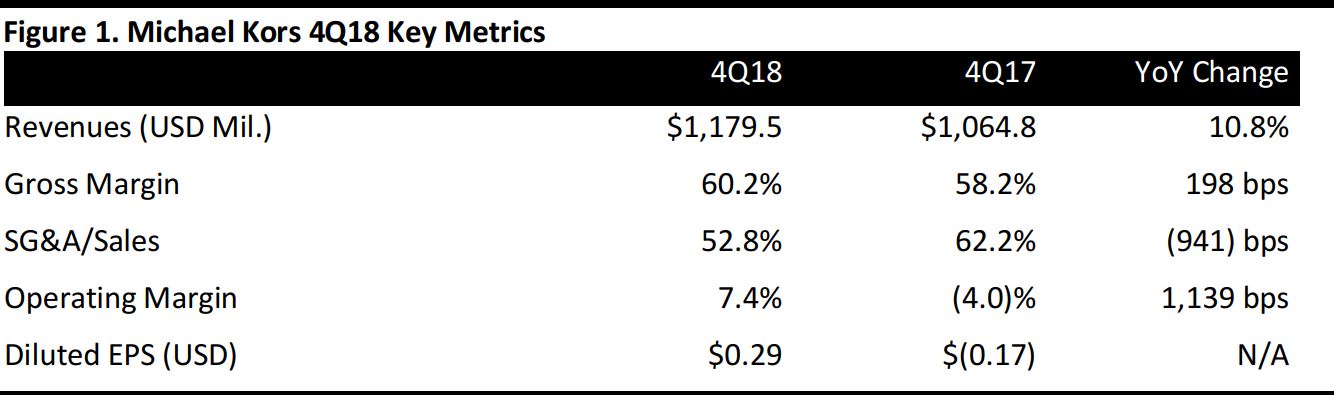

All data above are nonadjusted.

Source: Company reports/Coresight Research

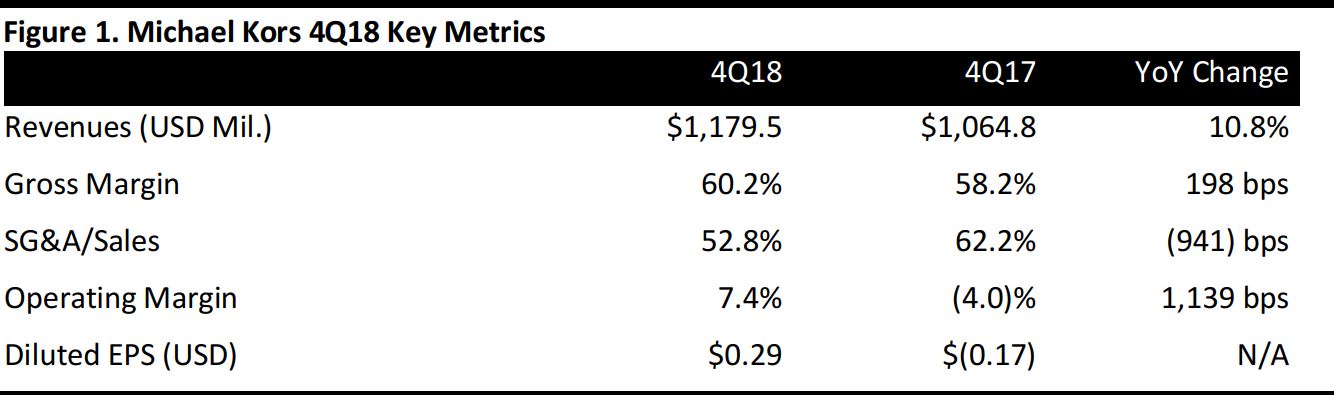

All data above are nonadjusted.

Source: Company reports/Coresight Research

4Q18 Results

Michael Kors reported a strong recovery in sales and profits in 4Q18, ended March 31.

- Revenues were up by a solid 10.8%, and at $1.18 billion, came in above the consensus estimate of $1.15 billion. The revenue uplift included a $107.9 million contribution from the acquisition of the Jimmy Choo brand. On a constant-currency basis, the company increased total revenues by 7.2%.

- Revenue growth accelerated from the prior quarter, when the company reported a 6.5% increase in revenues.

- Michael Kors grew gross profit by 14.5%, yielding an uplift to the gross margin of close to 200 basis points. The company noted gross margin gains from a higher proportion of retail sales, expanded MK Retail and MK Wholesale gross margins and the inclusion of Jimmy Choo.

- Operating expenses were down by 6.0%, yielding a very substantial fall in the SG&A ratio.

- Factoring in impairment charges, restructuring charges and inventory adjustment, adjusted diluted EPS of $0.63 was ahead of the consensus estimate of $0.60.

In terms of top-line performance, management noted the following:

- At the Michael Kors brand (MK), Retail revenues increased by 0.1%, with comparable sales falling by 1.7%, at constant exchange rates. Sales were driven by demand for accessories, footwear, ready-to-wear womenswear and men’s categories. As reported, growth in Asia was offset by a 2.5% revenue decline in the Americas.

- MK Wholesale revenues fell by 6.1% at constant exchange rates, which management attributed to the company’s planned reduction in inventory levels in the channel in an effort to drive more full-price sales and elevate the brand’s positioning. Americas revenues were down by 7.1% as reported.

- MK Licensing revenues fell by 11.1% as reported.

FY18 Results

For FY18, the company reported the following:

- Total revenues increased by 5.0% to $4.72 billion. This included a $222.6 million contribution from the Jimmy Choo acquisition. At constant exchange rates, total revenues were up 3.6% year over year.

- Gross profit increased by 7.4%, yielding a gross margin of 60.6%, up from 59.2% in FY17.

- Operating income climbed by 8.6% and generated an operating margin of 15.9%, versus 15.4% in the prior year.

Outlook

For 1Q19, management expects total revenues of approximately $1.135 billion, including $140–$145 million of incremental Jimmy Choo revenues. Comparable sales for the MK brand are expected to be broadly flat. Management expects to report diluted EPS in the range of $0.90–$0.95 in 1Q19.

For FY19, management expects total revenues to total approximately $5.100 billion, including $570–$580 million of incremental Jimmy Choo revenues. Comparable sales for the MK brand are expected to be approximately flat. The company expects to report FY19 EPS in the range of $4.65–$4.75.

All data above are nonadjusted.

Source: Company reports/Coresight Research

All data above are nonadjusted.

Source: Company reports/Coresight Research