METRO GROUP SET TO DEMERGE

On December 15, Germany’s Metro Group unveiled its post-demerger plans, at its Capital Markets Day in Düsseldorf. In mid-2017, the company will split into the following:

- Metro: Currently the Wholesale and Food Specialist Company (WFS), which consists of MetroCash & Carry and Real hypermarkets.

- Ceconomy: The consumer electronics company, which consists largely of Media Saturn.

Separation will be on a 1:1 basis, with each Metro Group shareholder receiving one share in each of Metro and Ceconomy.

In the following sections, we outline key takeaways from the Capital Markets Day.

METRO: FOOD RETAIL AND WHOLESALE

Here are our top three themes from Metro Group’s presentation on its WFS division:

1) WFS is Predominantly a Wholesale Company

Some 80% of WFS revenues and a greater share of profits come from wholesaling. CEO Olaf Koch was at pains to emphasize the extent of its wholesaling, and one reason for this was the discount he perceives is being applied to the company’s shares. Metro Group has traditionally suffered from a “conglomerate discount” to the sum of its parts, and its WFS gets linked to a food-retail valuation multiple by analysts, Koch said. There is a “significant difference” in multiples for wholesalers, so Metro Group’s valuation stands to gain from being viewed as a wholesale firm.

2) Wholesale Opportunities are Different by Market

Metro Cash & Carry is recognizing that its wholesale customer types differ by market, and is moving from uniform stores following centralized templates and guidance to more tailored, focused stores. The aim of this is to drive comparable-sales growth through relevancy.

