Executive Summary

This fourth report in our Millennials Series examines how millennial consumers spend on home furnishings.

Millennials are typically defined as those born between 1980 and 2000. Given the 20-year span, this generation makes up a sizable chunk of the US and UK population. These consumers are increasingly valuable to furniture retailers as they are entering their peak spending years and are establishing family homes. However, as we note in this report, frugal habits, more mobile lives and smaller living spaces are among the factors depressing their worth to retailers.

Below, we identify ten characteristics of the millennials’ furniture market.

- Household formation and home ownership is declining: Millennials get married and form families and households later in life than previous generations, stifling demand for home furnishings.

- Living spaces are getting smaller: Millennials purchase less furniture as they opt to make only useful purchases and seek multifunctional products.

- Increased mobility: Millennials seek furniture that is easy to move and easy to assemble.

- Furniture sales are driven by the back-to-college period: College students are setting up new households and require furnishings for dorm rooms and apartments.

- Seeking a strong price and value proposition: Currently, millennials spend less on home furnishings than previous generations, largely due to lower incomes and a preference to spend on experiences rather than possessions.

- Appreciation of vintage furniture: Millennials tend to seek individuality and differentiation, and due to their more limited budgets, tend to have an affinity for vintage items.

- Acknowledge the importance of sustainability: Millennials appreciate products that are ethically and sustainably sourced.

- Attracted by connected furniture of the future: Millennials tend to be tech-savvy, so they are natural customers for technologically advanced furniture.

- Still visit brick-and-mortar stores: Tech-savvy millennials browse for and research potential furniture purchases online, but still embrace the brick-and-mortar shopping experience.

- Use of social media for decorating inspiration: This generation is more likely to browse and research products on Pinterest and Instagram to obtain design ideas and inspiration.

Established brands and retailers are facing competition from innovative, online startups that are catering to millennial shopping preferences while reshaping the furniture sector.

Introduction

In this fourth report in our Millennials Series, we explore how the millennial age group is reshaping the furniture sector. Our first report in this series considered how this generation is changing the nature of grocery retailing. In the second report of the series, we focused on the beauty category and in the third, we looked at leisure activities. We define millennials as those born between 1980 and 2000.

In the following pages, we explore how millennials are reshaping the furniture and home décor sectors in the US and the UK. We identify ten characteristics that have emerged to shape their home furnishings buying trends, and discuss the implications for retailers. These characteristics cover macroeconomic factors, prevailing consumer preferences, the competitive environment and future consumer and technology trends. We mention new online startup companies that offer unique and innovative furniture and home furnishings products in the US and UK markets.

