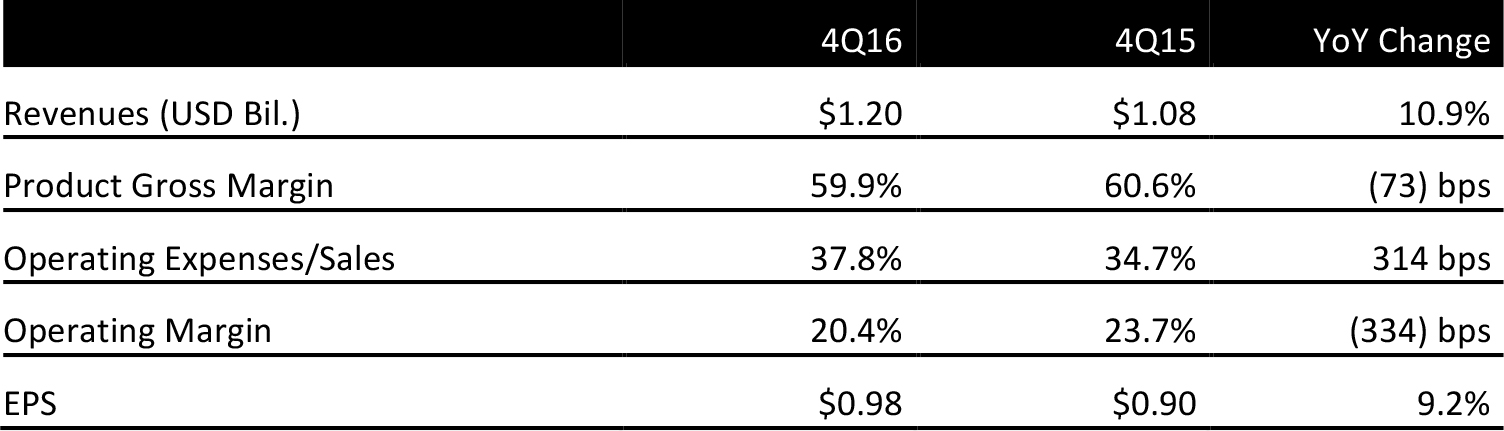

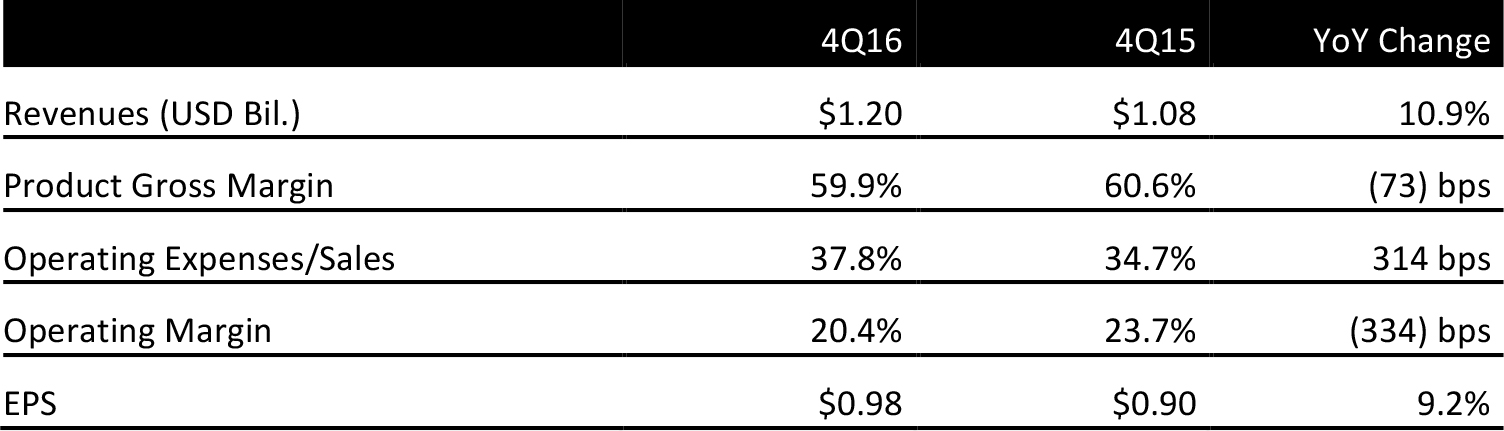

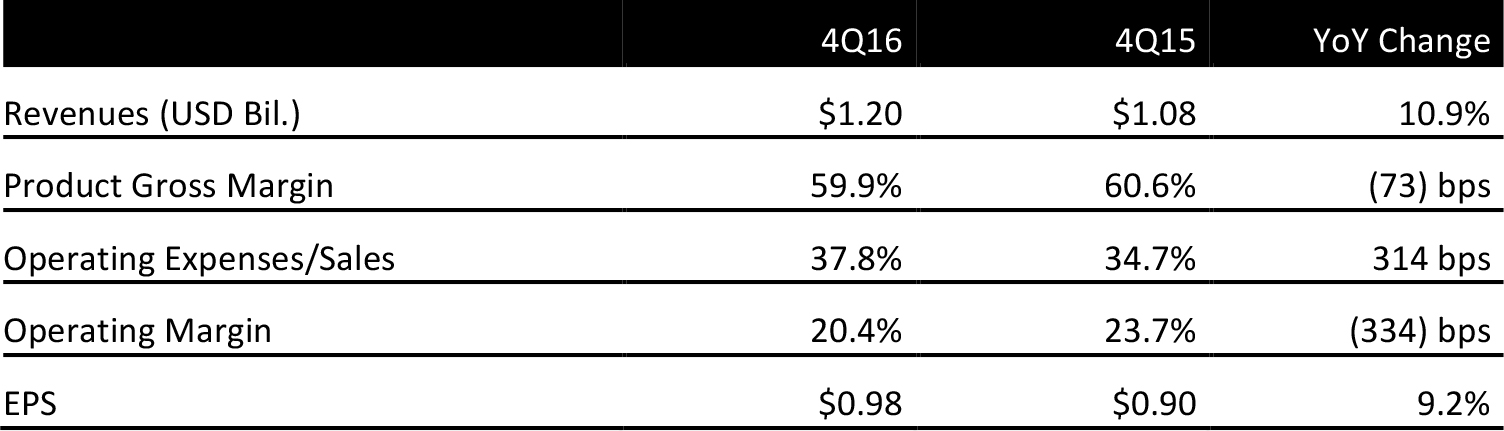

Source: Company reports

4Q16 RESULTS

Michael Kors reported fiscal 4Q16 revenues of $1.20 billion, up 10.9% year over year. On a constant-currency basis, revenue increased by 11.7%.

Retail net sales increased by 22.0% in the quarter, driven primarily by e-commerce sales from the company’s digital flagships. Same-store sales grew by 0.3% in the quarter.

On a constant-currency basis, total revenue in the Americas increased by 5.1% and European revenues increased by 18.1%. The strongest growth came from Asia, where revenue grew by 212.1% on a constant-currency basis.

Reported EPS was $0.98 for the quarter, up eight cents from the year-ago quarter, and beating the consensus of $0.97.

The company attributed its success in the quarter to refreshed marketing campaigns and diversified product offerings, as well as to strong performance from its digital e-commerce flagships.

FY16 RESULTS

For FY16, the company reported revenues of $4.7 billion, up 7.8% from FY15. Same-store sales decreased by 4.2%; on a constant-currency basis, though, they decreased by only 0.9%. FY16 EPS was $4.43, above the consensus of $4.41.

The company announced that it had purchased Michael Kors (HK) Limited, the exclusive licensee of the company in China and other parts of Asia, for $500 million in cash. The licensee generated total revenues of $197 million for FY16.

2017 OUTLOOK

Michael Kors forecasted revenues of $940–$950 million for fiscal 1Q17, below expectations of $1.03 billion, citing a planned reduction in wholesale shipments, decreased same-store sales (expected to be up in the mid-single-digit range), and an increase in operating expenses associated with continued global investments.

The company guided for flat revenues for FY17, despite an expected $200 million in revenue from the acquisition of the China licensee. EPS is expected to be $0.70–$0.74 for 1Q17, and $4.56–$4.64 for the fiscal year.