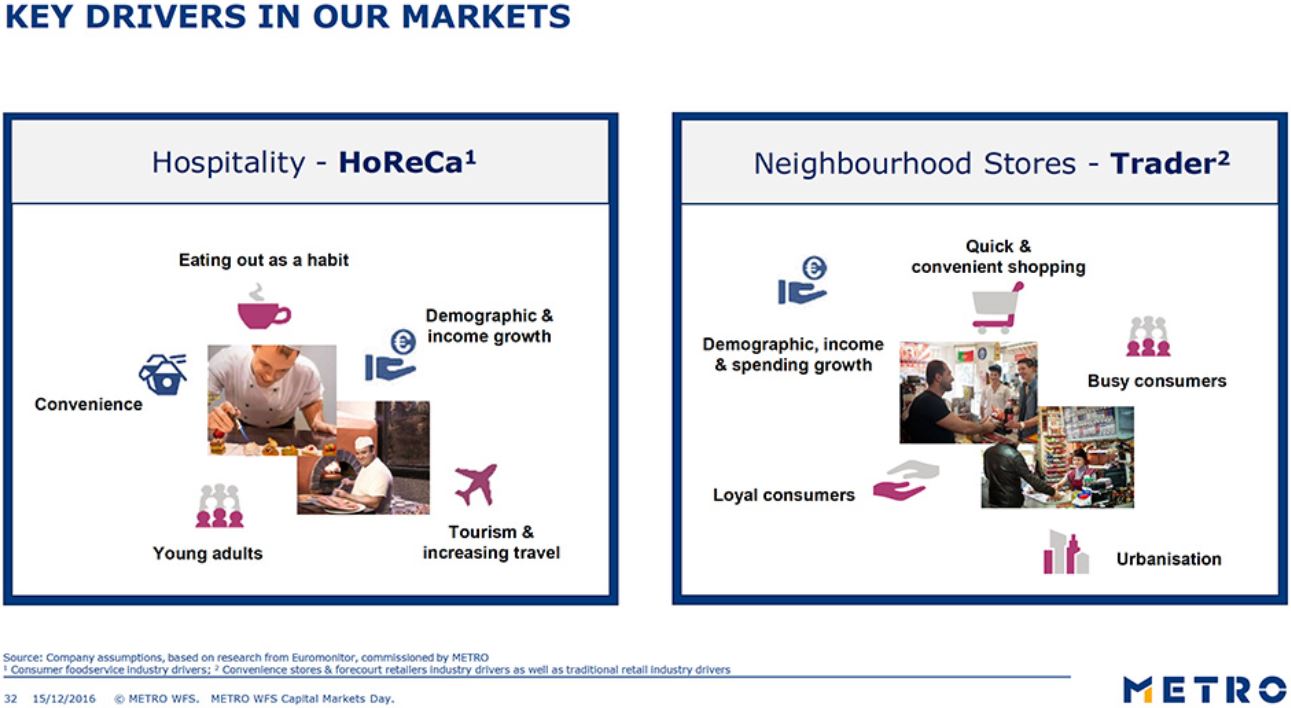

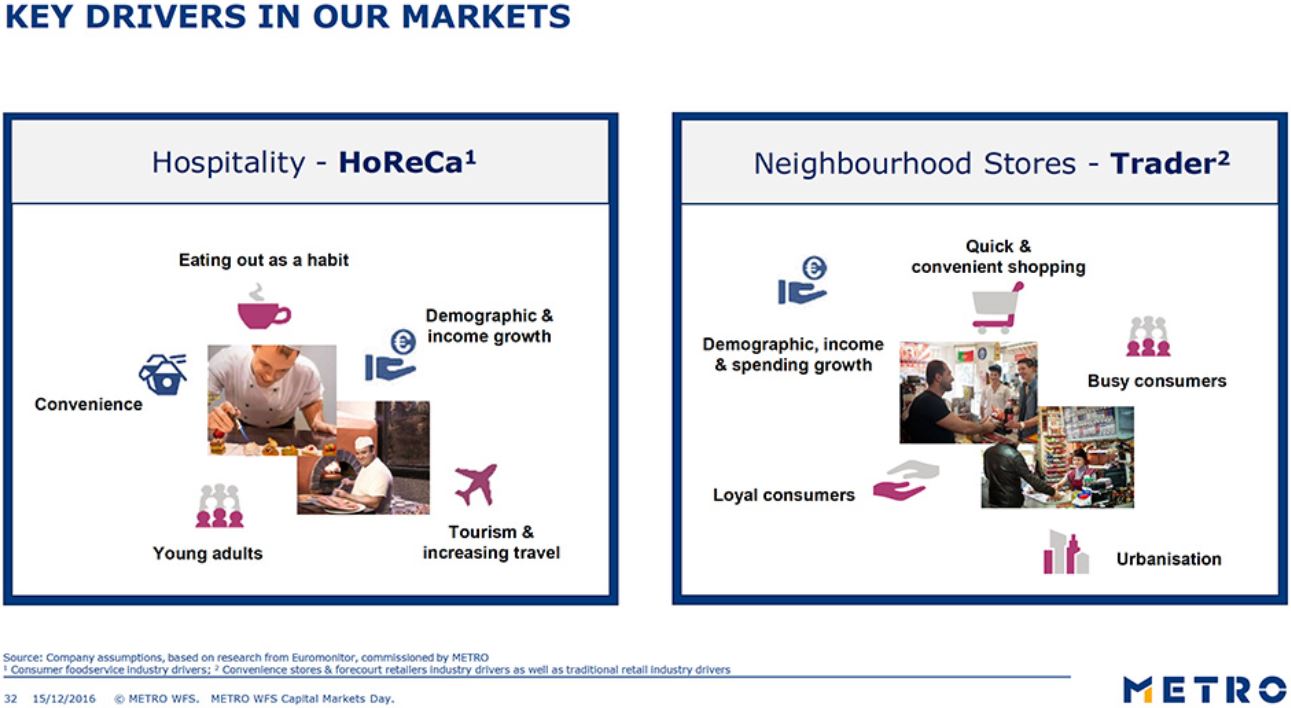

In implementing this, the company is focusing on two target groups: hotel, restaurants and cafés (HoReCa), and neighborhood retail stores (“mom and pop” stores).

Source: Metro Group

HoReCa offers very attractive margins, the company said, while lower-margin retail customers will remain an important element of the wider retail sector and, in Eastern Europe in particular, are a significant target market. Small companies in general, such as offices and institutions, comprise a third target segment, but they are not a key target, and Metro will not adjust its offering to cater particularly to these customers.

Metro is formatting its stores to cater to the dominant customer group in each market: in Italy, for instance, HoReCa customers are at the center of Metro’s offering, while in Romania, small retail customers are its principal customers. Differentiating by region is designed to underpin comparable sales growth, which is the central plank of Metro’s growth strategy.

