DIpil Das

Introduction

What’s the Story? Coresight Research has identified the expanding metaverse as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond. A Coresight Research survey of US metaverse users (aged 13+) conducted in March 2022 found that that over one-third of respondents plan to spend more on digital assets or NFTs (non-fungible tokens) in the next 12 months. Fashion brands and retailers will begin to turn to the metaverse (a computer-generated augmented and virtual reality where users can interact with one another in a 3D, immersive world) to realize opportunities in consumer engagement and alternative revenue streams. In this report, we examine the fashion industry, analyze the state of the metaverse in the fashion sector and discuss implications that can help brands and retailers capture more opportunities. Why It Matters The metaverse universe is in its infancy and businesses of all types are looking to stake a claim. We are seeing fashion brands and retailers entering the metaverse. Among the 40 fashion brands and retailers in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), half have entered the metaverse. We believe that the metaverse is set for tremendous growth and that fashion’s role will be increasingly prominent.Metaverse Fashion Set To Boom: Coresight Research Analysis

Fashion Brands and Retailers Are Betting on the Metaverse Fashion brands and retailers typically enter the metaverse through two key approaches:- Delivering virtual outfits in collaboration with gaming, social media or augmented reality (AR) tech platforms, aiming to provide users a sense of exclusivity and interesting experience while improving their sense of self

Burberry’s designs for Honor of Kings (left) and Ralph Lauren’s digital clothing collection available on Zepeto (right)

Burberry’s designs for Honor of Kings (left) and Ralph Lauren’s digital clothing collection available on Zepeto (right) Source: Burberry/Ralph Lauren [/caption]

- Launching digital products on the brand’s or retailer’s own platform and selling them as NFTs (non-fungible token, a digital asset that represents real-world objects)

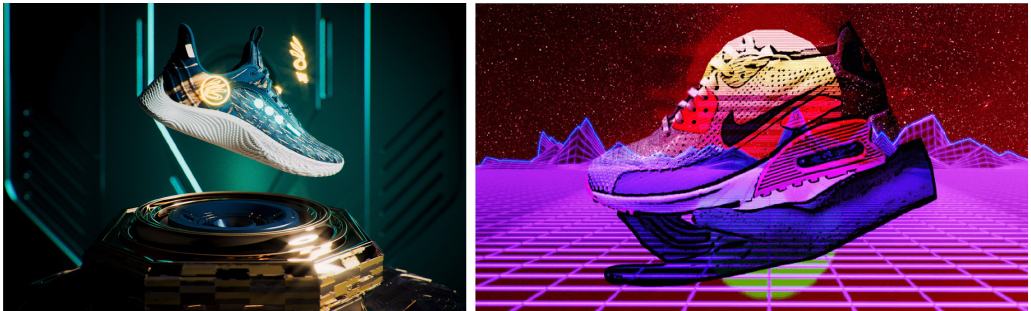

Under Armour’s virtual sneakers (left) and NIKE’s virtual sneakers (right)

Under Armour’s virtual sneakers (left) and NIKE’s virtual sneakers (right) Source: Under Armour/NIKE [/caption] In Figure 1, we present examples of recent developments in the space by selected fashion brands and retailers.

Figure 1. A Timeline of Selected Fashion Brands and Retailers That Entered the Metaverse in The Past 15 Months [wpdatatable id=2044 table_view=regular]

Source: Company reports Fashion in The Metaverse Is Not Yet a Big Earner, But Can Help Brands and Retailers Increase Traffic The metaverse now typically allows consumers to view digital apparel collections, create personalized 3D avatars and socialize with other users. Although apparel in the metaverse is not yet a big earner compared to physical clothing, using the metaverse as a marketing tool to redirect attention to actual goods is adding value to brands and retailers. We believe that selling digital products is a huge opportunity for apparel and footwear brands and retailers, and companies should establish their presence in the metaverse early to capitalize on user traffic and interest before the rates of land and tokens increase. (Read more in our Playbook on monetizing the metaverse.) We believe that innovating in virtual worlds will be essential to engaging consumers, especially younger generations who are more digitally adept. The Future of Metaverse Fashion

- More interoperability: There will be more interoperability in metaverse fashion, meaning that purchased outfits for one game or one platform will work in another, and consumers will be able to seamlessly travel between virtual spaces with the same virtual assets, such as avatars and digital clothing. Interoperability will also lead to more personalization and freedom. Right now, most platforms such as Roblox still restrict consumers from using virtual avatars or outfits across platforms, but some platforms such as ReadyPlayerMe allow people to create an avatar that they can use in hundreds of different virtual worlds, including in Zoom meetings through apps like Animaze. In the next few years, we believe blockchain-based technologies, such as cryptocurrencies and nonfungible tokens, can facilitate the transfer of digital goods across virtual borders.

- More interesting virtual experiences: The future of metaverse fashion will not be limited to simple product sales, but will include more interesting virtual experiences that can engage consumers and motivate purchasing desires. For instance, Gucci launched the Gucci Garden Experience on Roblox in May 2021. The Experience offers a virtual locale with a pool, balloon arches, and a shopping space where the prices of some items exceeded retail price tags (reaching above $4,000 or 350,000 Robux).

The pool in the Gucci Garden Experience

The pool in the Gucci Garden Experience Source: Gucci [/caption]

- More mature virtual stores: We expect more fashion brands and retailers to launch their own virtual e-commerce stores in addition to offering gaming experiences or virtual product collections, relying on tech partners like Obsess to build them. These immersive shopping stores will present products more clearly and make it easier for consumers to understand and purchase products, enabled by technologies such as web-based VR and AR. Building virtual stores will help increase consumer engagement, conversion and loyalty. Companies that have already created virtual online stores, including Charlotte Tilbury, Christian Dior, Dermalogica, Fendi, and Ralph Lauren, saw traffic boom.

- More customization: We see customization as an important part of the virtual apparel market as it serves a growing consumer group that seeks to showcase their individuality with personalized and unique apparel items. We expect custom virtual apparel to gain traction in the next few years, allowing consumers to create apparel with different colors, patterns, sizes and styles.

What We Think

Implications for Fashion Brands and Retailers- The metaverse presents opportunities for product sales, marketing and brand building and we encourage brands and retailers to experiment and invest in the space to capture the opportunities.

- There will be more interoperability, interesting virtual experiences, virtual stores, and customization in metaverse fashion in the next few years, and we recommend fashion brands and retailers capitalize on these factors to grow.

- There are extensive opportunities for technology platforms that can enable apparel brands and retailers to run smoothly in the metaverse. IoT and 5G are important technologies that replicate real-world objects and locations to improve operations and we believe companies that focus on these two technologies can capitalize on the growing digital fashion market.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]