The Millennials Series

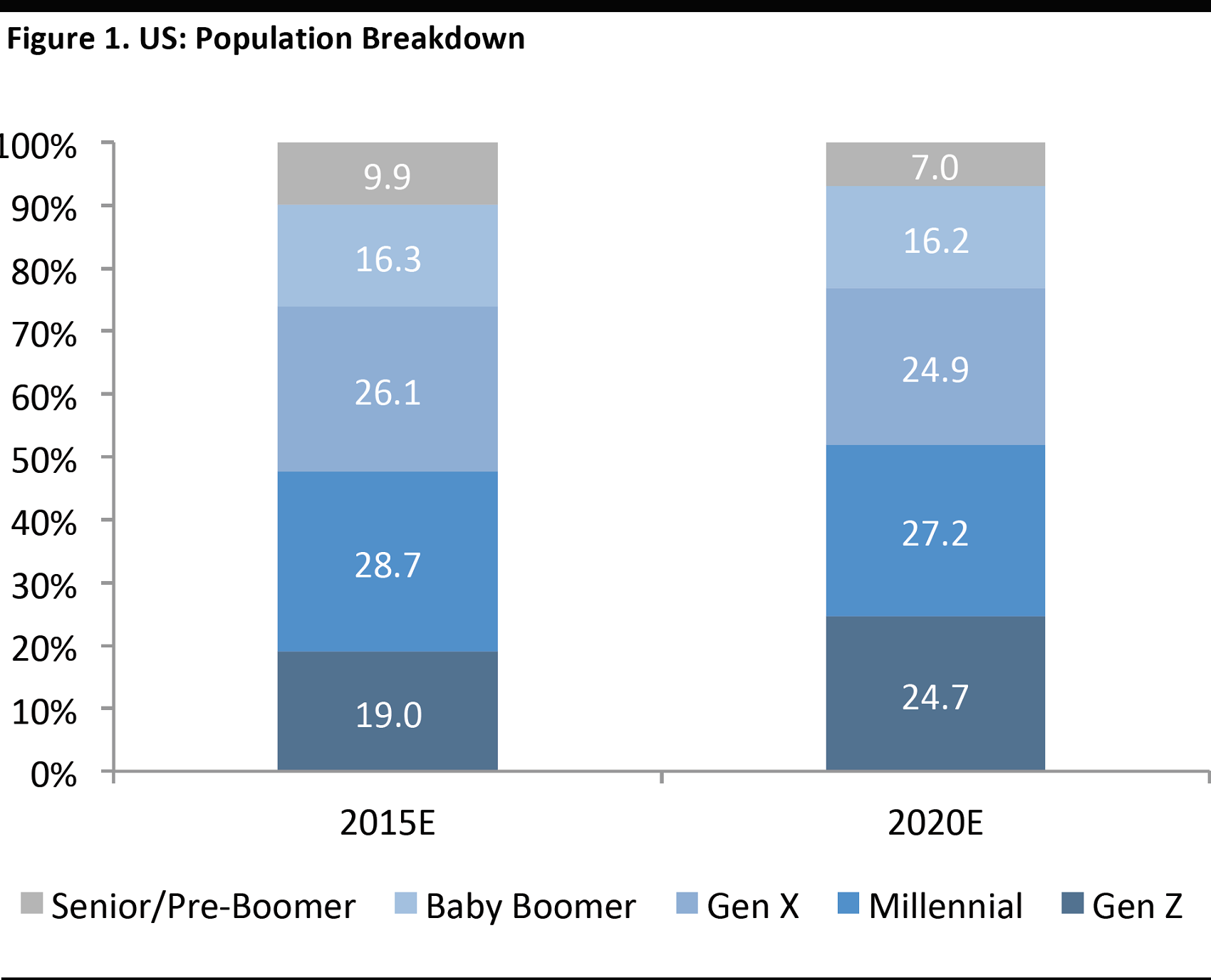

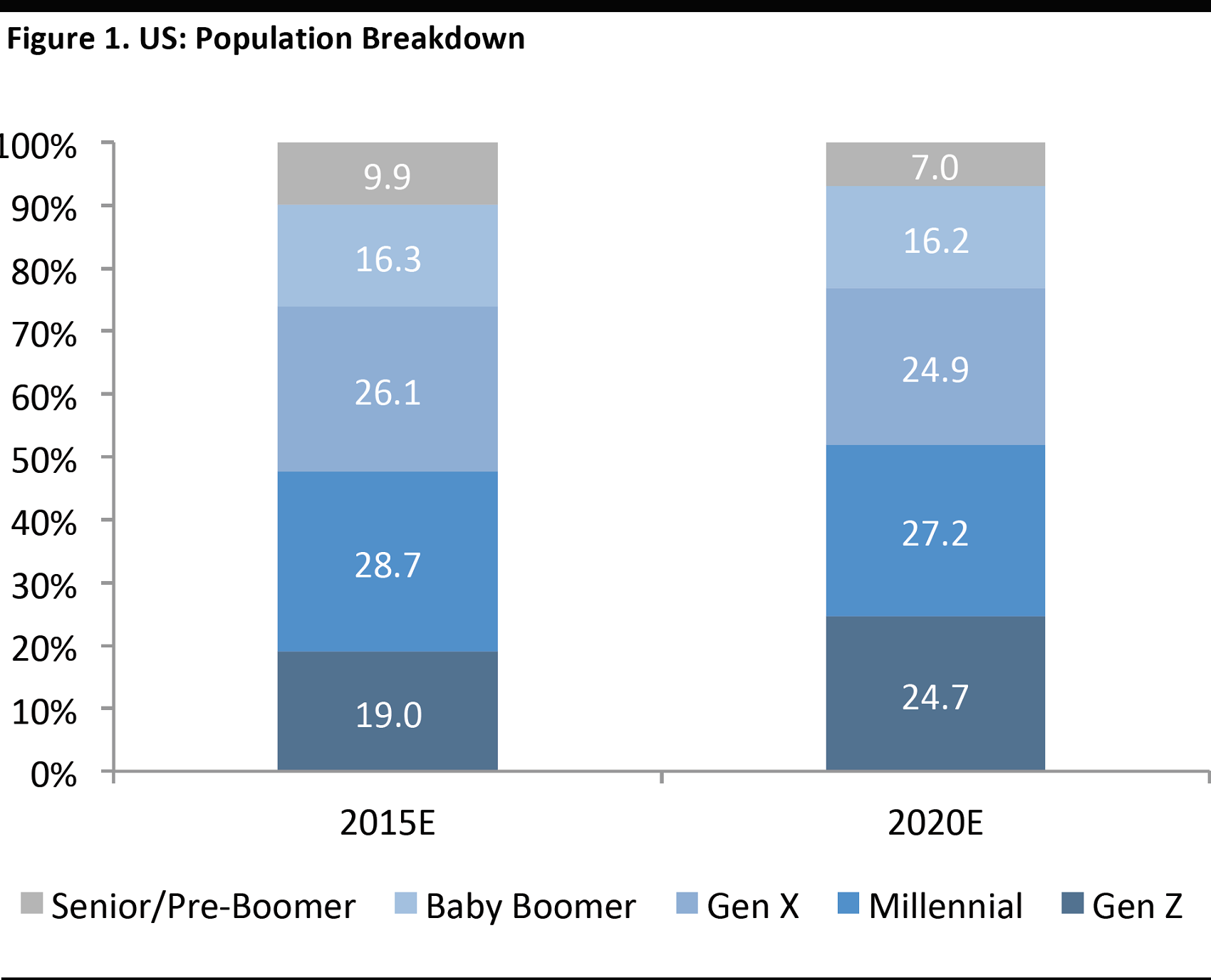

Millennials are typically defined as those born between 1980 and 2000. Given the 20-year age span, this generation makes up a sizeable chunk of the population.

Millennials accounted for approximately 29% of the total adult population in the US and 27% of the population in the UK in 2015.

Source: US Census Bureau/Fung Global Retail & Technology

This demographic is significant not only because of its size, but also because its consumer demands tend to differ notably from those of previous generations. While such a large group is inevitably diverse and complex, there are nevertheless some identifiable millennial trends:

- Many millennials have less money and financial security than previous generations.

- Millennials are highly adept at using technology and are very active on social media.

- They tend to be more socially conscious than older age groups, and are influenced by product offerings marketed as ethical, sustainable or environmentally friendly.

- They are more concerned with value and bargain hunting, in part out of necessity, as their economic opportunities have decreased.

- There is evidence that millennials are more interested in spending on experiences than on possessions.

- Similarly, there are indications that some millennials are shifting toward renting rather than owning belongings, from cars to furniture, although this may be influenced by the group’s relative economic insecurity.

- Because they are often pressed for time, millennials are likely to be looking for convenience, especially when shopping.

These preferences and behaviors are substantially affecting product and service markets worldwide. Major brands and retailers need to adapt to cater to the demands of this increasingly large and valuable consumer segment.

Millennials and Furniture

In the following sections of this report we discuss our ten identified hallmarks of this age group’s furniture and home décor and spending. These are:

- Household formation and home ownership is declining

- Living spaces are getting smaller

- Increased mobility

- Furniture sales accelerate in the back-to-college period

- Seek a strong price and value proposition

- An appreciation of vintage furniture

- Acknowledge importance of sustainability

- Attracted by connected furniture of the future

- Still visit brick-and-mortar stores

- Use of social media for decorating inspiration

1. Millennial Household Formation and Home Ownership is Declining

US and UK millennials delay household formation more than previous generations, due to high housing costs in US and UK cities, including high rents and tight mortgage-lending standards. Additionally, many millennials do not have stable employment and are struggling to pay off student loans, so are buying homes later in life. In response, millennials are likely to live at home with their parents for longer, or rent a room in an apartment with other flatmates.

According to the US Harvard Joint Center, household formation is closely correlated with housing affordability and income. Lower household formation rates depress consumer demand for furniture and home furnishings.

- The percentage of young Americans living with their parents has increased to a75-year high. In 2015, almost 40% of young Americans between the ages of 18 and 34, were living with parents, the largest percentage since 1940, according to Trulia, an online residential real estate website. In fact, even despite an improved economy since the financial crisis in 2008–2009, the number of young Americans aged 18–34 living with their parents has increased since 2005.

