Web Developers

EXECUTIVE SUMMARY

This third report in our Millennials Series looks at how millennial consumers spend their free time. A widely held view is that millennials are more inclined than other age groups to spend on experiences rather than on “stuff.” However, this does not mean millennials spend more than the average consumer on leisure categories:- As a share of their total spending, millennials in countries such as the US and the UK underindex on leisure spending versus the average consumer.

- In absolute terms, too, millennials typically spend less on leisure than do other age groups.

- In the US, millennials underindex on travel spending versus older age groups. American millennials are also less likely to take their full allowance of paid time off from work, and these two trends are almost certainly linked. In Europe, younger millennials underindex on travel spending slightly, but older millennials do not and both groups overindex on the number of trips taken. American millennials’ lower relative travel expenditure appears to be related to their reluctance to take time off work.

- Worldwide, millennials show a willingness to spend more on dining out. In the US, for example, they spend a greater proportion of their total leisure dollars on dining out versus other age groups. Survey data suggest that millennials find the social element of dining important, and that many prefer to eat at restaurants with plenty of choices and lower price points.

- Worldwide, millennials exhibit an interest in health and fitness, including in activities such as yoga, Pilates, fitness classes and, increasingly, meditation. Running, however, appears to be going out of fashion among millennials.

THE MILLENNIALS SERIES

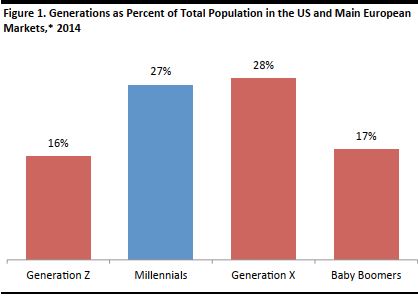

This third report in our Millennials Series looks at how millennial consumers spend their free time. Our first report in this series considered how this generation is changing the nature of grocery retailing. In the second report of the series, we focused on the beauty category. Millennials are typically defined as those born between 1980 and 2000. Given the generation’s 20-year age span, millennials make up a sizeable chunk of the population. Fung Global Retail & Technology estimates that, in 2014, millennials represented 27% of the total population in the combined US and major European markets, making the group the second-largest age segment in these markets, after Generation X. [caption id="attachment_90401" align="aligncenter" width="418"] Generation Zers were born in 2001 or later, millennials between 1980 and 2000, Generation Xers between 1960 and 1979 and baby boomers between 1946 and 1959.

Generation Zers were born in 2001 or later, millennials between 1980 and 2000, Generation Xers between 1960 and 1979 and baby boomers between 1946 and 1959.*The main European markets refer to the aggregate population in Germany, France, Italy, Spain and the UK.

Source: Eurostat/US Census Bureau/Fung Global Retail & Technology

[/caption] Because millennials range in age from 16 to 36, they constitute a consumer segment that is of growing value in most markets. While many millennials have less money and financial security than their peers in older generations do, they are typically in a high-growth phase in terms of their earnings. Millennials are in a life stage where they are, or soon will be, developing their careers, moving up the professional ladder and settling down into double-income households. So, year over year, their spending power will be increasing. This demographic is significant not only because of its size and growing spending power, but also because its consumer demands tend to differ notably from those of previous generations. While such a large group is inevitably diverse and complex, there are nevertheless some identifiable millennial trends:

- Millennials are highly adept at using technology and are very active social media

- They tend to be more socially conscious than older age groups, and are influenced by product offerings marketed as ethical, sustainable or environmentally friendly.

- They are more likely than older age groups to focus on health and well-being in areas such as food and physical activity.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

- They are more concerned with value and bargain hunting, in part out of necessity, as their economic opportunities have decreased.

- There is evidence that millennials are more interested in spending on experiences than on possessions.

- Similarly, there are indications that some millennials are shifting toward renting instead of owning belongings, from cars to clothes, although this may be influenced by the group’s relative economic insecurity.

- Because they are often pressed for time, millennials are likely to be looking for convenience, especially when shopping.

MILLENNIALS AND LEISURE

In this third report in our Millennials Series, we explore how millennials are reshaping the leisure sector. In the following sections of this report, we analyze:- How much millennials spend on leisure goods and services in markets such as the US and the UK, both in absolute terms and relative to other age groups.

- How American millennials underspend on travel versus other age groups. And how American millennials tend to be reluctant to take all the time off from work that they are due, and other factors in the travel category.