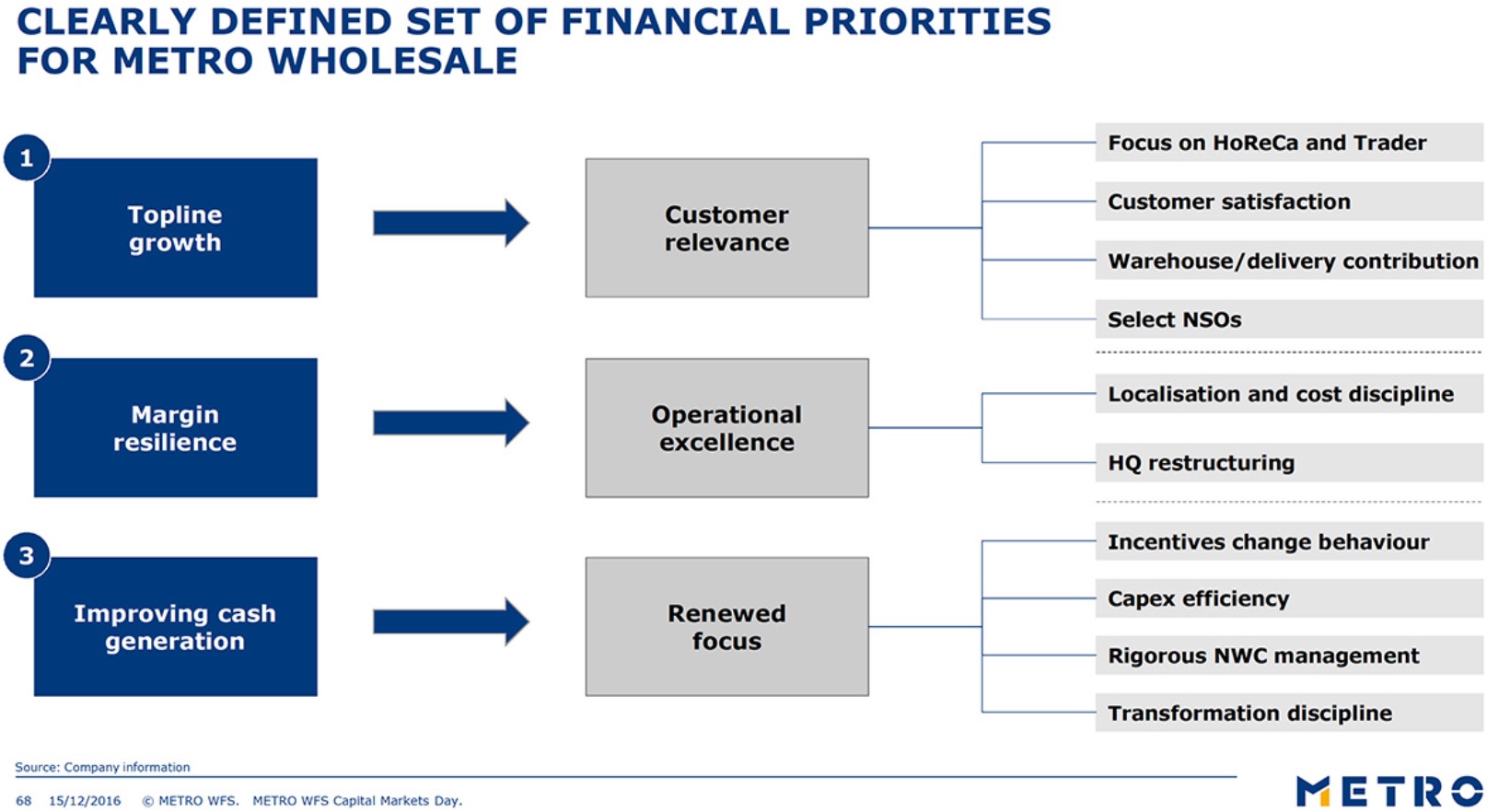

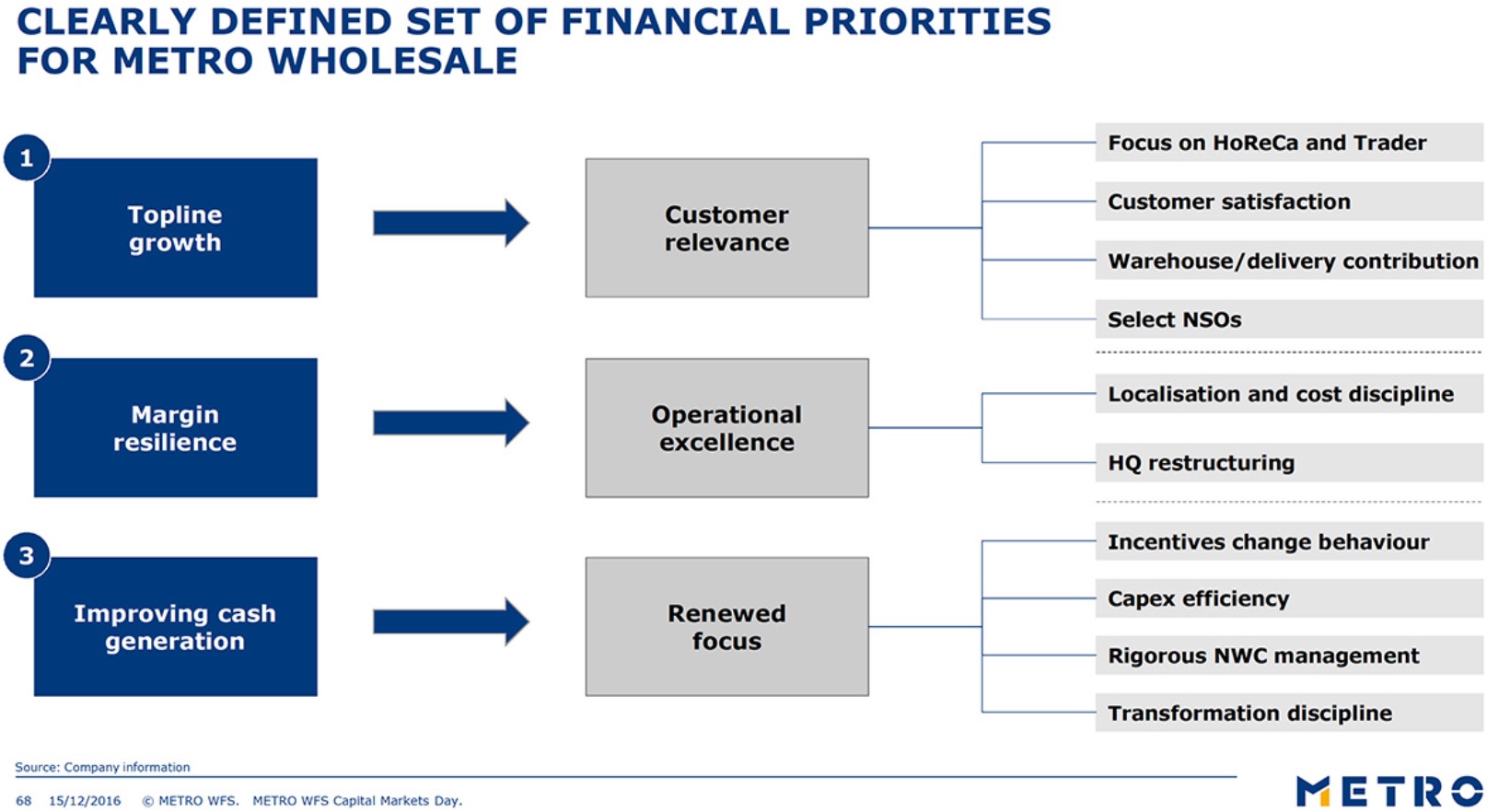

At the WFS group level, the company is targeting total sales growth of 3% or more in the medium term. Margin resilience and improved cash generation are further financial priorities for the group.

Source: Metro Group

3) Wide Choice is Not Sufficient to Satisfy Retail Customers

“Everything under one roof is not enough,” declared Koch; for grocery shoppers at the company’s retail hypermarkets, the shopping experience needs to be “inspirational.” To this end, Real launched a new concept format at Krefeld in November 2016, which Hoch described as a “sensation,” and the company updated on early trading. The first three weeks showed “promising signs of success,” with feedback “so extreme, so positive” that WFS has conviction that this model is the way forward.

WFS will convert selected “superior” Real locations to this concept, as well as applying “relevant modules” from the model to the bulk of its estate, and implement only selected elements to the tail-end of its estate.

CECONOMY: CONSUMER ELECTRONICS

Ceconomy is a “€22 billion startup company” with a “long-lasting history,” noted CFO Mark Frese. The company operates Media Markt and Saturn stores as well as pure-play Redcoon. As we discuss below, management noted that the company is the biggest consumer electronics retailer in Europe, operates in a dynamic market, has transformed its business in recent years and has opportunities to grow further.