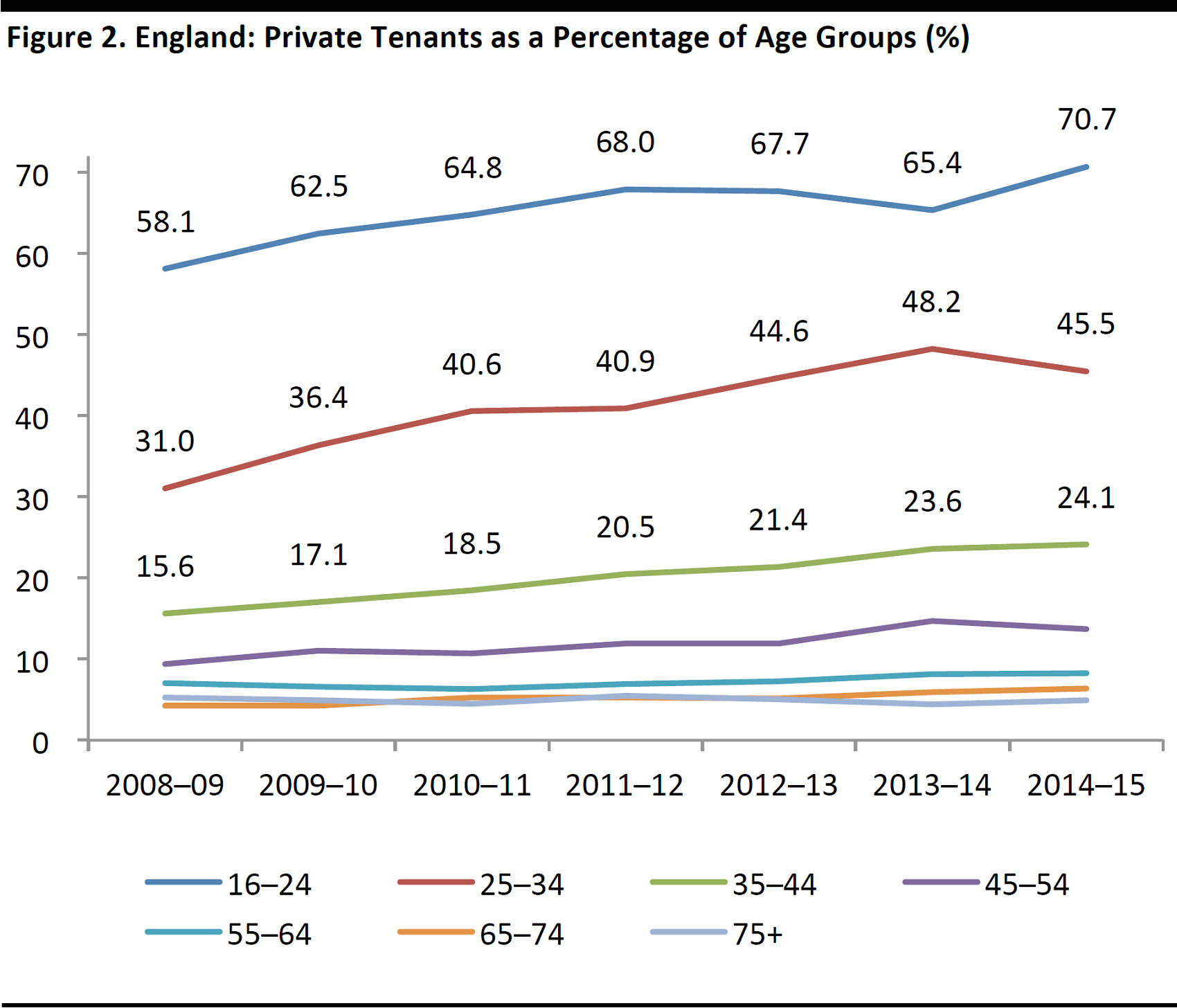

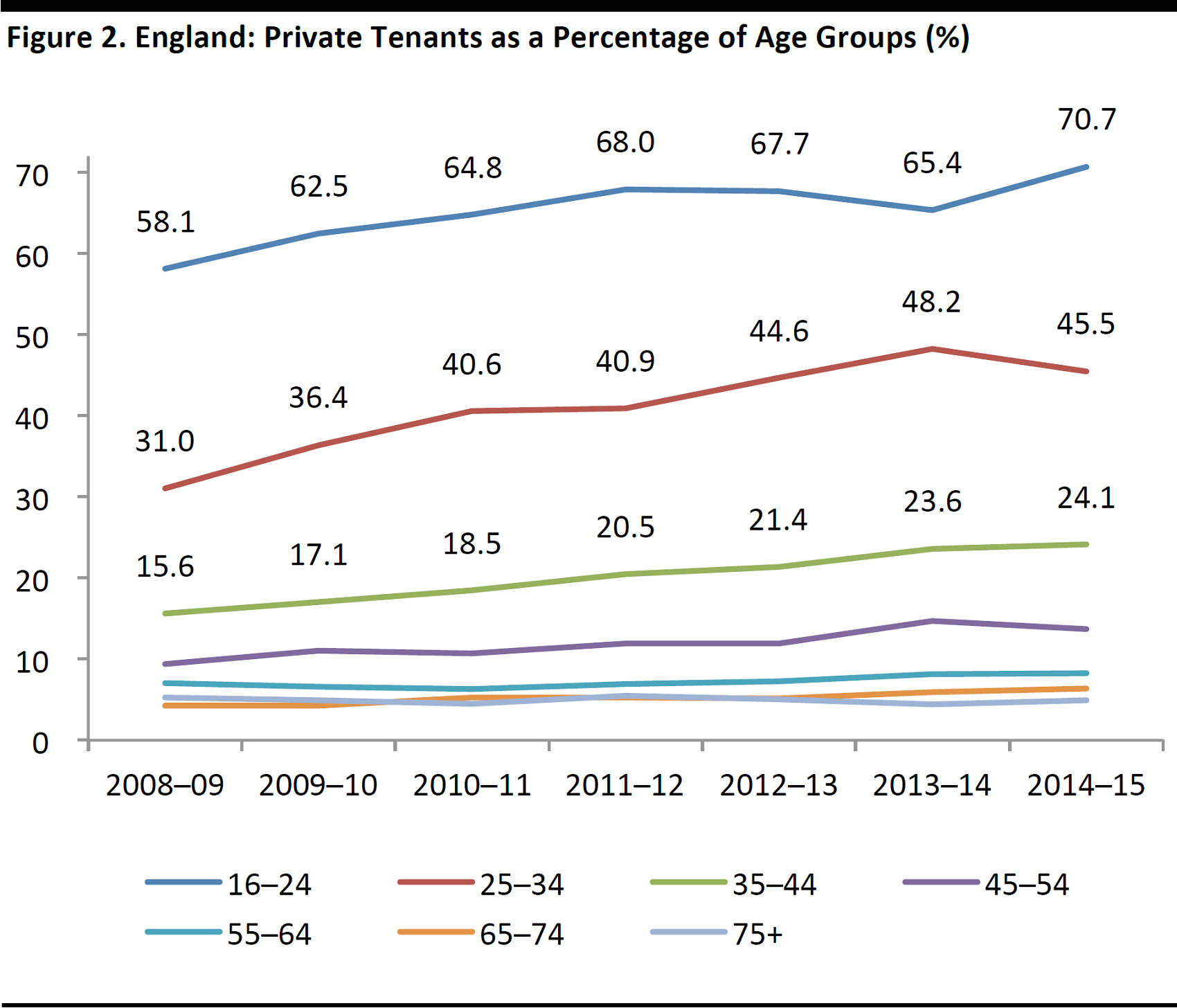

Likewise, in the UK, the proportion of renters versus homeowners has been increasing, particularly among millennials.

According to property firm Hammerson and market researchers Verdict, less than half of UK citizens born in 1990 will be homeowners by the age of 40, and 54% of millennials do not think they will ever be able to afford a property without financial aid from family.

Source: English Housing Survey, Department for Communities and Local Government

We see the renting trend impacting on the furniture market. For those who are renting unfurnished properties, or who need to buy additional furniture in a furnished property, there is likely to be little reason to invest in quality and longevity: they may need to disassemble or even dispose of the item the next time they move.

People who rent homes may not invest large sums in their homes, but they will still likely buy categories such as homewares and small decorative items. Items from these kinds of categories can be taken easily from house to house, are complementary to furnishings that may be provided by landlords and tend to carry a lower ticket price, which means there is less investment by the consumer.

2. Millennials’ Living Spaces are Getting Smaller

Space is often at a premium for millennials. Young people in the US and UK often move to urban areas where there is a greater concentration of jobs, and where living spaces tend to be smaller. Moreover, some UK and US millennials’ homes are getting smaller due to increasing housing and rental costs in cities. Space and storage considerations mean less furniture is required to avoid clutter. Since many millennials live in small spaces, they carefully assess product purchases for need and utility as well as willingness to take them when they move.

Space is a particular challenge in the UK, where homes are the smallest in Europe: average new builds there are only 92% of the recommended size, as architects reduce home and apartment sizes due to soaring house and land prices.

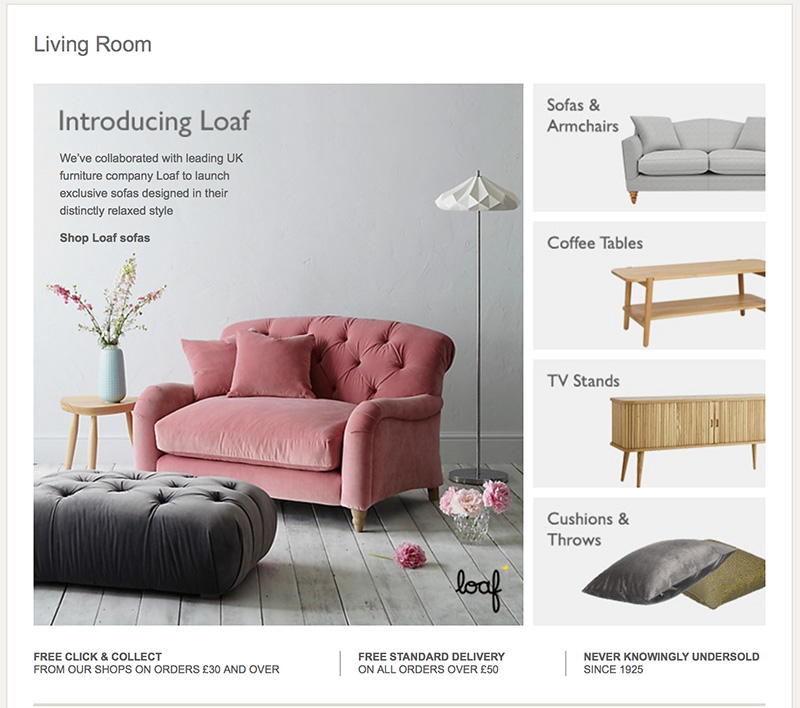

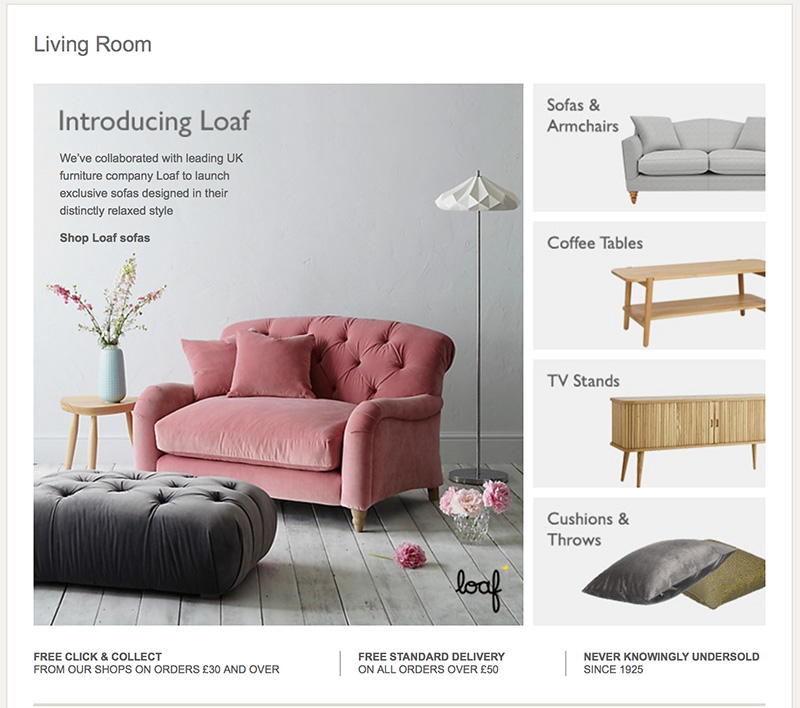

Source: John Lewis.com

Designers and retailers can appeal to millennials by producing smaller and more modular and multifunctional furniture that can more easily fit into smaller living spaces.

John Lewis reported that sales of smaller beds increased 53% year over year and mini-sofas by 12% in 2016. Strong sellers included a full-length mirror with shelves behind it, a coffee table that turns into a desk and a TV that doubles as a mantelpiece.

Urban living also means millennial consumers desire to purchase furnishings online and collect merchandise from convenient drop-off points, instead of trekking to out-of-town superstores. Companies need to offer accessible collection points in central areas.

IKEA has started opening smaller stores and city-center pickup points with better accessibility to public transport, much more conveniently located than its traditional out-of-town warehouses.