- How millennials across countries tend to overspend on dining out compared with other age groups.

- Millennials’ greater interest than many other age groups in fitness.

- What leisure activities millennials spend the most time on.

MILLENNIALS SPEND LESS ON LEISURE THAN OLDER GENERATIONS DO

Millennials like to spend on leisure services. In fact, the widely reported view of this age group is that they are more inclined than other age groups to spend on experiences rather than on material goods. As we document in this section, however, that interest in experiences does not mean that millennials spend more on leisure than the average consumer. Our analysis found that: [caption id="attachment_90403" align="aligncenter" width="409"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

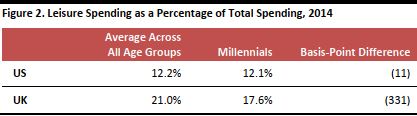

- As a share of their total spending, millennials underindex on leisure spending versus the average consumer.

- In absolute terms, too, millennials typically spend less on leisure than do other age groups.

Based on households’ spending by age of the head of household. In the US, millennials are people under age 35; in the UK, they are under age 30. These shares therefore also include some consumers who are younger than millennials (Generation Zers). However, given that these data are based on household spending by the age of the head of the household, Generation Z’s share of spending is estimated to be relatively low: virtually no households are headed by consumers under age 16.

Based on households’ spending by age of the head of household. In the US, millennials are people under age 35; in the UK, they are under age 30. These shares therefore also include some consumers who are younger than millennials (Generation Zers). However, given that these data are based on household spending by the age of the head of the household, Generation Z’s share of spending is estimated to be relatively low: virtually no households are headed by consumers under age 16. Source: US Bureau of Labor Statistics (BLS)/Office for National Statistics (ONS)/Fung Global Retail & Technology[/caption] In the following section, we analyze spending data from the US and the UK in more detail, to see how much millennials are spending and on what categories. The US: 25–34-Year-Olds Spend Less on Leisure than Older Age Groups Do In our analysis of millennial spending trends in the US, we used data from the BLS, and our definition of spending on leisure includes the following: eating out; travel; fees and admissions to events; movies, clubs and organizations; TV, radio and sound equipment; pets, toys, hobbies and playground equipment; and other products and services. [caption id="attachment_90406" align="aligncenter" width="415"]

Source: Shutterstock[/caption]

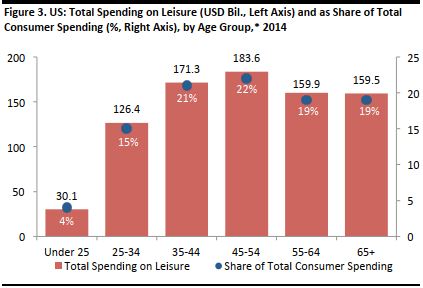

Millennials’ share of total consumer spending on leisure in the US was relatively low, according to the BLS’s 2014 Consumer Expenditure Survey (latest available), which shows average household expenditure by age of the head of household:

Source: Shutterstock[/caption]

Millennials’ share of total consumer spending on leisure in the US was relatively low, according to the BLS’s 2014 Consumer Expenditure Survey (latest available), which shows average household expenditure by age of the head of household:

- Households headed up by consumers ages 25–34 represented 15% of total leisure spending versus their 16% share of households.

- Consumers under 25 represented 4% of the leisure spending total versus their 7% share of households.

*By age of “reference person,” i.e., the head of the household

*By age of “reference person,” i.e., the head of the householdSource: BLS/Fung Global Retail & Technology

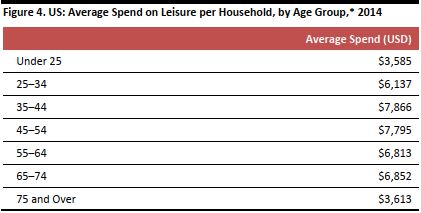

[/caption] It is worth noting that relatively few households are headed by someone younger than 25, as many very young adults are likely to live in households headed by a parent. The general leisure-spending trend is nevertheless indicative. On average, consumers ages 25–34 spent $6,137 on leisure in 2014, which is less than the average for any older age groups up to age 74. In the coming years, as millennials’ spending power grows, the gap between their leisure spending and that of older age groups is likely to narrow. [caption id="attachment_90408" align="aligncenter" width="421"]

*By age of “reference person,” i.e., the head of the household

*By age of “reference person,” i.e., the head of the householdSource: BLS/Fung Global Retail & Technology