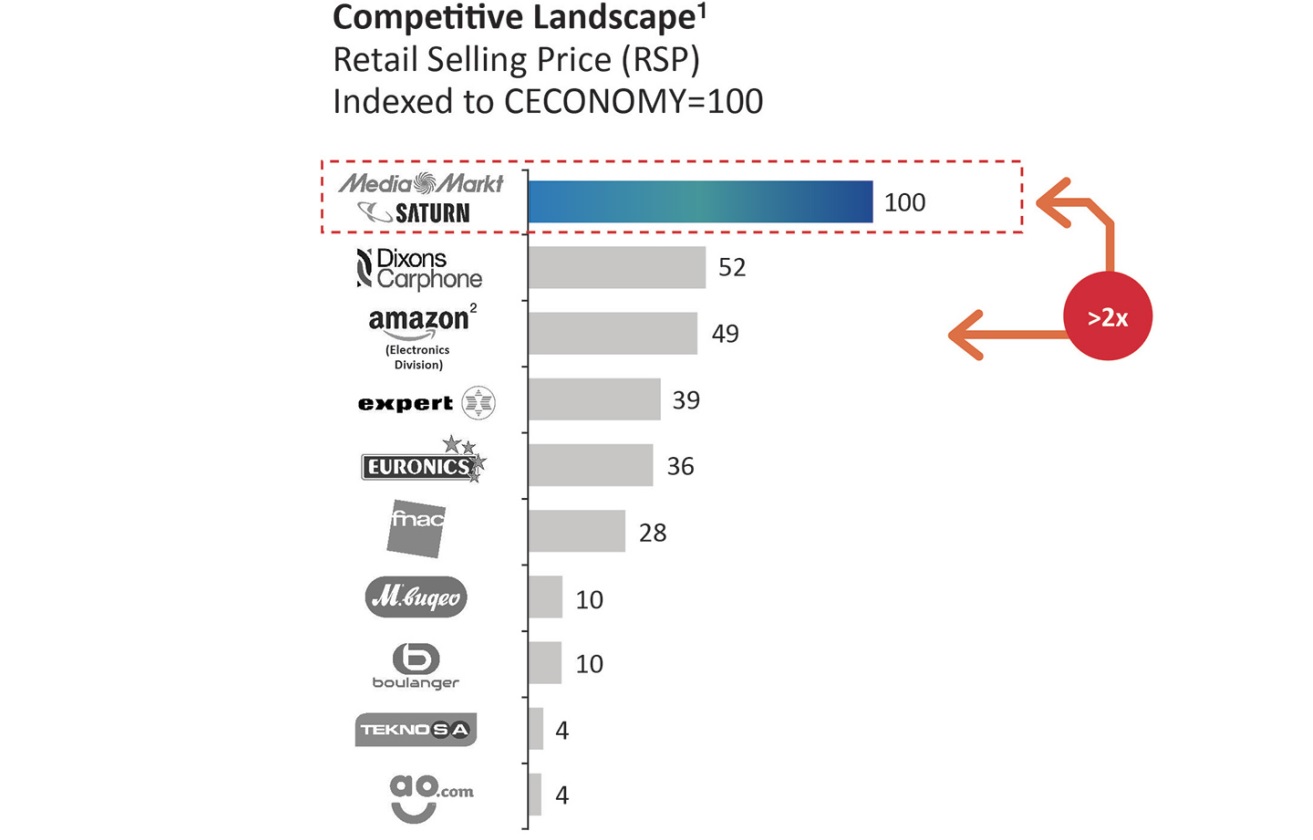

1) Ceconomy is Number 1 in Consumer Electronics in Europe

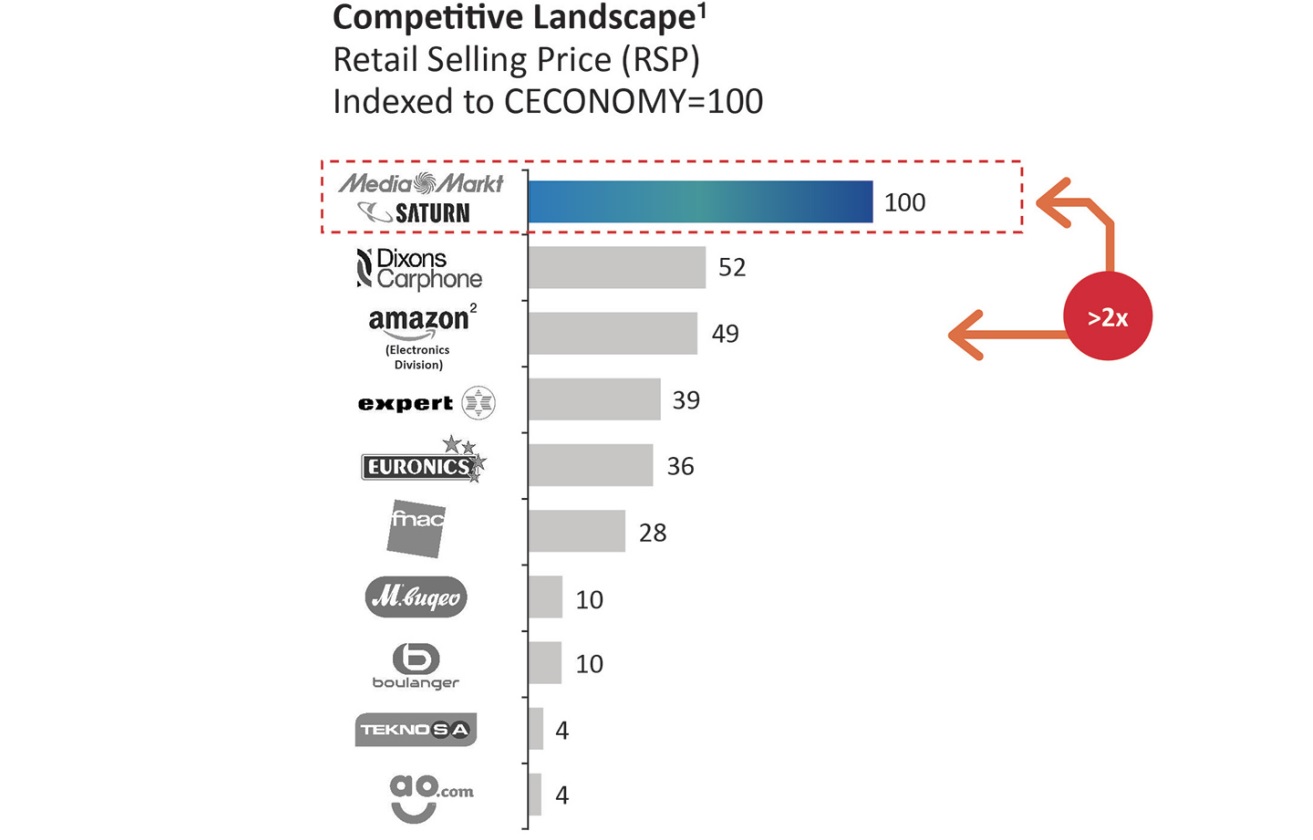

With €22 billion in sales, Ceconomy is the biggest consumer electronics retailer in Europe, at around double the size of nearest rival, Dixons Carphone. It is the market leader in nine countries.