3. Millennials are More Mobile

Millennials are also tending to live more transient lives than previous generations, moving cities or apartments more frequently, and so are more likely to be looking for efficient and pain-free furniture solutions. Millennial furniture purchases are more short term in nature and flat-pack, deconstructable furnishings are easy to transport and assemble.

Many new innovative online furniture retailers have been established that offer unique furniture pieces for the migratory millennial lifestyle.

Burrow, an online furniture retailer, designs and produces couches that are shipped in three or four boxes and are easily carried and assembled without tools in a few minutes.

Casper, an online mattress retailer, sells foam mattresses and delivers them compressed inboxes.

Campaign is an e-commerce furniture company that offers a range of sofas and chairs that can be assembled in a few minutes without any tools, are easily packed and convenient to move.

Greycork produces furniture pieces that are made of 9-10 components.

Wood-Skin, an Italian design studio, developed a self-assembling table that transitions from flat to fully built with a simple pull. The product folds by itself according to a predesigned pattern.

Source: wood-skin.com

4. Millennial Furniture Sales Accelerate in the Back-to-College Period

Particularly in the US, the back-to-college season is important for furniture and home décor spending by and for the youngest millennials, as college students are setting up a new household for the first time and require merchandise for dorm rooms and apartments.

US millennials spent over US$6 billion on dorm or apartment furnishings during the back-to-school season in 2015, according to the National Retail Federation (NRF). In the UK, the most commonly purchased back-to-university goods were bedroom items such as bed sheets and lamps, mentioned by 53.8% of survey respondents in November 2016, according to Verdict Retail.

5. Millennials Seek a Strong Price and Value Proposition

Millennials seek inexpensive furnishing items, as they have limited financial resources. Furthermore, due to their increased mobility, millennials tend to not invest in long-term furnishings. Many millennials also prefer to spend on experiences rather than possessions.

For these reasons, millennials seek furniture products that are affordable for adequate quality, providing good value functionality. According to Essential Retail, 27% of UK millennial consumers do not own a large piece of furniture and do not think they will be able to afford one in the next five to ten years.

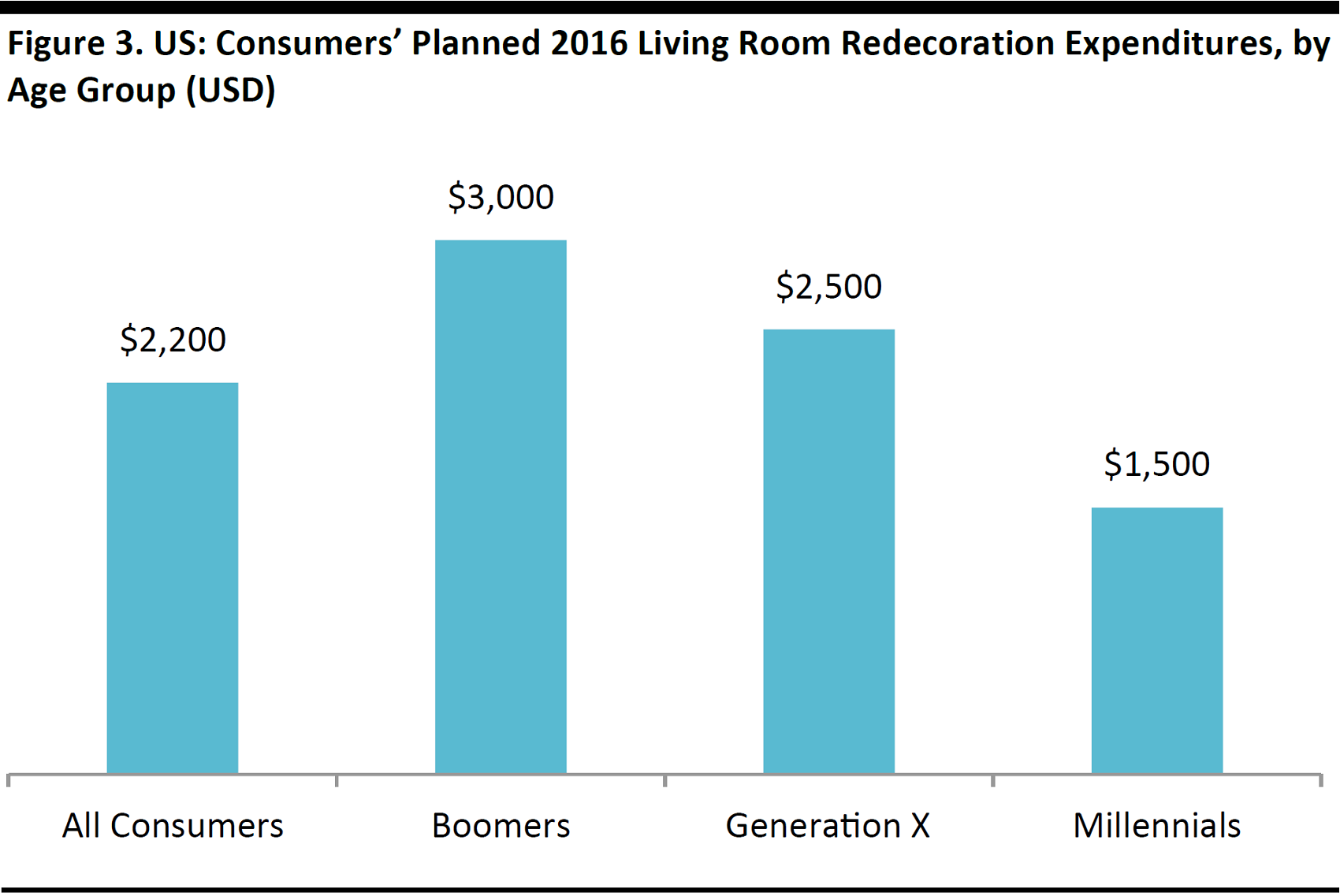

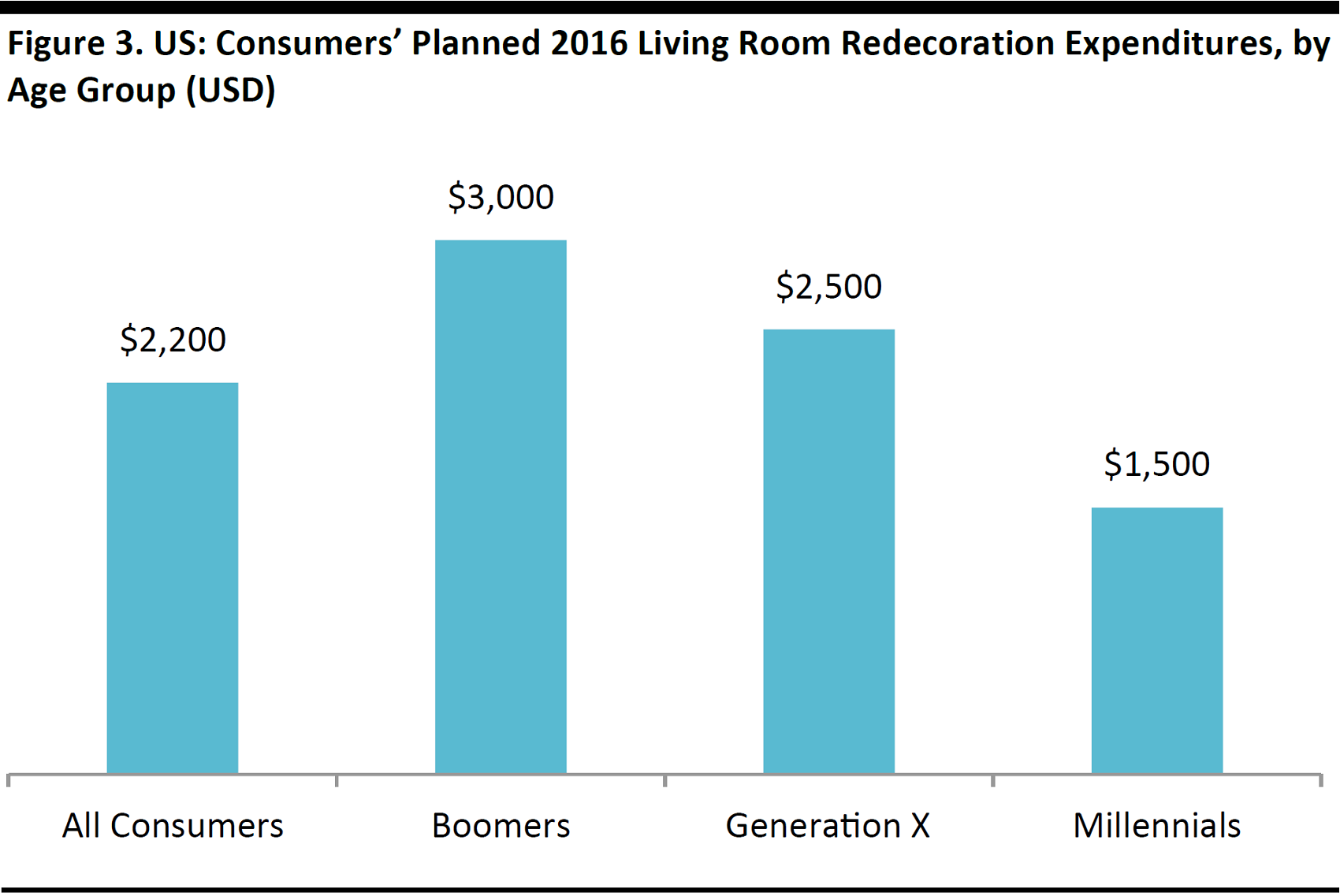

According to a 2016 study by Furniture Today, US millennials plan to decorate or redecorate the living room space first. However, as previously mentioned, millennials spend less even on living room furnishings, than other age groups, as depicted in the following graph.

