2Q16 RESULTS

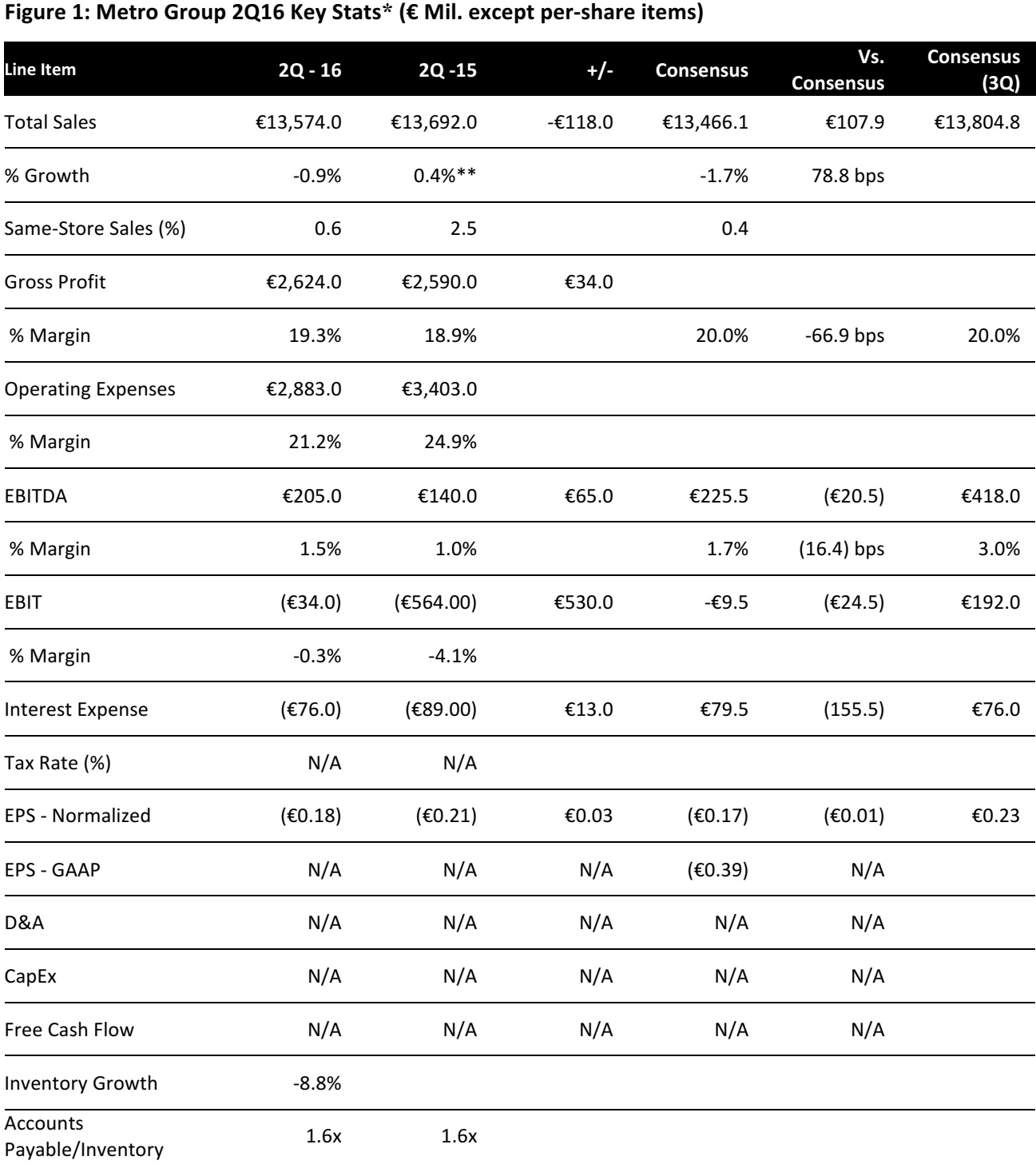

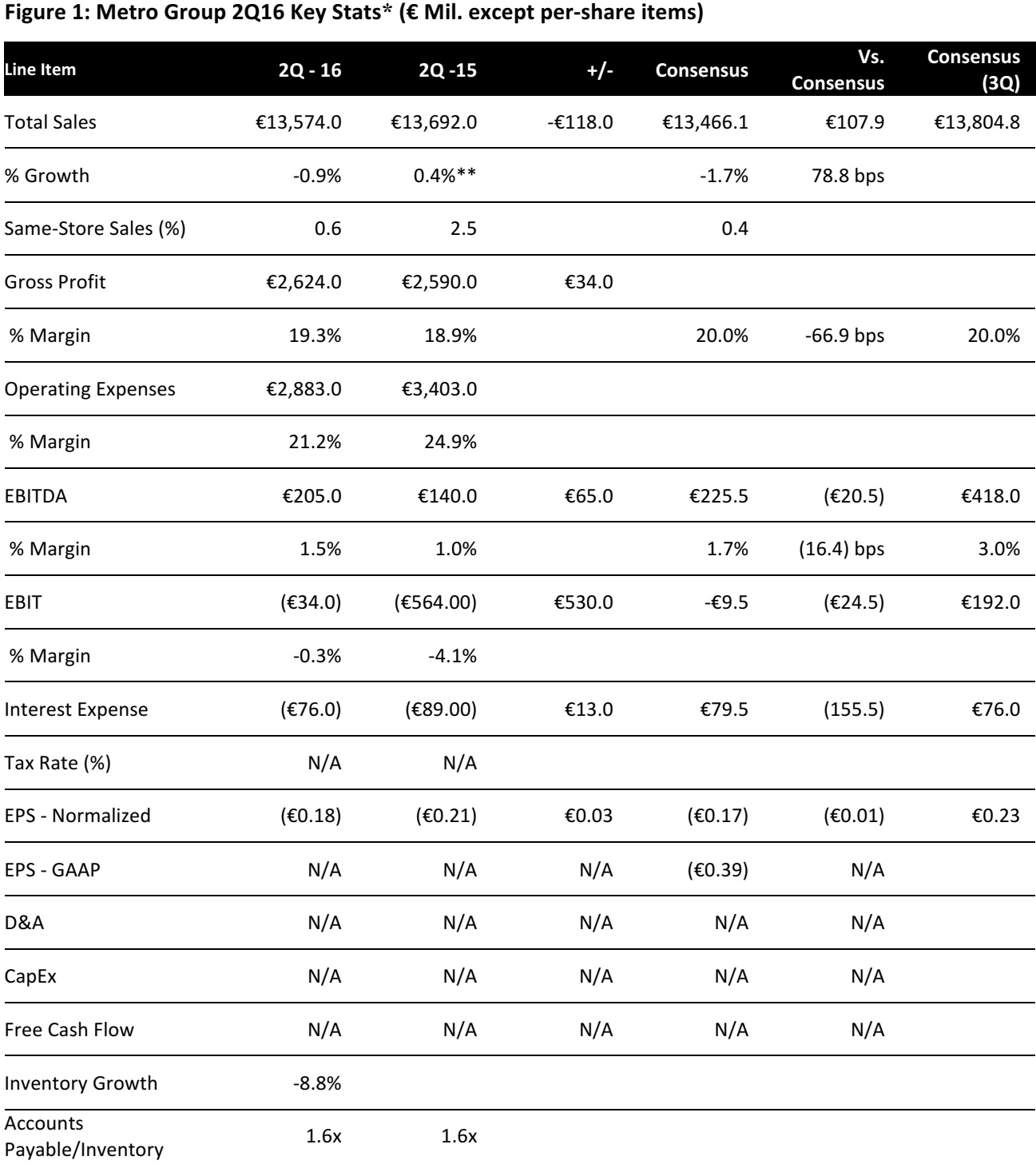

Metro reported normalized2Q16 EPS of €(0.18) versus consensus of €(0.17).

Total revenue was down 0.9%, to €13.6billion, beating consensus of €13.5 billion. Same-store sales were up 0.6%, versus consensus of +0.4%. Sales at Metro Cash &Carry and Real declined by 2.9% and 1.6% respectively and increased by 1.9% at Media-Saturn. However, comps increased for all three segments, +0.5% at Metro Cash & Carry, +0.7% at Media-Saturn and +0.5% at Real.

Operating loss was€34 million, narrower than the 2Q15 loss of €564 million.

2016 GUIDANCE

Metro expects a slight increase in revenues and comps for FY16. According to the company, Metro Cash & Carry and Media-Saturn should be instrumental in driving sales growth. Metro expects that sales at Real will also improve compared.

The company forecasts operating income before special items for FY16 to exceed the €1,511 million achieved in FY15.

Analysts expect revenue of €58.8 billion and operating income to reach €1,453 million in FY16, a decrease of 0.7% and 3.8% respectively versus FY15. The FY16 consensus estimate for normalized EPS is €1.77, and the consensus for GAAP EPS is €1.89.

The company announced that a decision on the contemplated demerger of the group into two separate entities, a wholesale and food specialist and a consumer electronics group, will be taken after a period of intensive consultation and review and subject to shareholders’ approval. In the eventuality of a decision in favor of the demerger, its implementation is aimed for mid-2017.

*Based on adjusted FY15 figures to account for discontinued operations (Galeria Kaufhof)

**Based on unadjusted figures

Source: Company reports