Source: Company reports

Metro AG, the Germany-based international retailing company, reported a 1Q16 decline of 7.2% in EBIT before special items, to €828 million, which was below the consensus estimate of €861 million, according to S&P Capital IQ. The earnings were negatively affected by unfavorable exchange rates, particularly related to the weakness of the ruble. In Russia, the group has a strong presence, with 152 stores as of the end of the reporting period.

The group recorded a 41.6% increase in EBIT after special items, to €1.2 billion. The substantial increase resulted from the sale of the Vietnamese operations of Metro Cash & Carry, which led to special items income of €427 million.

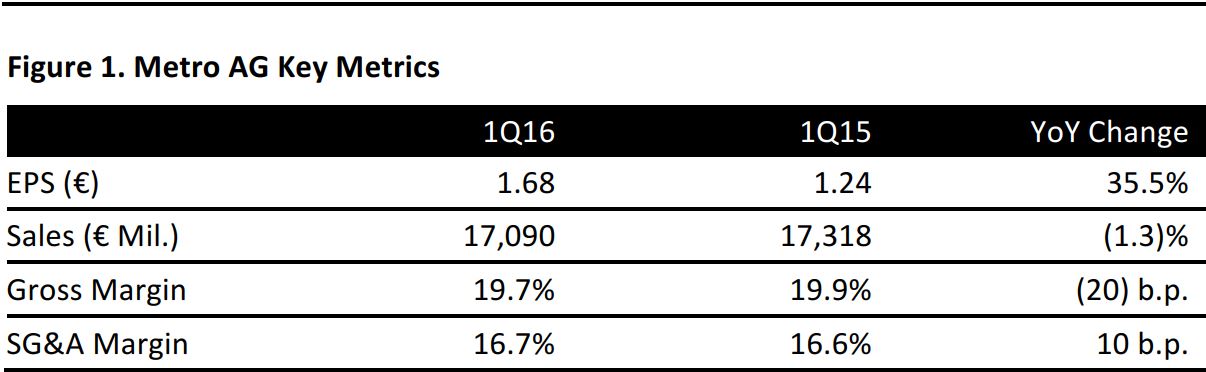

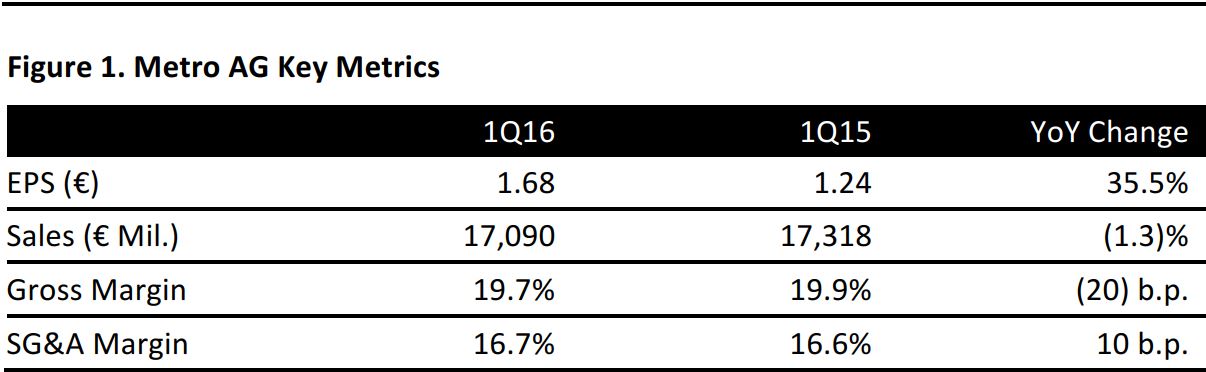

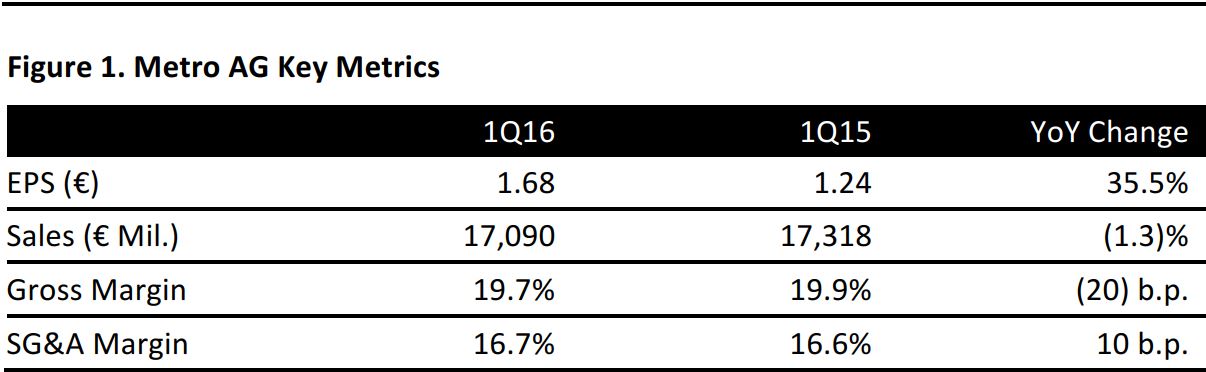

EPS was €1.68 in 1Q16, above the consensus estimate of €1.47, according to S&P Capital IQ. Adjusted for special items, EPSfor the period amounted to €1.12.

Metro reported a revenue decline of 1.3% for the quarter. At €17.1 billion, revenue for the period was above the consensus estimate of €16.9 billion recorded by S&P Capital IQ. The decline in reported sales was mainly due to the negative impact of the weak ruble and a net decline of 11 units in the group’s store portfolio.

Comps for the group were up 0.1% during the period, helped by the favorable momentum of Metro Cash & Carry (whose comps were up 0.2%) and electronics chain Media-Saturn (whose comps were up 0.4%). The latter chain had a positive Christmas trading period, particularly in Germany. However, group comps were held back by German hypermarket chain Real, whose comps fell 1.6%, dragged down by intense competition and deflationary food price trends.

Metro expects a slight increase in overall sales forFY16, driven by Metro Cash & Carry and Media-Saturn, despite an economic environment that is forecast to remain challenging. The group remains confident in its ability to generate earnings growth through the new fiscal year, thanks to its progress in transforming its business model; EBIT before special items is expected to rise slightly above the €1.5 billion achieved in FY15.

The 1Q16 results confirmed that Media-Saturn is the group’s best-performing retail division. Its online sales increased by 12% during the period. The Saturn Connect store in Cologne, which opened in October 2015, was voted “Store of the Year” by the German Retail Federation (HDE). Metro says the outlet is a prime example of the “digitalization” of store-based retail, and it has a strong focus on digital lifestyle products. The store’s product range includes lifestyle categories labeled as Connected Mobile (phones, notebooks and tablets), Connected Home (products and solutions for the networked home), Connected Fitness (wearables, action cameras and wellness products) and Connected Discovery (virtual reality glasses and “appcessories”).