DIpil Das

[caption id="attachment_93286" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

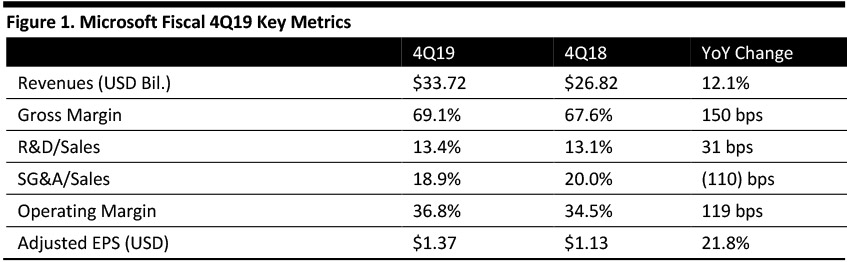

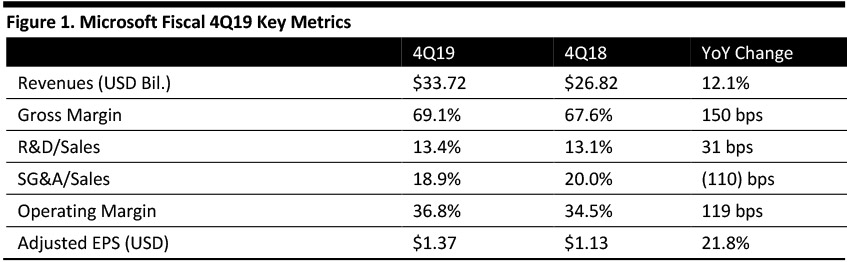

Microsoft reported fiscal 4Q19 revenues of $33.72 billion, up 12.1% year over year and beating the $32.77 billion consensus estimate.

Adjusted EPS was $1.37, up 21.8% year over year and beating the $1.21 consensus estimate. GAAP EPS was $1.71, compared with $1.14 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $125.8 billion, up 14.0% from the prior year.

Adjusted EPS was $4.75, up 22.3% from the prior year. GAAP EPS was $5.06, compared with $2.13 in the prior year.

Results by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Microsoft reported fiscal 4Q19 revenues of $33.72 billion, up 12.1% year over year and beating the $32.77 billion consensus estimate.

Adjusted EPS was $1.37, up 21.8% year over year and beating the $1.21 consensus estimate. GAAP EPS was $1.71, compared with $1.14 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $125.8 billion, up 14.0% from the prior year.

Adjusted EPS was $4.75, up 22.3% from the prior year. GAAP EPS was $5.06, compared with $2.13 in the prior year.

Results by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Microsoft reported fiscal 4Q19 revenues of $33.72 billion, up 12.1% year over year and beating the $32.77 billion consensus estimate.

Adjusted EPS was $1.37, up 21.8% year over year and beating the $1.21 consensus estimate. GAAP EPS was $1.71, compared with $1.14 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $125.8 billion, up 14.0% from the prior year.

Adjusted EPS was $4.75, up 22.3% from the prior year. GAAP EPS was $5.06, compared with $2.13 in the prior year.

Results by Segment

Source: Company reports/Coresight Research[/caption]

Fiscal 4Q19 Results

Microsoft reported fiscal 4Q19 revenues of $33.72 billion, up 12.1% year over year and beating the $32.77 billion consensus estimate.

Adjusted EPS was $1.37, up 21.8% year over year and beating the $1.21 consensus estimate. GAAP EPS was $1.71, compared with $1.14 in the year-ago quarter.

Fiscal 2019 Results

Fiscal 2019 revenues were $125.8 billion, up 14.0% from the prior year.

Adjusted EPS was $4.75, up 22.3% from the prior year. GAAP EPS was $5.06, compared with $2.13 in the prior year.

Results by Segment

- Productivity and Business Processes: Revenues were $11.0 billion, an increase of 14% (17% at constant currency).

- Office Commercial products and cloud services revenue increased 14%, driven by Office 365 Commercial revenue growth of 31%.

- Office Consumer products and cloud services revenue increased 6%, and Office 365 Consumer subscribers increased to 34.8 million.

- LinkedIn revenue increased 25%, with record levels of engagement. LinkedIn sessions grew 22%.

- Dynamics products and cloud services revenue increased 12%, driven by Dynamics 365 revenue growth of 45%.

- Intelligent Cloud: Revenues were $11.4 billion, an increase of 19% (21% at constant currency).

- Server products and cloud services revenue increased 22%, driven by Azure revenue growth of 64%.

- Enterprise Services revenue increased 4%.

- More Personal Computing: Revenues were $11.3 billion, an increase of 4% (6% at constant currency).

- Windows OEM (original equipment manufacturer) revenue increased 9%.

- Windows Commercial products and cloud services revenue increased 13%.

- Surface revenue increased 14%.

- Search advertising revenue excluding traffic acquisition costs increased 9%.

- Gaming revenue declined 10%, driven by a 3% fall in Xbox software and services revenue.

- Azure: Microsoft has 54 data center regions, which it claims is more than any other cloud provider. This year, the company introduced new cloud-to-the-edge services. Azure Sphere is an edge solution to secure the more than 9 billion multipoint control unit (MCU)-powered endpoints coming online each year, and IoT plug-and-play seamlessly connects IoT devices to the cloud. Microsoft offers cloud analytics in Azure Data Factory, Azure SQL Data Warehouse and Power BI.

- AI: Microsoft believes the quintessential characteristic of any new application will be AI and is democratizing AI infrastructure tools and services with Azure Cognitive Services, which will include a comprehensive portfolio of AI tools to embed into applications the ability to see, hear, respond, translate, reason and more. During the quarter, the company introduced new speech-to-text, search, vision and decision capabilities. Updates to Azure ML streamlined the building, training and deployment of machine learning models. Microsoft said 95% of the Fortune 500 uses Azure.

- Dynamics 365: This year, Microsoft introduced Dynamics 365 AI, a new class of AI applications built for engagement and intelligence. The company expects 500 million new apps to be created in the next five years, more than the total created in the last 40 years. Businesses will need to empower domain experts with tools to create applications and design robotic process automation to streamline and customize workflow such as service monitoring and time and expense tracking.

- Power Platform: This quarter, Microsoft introduced AI Builder, which adds AI capabilities such as object recognition to any Power App. With Power BI, Microsoft claims to be the leader in business intelligence in the cloud, with more than 25 million models hosted on the service and 12 million queries processed each hour.

- Double-digit revenue growth.

- Flat operating margins (the GAAP operating margin was 34.1% in fiscal 2019).

- Productivity and Business Processes revenues of $10.7-$10.9 billion.

- Intelligent Cloud revenues of $10.3-$10.5 billion.

- More Personal Computing revenues of $10.7-$11.0 billion.