Metro Group Is Modernizing Its Logistics Network in Germany

On September 18, Metro Group announced that it would make a substantial investment in modernizing its logistics infrastructure to support its German Metro Cash & Carry and Real operations. The company did not disclose the investment amount, but its press release referred to a “high double-digit million euro amount.”

The investment consists of three new logistics centers to be opened starting in 2017 and the expansion of one existing facility. The new centers will be able to handle the same stock volume currently handled by seven facilities.

Meeting the New Requirements of Retail Operations

Metro announced that the new logistics infrastructure will support the repositioning of its Metro Cash & Carry and Real operations. In particular:

- Metro Cash & Carry aims to introduce a professional food-service distribution concept to deliver directly to customers that include restaurants, hotels and catering companies. The Metro Cash & Carry model has historically relied on professional customers going to a store to buy and collect their purchases.

- Real is expanding its fresh food offering and multi-channel facilities to meet changing consumer shopping habits. The company has noted that consumers are paying greater attention to fresh and local produce, and it plans to include click-and-collect and drive-through facilities as part of its multi-channel offering.

With the modernization of its logistics infrastructure in Germany, Metro Group aims to improve efficiency and product availability while reducing in-store inventories. The company expects to enjoy substantial annual savings from its efforts, potentially in the “medium double-digit million euro range,” according to its press release.

