Source: Company reports/FGRT

Fiscal 3Q18 Results

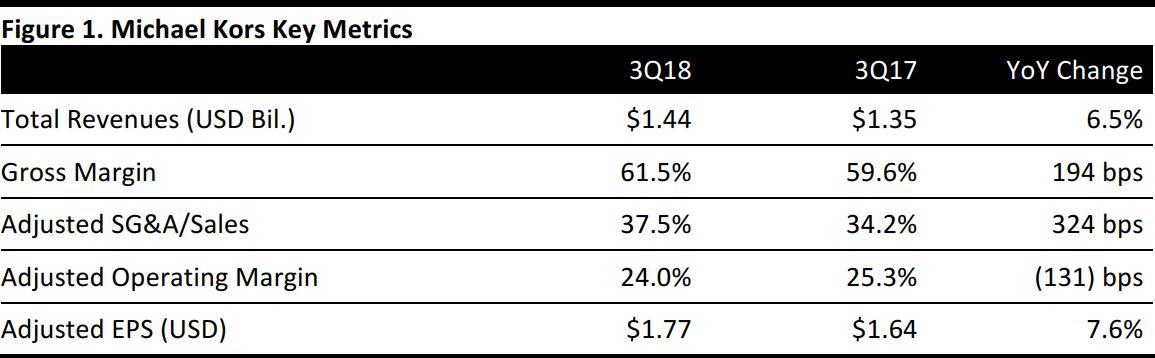

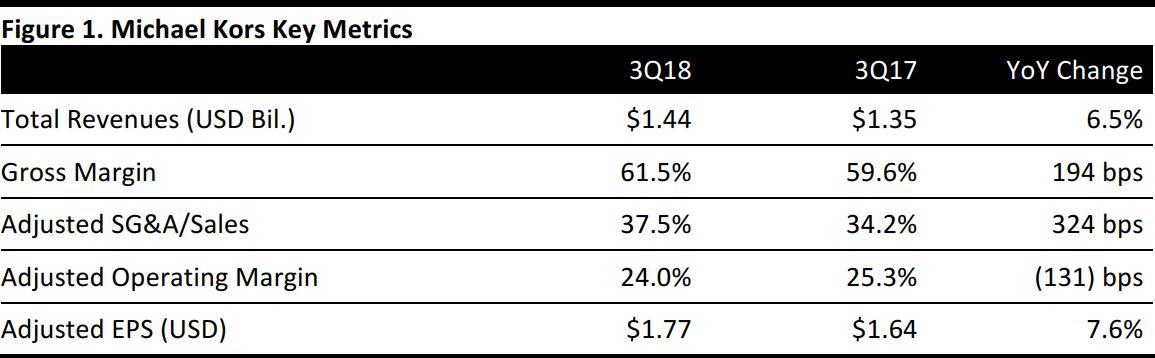

Michael Kors reported fiscal 3Q18 total revenues of $1.44 billion, up 6.5% year over year and ahead of the $1.38 billion consensus estimate.

Comps declined by 3.2% as reported and by 5.2% on a constant-currency basis, beating the consensus estimate of a 5.9% decline and guidance of a high-single-digit decline.

Adjusted EPS was $1.77, versus $1.64 in the year-ago quarter and beating the $1.29 consensus estimate. GAAP EPS was $1.42, compared with $1.64 in the year-ago quarter.

Details from the Quarter

- MK Retail revenue was $846.3 million, up 1.1% as reported and down 1.0% in constant currency.

- MK Wholesale revenue was $430.8 million, down 8.9% as reported and down 10.5% in constant currency.

- MK Licensing revenue was $48.3 million, up 12.3% both as reported and in constant currency.

- Total Michael Kors brand revenue was $1.33 billion, down 2.0% and down 3.9% in constant currency.

- Jimmy Choo contributed $114.7 million of revenue in the quarter.

Management offered the following comments on the quarter:

- On November 1, the company completed the acquisition of Jimmy Choo for 230 pence per share, with a total transaction value of approximately $1.35 billion.

- The company made continued progress on its Michael Kors Runway 2020 strategic plan:

- It elevated its brand position through an innovative fashion luxury offering.

- Accessories sales were better than expected due to the success of new product introductions infused with glamour and unique fashion elements.

- The women’s footwear and ready-to-wear businesses grew, as consumers embraced feminine and embellished holiday offerings.

- Comps exceeded expectations due to favorable responses to new products and reduced promotional activity that drove higher average unit retails in North American digital flagships and lifestyle stores.

Outlook

FY18 Guidance

For FY18, the company expects revenues of approximately $4.66 billion, which includes $225–$230 million from the Jimmy Choo acquisition and is slightly above the $4.62 billion consensus estimate. The company expects Michael Kors comps to decline by mid-single digits. EPS is expected to be $4.40–$4.45, versus the $4.00 consensus estimate, and the company expects no incremental EPS impact from Jimmy Choo.

Fiscal 4Q18 Guidance

For fiscal 4Q18, the company expects revenues of $1.11–$1.13 billion, including $110–$115 million of incremental revenue from Jimmy Choo. The company expects Michael Kors comps to decline by low single digits. EPS is expected to be $0.50–$0.55, below the $0.59 consensus estimate, including $0.07 per share of dilution from Jimmy Choo.