Source: Company reports/Fung Global Retail & Technology

FY16 Results

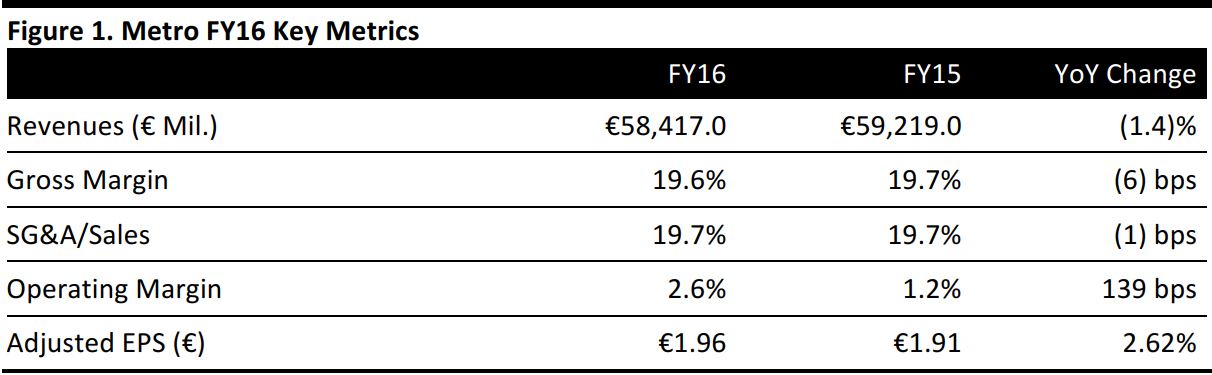

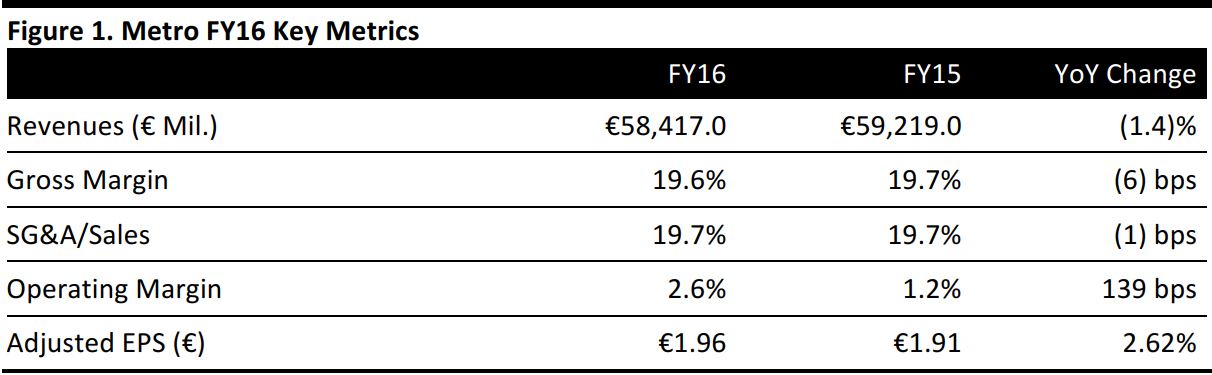

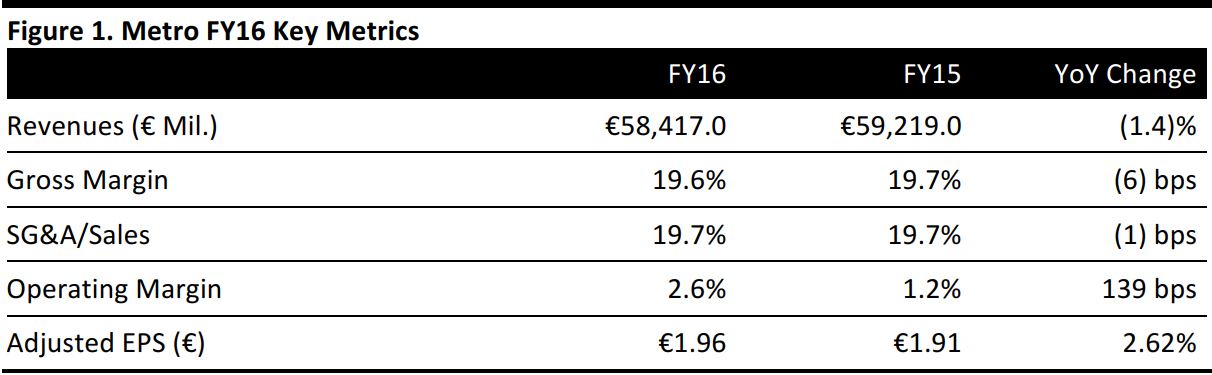

German retailer and wholesaler Metro Group reported sales of €58.4 billion in FY16, down 1.4% from €59.2 billion in FY15, and down slightly from the consensus estimate of €58.8 billion. The company stated that negative currency effects and the restructuring of the portfolio impacted sales. Adjusted EPS grew by 2.62% to €1.96, beating the consensus estimate of €1.78.

The gross margin decreased by 6 basis points to 19.6%, the SG&A margin fell marginally and the operating margin grew by 139 basis points. Sales in local currency grew by 0.4% and comps grew by 0.2%.

Performance By Segment

Metro Cash & Carry: Metro’s wholesale segment reported full-year sales of €29.0 billion, down 2.3% from €29.7 billion in FY15.Comps grew by 0.6% in this segment, with comparable sales of food rising by as much as 1.7%. After Metro’s acquisition in FY15 of Classic Fine Foods, a food-service business that serves hotels and restaurants in Asia, it undertook a similar strategic move during the year in Germany, with its acquisition of Rungis Express. Chairman Olaf Koch noted that this particular acquisition strengthened Metro’s existing delivery business by adding “special competencies” in the area of fresh foods.

Metro also acquired a similar business in France, called Pro á Pro, which supplies food to numerous large corporate caterers, public- and private-sector canteens, and independent food-service businesses. Koch noted that Metro’s move from an industrialized approach to a localized one of selling mainly to small and medium-sized enterprises (SME)has led to increased basket sizes and margin development in this segment. He stated that Metro has even negotiated better terms with its suppliers, and to expect more such moves that improve sales in this segment, in the coming quarters.

Media-Saturn: Media-Saturn reported full-year sales of €21.9 billion, up0.6% from €21.7 billion in FY15. In local currency terms, sales growth was 1.6%. Comps grew by 0.1%.

