albert Chan

Morrisons

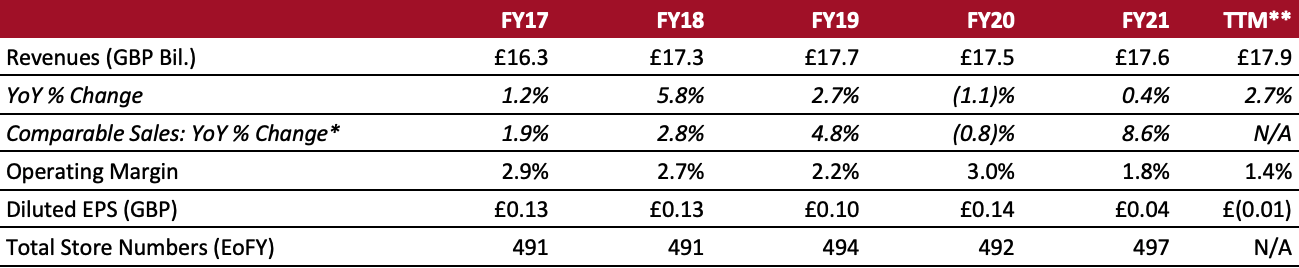

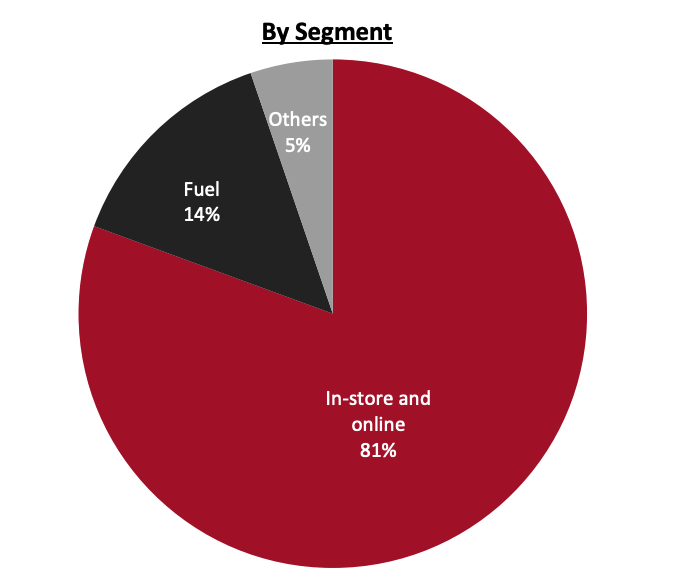

Sector: Food, drug and mass retailers Country of operation: UK Key product categories: Apparel, food and beverage, fuel, health and beauty, and general merchandise Annual Metrics [caption id="attachment_138931" align="aligncenter" width="700"] Fiscal year ends January 30 of the same calendar year

Fiscal year ends January 30 of the same calendar year*Excluding fuel

**Trailing twelve months ended August 1, 2021[/caption] Summary Morrisons was founded in 1899 and is headquartered in Bradford, England. It operates supermarkets and an e-commerce website, offering products in the clothing, fresh food and beverage, groceries, health and beauty, home and garden, pet, and toys categories. Morrisons also has a strong manufacturing business, reporting that it makes more than half of the fresh food it sells in stores. The company offers its products and services under the brand names Best, Eat Smart, Food to Go, Free From, Morrisons, Nutmeg, Price Crunch and Way Down. As of January 31, 2021, the company operates 497 supermarkets, 19 manufacturing sites and eight distribution centers. Company Analysis Coresight Research insight: Morrisons is the smallest of the UK’s “Big Four” supermarket chains, operating fewer than 500 stores. Nevertheless, Morrisons’ fresh food manufacturing capability, supported by its vertically integrated supply, provides a key point of differentiation from its competitors. After struggling to generate profits for a number of years, Morrisons made a significant recovery following the 2015 launch of its “Fix, Rebuild and Grow” strategy. This strategy refocused the company on its heritage as a fresh food manufacturer, and its aims include rationalizing and remodeling its store estate and maintaining competitive pricing. The plan enabled Morrisons to recover from an annual loss of £792 million ($1.1 billion) in fiscal 2015 to an operating profit of £254 million ($348 million) in fiscal 2021. In October 2021, US private-equity firm Clayton, Dubilier & Rice (CD&R) took control of Morrisons after its shareholders approved a £7 billion ($9.5 billion) takeover bid. The company was delisted from the London Stock Exchange (LSE) later in the same month, marking the end of the supermarket’s 54-year run as a publicly listed company. Morrisons’ buyout will see just two major UK grocery retailers remaining as public companies: market leader Tesco and second-place Sainsbury’s.

