DIpil Das

Introduction

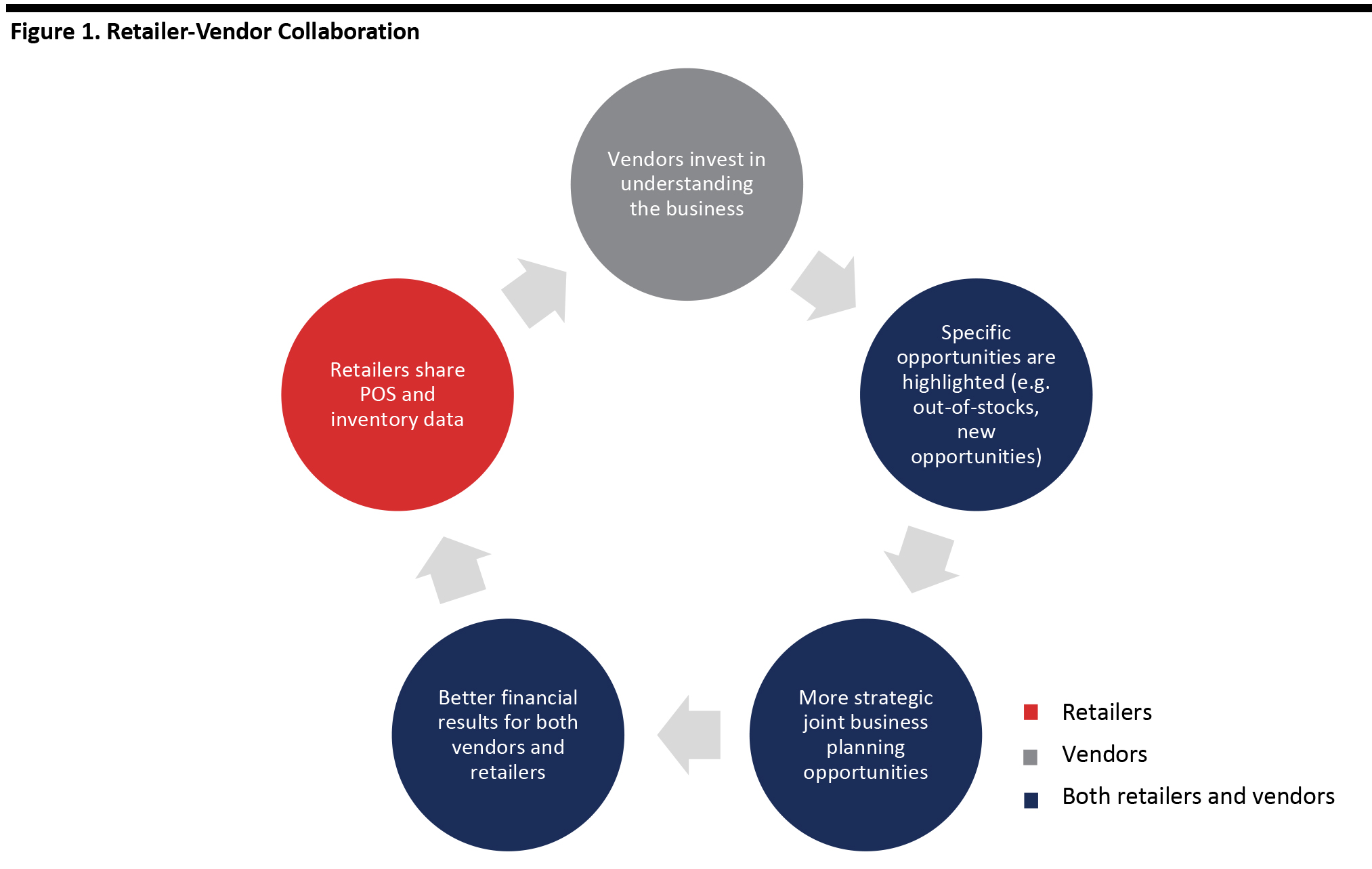

The fast-changing retail landscape has forced retailers to innovate and rely more on merchandise vendors as partners. To meet consumers’ needs, retailers leverage technology to help them forecast demand, create an efficient supply chain and generate growth. Increasingly, the savvy and systemic use of POS and inventory data in core retail processes is becoming a differentiator, and retailers and vendors are working together to improve performance. At the same time, many retailers have been focused on cutting costs in order to enable investment in their core businesses. They cannot afford a dedicated data internal team to gather, process and analyze data. Often, this has meant that resources once dedicated to mining inventory, merchandising and customer data are no longer in place, but the activities are just as relevant. This report is sponsored by SPS Commerce, a leading global retail network whose offerings include analytics solutions for retailers and vendors. We will discuss three key topics:- The role that data sharing with vendors plays in a retailer’s data strategy

