Source: Company reports/Coresight Research

Michael Kors Core Brand Still Stabilizing with Promising Capsule Collections

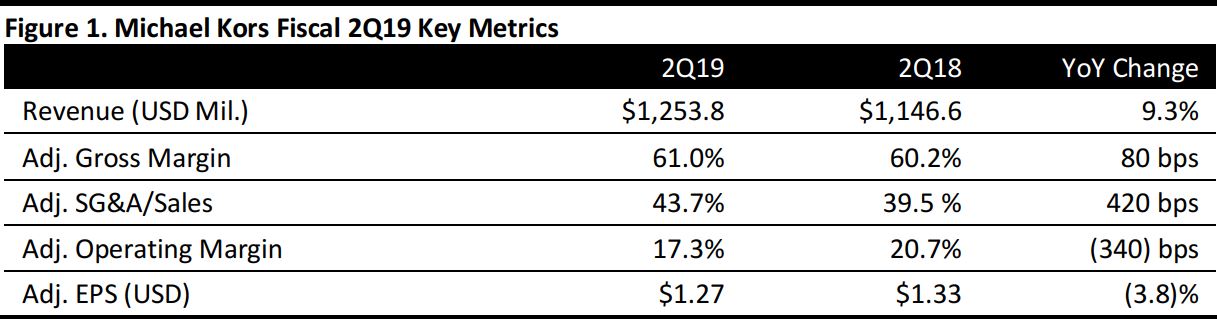

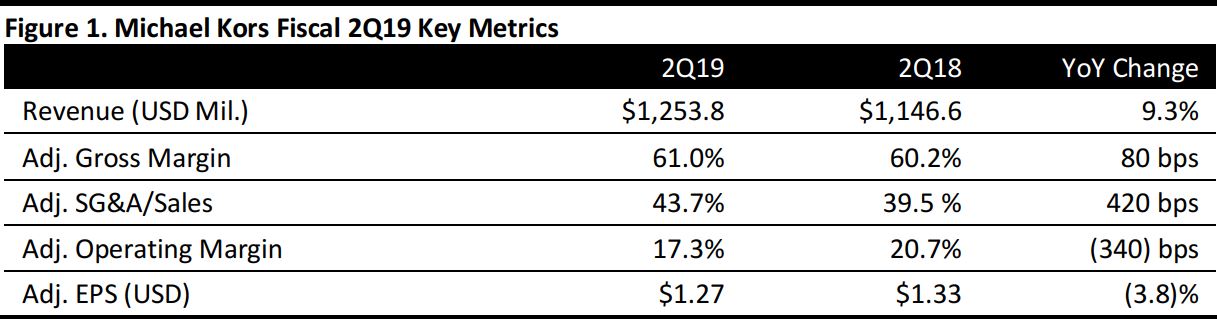

Michael Kors reported fiscal 2Q19 adjusted EPS of $1.27, a 3.8% decrease from $1.33 in the year-ago quarter and above the $1.10 consensus estimate. Per-share results benefited from 1.6% fewer shares outstanding. Total revenues were up 9.3% year over year, to $1,253.8 million, including a $116.7 million contribution from the November 1, 2017, acquisition of Jimmy Choo, and were modestly below the $1,261.3 million consensus estimate.

By segment, Michael Kors Wholesale revenue declined by 1.3%, to $457.8 million, while Michael Kors Retail sales were flat at $643.9 million and Michael Kors Licensing revenue declined by 6.8%, to $35.4 million.

Retail comps declined by 2.1%, or 1.3% on a constant currency basis, driven primarily by a high-single-digit decline in accessories inventory levels. Global e-commerce benefited comparable sales by 190 basis points.

By category, accessories posted a low-single-digit comp decline, which was partially offset by a double-digit comp increase in footwear and a mid-single-digit comp gain in women’s ready to wear. By region, Americas revenue rose by 2.4%, to $394.9 million, while Europe revenue declined by 9.8%, to $139.2 million, and Asia revenue increased by 4.3%, to $109.8 million.

Jimmy Choo delivered a low-single-digit comp, driven by strength in footwear that was partially offset by weaker handbag performance.

The company’s adjusted gross margin expanded by 80 basis points, to 61%, reflecting the inclusion of Jimmy Choo. Michael Kors Wholesale’s gross margin expanded by 130 basis points, reflecting lower product costs that were partially offset by a decline of 150 basis points in the Retail business’s gross margin. This yielded a net contraction of 30 basis points in gross margin for the Michael Kors brand.

Adjusted SG&A expense as a percentage of sales increased by 420 basis points, to 43.7%, primarily reflecting the addition of Jimmy Choo, where the seasonal cadence of the brand’s business had an effect (operating income is higher in the first and third fiscal quarters, and lower in the second and fourth fiscal quarters).

Adjusted operating margin for the Michael Kors brand declined by 100 basis points, to 19.7%, or $224.3 million, and Jimmy Choo’s adjusted operating loss was $7.4 million.

Inventories at the end of the period were $768 million, including $148 million associated with the acquisition of Jimmy Choo, compared with $697 million in fiscal 2Q18. Excluding Jimmy Choo, inventories declined by 11.0% year over year.

Another quarter of negative comps at Michael Kors Retail is discouraging, but we are enthused by some comments management made during the investor call. Specifically, the brand’s recent capsule collections, #MKGO Graffiti and #MKGO Bold, are modern, on-trend, and street- and athletic-inspired, and are seeing strong success and sell-throughs. Engaging marketing campaigns for limited capsule collections create buzz, demand and sales. The company plans to support #MKGO to help drive further sales momentum into the holiday season. Also, the brand continues to lead in social media, and grew its social media audience by 12% in the last 12 months to more than 43 million followers, making Michael Kors one of the most-followed fashion designers in the world.

Outlook

The company provided the following guidance for FY19:

- Michael Kors raised its full-year EPS guidance by $0.05, to $4.95–$5.05, reflecting better-than-anticipated fiscal 2Q19 operating performance and including dilution from Jimmy Choo of $0.05 to flat.

- The company reiterated its total revenue guidance of approximately $5.125 billion, including $580–$590 million of incremental Jimmy Choo revenue.

- Michael Kors Retail revenue is projected to grow by low single digits and comps are projected to decline by low single digits. The company expects unfavorable foreign currency to impact comparable store sales by more than 100 basis points.

- Both Michael Kors Wholesale revenue and Licensing revenue are projected to decline by low single digits.

- The company expects its operating margin to be approximately 18.2%, including 170 basis points of dilution from Jimmy Choo. Operating margin for the Michael Kors brand is expected to be in line with fiscal 2018 performance.

- The assumed tax rate is approximately 15.5% for the year.

- The company expects capital expenditures of approximately $225 million, which includes the planned opening of approximately 60 Michael Kors stores and 30 Jimmy Choo stores, store renovations, and IT expenditures.