Nitheesh NH

https://youtu.be/tqOOdqOXZjc

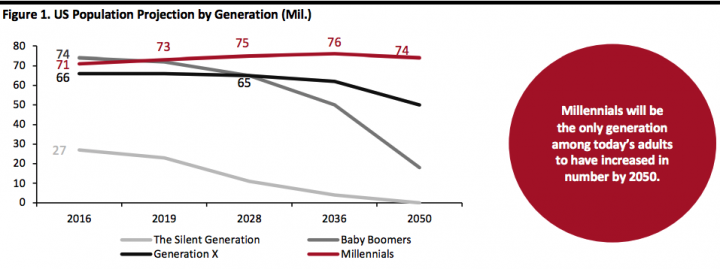

Definitions: The Silent Generation born 1928–1945; Baby Boomer Generation born 1946–1964; Generation X born 1965–1980; Millennial Generation born 1981–1996

Definitions: The Silent Generation born 1928–1945; Baby Boomer Generation born 1946–1964; Generation X born 1965–1980; Millennial Generation born 1981–1996

Source: US Census Bureau/Pew Research Center[/caption] Source: Euromonitor International[/caption]

Millennials are important for retailers not only due to their growing size and spending potential, but also because of their unique product demands, shopping habits and decisions. Here are some identifiable millennial-generation trends that set them apart from older cohorts:

Source: Euromonitor International[/caption]

Millennials are important for retailers not only due to their growing size and spending potential, but also because of their unique product demands, shopping habits and decisions. Here are some identifiable millennial-generation trends that set them apart from older cohorts:

Source: Tabs Analytics/Coresight Research[/caption]

Source: Tabs Analytics/Coresight Research[/caption]

Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Source: Prosper Insights & Analytic[/caption]

Source: Prosper Insights & Analytic[/caption]

Base: 1,293 US female respondents ages 18+, surveyed in September 2017

Base: 1,293 US female respondents ages 18+, surveyed in September 2017

Source: Kari Gran[/caption] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

According to Prosper, about 26% of consumers aged 18–34 prefer to shop for cosmetics at Walmart, broadly in line with the 35–54 and 55+ age groups at 29% and 28%, respectively. Millennials are more likely than older generations to buy beauty products from Target, with about 14% of those in the 18–34 group buying most often there, while only 9% and 5% of consumers aged 35–54 and 55+, respectively, prefer to buy at Target. Just 4% of the consumers aged 18–34 shopped for cosmetics most often on Amazon, in line with the older cohorts.

[caption id="attachment_89763" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

According to Prosper, about 26% of consumers aged 18–34 prefer to shop for cosmetics at Walmart, broadly in line with the 35–54 and 55+ age groups at 29% and 28%, respectively. Millennials are more likely than older generations to buy beauty products from Target, with about 14% of those in the 18–34 group buying most often there, while only 9% and 5% of consumers aged 35–54 and 55+, respectively, prefer to buy at Target. Just 4% of the consumers aged 18–34 shopped for cosmetics most often on Amazon, in line with the older cohorts.

[caption id="attachment_89763" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

Source: Hitwise[/caption]

Source: Hitwise[/caption]

Source: L’Oréal[/caption]

The CEO of Estée Lauder, Fabrizio Freda, considers millennials to be the key consumer segment. In order to understand millennials’ behavior and buying habits, Freda has set up a reverse mentoring scheme, where senior management is paired with younger-generation employees to exchange beauty ideas and opinions. Millennials comprise about 67% of the company’s workforce. In order to increase the company’s appeal among millennials consumers, Estée Lauder has acquired many niche make-up brands, such as Too Faced and Becca in 2016. The company’s millennial-focused strategies are performing well, particularly in China, where the cohort comprises more than half of Estée Lauder’s customers.

Ulta Beauty is a US-based specialty beauty retailer whose website and 1,174 stores offer over 25,000 products from more than 500 beauty brands. The company has added various beauty brands favored by millennials, such as Wet n Wild, ColourPop and Flower Beauty. Ulta’s website and the mobile app include a collection of tips, tutorials and social content.