| Tailwinds | Headwinds |

|

|

- Improve relative competitiveness for customers and help them save money by offering the best quality products at the best possible prices.

- Incorporate customer feedback into changes in the business.

- Make investments to improve customer service.

- Improve customer store visits by stocking local products, tailoring ranges to different demographics and making store adaptations.

- Increase number of local products from growers, farmers, fishermen and other food suppliers.

- Simplify and accelerate processes to create a leaner, more efficient business that is more responsive to customers.

- Use digital technology to provide increasingly easy, accessible and convenient services for customers—such as Scan and Go technology, digital shelf edge labels and contactless payment.

- Maximize cleaning hours and cleaning stations across its stores, depots, manufacturing sites and offices.

- Invest in extra touch cleaning, sanitizer dispensers and extra staff responsible for hygiene.

- Pursue new opportunities and swiftly scale ideas that work.

- Develop a food-to-go range though its new takeaway “Market Kitchen” concept, first introduced in February 2021.

- Remodel and improve existing store real estate to improve the shopping experience.

Company Developments

Company Developments

| Date | Development |

| October 19, 2021 | Morrisons shareholders approve £7 billion ($9.5 billion) takeover bid by private-equity firm CD&R, with 99.2% of the shareholders voting in favor of the deal. |

| September 30, 2021 | Morrisons partners with Deliveroo, to launch the latter’s rapid grocery delivery service Deliveroo Hop in Central London. |

| July 3, 2021 | Morrison accepts a £9.5 billion ($13.1 billion) takeover offer by a private consortium led by Softbank-owned Fortress Investment Group. |

| May 14, 2021 | Morrison announces that it has invested £16 million to prepare its cafés for reopening, updating décor and increasing safety measures. |

| April 21, 2021 | Morrison introduces a private-label range of plastic-free shampoo and conditioner bars with recyclable packaging. |

| March 2, 2021 | Morrisons acquires Cornwall-based seafood business Falfish for an undisclosed sum. |

| February 11, 2021 | Morrisons launches a new store in Camden, London, that will include a fresh-food takeaway feature called Market Kitchen. |

| November 9, 2020 | Morrisons announces it has restarted its food takeaway service at all of its 404 cafés nationwide, with the onset of the second UK lockdown. |

| October 1, 2020 | Morrisons announces that it will extend its commitment to pay smaller suppliers immediately until the end of January. |

| September 30, 2020 | Morrisons announces that it will recruit for over 1,000 permanent jobs to pick and pack customer orders received via Amazon.co.uk and Amazon Prime Now. |

| September 9, 2020 | Morrisons announces plans to acquire outdoor plant supplier Lansen Nursery. |

| August 19, 2020 | Morrisons and Amazon jointly announce the launch of “Morrisons on Amazon” store on Amazon.co.uk. |

| June 29, 2020 | Morrisons opens a new 5,400 square foot standalone Nutmeg and Home store in Bolsover, England. |

| May 11, 2020 | Morrisons and Amazon announces the expansion of its Prime Now grocery delivery service across London and other major cities in the UK. |

| April 7, 2020 | Morrisons partners with Deliveroo to offer same-day grocery delivery from more than 130 Morrisons’ stores. |

- David Potts—CEO

- Michael Gleeson—CFO

- Trevor Strain—COO

Source: Company reports