- The benefits of data sharing between retailers and vendors

- Best practices for data sharing, with case studies

Leveraging Data Is Critically Important for Retailers

As technology continues to evolve, retailers are continually advancing their use of data and analytics to improve all aspects of their business. Some of the most common use cases for retailer POS data include the following:- Buying—using widely available market data on key trends and competitor offerings. As shifts can happen rapidly, it is imperative for buyers to be on top of trends and bestsellers.

- Allocation—increasingly sophisticated retail analytics with POS data that can help retailers make better merchandise and supply-chain decisions.

- Inventory Levels—preventing out-of-stocks and low inventory levels, as well as excess inventory. Out-of-stocks lead to the loss of revenue opportunities, and excess inventory restricts companies’ cash flow and their ability to purchase more popular items.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The Role of Data Sharing and Analytics

While the role of data in all aspects of merchandising is increasingly important, in many cases, retailers are unable to allocate resources to these areas. As a result, they increasingly rely on their vendor base to understand and monitor sales and supply chain data, bring marketplace insights and recommend changes to assortment, allocation and inventory. Several vendors that we spoke with noted that they have seen a steady progression towards increased data sharing over the last 10 years. They believe that this was initially driven by retailer cost cutting, which eliminated the internal resources dedicated to analytics. As one vendor noted, “10 years ago, they [retailers] had teams internally to analyze the data in depth, but as they cut costs, that is shifting to the vendor.” There are distinct benefits for sharing data with vendors to accomplish these goals. Several of the retailers that we interviewed noted that they rely on their vendor partners to monitor inventory levels on individual SKUs (stock-keeping units) and to bring them new ideas. “An educated vendor is the best partner,” said one senior manager at a large apparel specialty retailer that uses SPS Commerce solutions.Impact of Collaboration on Retailers’ and Vendors’ Revenues