Source: Furniture Today/Fung Global Retail & Technology

In terms of aesthetics, millennials often prefer homes with clean lines and modern styles, and well-organized spaces, with efficient and abundant storage space.

Many millennials tend to favor furniture styles and designs that are minimalist, modern and fashionable. Among these shoppers, Scandinavian and industrial styles are popular, benefitting retailers such as IKEA.

6. Millennials Appreciate Vintage Furniture

Due to limited budgets, millennials are less likely to purchase pricey name brands to impress, while many seek original and unique items. However, many will still seek individuality and differentiation. Handmade items, artistic features and vintage pieces bring in an element of personalization.

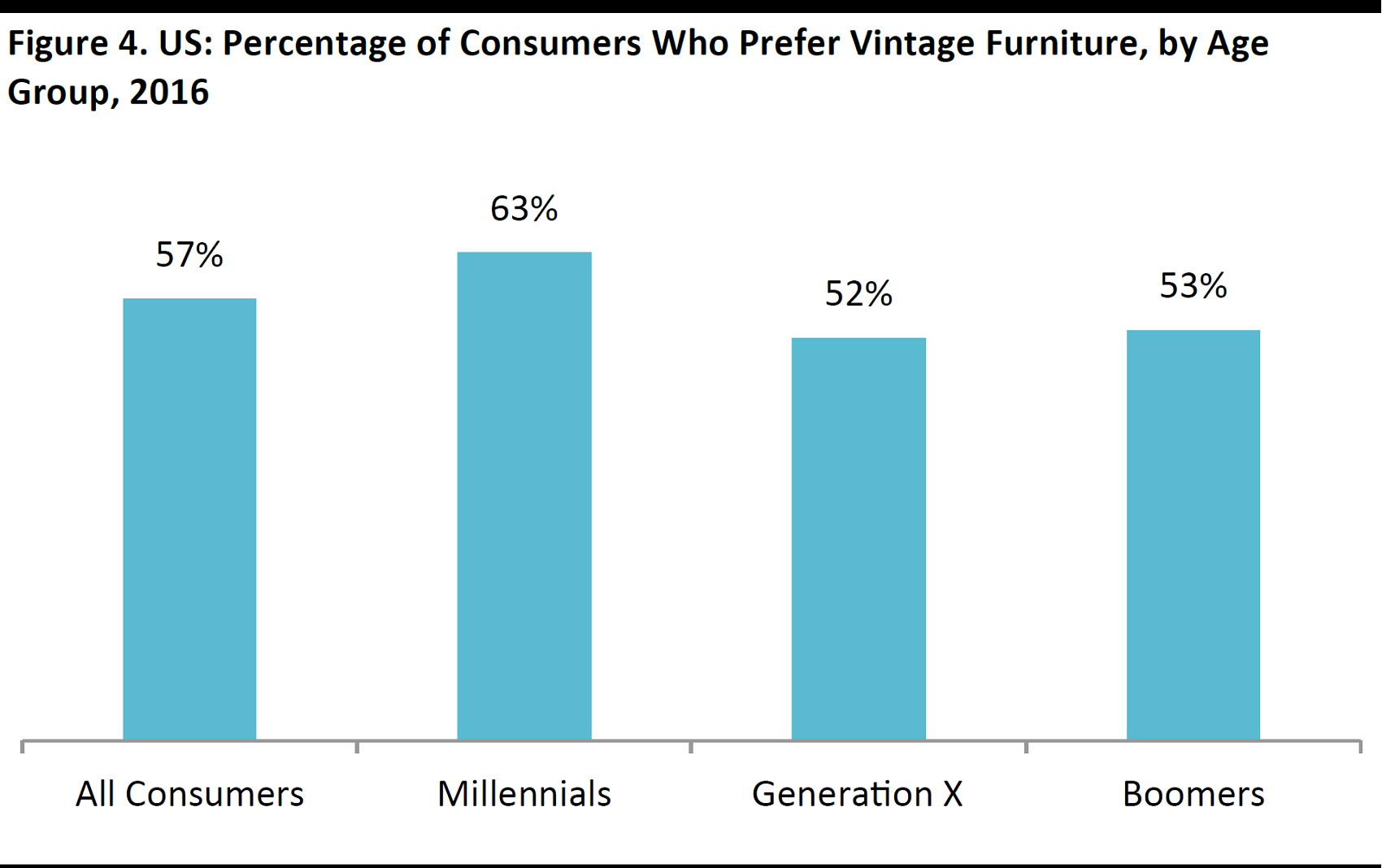

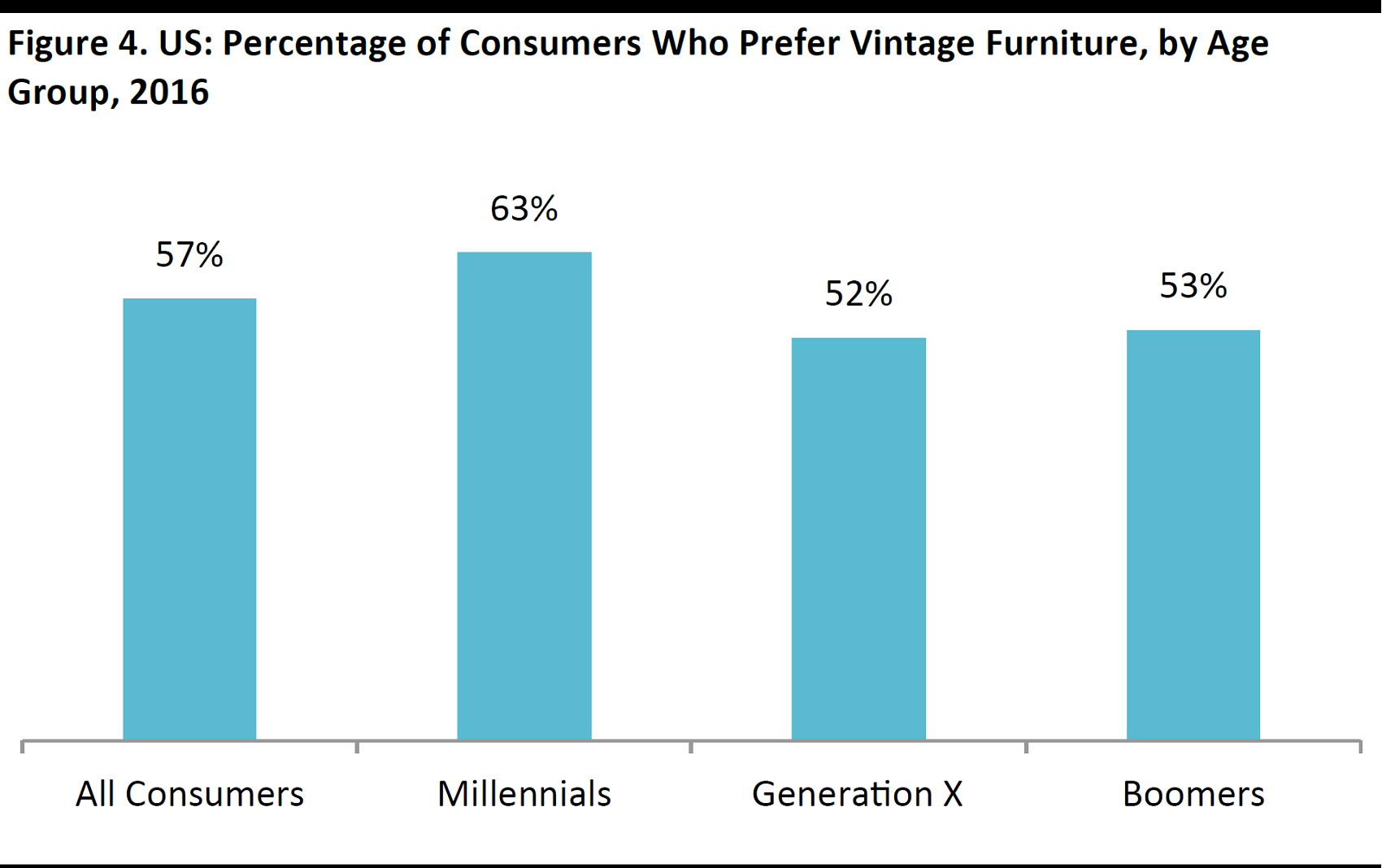

According to

Furniture Today, 63% of millennials prefer vintage furniture, a higher share than in other age groups, as depicted by the following graph.

