presentation, Morrisons’ CEO denied that the company was seeking to renegotiate its 25-year agreement with grocery pure play Ocado that has Ocado servicing its online orders. But Morrisons has said it is looking at ways of expanding its geographical coverage, given that the current service provides access to only 52% of the UK population, and excludes the Northeast and Southwest of England, along with all of Scotland. The deal with Ocado was another of the contentious decisions made by Morrisons’ previous management. For Morrisons, the terms of the agreement make it look like a costly, and perhaps unnecessarily long-term, deal.

Online is here to stay—indeed, we view it as a key weapon for traditional grocers battling against the discounters, whose business models make online grocery retailing impractical. So, we do not expect Morrisons to retreat from this channel, but we are sure we are not alone in wondering if its agreement with Ocado will be unraveled in the medium term.

The deal with Ocado was another of the contentious decisions made by Morrisons’ previous management. For Morrisons, the terms of the agreement make it look like a costly, and perhaps unnecessarily long-term, deal.

Online is here to stay—indeed, we view it as a key weapon for traditional grocers battling against the discounters, whose business models make online grocery retailing impractical. So, we do not expect Morrisons to retreat from this channel, but we are sure we are not alone in wondering if its agreement with Ocado will be unraveled in the medium term.

And Growing Profits

The sale or closure of loss-making stores will contribute to improvements in the bottom line, but regaining sales momentum is a more important factor. In its interim presentation, Morrisons pledged improvements to three operational levers to grow profits: sales volumes, margins and asset intensity. “The rebuilding will start with more customers and more volume growth,” promised Trevor Stain, the company’s Chief Financial Officer.

Volumes may well grow, but converting this to value growth will be hard in a deflationary market. Moreover, we think margin gains on comparable products will be tough to achieve, given the ongoing price investment that competition is likely to make a necessity.

The sale or closure of loss-making stores will contribute to improvements in the bottom line, but regaining sales momentum is a more important factor. In its interim presentation, Morrisons pledged improvements to three operational levers to grow profits: sales volumes, margins and asset intensity. “The rebuilding will start with more customers and more volume growth,” promised Trevor Stain, the company’s Chief Financial Officer.

Volumes may well grow, but converting this to value growth will be hard in a deflationary market. Moreover, we think margin gains on comparable products will be tough to achieve, given the ongoing price investment that competition is likely to make a necessity.

What It Means

- Morrisons, belatedly, is doing the right things by cutting prices and simplifying its proposition. Moreover, we view online grocery as a key weapon against no-frills discounters, so the company’s ambitions to improve coverage are encouraging.

- Morrisons’ story shows how discounters Aldi and Lidl have changed the conversation in UK grocery retail. Stores are going back to basics, and grocers such as Morrisons and Tesco are refocusing on fundamental elements: low prices and tailoring ranges to market and availability. Frills are out of fashion.

- Attempts by nondiscount grocers to differentiate through store experience have failed. Morrisons’ smartened-up supermarkets, with their infamous misty veg machines, and Tesco’s “wooden” store refits only served to convince shoppers that these stores were more expensive than their rivals. Nor is this confined to the UK. In France, Carrefour, too, embarked on an unsuccessful round of elaborate store refurbishments before abandoning the effort in favor of lower prices.

- It may hit margins, but investment in EDLPs looks to be the surest way nondiscount grocers can stem loss of market share.

- All these are lessons for retailers in other markets—such as the US and Australia—where discounters are already growing quickly and new discount names are eyeing market entries.