Source: Metro Group

This scale means it becomes “almost necessary” for suppliers to partner with Ceconomy, noted CEO Pieter Haas. Indeed, major suppliers are more dependent on Ceconomy than Ceconomy is on major suppliers, Haas argued.

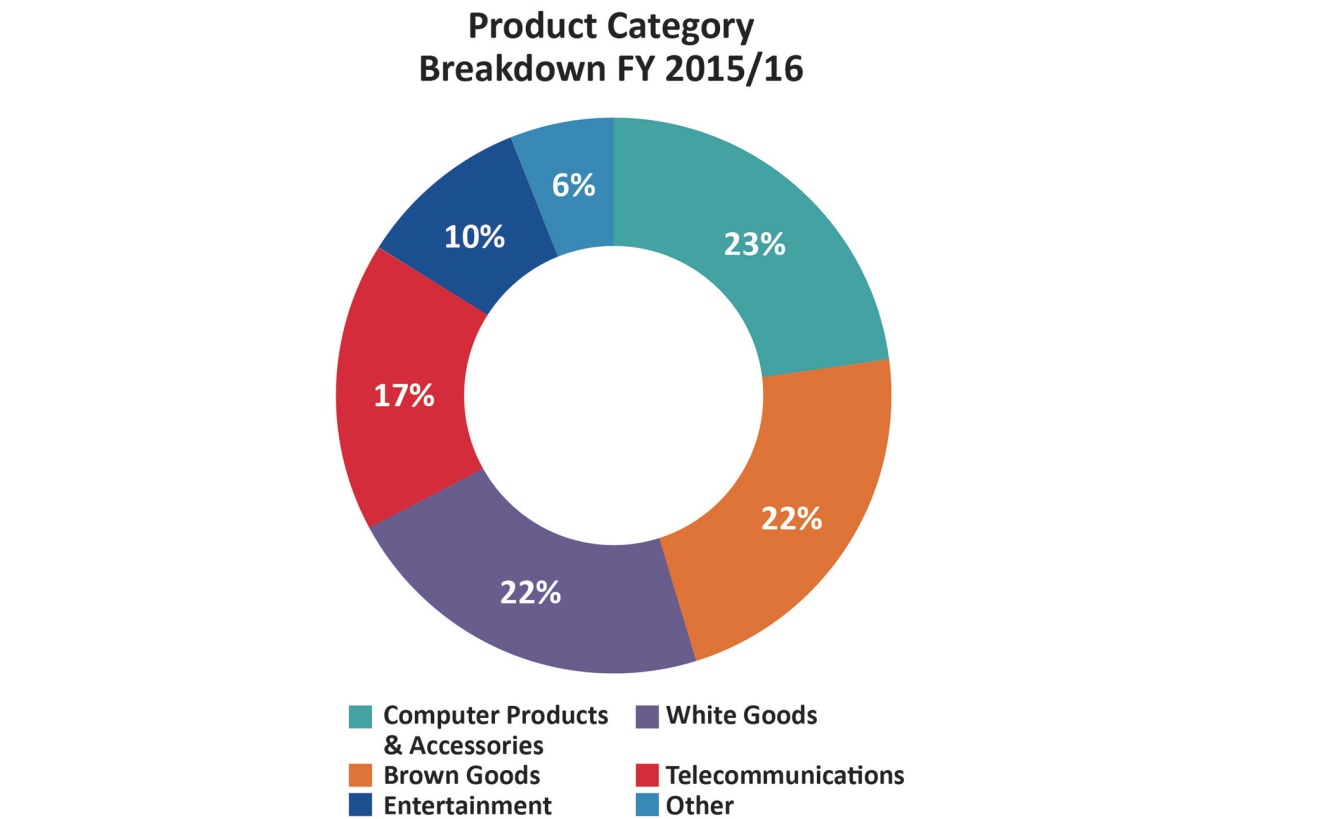

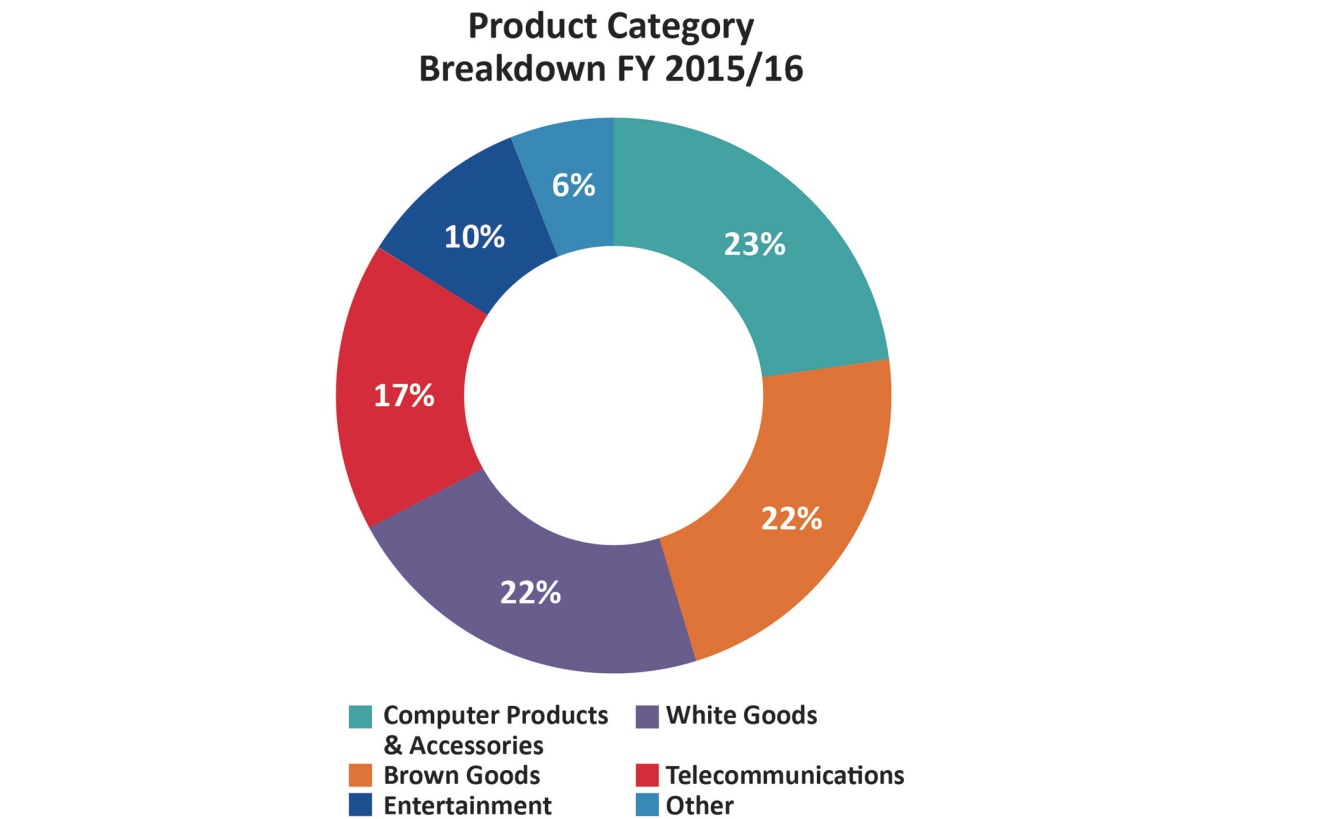

The breadth of product range, means Ceconomy is well-prepared for the integration of technology and the Internet of Things, Haas said. Single-category retailers would find it difficult to cater for the “connected world.”

Source: Metro Group

Meanwhile, an improved service offering is bolstering Media-Saturn’s proposition. Services spanning credit, set-up, delivery, digital content, repairs and warranties brought in €1.3 billion of revenue for the group in fiscal 2016.

2) The European Consumer Electronics Market is Dynamic

The European consumer electronics market is worth €300 billion, and Ceconomy’sgeographical presence means it covers 70% of this total.

Dynamics in the European electronics market that were noted by the company include:

- Growth in sales of appliances and telecoms have driven expansion in the market over the four years through 2016. The total market is growing at a modest 1%–2% per year.

- In the countries where Ceconomy operates, some 17.3% of consumer electronics sales were online in 2015, and the company expects this to grow to a 22.3% share in 2020.

- In the markets where Ceconomy is present, multichannel retailers are driving online growth, rather than pure plays.

- There remains much scope for consolidation, with many countries seeing the five biggest consumer electronics retailers capturing less than 50% of the market.

- It is expensive to consolidate the consumer electronics market: retailers must invest in omnichannel capabilities, IT and pricing and data abilities.