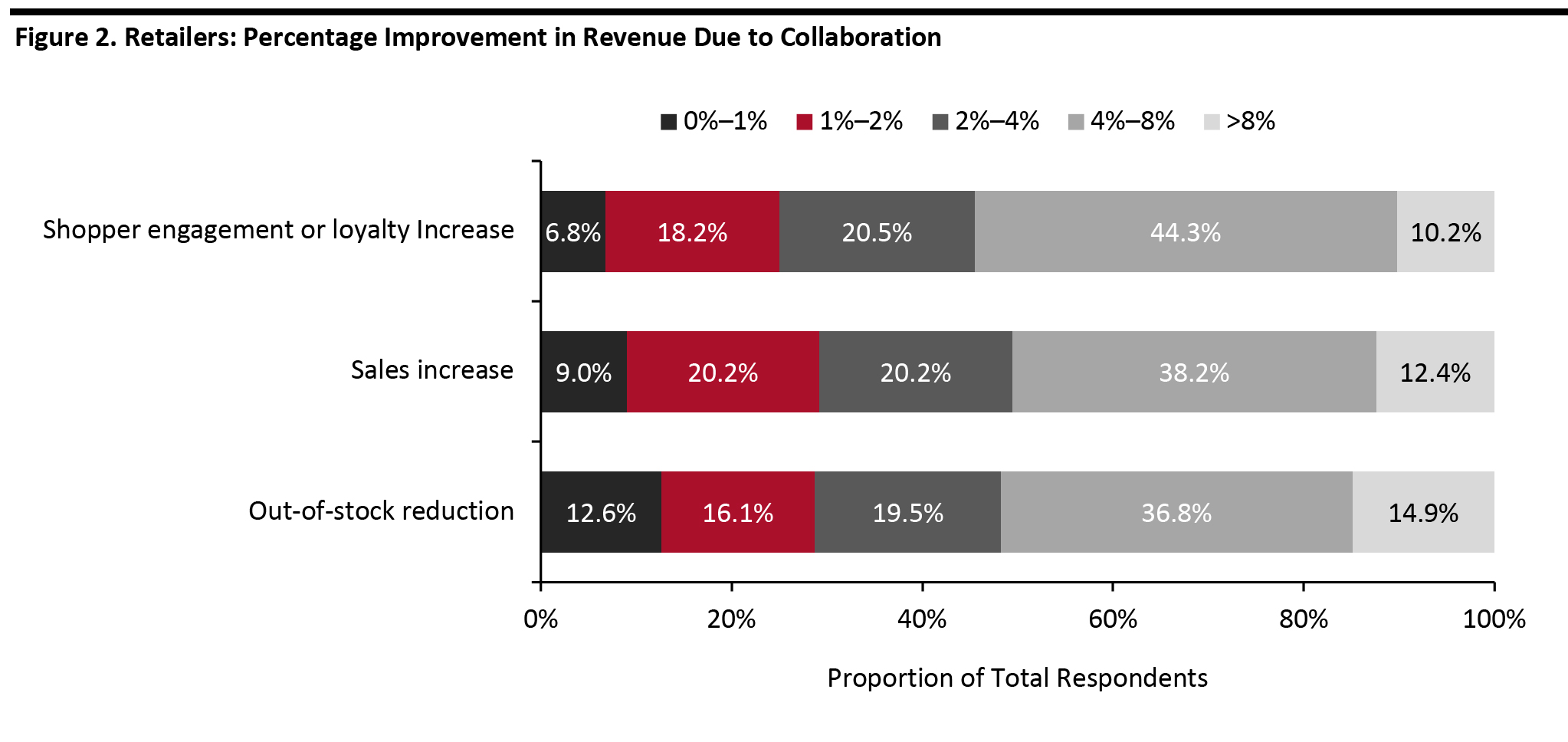

Over the past two years, retailers have gained efficiencies in business operations through improved collaboration. Increased inventory efficiency—from both inventory optimization and the reduction of out-of-stocks—can have a direct and measurable impact on overall revenue. We asked retailers and vendors about the impact of improved collaboration on their financials. Respondents were asked to select the financial impact of improved collaboration across the following options: out-of-stock reduction, reduction of costs, sales increase, profit increase and an increase in shopper engagement or loyalty. For retailers, reduced out-of-stocks is critical to improving inventory efficiency, and with fewer out-of-stock items, retailers can increase their revenue. In our survey, 51.7% of retailers that stated their collaboration had improved over the past two years noted that their revenues increased more than 4% as a result of improved out-of-stocks and 54.5% reported a similar sales impact from increased shopper engagement. Vendors also saw revenue benefits from enhanced collaboration and data sharing. [caption id="attachment_113953" align="aligncenter" width="700"] Base: 89 retailers that stated their collaboration had improved over the past two years

