DIpil Das

UK Retail Sales: May 2022

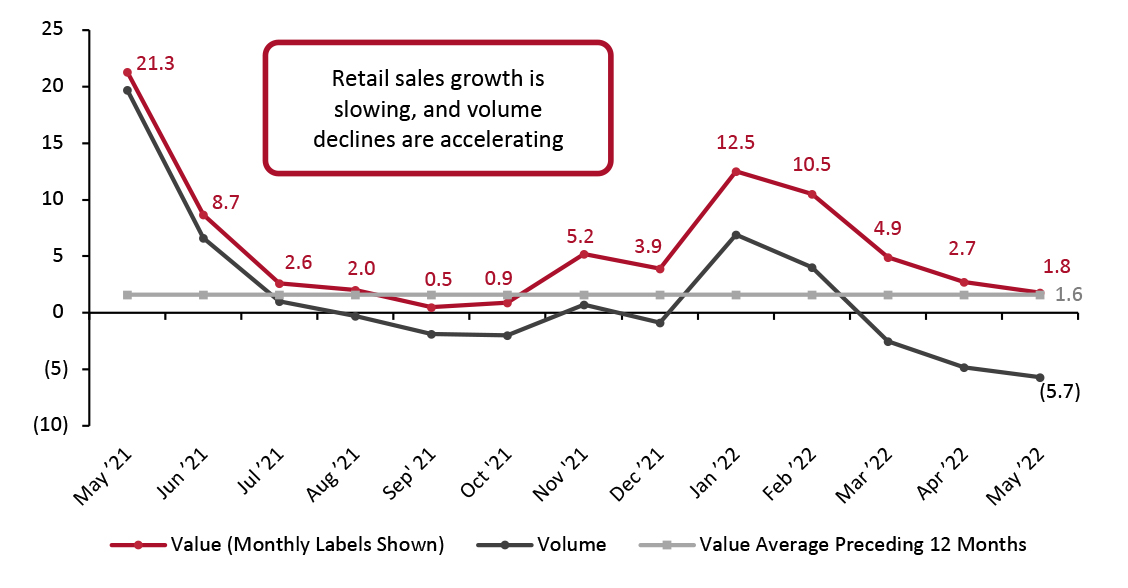

In May, total UK retail sales continued its downward momentum. Total UK retail sales growth (excluding automotive fuel) slowed to just 1.8% in May. In May, the ONS’s implied retail inflation metric continued to accelerate; retail inflation grew 8.0% from the previous year, slightly higher than the 7.9% year-over-year growth in prices in April. The slight acceleration indicates inflation still may not have reached its peak in the UK. On June 16, the Central Bank of England implemented its fifth interest rate hike since December and expects the economy as a whole has slowed in the second quarter. The Bank of England now expects total UK GDP to have shrunk by 0.3% in the second quarter. While surface-level sales value growth is slowing, it remained in positive territory in May. Sales volume declines continued to accelerate in May to 5.7% year over year, up from April’s volume decline of 4.8%. Excluding April and May of 2020 when the onset of the pandemic and lockdown measures drove record-high volume declines, the current volume declines are the largest since 1992. Consumers are unable to purchase goods in the same quantities they were previously able to due to rising costs. Despite three consecutive months of year-over-year declines, sales volumes were 2.6% above their February 2020 pre-pandemic values, according to the ONS.Figure 1. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): YoY % Change [caption id="attachment_150297" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted Source: ONS/Coresight Research [/caption] Retail Sales Growth by Sector In a modest month of sales growth amidst a backdrop of a 30-year high inflationary context, several sectors saw sharp declines in sales growth while a few notable sectors exhibited year-over-year sales increases.

Electrical goods specialists saw sales declines accelerate in May. Sales declined by a stark 20.6% in comparison with April’s 13.7% year-over-year sales decline.

