Web Developers

This deal is the culmination of the decades of work Donatella Versace has done in concert with Versace’s management team, led by Versace CEO Jonathan Akeroyd. The Versace family and shareholders will be able to monetize their assets while remaining involved in the brand’s future growth as part of the new entity—Capri Holdings Limited—and participating in the growth of the entire Capri portfolio.

Akeroyd will continue to run the Versace management team and Donatella will continue to lead the brand’s creative vision.

The $2.12 billion purchase price represents a 2.5 times revenue multiple and 22 times EBITDA multiple, and is projected to be dilutive in the first year, modest accretion in the second year, with high single digit accretion in the third year, and an EBITDA margin in the high-teens. The Versace acquisition will further diversify Kors/Capri’s geographic portfolio from: 66% Americas to 57% Americas; 23% Europe to 24% Europe; and, 11% Asia to 19% Asia.

The goal of this acquisition for Versace is to grow from $850 million to $2 billion in revenues on an additional 100 stores, increase its accessories and footwear penetration to 60% from the present 35% of total revenues, and grow its e-commerce business and building on the brand’s runway momentum. Kors can help Versace achieve these growth targets by using the former’s supply chain, and operational and financial acumen.

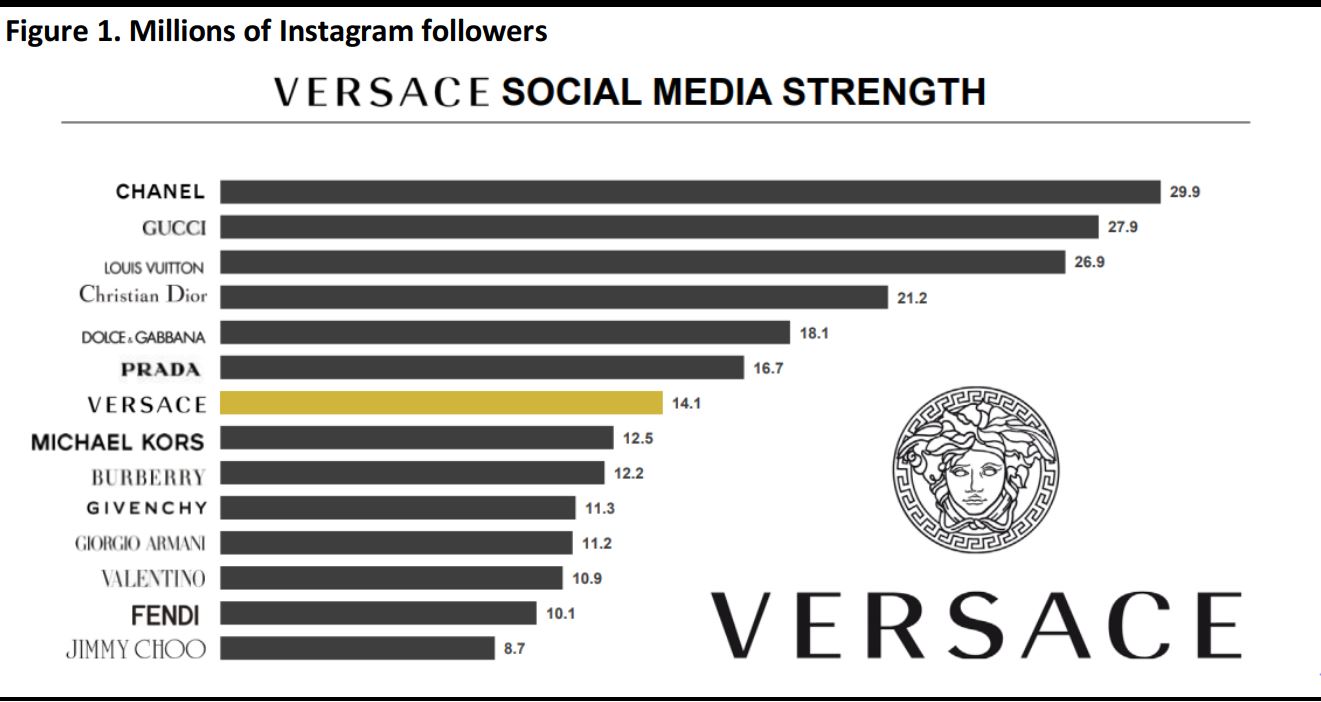

The Versace brand enjoys more than 80% brand awareness in many of its major markets. Donatella has 3.5 million followers and Versace has 14.1 million followers (Figure 1), nearly four times as many. Celebrities and fashion models are frequently seen in Versace gowns and menswear. The brand extends from glamour gowns to an iconic home furnishing collection and has one of the bestselling luxury fashion items in the very strong active sneaker market. Also, Versace is registering double-digit comps across its 200 stores.

The combined Versace-Jimmy Choo-Michael Kors entity will be an $8 billion opportunity with Jimmy Choo at $1 billion and Michael Kors at $5 billion.

This acquisition is a diversification move for Kors, a responsible strategy that alleviates the pressure on any one brand to drive overall corporate results. Kors is still in the early stages of integrating the Jimmy Choo acquisition and Coresight believes that it will put the infrastructure in place to add more additional luxury brands to its platform. That said, finding the right collection of brands to bring into a portfolio is time consuming and the subsequent work of learning across platforms while preserving brand DNAs and keeping consumer touchpoints brand specific is a challenge; the French do this very well, it will be interesting to watch how the US luxury house cultivates brands and their distinctive POVs while leveraging operational infrastructures. The last thing consumers want to see is a blurring of the brands. Versace is the Italian sexy and Kors is American ease.

It is still early days in the race between Tapestry and Capri to become the leading New Luxury (inclusive, social and democratic) brand portfolio. Capri has gone very international with its brand choices, while Tapestry’s brand portfolio is US-based, though the brands enjoy global recognition.

Source: ListenFirst “Luxury Fashion Universe”

Source: ListenFirst “Luxury Fashion Universe”