LVMH-owned cosmetics retailer Sephora operates personal care and beauty stores globally. In recent years, Sephora has invested heavily in its website and partnered on various social media platforms, such as with rising YouTube influencer SoothingSista. The company has adopted a two-way conversation strategy with its customers, including implementing a conversational campaign around prom on Kik, a cross-platform mobile application catering to millennials and teens. In 2016, the company revived its private-label cosmetics in order to attract millennials, for whom price is a key driver. It has also been promoting the Sephora collection in various millennial-friendly environments, such as the annual Coachella Valley Music and Arts Festival.

Source: L’Oréal[/caption]

The CEO of Estée Lauder, Fabrizio Freda, considers millennials to be the key consumer segment. In order to understand millennials’ behavior and buying habits, Freda has set up a reverse mentoring scheme, where senior management is paired with younger-generation employees to exchange beauty ideas and opinions. Millennials comprise about 67% of the company’s workforce. In order to increase the company’s appeal among millennials consumers, Estée Lauder has acquired many niche make-up brands, such as Too Faced and Becca in 2016. The company’s millennial-focused strategies are performing well, particularly in China, where the cohort comprises more than half of Estée Lauder’s customers.

Ulta Beauty is a US-based specialty beauty retailer whose website and 1,174 stores offer over 25,000 products from more than 500 beauty brands. The company has added various beauty brands favored by millennials, such as Wet n Wild, ColourPop and Flower Beauty. Ulta’s website and the mobile app include a collection of tips, tutorials and social content.

LVMH-owned cosmetics retailer Sephora operates personal care and beauty stores globally. In recent years, Sephora has invested heavily in its website and partnered on various social media platforms, such as with rising YouTube influencer SoothingSista. The company has adopted a two-way conversation strategy with its customers, including implementing a conversational campaign around prom on Kik, a cross-platform mobile application catering to millennials and teens. In 2016, the company revived its private-label cosmetics in order to attract millennials, for whom price is a key driver. It has also been promoting the Sephora collection in various millennial-friendly environments, such as the annual Coachella Valley Music and Arts Festival.

Introduction

Aged 19–39, as of 2019, millennials are a core consumer segment for most beauty brands and retailers — and as this generation’s spending power rises, their significance to brands and retailers will only increase. Millennials are the cohort born between 1980 and 2000; they are also referred to as Generation Y. This generation, spanning a 20-year range, reaches from those still in college to those who have settled down with families and mortgages. In this report, we will assess the impact of millennials’ buying habits and preferences on the global beauty industry. Though much of the published data in this report focus on the beauty shopping habits of millennials in the US, we have incorporated notable global data where appropriate.The Number of Millennials in the US Is Growing

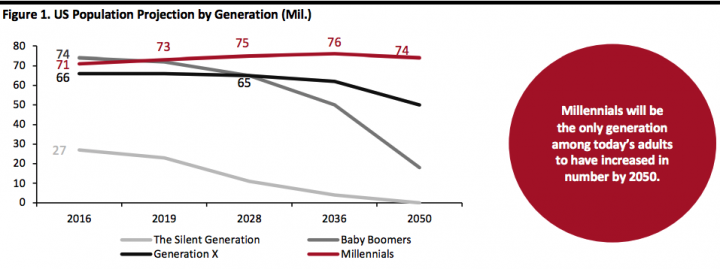

According to a Pew Research Center analysis of US Census Bureau data from 2016, millennials are the second-largest adult generation in the US, with 71 million people, behind baby boomers at 74 million. In recent years, the millennial population continues to grow in the US with the arrival of young immigrants, while baby boomers are shrinking in population as the number of deaths exceeds the number of older immigrants. According to Pew, which uses slightly different start and end dates for these generations than we do, millennials will surpass baby boomers as America’s largest living adult generation in 2019. Pew estimates that the number of baby boomers in the US will decline to 72 million and the number of millennials will surge to 73 million by the end of this year. Pew forecasts that millennials will be the only generation among today’s adults to have increased in number by 2050; all of the older generations will decline in population. [caption id="attachment_89755" align="aligncenter" width="700"] Definitions: The Silent Generation born 1928–1945; Baby Boomer Generation born 1946–1964; Generation X born 1965–1980; Millennial Generation born 1981–1996

