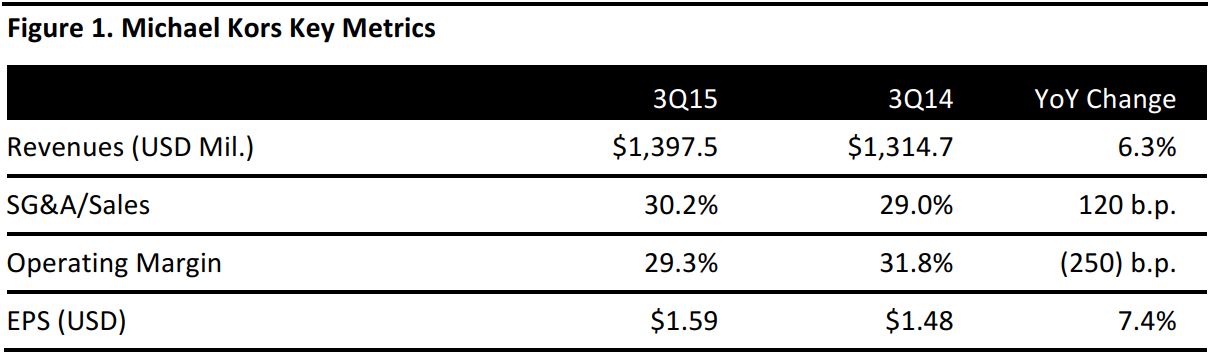

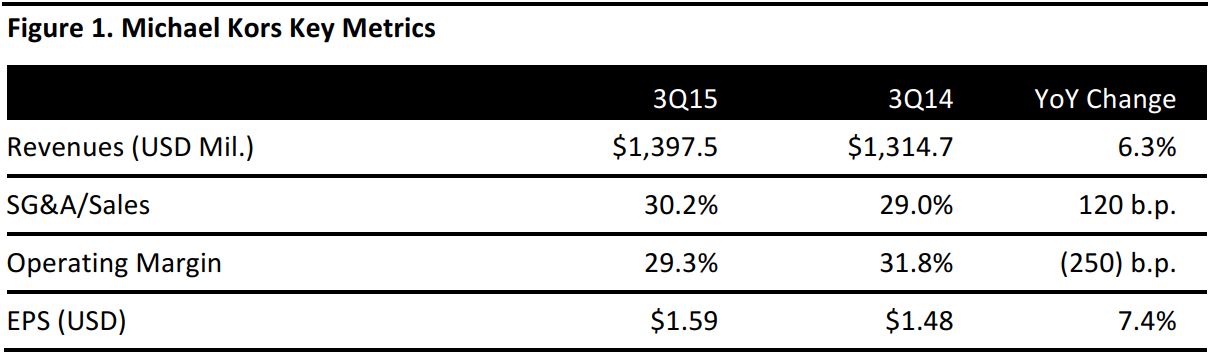

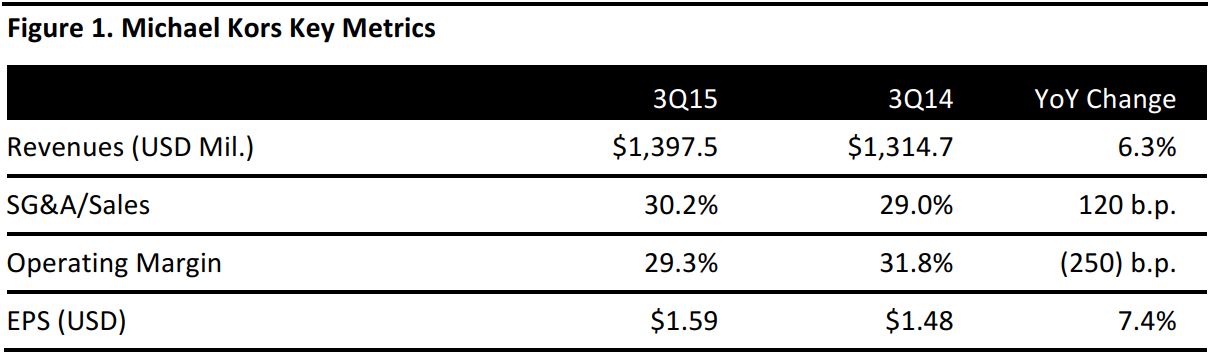

Source: Company reports

Michael Kors’ 3Q15 EPS was $1.59 versus consensus of $1.46.

Total revenues increased by 6.3%, to $1.40 billion, versus expectations of $1.36 billion. Comps were (0.9)% versus consensus of (4.4)% and versus guidance for a mid-single-digit decline. By segment, retail revenues increased by 11.1%, to $766.2 million, versus consensus of $728.6 million; wholesale revenues increased by 0.3%, to $575.5 million as compared to expectations of $573.5 million; and licensing revenues increased by 8.4%, to $55.8 million versus consensus of $49.9 million.

Total revenue in the Americas increased by 0.4%, to $1.06 billion. European revenue grew by 14.3% to $276.0 million, and revenue in Japan increased by 59.1%, to $25.5 million.

Sales were driven by an increase in conversion in the retail channel despite continued declines in mall traffic.

Management provided 4Q15 guidance for EPS of $0.93–$0.97 versus consensus of $1.00. Comps are expected to be flat and total revenues are expected to be $1.13–$1.15 billion versus consensus of $1.16 billion.

The company reaffirmed its full-year guidance. EPS is expected to be $4.38–$4.42 versus consensus of $4.32. Revenue is expected to be $4.64 billion versus prior guidance of $4.60–$4.65 billion and comps are expected to show a mid-single-digit decline.