The company noted that online sales under the Media Markt and Saturn brands grew strongly by 11% year over year, accounting for 9% of sales in this segment. Metro implemented several moves during the year that has led to this development. Koch noted that Media Markt Club, a loyalty program that was launched earlier this year, has been successful, with over 2.9 million customers registered as of November 2016. He also stated that nearly 40% of online orders are collected in-store. Digital shelf labels rolled out in over 1,000 stores is another strategy that Metro has implemented to promote multichannel engagement, Koch said.

Real: Real reported full-year sales of €7.5 billion, down 3.3% from €7.7 billion in FY15. Comps fell by 1.1%. Koch mentioned that the closure of unprofitable stores has led to the sales decline in this segment. He noted that Metro is working on a program to remodel and optimize Real’s store network and trialed a hybrid-store concept earlier this year that sells fresh and ultra-fresh food to bulk shoppers.

Koch stated that previous acquisitions under this segment led to the distribution of administration and control of this division across many locations. He said that Metro aims to restructure this segment and ensure that all central functions will be consolidated in Düsseldorf to help Real performmore efficiently.

Outlook

Metro expects sales to increase slightly over the next fiscal year and for adjusted EBIT to exceed the current level of €1,560 million. It expects Metro Cash & Carry and Media-Saturn to contribute to an anticipated increase in comparable sales.

Management stated that the outlook for FY17 is adjusted for currency effects, is based on the current group structure and assumes a continuously complex geopolitical situation. The company added that the outlook will be adjusted once the planned demerger of the group into separate businesses, with one focused on wholesale and food and the other focused on consumer electronics, is approved at the Annual General Meeting in February 2017, as expected, and implemented through fiscal year 2017, as scheduled.

Analysts estimate FY17 revenue to be about €60.2 billion and adjusted EPS to be €2.03.