Definitions: The Silent Generation born 1928–1945; Baby Boomer Generation born 1946–1964; Generation X born 1965–1980; Millennial Generation born 1981–1996Source: US Census Bureau/Pew Research Center[/caption]

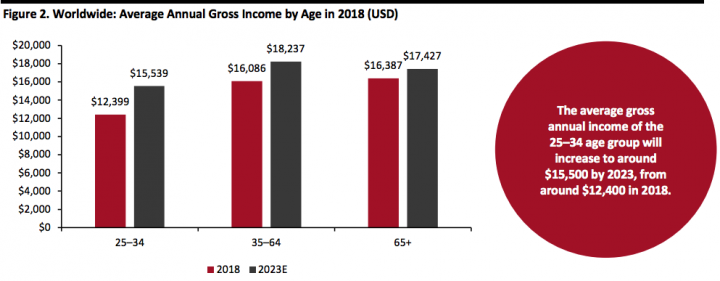

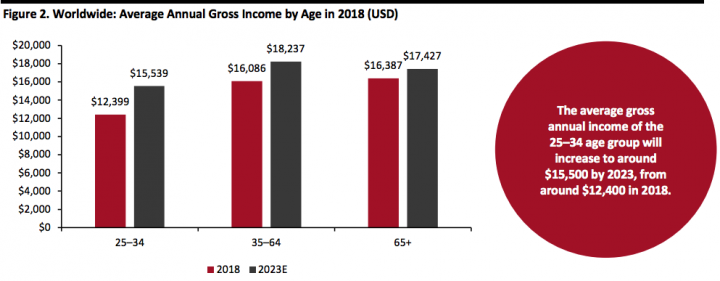

Millennials Comprise More Than 35% of the Workforce and Their Spending Potential Is Increasing

According to another Pew analysis of US Census Bureau data, using the same generation dates as in the chart above, in 2017, millennials comprised 35% of the labor force in the US, showing a high potential for spending power. Millennials’ spending power is expected to increase in the coming years. According to Euromonitor, in 2018, the average gross income of those who were then aged 25–34 () was around $12,400 per year. The gross income of this cohort is forecast to grow to about $15,500 per year by 2023, implying a compound annual growth rate (CAGR) of 4.6%, much higher than the implied average gross income CAGR of 2.5% and 1.2% for those who were aged 35–64 and 65+ in 2018, respectively. [caption id="attachment_89756" align="aligncenter" width="700"] Source: Euromonitor International[/caption]

Millennials are important for retailers not only due to their growing size and spending potential, but also because of their unique product demands, shopping habits and decisions. Here are some identifiable millennial-generation trends that set them apart from older cohorts:

Source: Euromonitor International[/caption]

Millennials are important for retailers not only due to their growing size and spending potential, but also because of their unique product demands, shopping habits and decisions. Here are some identifiable millennial-generation trends that set them apart from older cohorts:

- Millennials tend to be more educated (in formal terms) than previous generations. According to a Pew survey, about 36% of US millennial women have at least one bachelor’s degree, compared with just 9% of women of the silent generation at the same age. The survey provides a similar result for men, with about 29% of US millennial men completing at least one bachelor’s degree, compared with 15% of men of the silent generation at the same age.

- Millennials are tech-savvy and more likely to research products online than their older counterparts before making the buying decision. According to the US Millennials 2019 survey by eMarketer, about 85% of millennials have made at least one purchase via a digital channel in 2018, compared with 78% of Gen Xers and 59% of baby boomers.

- Millennials differ widely from older generations in terms of shopping habits and preferences. This demographic rejects many large brands their parents preferred and looks for brands that provide a unique experience, convenience and greater value. Millennials tend to be more conscious of the social and environmental impact of their purchase decisions and more likely to prefer natural and organic products.