DIY and hardware stores exhibited a fourth consecutive month of sales declines. In May, sales at DIY and hardware stores declined by 8.1%, representing an acceleration from April’s 6.8% year over year sales decline but still an easing from March’s 17.7% year-over-year sales decline. Sales at health and beauty specialists turned negative in May. Sales declined by 1.2%, a downturn from April’s 4.9% sales growth.Similarly, sales growth at books and news stores also turned negative this month. Sales at books and news stores declined by 2.1% from the previous year, a downturn from April’s 4.9% year-over-year growth.

The same story is true for furniture and lighting stores. Sales growth took a sudden fall and turned negative after posting very strong sales growth in the first four months of the year. Sales declined by 9.3% in May.Grocery retailers’ sales were positive this month, growing 1.9% from the previous year. Sales growth continues to underpace consumer price increases of food and non-alcoholic beverages. In May, the price of food and non-alcoholic beverages rose by 7.9% from the previous year, implying a real-terms sales loss of approximately 6.0%.

Internet pure plays continued to see sales declines, reflecting the overall struggling e-commerce sector in the UK. Sales declines have been easing in recent months. This month, Internet pure play sales declined by just 1.7%, an improvement from the month of April when sales declined by 5.1% In a more positive light, the apparel sector continued its strong 2022 performance. Sales at clothing specialists rose by 16.7% from the previous year, accelerating from April’s 9.7% sales growth. Sales at large clothing specialists increased by 9.8% from May 2021, while sales at small clothing specialists doubled, growing 103.5% from the previous year. The complimentary footwear sector also stayed healthy in May. Sales grew 14.6% from the prior year. Finally, department store/mixed-goods retailers’ sales are modestly positive. Sales at department stores/mixed-goods retailers grew 2.3% from the previous year. Sales growth has marginally accelerated in two consecutive months.Figure 2. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=2085 table_view=regular]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS

