Source: Company reports/Fung Global Retail & Technology

Fiscal 4Q17 Results

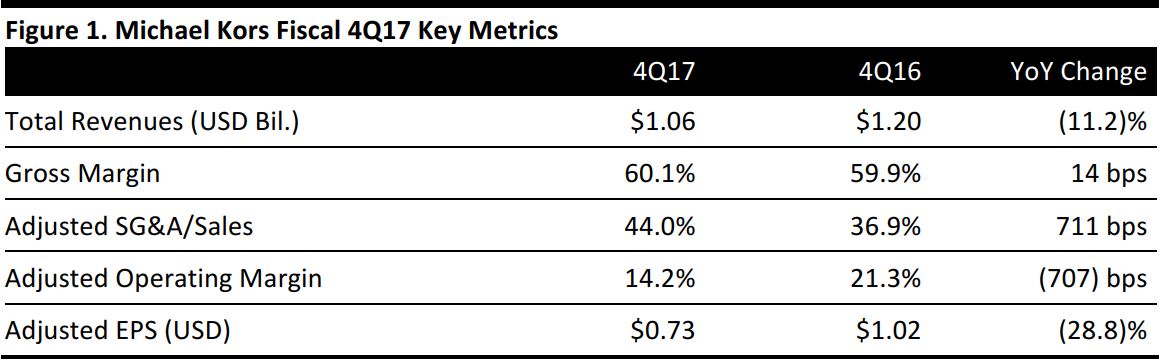

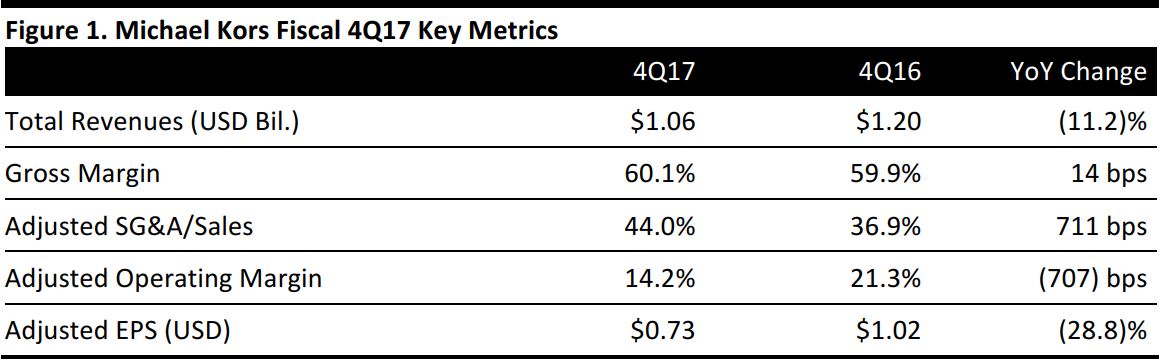

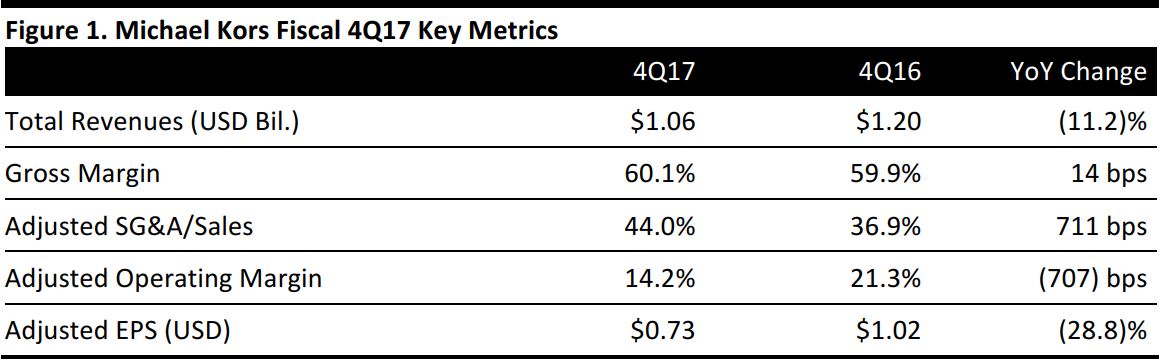

Michael Kors reported fiscal 4Q17 total revenues of $1.06 billion, down 11.2% year over year,but slightly ahead of the $1.05 billion consensus estimate. On a constant currency basis, total revenues were down 10.6%. FY17 comprised 52 weeks versus 53 weeks for FY16; the additional week in FY16 raised revenues by $34 million.

Comps declined by 14.1% as reported in the quarter and decreased by 13.6% on a constant currency basis.

The company’s operating margin declined by 707 basis points, primarily due to the inclusion of business in Greater China and investments in new stores, e-commerce, omnichannel capabilities and infrastructure improvements, as well as deleveraging.

Adjusted EPS was $0.73 versus $1.02 in the year-ago quarter,but was ahead of the $0.70 consensus estimate. The figure excludes $193.8 million of non cash impairment charges primarily associated with under performing full-price retail stores. GAAP EPS was $(0.17).

Details from the Quarter

Retail net sales increased by 0.5%, to $575.3 million, driven primarily by 159 new store openings, including 111 stores that resulted from the acquisition of the previously licensed operation in Greater China.

Wholesale net sales declined by 22.8%, to $456.1 million, and declined by 22.3% in constant currency. Licensing revenue declined by 6.2%, to $33.4 million.

Total revenue in the Americas declined by 18.0%, to $721.0 million as reported, and declined by 18.3% in constant currency. Europe revenue declined by 15.3%, to $215.2 million as reported, and decreased by 11.5% in constant currency. Asia revenue increased by 96.3%, to $128.6 million as reported, and increased by 95.1% in constant currency.

As of the end of the quarter, the company operated 827 retail stores, including concessions, plus 133 additional retail stores, including concessions, operated through licensing partners, for a total of 960 stores.

Management commented that FY17 had been challenging given the difficult retail environment and elevated promotional levels.

FY17 Results

For the year, total revenue declined by 4.6%, to $4.49 billion from $4.71 billion in the prior year, and was down 4.4% in constant currency.

Retail net sales increased by 7.4%, to $2.57 billion, on a comp decrease of 8.3%. In constant currency, retail net sales grew by 7.8% and comparable sales declined by 8.1%.

Wholesale net sales declined by 17.2%, to $1.78 billion, and declined by 17.0% in constant currency. Licensing revenue declined by 15.9%, to $145.8 million.

Outlook

Looking ahead, the company plans to expand its fashion innovation in its accessories assortments, right-size its store fleet and elevate its store experience. Management commented that FY18 will be a transition year to establish a new baseline before returning to long-term growth.

Separately, the company announced plans to improve the profitability of its store fleet by closing 100–125 full-price retail stores over the next two years, which should realize ongoing annual cost savings of $60 million.

FY18 Guidance

For FY18, the company expects EPS of $3.57–$3.67 versus consensus of $3.94 and revenues of $4.25 billion versus consensus of $4.37 billion.

1Q18 Guidance

For 1Q18, the company guided for EPS of $0.60–$0.63 versus consensus of $0.80 and for revenues of $910–$930 million versus consensus of $940 million.