US Millennials’ Beauty Buying Behaviors and Spending Habits

When it comes to shopping for beauty products, US millennials are notably different from their older counterparts.US Millennials Buy More Types of Beauty Products

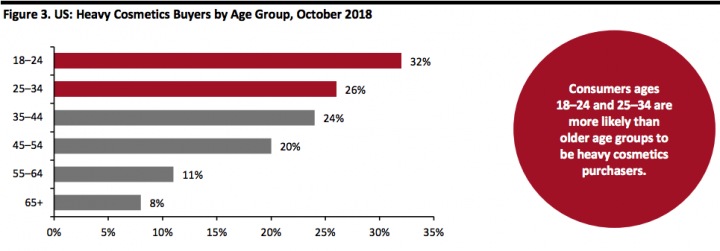

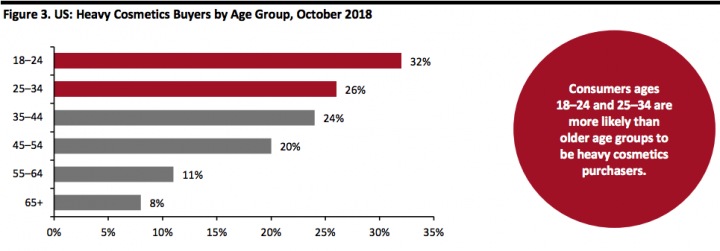

According to a 2018 TABS Cosmetics Study, millennials are more likely to be heavy cosmetics buyers (those who buy more than 10 types of products a year) than their older counterparts. In October 2018, TABS Analytics surveyed 1,000 women aged 18 to 75 and looked at 20 types of cosmetic products. According to the study, consumer ages 18–24 and 25–34 were the most likely to be heavy cosmetics purchasers. [caption id="attachment_89757" align="aligncenter" width="700"] Source: Tabs Analytics/Coresight Research[/caption]

Source: Tabs Analytics/Coresight Research[/caption]

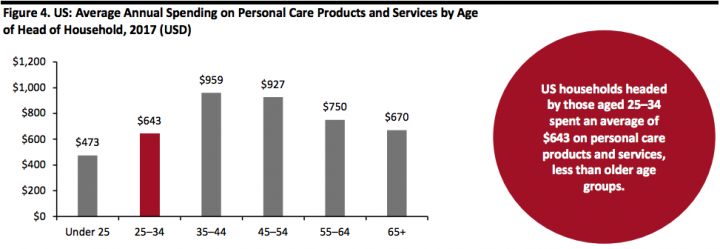

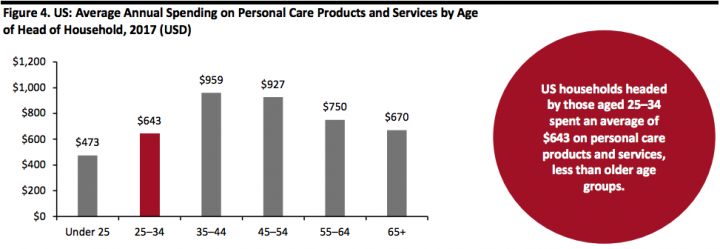

US Millennials Underspend on Beauty

Despite millennials’ greater likelihood of being heavy beauty purchasers, on average they underspend on the broader personal care category. According to spending data from the US Bureau of Labor Statistics, millennials tend to spend less on beauty products than do older generations. Households headed by those aged 25–34 spent an average of $643 on personal care products and services in 2017, less than the average spending by households headed by older age groups. One of the main reasons is younger consumers’ lower disposable incomes. Some of the youngest millennials are yet to join the workforce, and many millennials will not yet have reached their peak earning years. [caption id="attachment_89758" align="aligncenter" width="700"] Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