Source: Furniture Today/Fung Global Retail & Technology

This preference for vintage furniture has contributed to the popularity of second-hand and used outlets, as well as online marketplaces.

- Amazon launched a US and UK marketplace called Handmade at Amazon that sells artisan products similar to Notonthehighstreet.com and online marketplace for handmade objects Etsy. The Amazon marketplace offers over 1,000 products including furniture, home décor and artwork.

- Crate and Barrel also recently announced the launch of a marketplace that offers highly curated products from third-party sellers.

7. Millennials Acknowledge the Importance of Sustainability

According to research firm Mintel, millennial consumers are more likely than other generations to consider sustainability before making purchases. Millennials appreciate products that are ethically and sustainably sourced and considered environmentally friendly. These values translate into millennials seeking to purchase efficient appliances and products that reduce energy consumption, such as LED lightbulbs. According to Accenture, millennials tend to be keen to adopt new energy-related products and service applications, for example, smart-home technology such as lights and exhaust fans that turn on and off viasensors.

John Lewis, a UK department store, reported that sales of connected home items, such as Nest technology that can adjust heating and lighting via a mobile phone app, were up 89% year over year in 2016. Home monitoring technology grew 265% year over year and represented the chain’s fastest-growing categories.

IKEA is a retailer at the forefront of sustainable product development and has developed smart lightbulbs and lighting panels controlled by a remote control. IKEA is also working on developing plastic materials made from recycled and renewable sources.

8. Millennials are Attracted by Connected Furniture of the Future

Millennials tend to be tech-savvy, so they are a natural customer base for a new wave of technologically advanced furniture products.

The furniture of the future will provide all kinds of connectivity, and there will be a rise in internet-enabled and digitally-transformable furniture that will be controlled remotely through apps.

Innovative products that connect furniture with smart phones or combine furniture with technology and fashion design are emerging in the US and globally.

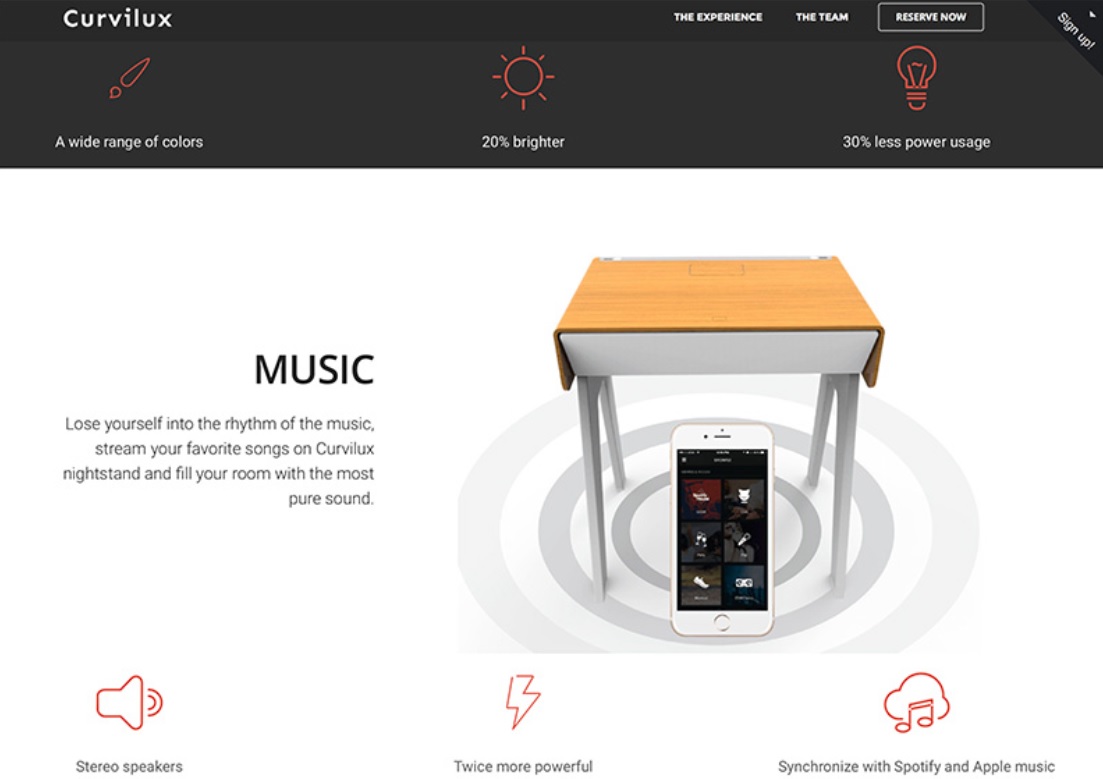

Curvilux designed a nightstand that can answer calls, stream music, set mood lighting and charge devices.

Source: curvilux.com

Sleep Number, a US mattress manufacturer, produced a SleepIQ mattress that controls desired comfort levels for different body parts through a smartphone app. The technology also gathers sleeping heart rate data, motion and breathing, as well as analyses data and rates sleep quality. The mattress also connects with health and fitness apps such as Fitbit.

King Living, an Australian furniture company, produces King Sofa, which incorporates voice-controlled reclining via the Apple iPhone using the Siri assistant.

HUMElab designed an interactive touch coffee table that serves as a typical coffee table but also allows users to play video games on it, handle documents, send emails and watch videos.

IKEA has produced furniture that includes wireless mobile phone charging stations.

9. Millennials Still Visit Brick-and-Mortar Stores

US millennials research and purchase home furnishings at a quick pace, with the majority spending one week only to research products, according to

Furniture Today.

Among all furniture types, millennials take the longest to research a sofa purchase; on average, they take a month before committing to a purchase decision.

- US millennials are also not willing to wait for furniture deliveries for a long time, especially for online purchases.

- Almost half of millennial online buyers expect a delivery within 1-2 weeks and 13% less than a week or even the same day.

- With in-store purchases, 36% want same-day delivery and 31% less than one week, according to Furniture Today.