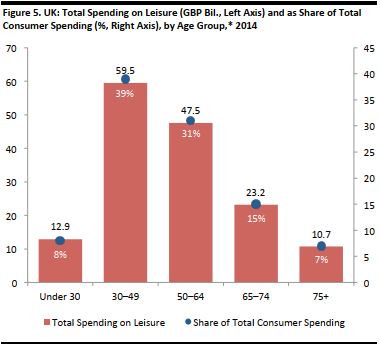

[/caption] The UK: Households Headed by Those Under Age 30 Underspend on Leisure In the UK, the age breaks for official household spending data are less granular, but they show a similar pattern to that seen in the US:

- According to ONS data for 2014 (latest available), households headed by those under age 30 represented only 8% of total spending on leisure.

- However, 10% of all UK households were headed by someone under age 30 in 2014.

*By age of “reference person,” i.e., the head of the household

*By age of “reference person,” i.e., the head of the householdSource: ONS/Fung Global Retail & Technology

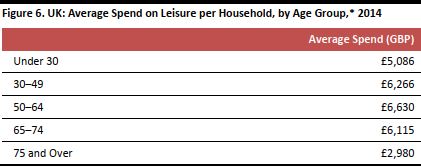

[/caption] We found that millennials’ leisure spending in the UK was similar to their peers’ spending in the US. The average leisure spend per UK household headed by someone under age 30 was less than that of households led by those in any older age brackets, up to 75 years. British millennials under age 30 spent an average of £5,086 on leisure in 2014, we calculate. [caption id="attachment_90410" align="aligncenter" width="421"]

*By age of “reference person,” i.e., the head of the household

*By age of “reference person,” i.e., the head of the householdSource: ONS/Fung Global Retail & Technology

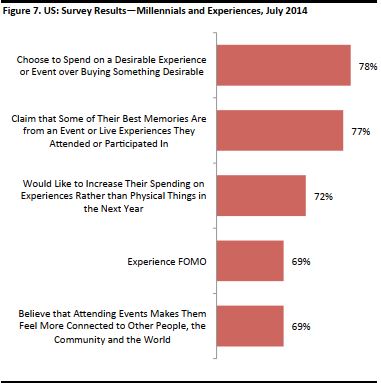

[/caption] Spending on Experiences Rather than on Stuff Survey data confirm that millennials tend to spend less on leisure than older generations do—despite millennials’ preference to spend on experiences rather than on material goods. According to a 2014 survey by Eventbrite and Harris Poll, a clear majority of millennials choose to spend on experiences or events rather than on stuff. The “fear of missing out” (FOMO), or the apprehension that others are having enjoyable experiences that one is not part of, is common among millennials, many of whom feel that some of their best memories are from events and experiences. [caption id="attachment_90411" align="aligncenter" width="381"]

Source: Eventbrite/Harris Poll[/caption]

Source: Eventbrite/Harris Poll[/caption]

THREE TOP TAKEAWAYS ON MILLENNIALS AND LEISURE

So, what leisure activities are millennials actively engaging in and spending freely on? In this section, we identify three hallmarks of this age group’s leisure category consumption:- In the US, millennials underindex on travel spend versus their older peers, while in Europe, this age group does not underindex on number of trips taken but younger millennials underspend on travel versus older age groups.

- Worldwide, millennials show a willingness to spend relatively more than other age groups on dining out.

- Also worldwide, this age group exhibits a strong interest in health and fitness, including in activities such as yoga.

1. US MILLENNIALS SPEND LESS ON TRAVEL THAN OTHER AGE GROUPS DO

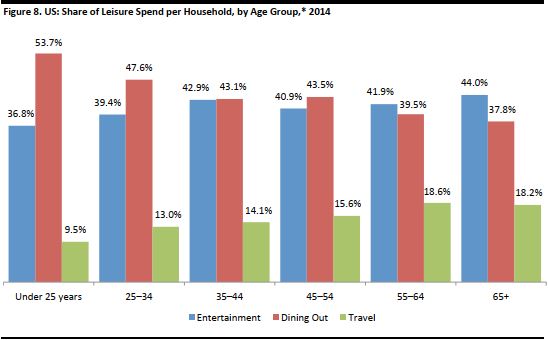

Our analysis of BLS data shows that, younger age groups in the US, including consumers ages 25–34, underspend on travel versus their older peers. Only 13% of this age group’s total leisure spend is on travel compared with over 15% among 45–54-year-olds and over 18% among 55–64-year-olds. Also according to our analysis of BLS data, American consumers under age 35 allocate more of their leisure spending to dining out than older age groups do. [caption id="attachment_90412" align="aligncenter" width="548"] *By age of “reference person,” i.e., the head of the household