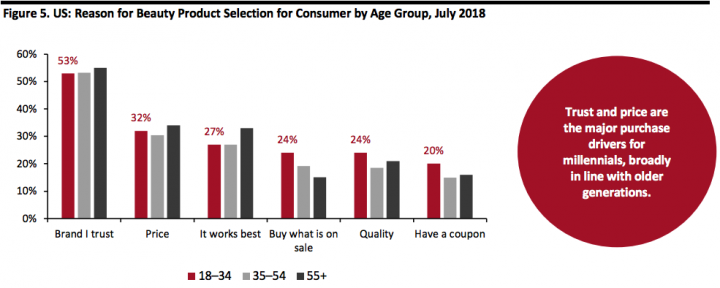

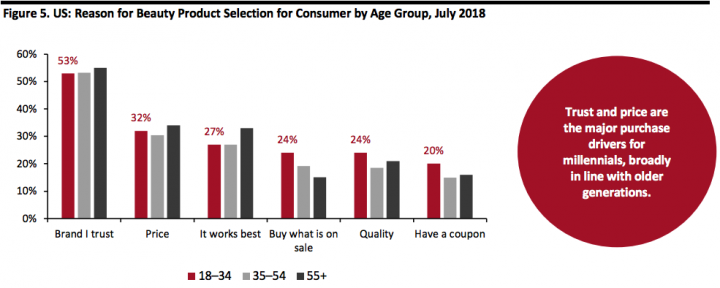

Trust and Price Are Their Major Purchase Drivers

Like older generations, US millennials value trust more than anything else when selecting a beauty brand. According to a US survey by Prosper Insights & Analytics in July 2018, more than 50% of those in the 18–34 age group said they would select a beauty product based on trust, broadly in line with the 35–54 and 55+ age groups. Similar to older generations, for millennials price is the second-most important criterion. However, compared with older shoppers, millennials are more likely to visit different stores to get the best deals and also to use coupon codes when buying a beauty product. Millennials are more likely than previous generations to value quality, with about 24% of consumers in the 18–34 age group saying they would select a cosmetics brand based on this factor, compared with 19% and 21% of the consumers aged 35–54 and 55+, respectively. [caption id="attachment_89759" align="aligncenter" width="700"] Source: Prosper Insights & Analytic[/caption]

Source: Prosper Insights & Analytic[/caption]

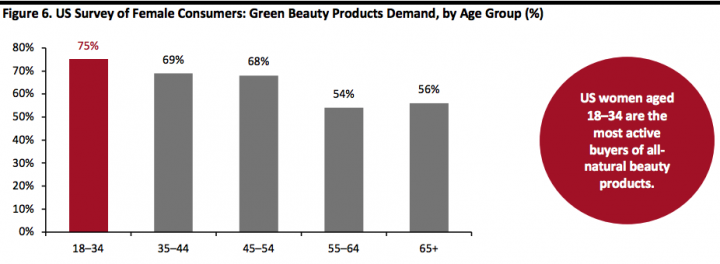

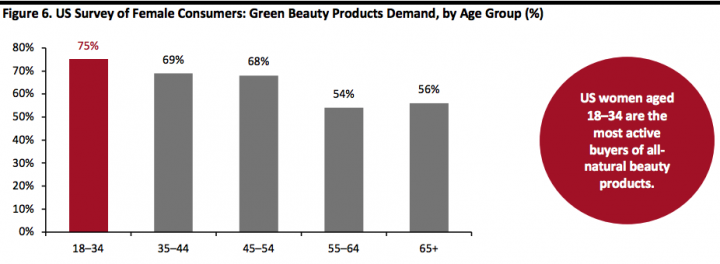

Millennials Follow a Green Approach to Beauty

Millennials often prefer natural and organic products. According to a 2017 survey by natural skincare brand Kari Gran, US women aged 18–34 are the most active buyers of all-natural beauty products. About 75% of women in this age group say purchasing a natural product is important to them. [caption id="attachment_89760" align="aligncenter" width="700"] Base: 1,293 US female respondents ages 18+, surveyed in September 2017

Base: 1,293 US female respondents ages 18+, surveyed in September 2017Source: Kari Gran[/caption]