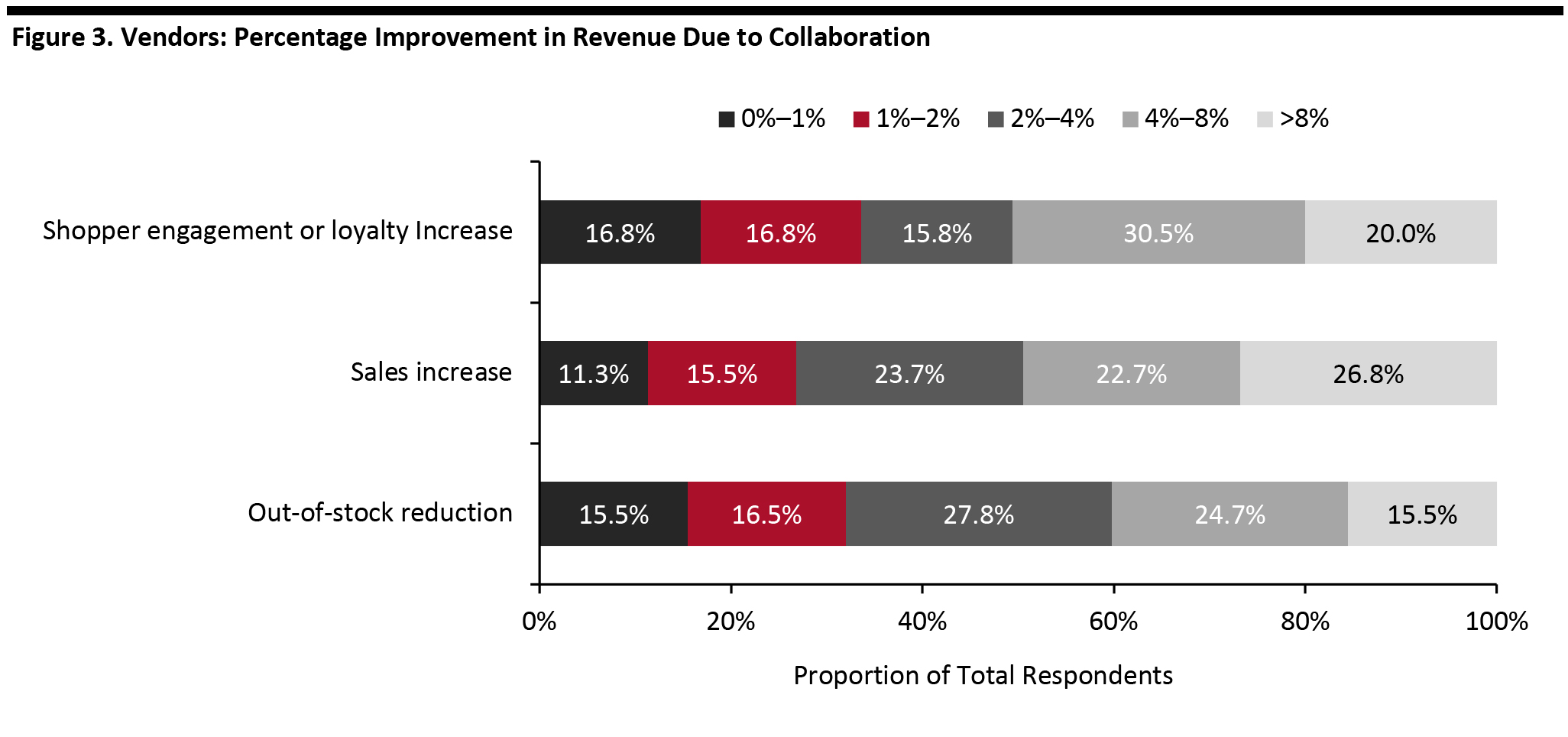

Base: 89 retailers that stated their collaboration had improved over the past two years Source: Coresight Research [/caption] Vendors also saw revenue benefits from enhanced collaboration and data sharing. In our survey, 40.2% of vendors that stated their collaboration had improved over the past two years noted that their revenues increased more than 4% as a result of improved out-of-stocks, and 50.5% reported a similar sales impact from increased shopper engagement. [caption id="attachment_113954" align="aligncenter" width="700"]

Base: 97 CPG vendors that stated their collaboration had improved over the past two years

Base: 97 CPG vendors that stated their collaboration had improved over the past two years Source: Coresight Research [/caption]

Additional Benefits

The retailers we spoke to that are sharing sales and inventory data with their vendor partners cited multiple examples of tangible benefits from their data-sharing programs. Below, we summarize the most commonly cited examples:- Inventory turnover—Vendors with SKU-level and store-level data are using that data to identify slow-moving SKUs, suggest tweaks to the promotion plan to move items that are not selling in a particular location and spot inventory build-up that needs to be addressed. Retailers cited significant benefits in reduced costs from out-of-stocks and overstocks.

- Returns—POS and inventory data provides visibility into consumer returns, helping both retailers and vendors investigate high-return-rate items and quickly make changes to combat this.

- Shopper experience—When inventory levels and out-of-stocks improve, so does the shopping experience. In our survey, two-thirds of retailers stated that improved collaboration with vendors has led to increased customer satisfaction.