*By age of “reference person,” i.e., the head of the householdSource: BLS/Fung Global Retail & Technology

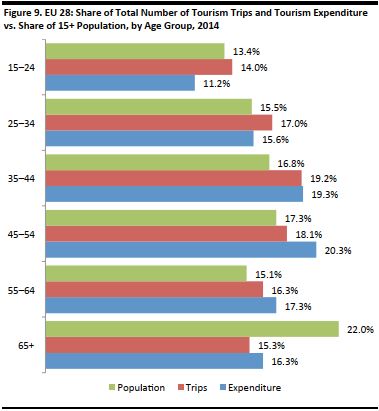

[/caption] In the US in 2014, households headed by those ages 25–34 spent an average of just under $800 on travel; this compares to well over $1,000 in each older age group, with the exception of those ages 65 and over. Households headed by consumers under age 25 spent much less on travel—just $340. (This category covers only out-of-town trips, not day-to-day travel or commuting costs.) This underspending on travel is not seen among older European millennials, although younger millennials (those aged under 25) underspend a little. Data for the 28 European Union (EU) countries indicate that millennials in the EU overindex on their share of total tourism trips:

- Those ages 15–24 take a share of trips that is slightly greater than their share of the population aged 15 and older, but they underindex on spending.

- Those ages 25–34 also overindex on the share of trips taken; their share of spending is broadly in line with their share of population.

Source: Eurostat/Fung Global Retail & Technology[/caption]

Confirming that younger millennials tend to spend less than some older age groups on travel, ONS data show that UK households aged under 30 spent on average £380 on accommodation services in 2014; this compared to £437 among those households headed up by 30–49-year-olds.

Millennials Sacrifice Time Off, but Want to Make the Most of Vacations

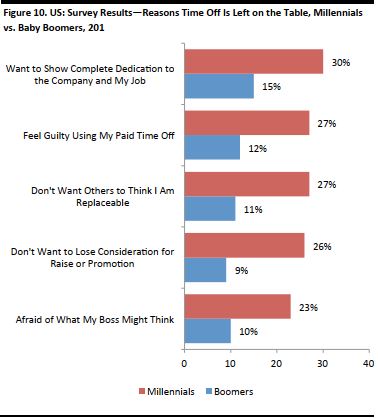

In the US, the abovementioned underindexing on travel spend among millennials appears to be related to the relatively few vacation days this age group takes from work. Many American millennials are not using their full vacation allowances, as they are under pressure at work to show their dedication to their employer:

Source: Eurostat/Fung Global Retail & Technology[/caption]

Confirming that younger millennials tend to spend less than some older age groups on travel, ONS data show that UK households aged under 30 spent on average £380 on accommodation services in 2014; this compared to £437 among those households headed up by 30–49-year-olds.

Millennials Sacrifice Time Off, but Want to Make the Most of Vacations

In the US, the abovementioned underindexing on travel spend among millennials appears to be related to the relatively few vacation days this age group takes from work. Many American millennials are not using their full vacation allowances, as they are under pressure at work to show their dedication to their employer:

- According to the US Travel Association’s research, American millennials are leading the trend of being “work martyrs”—people who think no one else at their company can do their work while they are away, and who do not want others to think they are replaceable or who feel guilty for using their paid time off.

- Fully 48% of American millennials think it is a good thing to be seen as a work martyr by their boss; the percentage is significantly higher than among Gen Xers (39%) and baby boomers (32%).

- Another factor may be that millennials, who are in the early stages of their careers and in junior positions, are more likely to have fewer vacation days compared with their colleagues in more senior positions.

Source: US Travel Association/Fung Global Retail & Technology[/caption]

Additionally, a 2015 EY study on work-life challenges found that millennials in the US are much less likely to take a career break after having a child (50%) compared with Gen Xers (75%) and baby boomers (67%).

Millennials Who Do Travel Look for Unique Experiences

According to the American Society of Travel Agents (ASTA), because millennials have limited vacation time, they want to ensure they get the greatest value possible when traveling during the precious time they do have away from work.