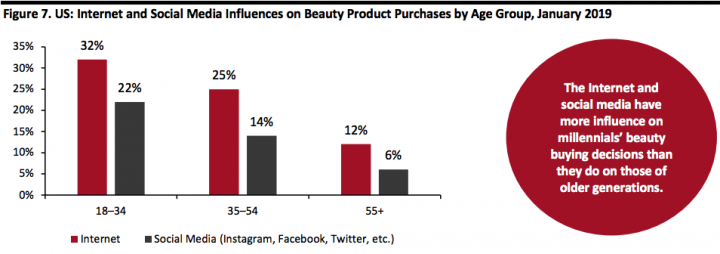

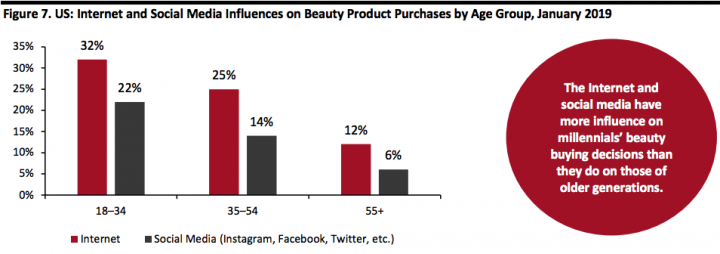

Internet and Social Media Are the Major Influencers in Millennials’ Beauty Buying Decisions

Millennials are digital natives and so are more likely than older age groups to seek out product reviews on blogs and social networks. According to a survey by Prosper Insights & Analytics in January 2019, about 32% of US consumers in the 18–34 age group said they have made a beauty-related purchase based on Internet posts, such as online reviews and beauty blogs, compared with only 25% of those aged 35–54 and 12% of those aged 55+. According to the survey, about 22% of consumers aged 18–34 said social media such as Instagram, Facebook and Twitter influences their beauty shopping decisions, compared with only 14% and 6% of the 35–54 and 55+ age groups, respectively. [caption id="attachment_89761" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

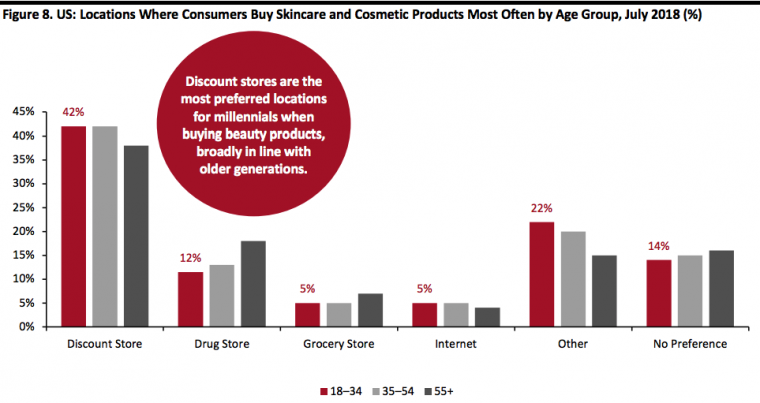

Millennials’ Cross-Channel Approach to Beauty Shopping

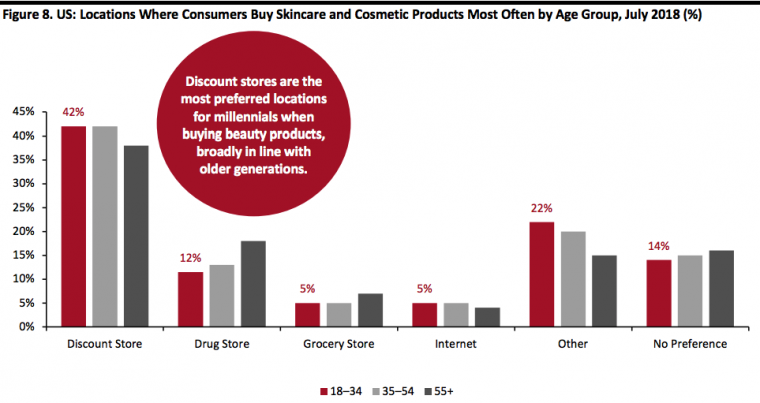

Most Millennials Research Beauty Products Online but Prefer to Buy in Store Millennials browse, research and gain knowledge about beauty products online, but when it comes to the purchasing, this generation most often buys in store. According to a survey by Prosper in July 2018, which asked respondents which single retail channel they most often used to buy skincare and cosmetics products:- Some 42% of US consumers in the 18–34 age group most often buy skincare and cosmetics products from a discount store, the same percentage as the 35–54 group but a slightly higher proportion than those aged 55+.

- Drug stores are the second-most-preferred locations for millennials when buying beauty products. However, millennials are less likely than other age groups to say drug stores are where they mostly buy skincare and cosmetics products, with only 12% of those aged 18–34 saying they buy there, compared with 18% of consumers aged 55+.

