Source: Company reports/FGRT

Fiscal 1Q18 Results

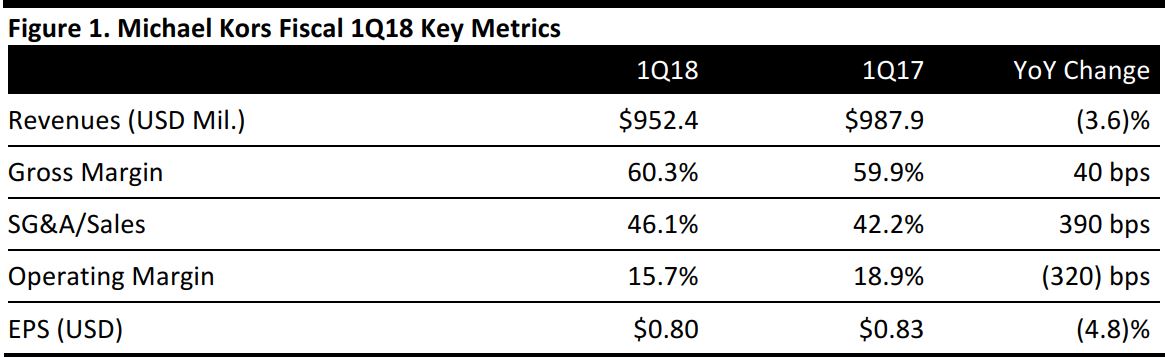

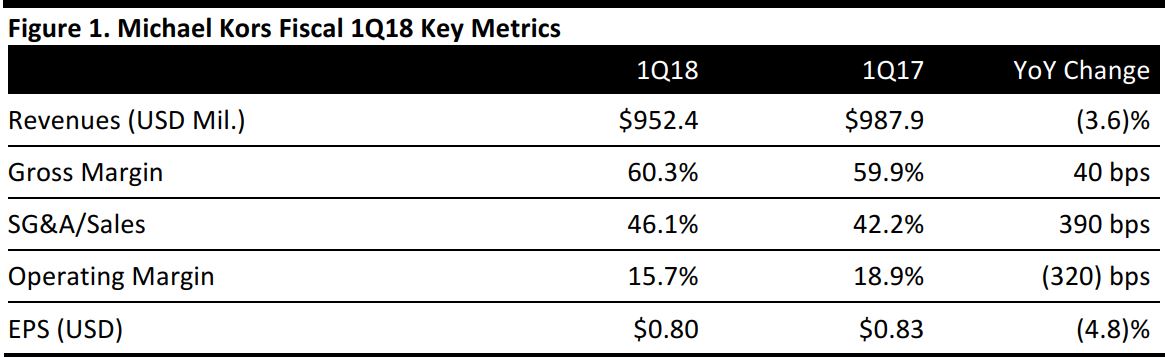

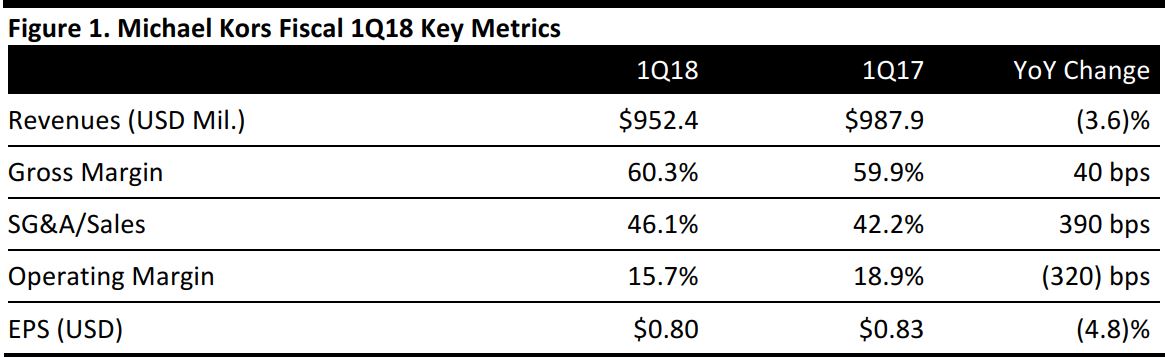

Michael Kors reported fiscal 1Q18 revenues of $952.4 million, down 3.6% year over year and ahead of the $918.7 million consensus estimate. EPS was $0.80, beating the consensus estimate of $0.62. Management was pleased with the better-than-expected results, which were driven by better-than-anticipated retail comps in North America and Europe.

Reported comps were down 5.9% versus the consensus estimate of a 9.2% decline and prior guidance of a high-single-digit decline.

By business segment, the retail division reported $619.9 million in revenue, down 10% year over year and versus the $559.1 million consensus estimate. The result was largely driven by 67 net new store openings year to date and the impact of the Greater China license. Wholesale net sales were down 23%, to $303.6 million. Licensing revenue decreased by 5.6%, to $28.9 million.

The company’s gross margin was 60.3% versus the consensus estimate of 60.5% and was up from 59.9% in the year-ago quarter. Inventory was $616.1 million, up 1.5% year over year, versus a sales decline of 3.6% in the quarter.

Company management reiterated its recently announced plan to form a global fashion luxury group. It believes that this decision will increase the brand’s long-term shareholder value and increase the company’s international exposure.

Outlook

The company provided 2Q18 EPS guidance of $0.80–$0.84, which is higher than the consensus estimate of $0.78. Revenues are expected to be $1.035–$1.055 billion, versus the consensus estimate of $1.01 billion.The company expects comps to decrease by mid-single digits in 2Q18.

For the fiscal year ending March 2018, the company guided for EPS of $3.62–$3.72, versus the consensus estimate of $3.54. Comps are expected to decrease by mid-single digits.

This outlook does not include any expectations related to the Jimmy Choo acquisition, as the transaction has not yet been completed. It is expected to close early in the company’s third fiscal quarter, and incremental revenue is expected to be approximately $275 million for the second half of FY18 and $570–$580 million for FY19. The acquisition is expected to be dilutive to EPS in the low-single-digit percentage range in both FY18 and FY19 and accretive in the low single digits in FY20, excluding related onetime transaction and transition costs.