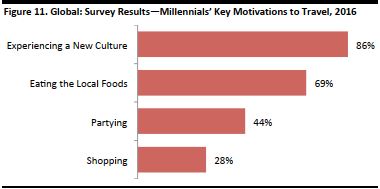

In 2016, Topdeck Travel, a travel company that focuses on the 18–30-something market, surveyed 31,000 people (94% of which were ages 18–30) from 134 different countries in order to gauge their travel preferences. The survey found that the key motivation to travel was to experience a new culture. When asked how they choose where to travel next, 76% of respondents stated that friends’ recommendations were a main factor. Often, these recommendations can be found on social media.

[caption id="attachment_90415" align="aligncenter" width="374"]

Source: US Travel Association/Fung Global Retail & Technology[/caption]

Additionally, a 2015 EY study on work-life challenges found that millennials in the US are much less likely to take a career break after having a child (50%) compared with Gen Xers (75%) and baby boomers (67%).

Millennials Who Do Travel Look for Unique Experiences

According to the American Society of Travel Agents (ASTA), because millennials have limited vacation time, they want to ensure they get the greatest value possible when traveling during the precious time they do have away from work.

In 2016, Topdeck Travel, a travel company that focuses on the 18–30-something market, surveyed 31,000 people (94% of which were ages 18–30) from 134 different countries in order to gauge their travel preferences. The survey found that the key motivation to travel was to experience a new culture. When asked how they choose where to travel next, 76% of respondents stated that friends’ recommendations were a main factor. Often, these recommendations can be found on social media.

[caption id="attachment_90415" align="aligncenter" width="374"] Source: Shutterstock[/caption]

[caption id="attachment_90416" align="aligncenter" width="380"]

Source: Shutterstock[/caption]

[caption id="attachment_90416" align="aligncenter" width="380"] Source: Topdeck Travel[/caption]

Technology and social media play an important part in the lives of millennials, and many of them share posts from their holidays on social networks:

Source: Topdeck Travel[/caption]

Technology and social media play an important part in the lives of millennials, and many of them share posts from their holidays on social networks:

- Topdeck Travel’s survey found that only about 10% of millennials do not update their social media accounts while traveling.

- In July 2014, Eventbrite and Harris Poll found that 60% of millennials surveyed had posted about, tweeted about, or shared events or experiences on social media in the past year.

2. DINING OUT CAPTURES A GREATER SHARE OF MILLENNIALS’ LEISURE SPENDING THAN IT DOES FOR OLDER AGE GROUPS

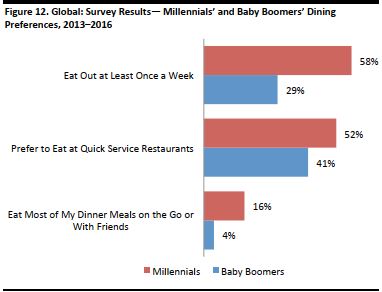

More universal is the greater tendency among millennials to spend on dining out. Among 25–34-year-old Americans, dining out captures fully 48% of their total leisure spend. This compares with a little over 43% in both the 35–44-year-old and 45–54-year-old age groups. A wealth of evidence confirms this trend across multiple countries:- According to a 2015 Morgan Stanley survey of American adults, 53% of millennials go out to eat at least once a week versus 43% for the broader population.

- The US’s National Restaurant Association notes that millennials view dining out as a social event, and that they often prefer to eat at restaurants that offer a wide range of choices and lower price points. Although millennials are often very price conscious, they may prefer to dine out for social and experiential reasons, even if eating at home would be considerably cheaper.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

- According to Nielsen’s Global Generational Lifestyles report—which relied on survey responses from more than 30,000 online consumers in more than 60 countries between 2013 and 2016—the share of millennials who said they dine out at least once a week was double that of baby boomers (58% of millennials versus 29% of baby boomers). And although the percentage of millennials who said they eat most of their dinner meals on the go or with friends was relatively low, at 16%, it was still significantly higher than that recorded for baby boomers (4%).

- In the US in 2014, households headed by consumers ages 25–34 spent an average of $2,921 on dining out. Although this was slightly lower than the average for those ages 35–44 and those ages 45–54, it was higher than the average spent by those ages 55–64. And, as previously mentioned, dining out accounted for a greater share of total leisure spend for millennials than it did for older age groups.