3) Ceconomy has been Transformed

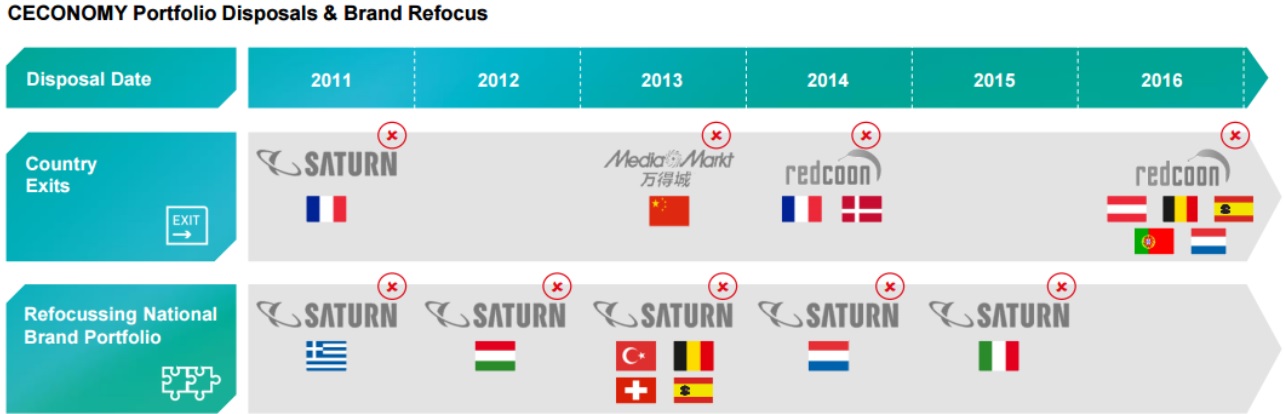

CEO Pieter Haas argued that Ceconomy is founded on a strong base, because the consumer electronics business has spent the past few years shaping up, slimming down and pushing online.

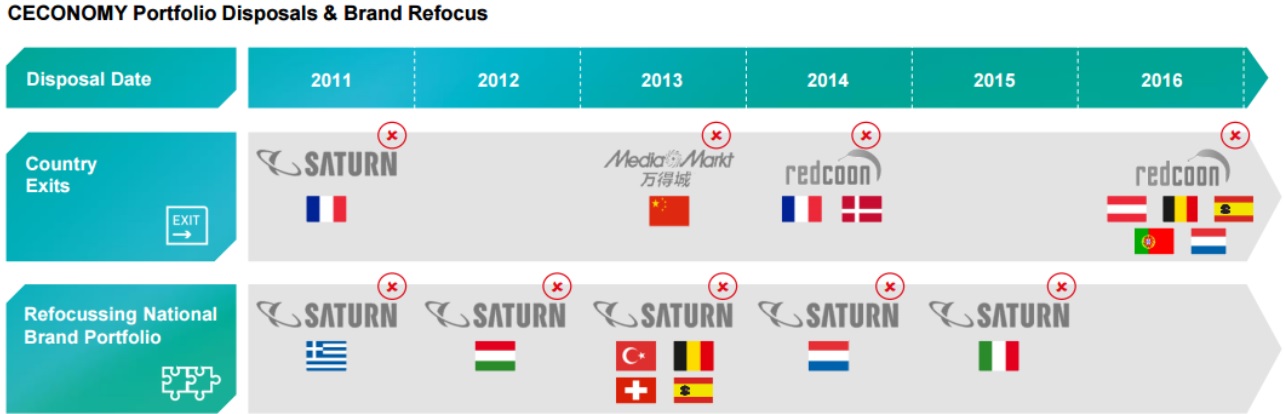

- Shaping up: The company has focused on core banners, cutting the Redcoon and Saturn name in some markets to focus on the core Media Markt banner.It has also constantly invested in upgrading and remodeling its stores.

- Slimming down: It has “cleaned up” its store portfolio, exiting a number of markets such as France and China, making some store closures and “rightsizing” some other stores to reduce sales area.

Source: Metro Group

- Haas noted that Media Saturn “invented supermarkets for electronics but digitalization took us by surprise.” While the company was “late to digitalization,” it was not as late as some companies, and it has made rapid progress since first launching e-commerce in 2010. Some 8.9% of group sales were online in fiscal 2016. As we discuss in the next section, pushing up this proportion is one of the company’s objectives to grow sales in the coming period.

Source: Metro Group

4) Opportunities for Growth

Ceconomy may already be Europe’s biggest consumer electronics retailer, but Haas noted that pockets of growth opportunities remain. Among the levers that the company can pull to grow the top and bottom lines are:

- Growing online sales in its key markets: online’s share of sales at Ceconomy lags its share of the total consumer electronics market in the company’s major markets.

- Opening new stores, across a variety of formats including smaller stores.

- Expanding its services and solutions offering to boost sales and margins. The company is aiming for 10% of total revenues to come from services in the mid-term.

- Utilizing data to offer greater personalization of communications and offers to customers.

The company has a mid-term ambition to grow sales at a CAGR of 3% or more, in the context of “moderate” annual growth of 1%–2% in the overall consumer electronics market. It is targeting a 5% EBITDA margin, up from the 3.6% margin achieved in fiscal 2016.