Online Retail Sales Declines Showing Signs of Ease

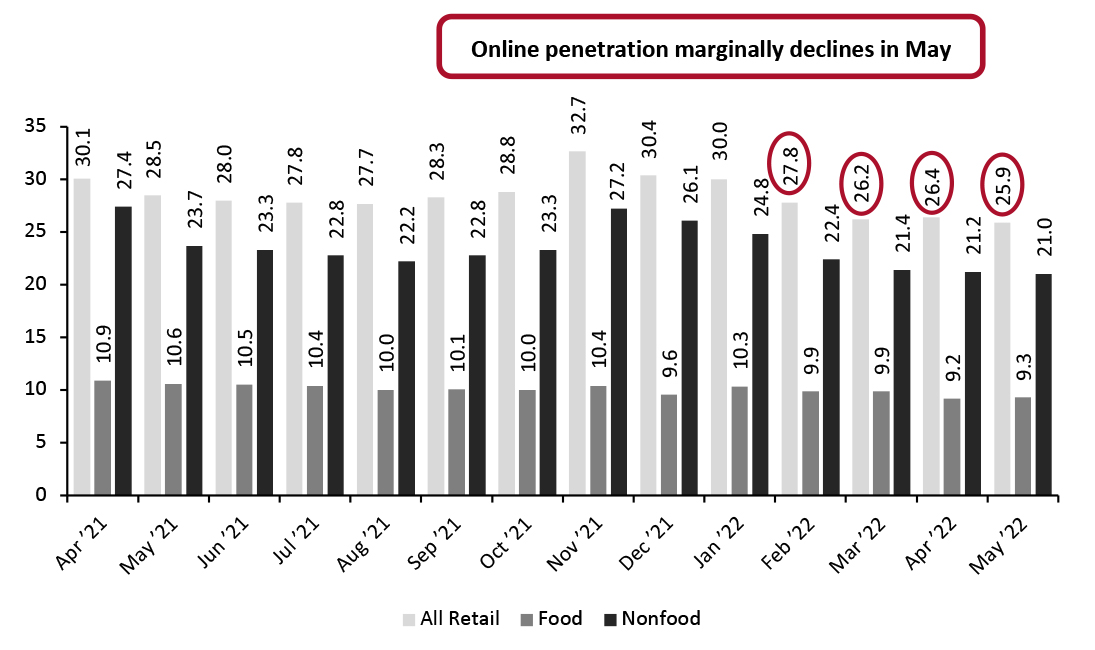

Thus far in 2022, e-commerce sales growth has been in negative territory with sales declines accelerating during January–March. In April, online sales declines began to ease although they still have a way to go to get back into positive online sales growth territory. In May, online retail sales declines continued to ease, declining by 7.3% from the previous year compared with April’s 9.9% sales decline. Overall online sales declines were driven by a 20.1% decline in online sales of household goods, and 12.3% decline in online sales of non-specialized stores. Furthermore, online sales of food declined by 10.2%, while online sales of apparel turned back into positive territory, reflecting the overall strength of the apparel sector, growing 2.2% from the previous year.As shown in Figure 3 below, online sales as a percentage of overall retail sales in May was in line with recent trends, although declining marginally. In May, online sales accounted for 25.9% of total retail sales, which represents the lowest overall online penetration since March 2020, according to the ONS.

Figure 3. Online Retail Sales as % of Total Retail Sales [caption id="attachment_150298" align="aligncenter" width="701"]

Food and nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted

Food and nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted Source: ONS [/caption] Covid-19 Lockdown Timeline Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed. On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen May 13 and furniture stores May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards. On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4. On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household. On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24. On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing. On October 12, the UK government announced a three-tier lockdown system, which classified regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher tiers of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers. On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more. Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click- and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services. Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions. On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021. On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions. Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns. On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February. On January 27, the government announced that travelers arriving from “red list” countries must quarantine in hotels specified by the government. On February 22, the government laid out a roadmap to ending lockdowns in England. Restrictions will start to be eased from March 29, nonessential retail stores and services such as hairdressers will be allowed to reopen from April 12, and final restrictions will be ended on June 21. On March 25, the UK lowered the Covid-19 risk level from four to three on a scale of five. On April 12, the government eased raft of restrictions across England, with gyms, zoos, theme parks, pubs and restaurants allowed to reopen for outdoor service and shops and hairdressers again permitted to serve customers. On April 20, Sturgeon announced that Scotland will move to Covid protection Level 3 from Level 4 on April 26, meaning hospitality venues such as cafés, pubs and restaurants and beauty salons can reopen. On May 17, England eased restrictions further with groups of up to six people from different households allowed to socialize indoors, pubs and restaurants can serve indoors and entertainment venues such as museums, cinemas, and theatres can reopen. On June 14, England delayed the final stage of easing lockdown restrictions by month, until July 19, due to the increase in cases of the more transmissible Delta variant. After more than a year under some form of restriction, England lifted almost all remaining Covid-19 rules on July 19, 2021. This included the opening of nightclubs and lifting capacity restrictions on big events and performances. On December 13, British health secretary Sajid David announced that approximately 200,000 people nationwide had tested positive for the Omicron variant. On December 14 Prime Minister Boris Johnson put forth a new policy of mask mandates and proof of vaccine certification to enter nightclubs and other crowded public spaces. On January 19, 2022, Prime Minister Johnson lifted the mask mandate and no longer required proof of vaccination to enter large or crowded places, signaling the worst of the Omicron variant was behind in the UK. On February 24, 2022, the legal requirement to self-isolate upon testing positive was removed in England as part of the government’s “Living with Covid” plan. Contact tracing of those testing positive and self-isolation for contacts of positive cases also ended in England. On March 18, 2022, all international travel restrictions, such as passenger locator forms and Covid-19 testing for unvaccinated travelers, were removed. On March 24, 2022, Covid-19 provisions attached to statutory sick pay were removed in England. Guidance on workplace risk assessments was also removed. From April 1, 2022, free universal Covid-19 testing will be removed in England.