Source: Nielsen, Global Generational Lifestyles[/caption]

Source: Nielsen, Global Generational Lifestyles[/caption]

3. HEALTH AND FITNESS

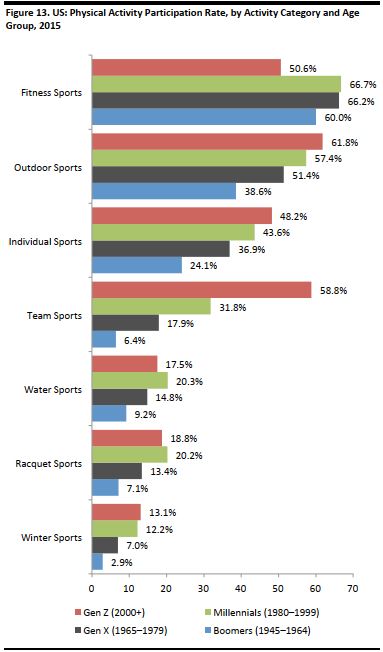

Being Healthy Means More than Looking Good In the US, millennials show the highest participation rates of any age group in fitness sports and the second-highest participation rates in outdoor sports and individual sports. According to the Physical Activity Council’s 2016 Participation Report, millennials in the US participated in more fitness, racquet and water sports than other generations did in 2015 (fitness sports include aerobics, running/jogging, weight lifting and swimming). Generational differences are most visible in team sport participation rates, and Gen Zers are by far the most active in team sports. [caption id="attachment_90419" align="aligncenter" width="383"] Source: Physical Activity Council[/caption]

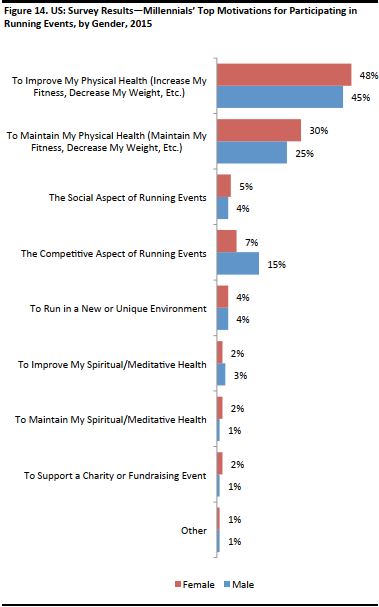

According to Running USA’s Millennial Running Study, the top motivation for male and female millennials in the US to attend a running event in 2015 was to increase their physical health, followed by to maintain their physical health. Millennial men found the competitive aspect of running events more important, while women ranked the social aspect of running events and maintaining their spiritual/meditative health higher than men did.

[caption id="attachment_90420" align="aligncenter" width="379"]

Source: Physical Activity Council[/caption]

According to Running USA’s Millennial Running Study, the top motivation for male and female millennials in the US to attend a running event in 2015 was to increase their physical health, followed by to maintain their physical health. Millennial men found the competitive aspect of running events more important, while women ranked the social aspect of running events and maintaining their spiritual/meditative health higher than men did.

[caption id="attachment_90420" align="aligncenter" width="379"] Source: Running USA, Millennial Running Study[/caption]

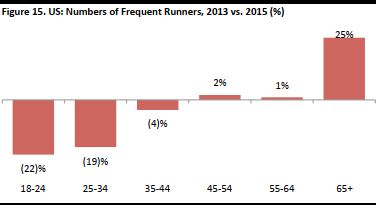

While running, either alone or in events, is a popular activity, some figures suggest that millennials are to blame for the end of the “running boom.” The Sports & Fitness Industry Association recorded a decline between 2013 and 2015 in the number of American millennials who ran 50 times a year or more. These findings are in line with the data from Running USA, which reported a decline in the number of people participating in running events in the US in the same period.

[caption id="attachment_90421" align="aligncenter" width="377"]

Source: Running USA, Millennial Running Study[/caption]

While running, either alone or in events, is a popular activity, some figures suggest that millennials are to blame for the end of the “running boom.” The Sports & Fitness Industry Association recorded a decline between 2013 and 2015 in the number of American millennials who ran 50 times a year or more. These findings are in line with the data from Running USA, which reported a decline in the number of people participating in running events in the US in the same period.

