Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

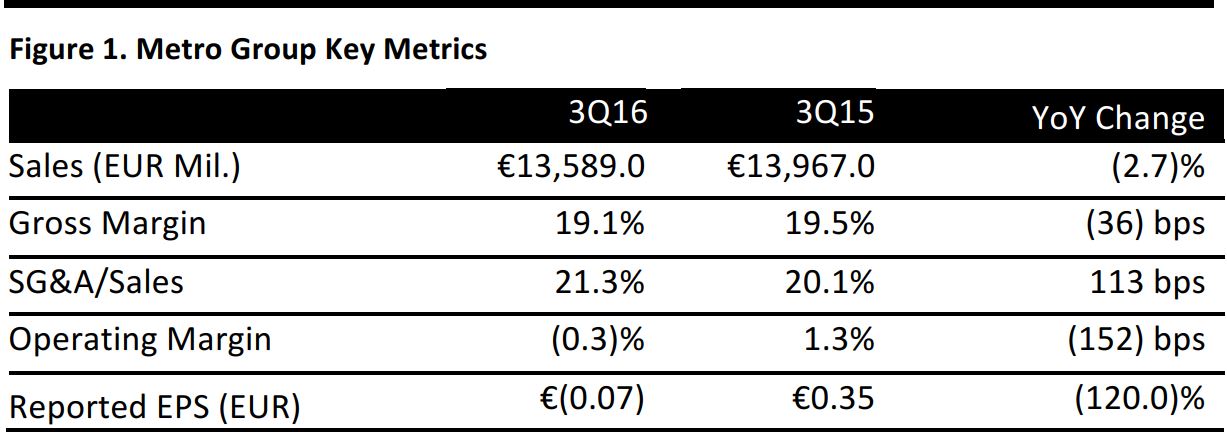

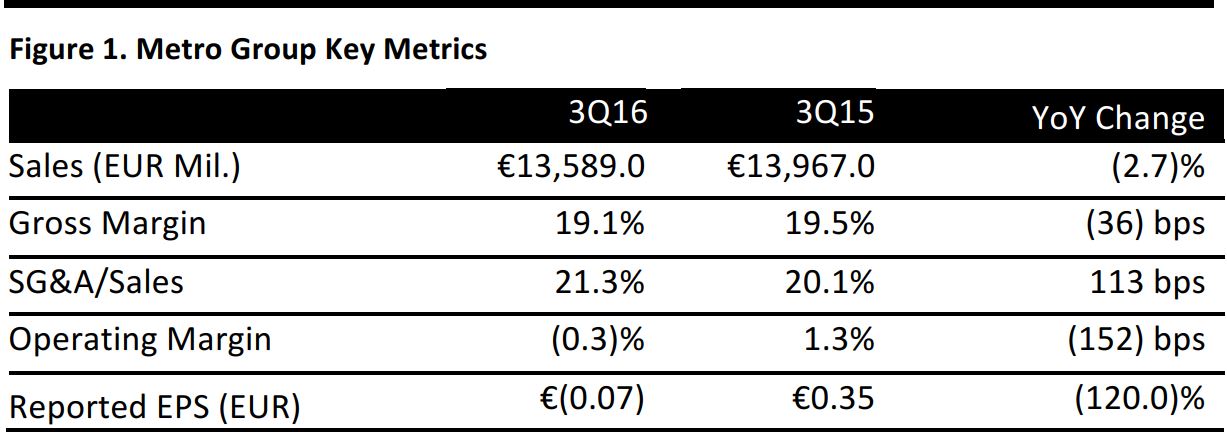

German retailer and wholesaler, Metro Group, reported sales of €13,589 million in 3Q16, down 2.7% from €13,967 million in 3Q15, and slightly below the consensus estimate of €13,788.20 million.

The SG&A/sales margin rose by 113 basis points and the operating margin declined by 152 basis points. Metro Group reported an operating loss of €36 million in the quarter, but the operating profit, excluding special items, was €154 million. The reported basic and diluted EPS for the period was €(0.07), down 120% from 3Q15, and missed the consensus estimate of €0.02. Normalized EPS was €0.24, close to the consensus estimate of €0.23.

Special items include gains from the disposal of Galeria Kaufhof and Metro Cash & Carry Vietnam, and expenses related to the restructuring of its main wholesale business.

Foreign exchange losses due to the weak Russian rouble and terrorism in France and Germany had a severe impact on Metro’s earnings over the reporting period. The company also made investments in customer loyalty activities and the development of IT solutions to support its multi-channel operations.

PERFORMANCE BY SEGMENT

Metro Group has four main reporting segments: Metro Cash & Carry, Media Saturn, Real, and Others. As part of its restructuring plan for Metro Cash & Carry, the company implemented a new operating model that will replace the previous reporting regions of Germany, Western Europe, Eastern Europe, and Asia/Africa. The new segments under this division are regrouped according to, “the strategic focus on the customer groups” of each of the subsidiaries in these regions. We look at these below.

Metro Cash & Carry: Sales in this segment amounted to €7,113 million during the period, down 4.5% and up 0.2%, in local currency, from 3Q15.Comps were 0.1%. The company said the acquisitions of Classic Fine Foods and Rungis Express made positive contributions in this segment. The sub-segments under this division are:

- Horeca: This focuses on hotels, restaurants and catering firms in Western Europe, Japan and Turkey, and Classic Fine Foods, and accounts for nearly 50%—-the largest share—of Metro Cash & Carry. Sales for the quarter were €3,552 million, up 1% year over year.

- Multispecialists: Includes hotels, restaurants and catering firms outside the regions mentioned above, and service, companies, and offices (SCO). Sales in this segment amounted to €2,858 million in the quarter, down 7.2% year over year.

- Traders: This includes independent retailers from Moldova, Poland, Romania, and Ukraine. Sales were €699 million, down 4.9% from 3Q15.

- Others: These include trading offices and countries where Metro Cash & Carry has withdrawn. Sales in this segment were €4 million.

Media Saturn: The consumer electronics segment of Metro made sales of €4,689 million in the quarter, up 1.5%, which is up 3.2% in local currency. The segment posted comps of 1.2%. The company noted online sales for this segment grew by 7.8% during the quarter. It has been making significant investments in IT solutions to boost its multi-channel capabilities.

Metro Group also said television sales in Germany particularly, increased during the European Football Championship, but this product group also generates disproportionately low margins.

Real: Sales in this segment fell by 6% to €1,771 million and comps were (3.5)%. The company attributed the decline in reported sales to the closure of 10 stores in this segment, and in comparable sales to deflationary price developments in key product categories.

Others: This segment comprises Metro Group’s sourcing activities in Hong Kong, its logistics services and real estate activities. Sales in this segment were €28 million, up 14.4% from 3Q15.

OUTLOOK

Metro Group noted the outlook for the year is based on the current group structure and anticipation of, “a persistently complex geopolitical situation.” It expects only a slight increase in overall sales and comps and sustained growth in earnings. Leadership will continue to implement efficient operational structures and strict cost management through the rest of the year, representatives said.

DEMERGER OF THE GROUP

The management and supervisory boards of Metro Group’s holding company, Metro AG, are mulling a demerger of the wholesale and food specialist businesses from the consumer electronics group. Subject to due diligence and a shareholder vote, the company is likely to implement the demerger by mid-2017, which would result in the creation of two independent, listed companies.