- Like their older counterparts, relatively few millennials mostly buy beauty products online; only 5% of the 18–34 age group agreed that they buy skincare and cosmetics most often through online platforms.

Source: Prosper Insights & Analytics[/caption]

According to Prosper, about 26% of consumers aged 18–34 prefer to shop for cosmetics at Walmart, broadly in line with the 35–54 and 55+ age groups at 29% and 28%, respectively. Millennials are more likely than older generations to buy beauty products from Target, with about 14% of those in the 18–34 group buying most often there, while only 9% and 5% of consumers aged 35–54 and 55+, respectively, prefer to buy at Target. Just 4% of the consumers aged 18–34 shopped for cosmetics most often on Amazon, in line with the older cohorts.

[caption id="attachment_89763" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics[/caption]

According to Prosper, about 26% of consumers aged 18–34 prefer to shop for cosmetics at Walmart, broadly in line with the 35–54 and 55+ age groups at 29% and 28%, respectively. Millennials are more likely than older generations to buy beauty products from Target, with about 14% of those in the 18–34 group buying most often there, while only 9% and 5% of consumers aged 35–54 and 55+, respectively, prefer to buy at Target. Just 4% of the consumers aged 18–34 shopped for cosmetics most often on Amazon, in line with the older cohorts.

[caption id="attachment_89763" align="aligncenter" width="700"] Source: Prosper Insights & Analytics[/caption]

Source: Prosper Insights & Analytics[/caption]

Top 10 Beauty Brand Websites Among Millennials

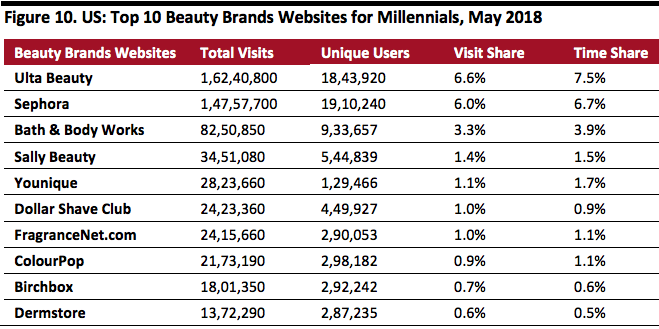

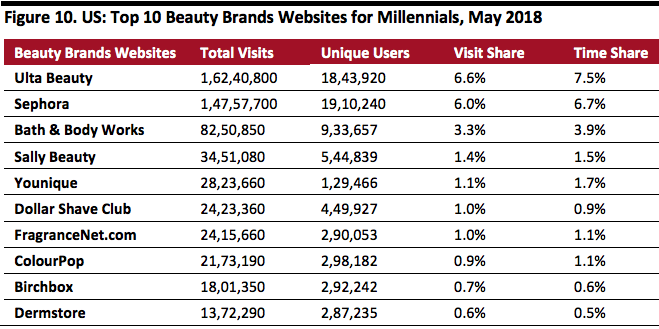

According to the online competitive intelligence service provider Hitwise, within the health and beauty Industry, millennials spend a higher share of their online time on beauty websites than do older generations, who spend more of their visits and online time on health and pharmacy-related sites. In May 2018, Hitwise ranked various beauty-brand websites reaching millennials based on data pulled using its audience-centric search tool Hitwise AudienceView over eight weeks ending April 7, 2018. According to these data, Ulta Beauty, Sephora and Bath & Body Works are the top beauty-brand websites among millennials in terms of visits and online time. Total visitors are measured by counting the same users, even when they visit multiple times, in the overall tally. Unique users, on the other hand, measure the number of individuals who visit the website, no matter how often they visit. While Ulta Beauty and Sephora have nearly identical numbers of unique users, Ulta has an edge in attracting and engaging millennials online. Millennials spend 7.5% of their online time and about 6.6% of their visits on Ulta.com, compared with 6.7% of their time and 6.0% of their visits on Sephora.com. The Hitwise data indicates that millennials spend more time at Ulta.com than Sephora.com to shop for cosmetics products, learn about beauty brands and share their experiences. [caption id="attachment_89764" align="aligncenter" width="659"] Source: Hitwise[/caption]