[caption id="attachment_90421" align="aligncenter" width="377"] Source: Sports & Fitness Industry Association[/caption]

John Connors, VP of Product Development at Bigsley Event House, the parent company of The Color Run, told The Wall Street Journal that millennials are interested in new experiences, but that they do not want to be identified with a particular activity. He said that the company saw a drop in participation in its color runs for the first time in 2015, and that it expects participation to decline further in 2016.

Generation Yoga: Meditation on the Rise

The trend of constantly being on the go comes with a price: in the US, millennials are the most stressed-out generation. According to the American Psychological Association’s (APA’s) 2015 Stress in America report, millennials have the highest reported stress level of all generations, and are also the most likely to say their stress has increased in the past year. Financial pressures cause millennials the most stress.

Although watching TV/movies for more than two hours a day and surfing on the Internet are the most commonly used stress-management techniques among millennials, according to the APA, more and more young adults are turning to meditation to help manage their stress.

[caption id="attachment_90422" align="aligncenter" width="374"]

Source: Sports & Fitness Industry Association[/caption]

John Connors, VP of Product Development at Bigsley Event House, the parent company of The Color Run, told The Wall Street Journal that millennials are interested in new experiences, but that they do not want to be identified with a particular activity. He said that the company saw a drop in participation in its color runs for the first time in 2015, and that it expects participation to decline further in 2016.

Generation Yoga: Meditation on the Rise

The trend of constantly being on the go comes with a price: in the US, millennials are the most stressed-out generation. According to the American Psychological Association’s (APA’s) 2015 Stress in America report, millennials have the highest reported stress level of all generations, and are also the most likely to say their stress has increased in the past year. Financial pressures cause millennials the most stress.

Although watching TV/movies for more than two hours a day and surfing on the Internet are the most commonly used stress-management techniques among millennials, according to the APA, more and more young adults are turning to meditation to help manage their stress.

[caption id="attachment_90422" align="aligncenter" width="374"] Source: Shutterstock[/caption]

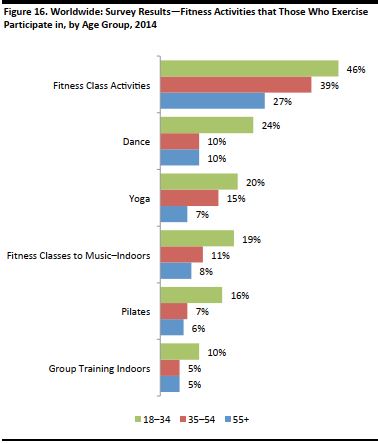

Different types of meditation have been around for centuries, but, as with many other long-established ideas and practices, millennials are tailoring meditation to their own needs. Yoga is among the popular meditation exercises in which millennials are most active, according to Nielsen. Different forms of meditation have emerged and are gaining popularity among millennials, from rooftop yoga sessions to transcendental meditation to hot yoga.

[caption id="attachment_90423" align="aligncenter" width="378"]

Source: Shutterstock[/caption]

Different types of meditation have been around for centuries, but, as with many other long-established ideas and practices, millennials are tailoring meditation to their own needs. Yoga is among the popular meditation exercises in which millennials are most active, according to Nielsen. Different forms of meditation have emerged and are gaining popularity among millennials, from rooftop yoga sessions to transcendental meditation to hot yoga.

[caption id="attachment_90423" align="aligncenter" width="378"] Based on online survey of 4,610 people in 13 countries: Australia, Brazil, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, the UK and the US.

Based on online survey of 4,610 people in 13 countries: Australia, Brazil, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, the UK and the US.Source: Nielsen, Nielsen: Les Mills Global Consumer Fitness Survey

[/caption] Catering to the demand for yoga, Bigsley Event House has launched a glow-in-the-dark yoga event with DJs, called Soul Pose, which the company is planning to expand to 15–20 cities in the US, Canada and Australia. Elsewhere, ancient meditation techniques are meeting 21st-century technologies. For the on-the-go, tech-savvy generation, there are numerous meditation apps on the market, such as Buddhify, Headspace, Mindbody and The Mindfulness App. Such apps have become highly popular; Headspace alone has more than 7 million users in 200 countries, according to lifestyle platform Balance.