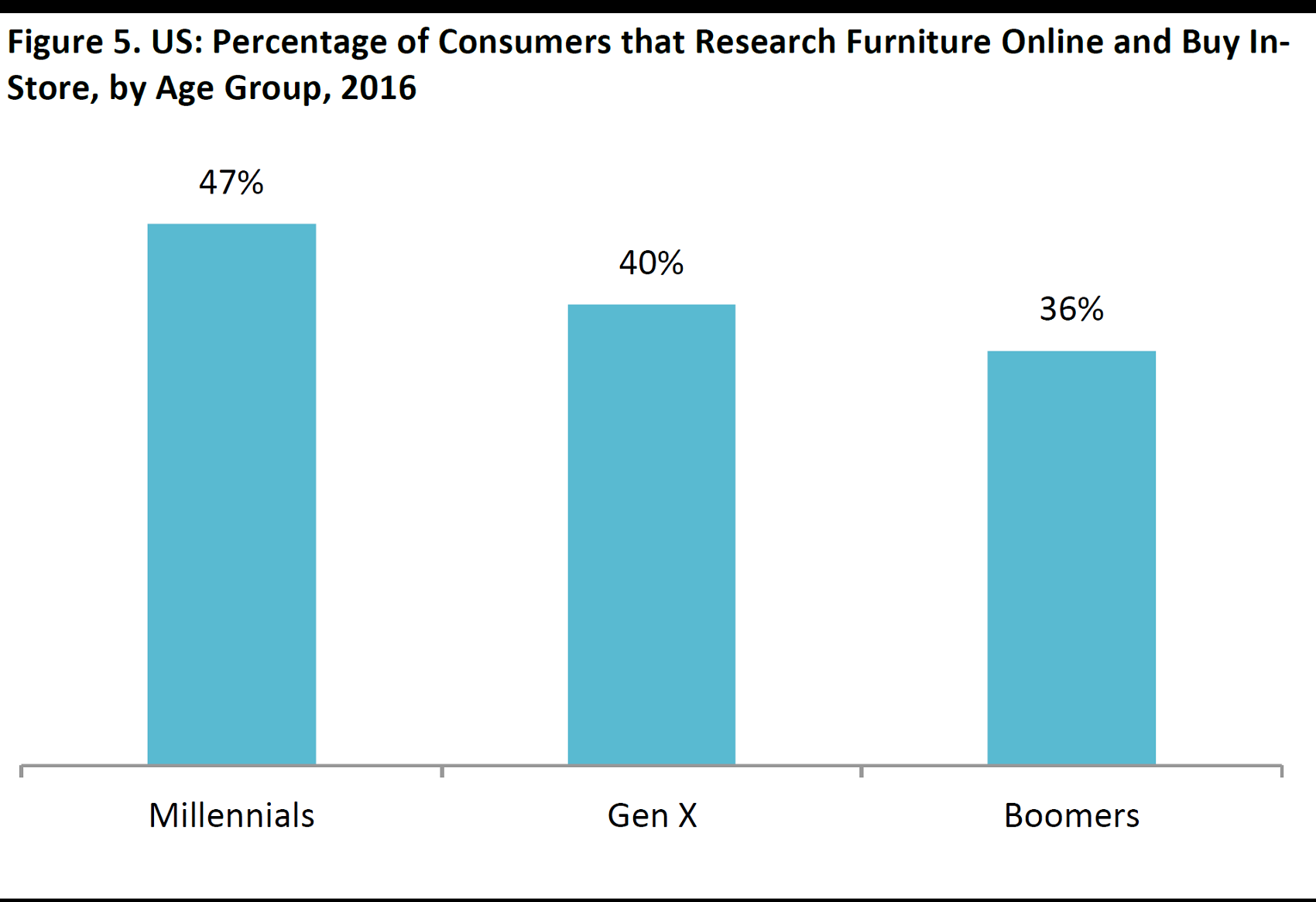

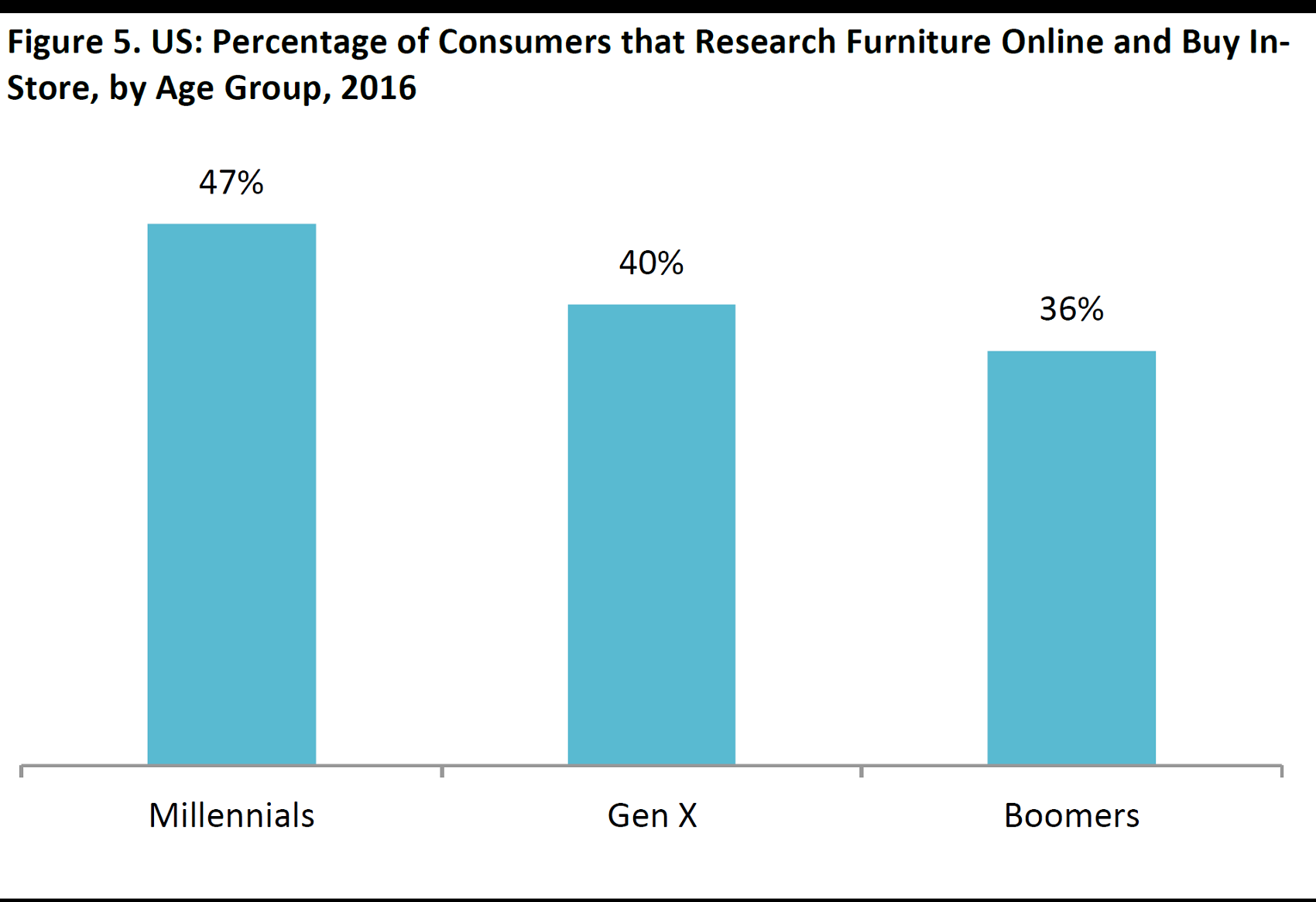

Tech-savvy millennials browse for and research potential furniture purchases online, but still embrace the brick-and-mortar shopping experience. According to

Furniture Today, 47% of US millennials shop for furniture online, but buy at brick-and-mortar stores. Meanwhile, only 3% of US millennials do not find it necessary to touch and feel furniture and mattresses before making a major purchase, according to Accenture.

Source: Furniture Today/Fung Global Retail & Technology

The online channel in the US and UK will continue to develop robustly with the adoption of new technologies such as virtual and augmented reality (VR/AR). Consumers will increasingly shop for home products with the aid of VR and AR, facilitating fast and easy product visualization, including of products tailored or designed to order. And furniture retailers can use app technology and AR to show consumers how certain furniture can fit into their homes.

- IKEA used VR at a pop-up restaurant in London, where customers could use an app to visualize in 3D how catalogue items would look in their homes.

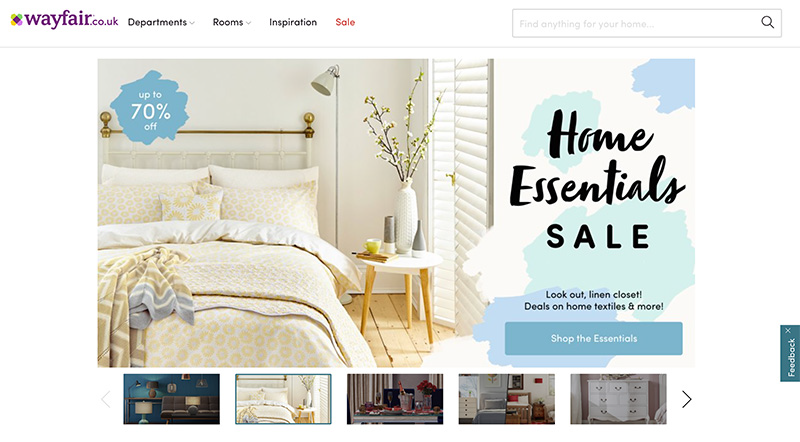

- Wayfair, a US online pure-play furniture retailer, launched an app designed to guide shoppers using VR through virtual furniture showrooms.