Disparities in Data Sharing

Despite the well-established benefits that we have outlined, there are still some retailers that are reluctant to share some or all of their data, although this is no longer the norm. As these programs have continued to mature, retailers and vendors are sharing data more. One vendor that we spoke with estimated that 75% of its retailer partners shared data with it at a frequency and granularity that enabled them to generate actionable insight on a regular basis. The frequency and granularity of data shared varies significantly by category, country and even within categories. Many vendors told us that the impact of sharing data with retailers was evident: When vendors had more data to analyze, they could more frequently generate ideas for retailers to achieve higher inventory efficiency. One retailer shared that some of its vendors would call on a weekly basis and say, “This store is out of stock on this one widget.” In addition, several interviewees noted that more of retailers’ internal resources were directed toward those accounts because they delivered better sales results. In Figure 4, we highlight the three primary archetypes of data sharing that we encountered in our research.Figure 4. Three Archetypes of Data Sharing [wpdatatable id=365 table_view=regular]

Source: Coresight Research

Reasons for Limited Sharing

In cases where retailers are reluctant to share data, three common reasons emerged:- Own portals—In our interviews, we found that retailers that have their own data portals are often unable to make the investment necessary to make data available to vendors with the appropriate controls. Several of the retailers that we interviewed overcame this issue by transitioning their data-sharing programs to an external third party such as SPS Commerce. This offloaded the operations and staffing of this function entirely.

- Cultural resistance—In this case, retailers are generally concerned that the data would be used against them. One vendor noted that this is a very common concern at the outset of data sharing but that this tends to dissipate over time as the retailer and vendor begin to mutually benefit from data sharing.

- Capability—Some interviewees noted that they do not receive data from smaller retailers that lack the capability to harness the data. Given the importance of data, this is becoming less common, although it exists where the retail market is highly fragmented. Engaging a third party to manage the program is one solution.

Shifting to an External Provider

As retailers are seeking to reduce costs, more are shifting their data-sharing programs to external providers such as SPS Commerce. We spoke with retailers that shifted from an internal-vendor data-sharing program to one managed by an external provider. They offered the following advice:- Select a provider of high quality—Retailers noted that data accuracy is critically important. If a merchant is also using an internal system, ensure that the data within the two systems are updated with similar frequency, or ensure that both merchants and vendors understand the differences in the data sets. Timeliness and accuracy of data are critical.

- Leverage an industry leader—Retailers that shifted from internally generated data sharing to an external platform noted that most of their vendors benefited from the move because it involved a shift to a standard platform that they used with other retail accounts. This streamlined the vendors’ work and made it easier to give the retailer relevant industry insights.

- Stop direct sharing—One of the key benefits of moving to an external provider is removing the workload from a retailer’s internal staff. Key to transitioning vendors to the new system is ensuring that they do not revert to merchants for the data. One retailer noted that this took some time, but now, they do not get requests for data from vendors to their merchants.

- Address a shift to pay-to-play—One retailer that we spoke with said that it saw initial resistance from vendors because they were shifting from a free to a paid system. They noted that this primarily came from smaller vendors that were not already using the external data provider or that were doing a small amount of business. In this case, the retailer addressed the concern by offering a sponsored program for smaller vendors.

Best Practices for Vendors

Both vendors and retailers that we spoke with highlighted the significant benefits that data sharing provides. Vendors that have invested in leveraging data discussed significant impacts for both the brand and the retailer. However, building trust with the retailer is critical to realizing those benefits. There are a number of best practices to follow to build trust and maximize gains when sharing data:- Be transparent about results—One vendor noted that it is important to not sugar-coat historical results if they were not favorable. Exploring why the results were not good and the adjustments to be made does more to build credibility, while trying to make the numbers look better than they really are only diminishes trust and credibility.

- Bring the data into conversations—Vendors should be reviewing data weekly and identifying new opportunities at the very least on a monthly basis, although several larger vendors mentioned identifying opportunities for improvement across their portfolio weekly.

- Identify new ideas and opportunities—The key to success is to continually identify new opportunities for the retailer. The most common opportunities that we heard are noted in Figure 5.