Multi-Channel and Fresh Produce Imply New Priorities for Logistics

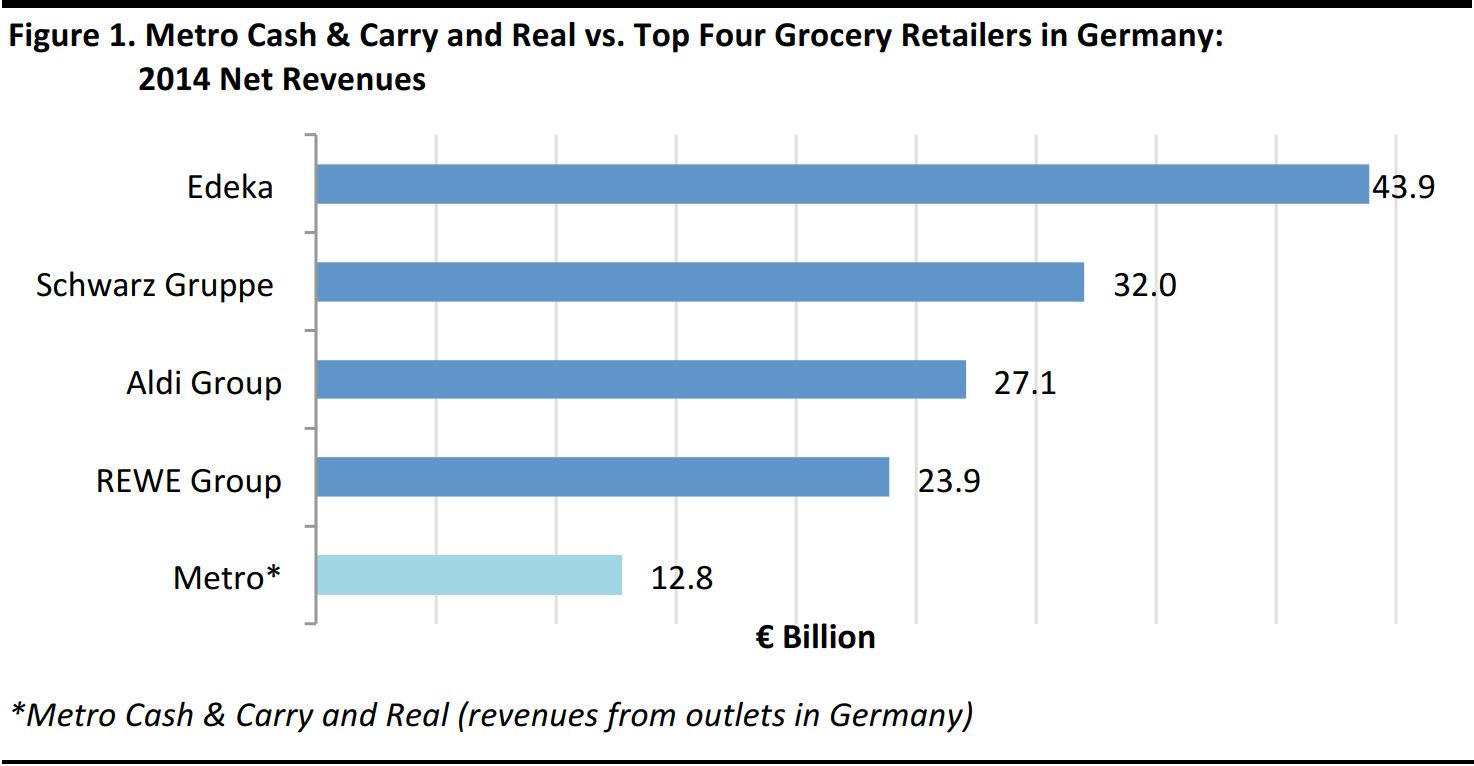

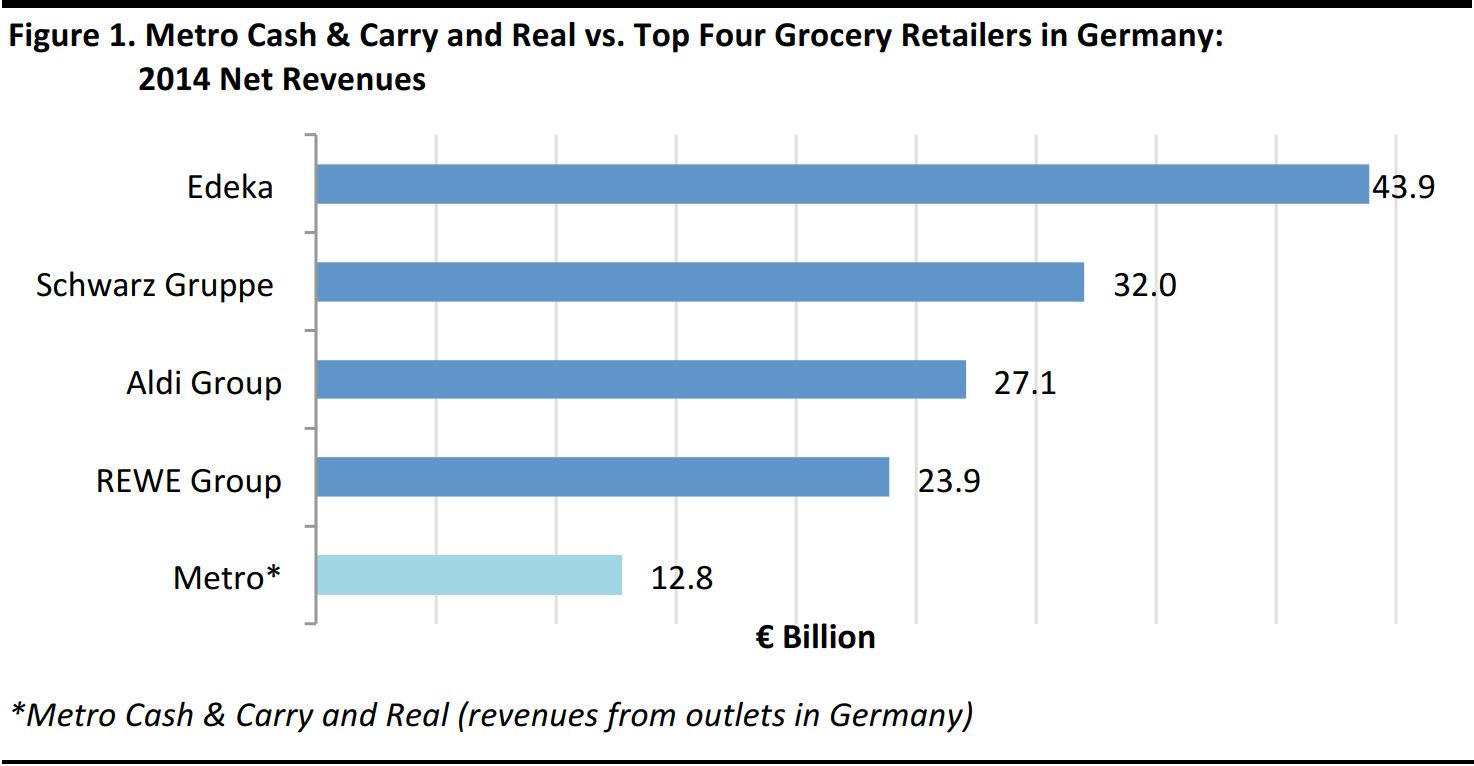

Metro Group has been committed to changing its German store operations in order to remain competitive in its domestic market. Competition remains strong in Germany, thanks to the presence of discounters Aldi and Lidl and the leadership of grocery multiple Edeka.

Source: Company reports/Euromonitor International/Trade Dimensions/Statista/FBIC Global Retail & Technology

The repositioning of Metro Cash & Carry and Real will require logistics support that offers speed, efficiency and frequency. The chains will need to be able to deliver to clients’ business premises, supply hypermarkets with fresh products daily and cope with the extra demand that multi-channel offerings entail.

As part of its repositioning strategy, Metro Group revamped its Real hypermarkets. It started with the Essen flagship store in November 2013, and extended the refurbishment to 30 other retail locations. New Real stores feature free wi-fi and integrate the in-store and online shopping channels. For instance, customers can use the stores as click-and-collect points (at no additional charge) for nongrocery purchases processed on the Real.de portal.

Two stores feature drive-through facilities, which enable customers to pick up groceries they ordered via the Real-drive.de portal without getting out of their car. The new stores also have areas that boast a local market feel, with handwritten product tags, butcher desks and fruit stands. According to Metro Group, the focus on local produce and the new multi-channel facilities have increased the stores’ attractiveness.