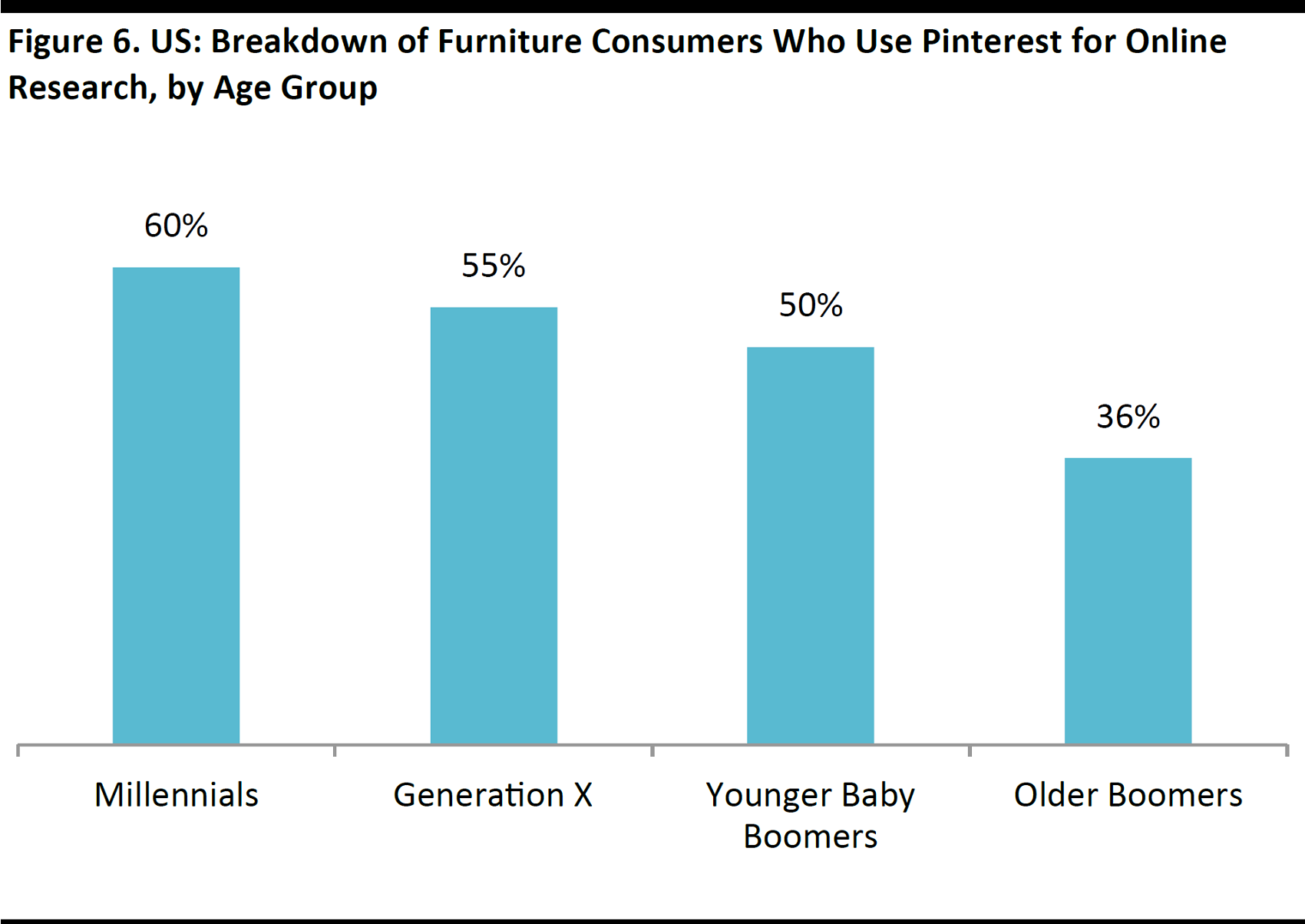

10. Millennials Use Social Media for Decorating Inspiration

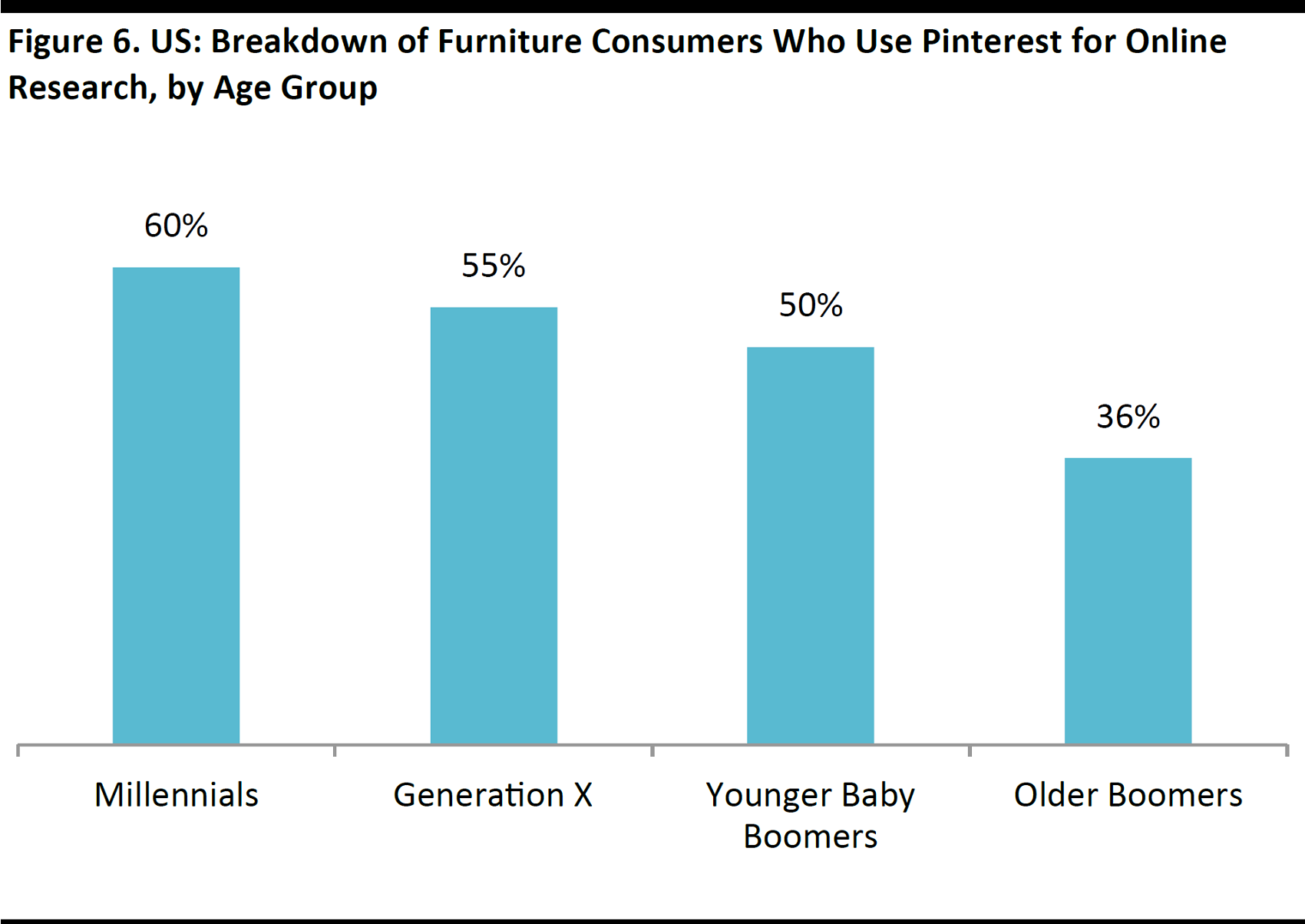

Millennials follow design trends on social media sites such as Pinterest and Instagram and use them to generate furnishing and decorating ideas.

Social media is also becoming a more popular channel for online product research and idea sharing. Pinterest is the leading social media site US consumers use to research furniture products, and the site’s popularity is the strongest among millennials, according to

Furniture Today.

Source: Furniture Today/Fung Global Retail & Technology

Which Retailers are Set to Benefit from Millennial Purchasing Habits?

We believe the retailers that are benefitting the most from millennial furniture purchasing habits—and will continue to do so—will be those that offer low prices, on-trend merchandise and continuously new merchandise providing ample choice and variety. These include Amazon, IKEA, Wayfair and At Home.

Amazon has been the fastest-growing UK furniture and homewares retailer over the past five years, apart from Dunelm. Amazon has more than doubled its UK home purchases market share since 2011, and is forecast to reach 3.7% in 2016, according to research firm Conlumino.

IKEA has increased its UK sales for a fifth consecutive year and has announced a goal to double its UK sales by 2020. The company opened four small order-and-collection shops in the UK in 2016.

Wayfair is the leader in the US furniture e-commerce space and posted a strong performance in the holiday 2016 period.

Source: wayfair.co.uk

At Home, a US-based retailer, has reported 11 straight quarters of comparable sales increases and doubled its store footprint over the past four years. At Home operates brick-and-mortar stores only (online selection browsing capability) and its business model is similar to fast-fashion apparel disruptors Zara and H&M. The company has a fast product cycle, due to the fact that it designs 70% of its merchandise, having a 3- to 9-month development process, compared to two years for legacy furniture chains.

At the same time, established brands and retailers are likely to face competition from newer companies that target millennials’ demands more sharply. Nimbler, tech-enabled online pure players are often focused on serving millennial needs, which means that they can chip away at legacy brands’ current and future customer bases.

Key Takeaways

- Because millennials range in age from 16 to 36, they constitute a consumer segment that is of growing value in most markets.

- Currently, millennials in the US and the UK spend less on furniture than previous generations, largely because they have lower incomes and household formation levels, as well as a propensity to live in smaller urban dwellings.

- Millennials mainly prioritize furniture items that make their lives easier and more enjoyable, and only make useful purchases that represent good value.

- Millennials seek small, multifunction and affordable furnishings and are attracted by products with embedded technology.