Figure 5. Most Common Recommendations from Vendors, Resulting from Data Sharing [wpdatatable id=366 table_view=regular]

Source: Coresight Research

Case Studies

Specialty Apparel Retailer Wins with Data Sharing A large specialty apparel retailer with multibillion-dollar sales has been sharing data with vendors for many years. Given the internal burden of maintaining its own data-sharing system, the retailer recently transitioned to using a third party, SPS Commerce. The retailer wanted its vendors to have access to as much of its POS and inventory data as possible and views its vendors as true partners in its business. With the externally managed data-sharing system in place, the retailer now shares information at the product level, across the hierarchy, locations and times. The retailer reported that most of its vendors benefited from the transition to an external third party, as it was a standard and familiar provider to the vendor base already. Within one year of transitioning to an external data provider, vendors that represent 85% of its sales are currently receiving and actively using the data. The retailer pointed out that smaller vendors seem to analyze the data more intensively and frequently. Some smaller vendors will use the data to monitor the inventory situation at each store and communicate with the retailer on a weekly basis. Some large vendors that use sales representatives are more likely to communicate with the retailer than those which do not. Vendors have shared insights into promotional strategies, inventory and more with the retailer. For example, with e-commerce being the test ground for new products, sales representatives can leverage online sales data for one product to convince the retailer to move it into physical stores. The retailer noted that it is in the early stages of encouraging small vendors to adopt the platform and has offered a scholarship program to encourage usage, but only a few have applied. There are some limits on the retailer’s data sharing. Instead of reporting dollar values for a category, the retailer compares the vendor’s performance relative to others through percentage data—for example, it will share that “a jacket vendor saw order growth of 3% this year, while the category was up 5%”. Mid-Size Vendor Makes Better Data-Driven Recommendations A multimillion-dollar outdoor gear vendor with approximately 400 employees began using the SPS Commerce data-sharing solution across multiple specialty retailers on the recommendation of a new head merchant who had come from larger manufacturers. The vendor has been actively using the platform across a large number of its retail accounts for four years. The manufacturer’s retailers consist of both national chains and small independent “mom-and-pop” stores. Through SPS Commerce, the company can use national account data to drive directional trends for independent retailers. The amount of data shared with the vendor varies. Sometimes, the manufacturer only sees SKU-level data without information on channel or location. The vendor has built additional data-analysis capacity, having previously only used the data to track sales performance on a monthly basis, with information on the average online sales price and average sales per store. Now, it can break down the data into regions, leverage the heat map function to identify opportunities for assortment reallocation and more. Another benefit of using the SPS Commerce solution across multiple accounts is that it adds confidence in making merchandising decisions. The vendor noted, “The merchant conversation is different with retailers that share more data. A well-prepared account manager could take a lot of work off the buyer’s plate.” In addition, data-driven decisions can build a better level of trust between vendors and retailers. The vendor generally did not face hurdles in having retailers share data, but there were rare cases in which they were reluctant to do so at the beginning; one retailer took about three years to convince, but eventually, the vendor became this retailer’s top vendor and obtained access to more information.Key Insights

As the retail environment remains challenging, retailers and vendors are increasingly collaborating to drive mutual benefit. We observed a global trend of retailers and vendors implementing strong data-sharing programs. Retailers are increasingly looking to their vendor partners to regularly monitor their data and suggest improvements to allocation and inventory. As a result, vendors are building their data-analysis capabilities. One vendor that we spoke with estimated that 75% of its retailer partners shared data with it at a sufficient level that it could derive actionable insights on a regular basis. We found that improved collaboration through data sharing yields measurable impacts to revenues as well as increased customer satisfaction and improved inventory positions. In our survey, over half of the retailers with improved supplier collaboration shared that their revenues grew by more than 4% as a result of improved out-of-stock positions and increased shopper engagement. Our view is that data sharing will continue to advance, and the most sophisticated retailers will expand their data-sharing programs to drive better business outcomes.Survey Methodology

This study is based on the analysis of data from an online survey of 210 grocery/FMCG/CPG manufacturers/vendors and retailers. The survey selected respondents selected based on the following criteria:- Based in France, Germany, the UK or the US, with at least 50 respondents per country.

- Works in, or supplies products to, brick-and-mortar, e-commerce and business-to-business retail.

- Employed in companies with an annual turnover equal to, or exceeding, $3 billion in the most recent fiscal year.

- Holding senior positions (owners, C-suite, VP/EVP, directors, senior managers).

- Responsible for operations management, merchandising, customer insights and analytics, logistics and supply chain, product sourcing, sales and marketing.

- Holding roles with significant strategic decision-making responsibilities.