The Struggle Is Real

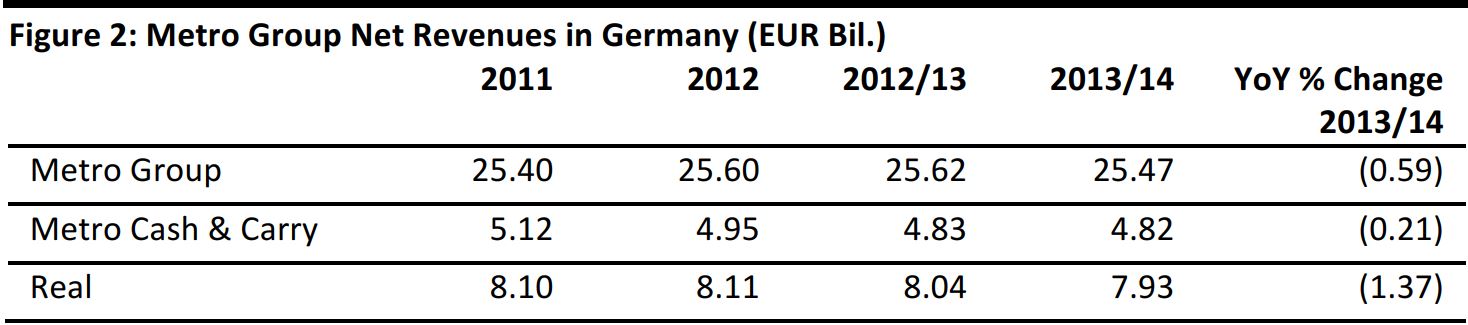

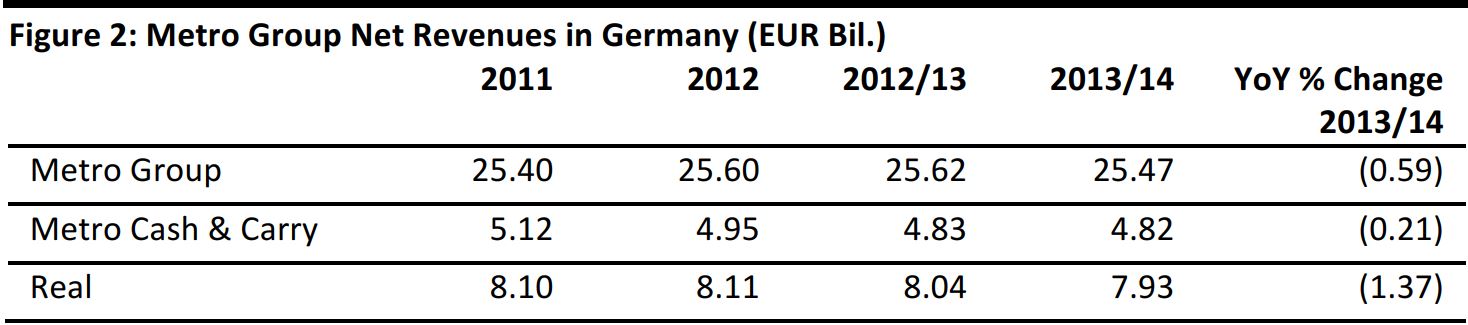

The repositioning of Metro Cash & Carry and Real was needed, as Metro Group revenues have been declining in the last five years, with Real showing the worst performance. Real sales have been struggling for a long time; as far back as 2011, Metro Group was said to be preparing to sell the hypermarket chain. However, the repositioning and the announced investment in logistics show that Metro Group has abandoned the plan to sell Real and is now committed to its hypermarket brand for the long haul.

Until 2012, fiscal year-end was December 31; since 2013, the fiscal year has run from October 1 through September 30

Source: Company reports/S&P Capital IQ

The changes to Metro Cash & Carry and Real operations are certainly sensible moves, as is the investment in more efficient logistics to support these changes. The new logistics structure will enable Metro Group to provide faster and more frequent deliveries, increase the volumes it handles, and, thanks to improved efficiency and centralization, achieve significant savings. And we believe that the repositioning and logistics improvements will certainly help the chains respond to customers’ evolving needs.

Customers have seemed to respond well to the repositioning of the brands. In the Real store in Essen, sales increased by 15% and the number of visitors grew by 25% in the first year of operation following its refurbishment in October 2013. However, the question remains whether these moves will be enough to revive Metro Group’s revenues, particularly the Real hypermarkets’ struggling sales.

The hypermarket format in Germany has never been successful. Discounters remain popular and there is little apparent demand for trading up to hypermarkets. German shoppers tend to be frugal with their day-to-day purchases and seem to prefer smaller store formats. Leading German grocery retailer Edeka runs predominantly small supermarket formats, while Aldi and Lidl run only small discount stores. The challenge for Metro Group’s Real operations might well be more profound than either brand positioning or logistics, as German consumers seem to just not like the hypermarket model.

On September 18, Metro Group announced that it would make a substantial investment in modernizing its logistics infrastructure to support its German Metro Cash & Carry and Real operations. The company did not disclose the investment amount, but its press release referred to a “high double-digit million euro amount.”

The investment consists of three new logistics centers to be opened starting in 2017 and the expansion of one existing facility. The new centers will be able to handle the same stock volume currently handled by seven facilities.

On September 18, Metro Group announced that it would make a substantial investment in modernizing its logistics infrastructure to support its German Metro Cash & Carry and Real operations. The company did not disclose the investment amount, but its press release referred to a “high double-digit million euro amount.”

The investment consists of three new logistics centers to be opened starting in 2017 and the expansion of one existing facility. The new centers will be able to handle the same stock volume currently handled by seven facilities.