Source: Hitwise[/caption]

Leading Beauty Companies Are Investing to Cater to the Needs of Millennials

Some of the leading mentioned below have identified how the beauty industry is being transformed by millennials and are investing in meeting the needs of this demographic. L’Oréal offers various beauty brands, such as L’Oréal Paris, L’Oréal Luxe, Lancôme, Garnier, NYX Professional MakeUp and Urban Decay, among others. In order to cater to tech-savvy millennials, the company has been working with bloggers and other global influencers to create content for YouTube, Facebook and Instagram. L’Oréal also invites digital-native consumers to take part in the product development process. In 2017, L’Oréal invested in Tallify , a startup that connects brands with social media influencers. The company allocates more than 30% of its media budget on digital channels. Among all its brands, L’Oréal Luxe is gaining traction among millennials particularly. This generation is more interested in couture labels such as Yves Saint, Valentino and Giorgio Armani, with whom L’Oréal entered into a licensing agreement in 2018. [caption id="attachment_89765" align="aligncenter" width="709"] Source: L’Oréal[/caption]

The CEO of Estée Lauder, Fabrizio Freda, considers millennials to be the key consumer segment. In order to understand millennials’ behavior and buying habits, Freda has set up a reverse mentoring scheme, where senior management is paired with younger-generation employees to exchange beauty ideas and opinions. Millennials comprise about 67% of the company’s workforce. In order to increase the company’s appeal among millennials consumers, Estée Lauder has acquired many niche make-up brands, such as Too Faced and Becca in 2016. The company’s millennial-focused strategies are performing well, particularly in China, where the cohort comprises more than half of Estée Lauder’s customers.

Ulta Beauty is a US-based specialty beauty retailer whose website and 1,174 stores offer over 25,000 products from more than 500 beauty brands. The company has added various beauty brands favored by millennials, such as Wet n Wild, ColourPop and Flower Beauty. Ulta’s website and the mobile app include a collection of tips, tutorials and social content.

LVMH-owned cosmetics retailer Sephora operates personal care and beauty stores globally. In recent years, Sephora has invested heavily in its website and partnered on various social media platforms, such as with rising YouTube influencer SoothingSista. The company has adopted a two-way conversation strategy with its customers, including implementing a conversational campaign around prom on Kik, a cross-platform mobile application catering to millennials and teens. In 2016, the company revived its private-label cosmetics in order to attract millennials, for whom price is a key driver. It has also been promoting the Sephora collection in various millennial-friendly environments, such as the annual Coachella Valley Music and Arts Festival.

Source: L’Oréal[/caption]

The CEO of Estée Lauder, Fabrizio Freda, considers millennials to be the key consumer segment. In order to understand millennials’ behavior and buying habits, Freda has set up a reverse mentoring scheme, where senior management is paired with younger-generation employees to exchange beauty ideas and opinions. Millennials comprise about 67% of the company’s workforce. In order to increase the company’s appeal among millennials consumers, Estée Lauder has acquired many niche make-up brands, such as Too Faced and Becca in 2016. The company’s millennial-focused strategies are performing well, particularly in China, where the cohort comprises more than half of Estée Lauder’s customers.

Ulta Beauty is a US-based specialty beauty retailer whose website and 1,174 stores offer over 25,000 products from more than 500 beauty brands. The company has added various beauty brands favored by millennials, such as Wet n Wild, ColourPop and Flower Beauty. Ulta’s website and the mobile app include a collection of tips, tutorials and social content.

LVMH-owned cosmetics retailer Sephora operates personal care and beauty stores globally. In recent years, Sephora has invested heavily in its website and partnered on various social media platforms, such as with rising YouTube influencer SoothingSista. The company has adopted a two-way conversation strategy with its customers, including implementing a conversational campaign around prom on Kik, a cross-platform mobile application catering to millennials and teens. In 2016, the company revived its private-label cosmetics in order to attract millennials, for whom price is a key driver. It has also been promoting the Sephora collection in various millennial-friendly environments, such as the annual Coachella Valley Music and Arts Festival.