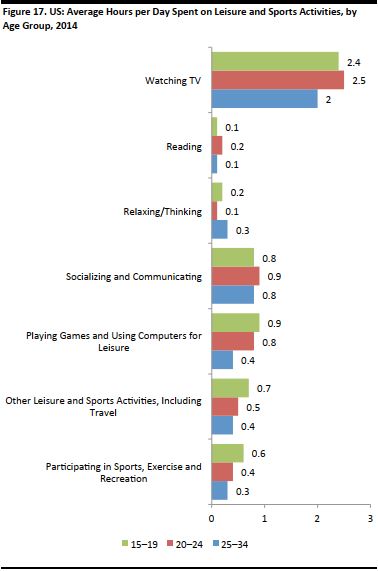

LEISURE ACTIVITIES BY TIME SPENT: WATCHING TV IS MOST POPULAR PASTIME

Despite millennials’ interest in fitness and physical activity, when it comes to the average time they spend participating in various leisure activities per day, watching TV is the top activity among US millennials, according to the BLS. [caption id="attachment_90424" align="aligncenter" width="374"] Source: Shutterstock[/caption]

However, the way millennials watch TV has changed dramatically in only a few years, with a majority of millennials in the US now streaming TV online. According to market research firm Horowitz Research in May 2016:

Source: Shutterstock[/caption]

However, the way millennials watch TV has changed dramatically in only a few years, with a majority of millennials in the US now streaming TV online. According to market research firm Horowitz Research in May 2016:

- Streaming accounts for 54% of American millennials’ TV viewing time , compared with 25% for live TV.

- In terms of total TV content consumed by American viewers ages 18 and older, some 50% of content is live and 29% is streamed.

Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

- Among millennials in the US, the weekly share of content that is streamed rose from 15% in 2012 to 54% in 2016, while traditional viewing of live content dropped from 75% to 39% over the same period.

Source: BLS/Fung Global Retail & Technology[/caption]

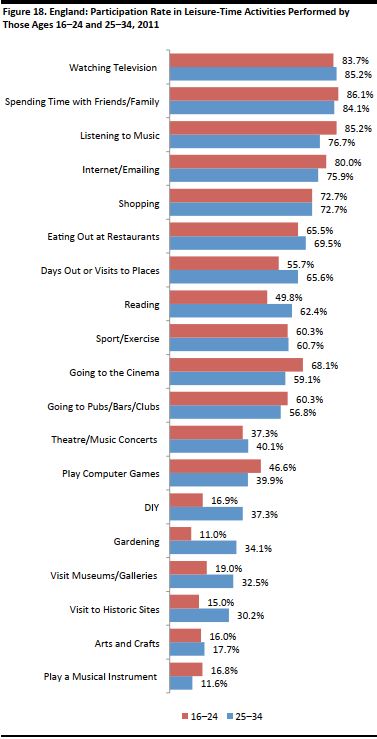

We see a similar pattern in England, where watching TV is a popular leisure-time activity among millennials. This is closely followed by spending time with family and friends, listening to music, and browsing the Internet. Unsurprisingly, activities that may be deemed more sophisticated or “slower,” such as visiting historic sites, are more popular among older millennials (ages 25–34) than among younger millennials (ages 16–24).

[caption id="attachment_90427" align="aligncenter" width="377"]

Source: BLS/Fung Global Retail & Technology[/caption]

We see a similar pattern in England, where watching TV is a popular leisure-time activity among millennials. This is closely followed by spending time with family and friends, listening to music, and browsing the Internet. Unsurprisingly, activities that may be deemed more sophisticated or “slower,” such as visiting historic sites, are more popular among older millennials (ages 25–34) than among younger millennials (ages 16–24).

[caption id="attachment_90427" align="aligncenter" width="377"] Source: ONS/Fung Global Retail & Technology[/caption]

Source: ONS/Fung Global Retail & Technology[/caption]

KEY TAKEAWAYS

As a relatively young age group whose members are still climbing the career ladder, millennials underindex most older generations in terms of how much they spend on leisure goods and services. As their purchasing power rises, their share of total spending should increase significantly. In the US, millennials underspend on travel relative to older age groups, and this appears to be related in part to an unwillingness to take their full allocation of paid time off. We do not see a similar trend in Europe, where millennials tend to take more trips relative to some other age groups; even in Europe, however, younger millennials underspend on travel. Across multiple countries, millennials show a willingness to spend on dining out. In the US, for example, they spend a greater share of their total leisure dollars on dining out than other age groups do. Fitness and physical activity are important for this age group, with fitness classes, yoga and Pilates proving popular. Running, however, appears to be going out of fashion somewhat among millennials. [caption id="attachment_90428" align="aligncenter" width="369"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]