Nitheesh NH

US

| What’s New? | Trend Data | Positive or Negative* |

| Earnings vs. Inflation: In April, the consumer price increases remained near a four-decade high, although they slightly eased in response to climbing interest rates. Average weekly earnings growth remained exactly in line with the previous month—in April, average weekly earnings grew 4.6% year over year. Inflation continues to outpace average weekly earnings growth, cutting into consumers’ discretionary spending abilities. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_148069" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

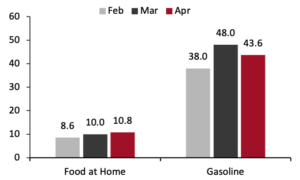

| Food and Fuel Prices: Food and gas price inflation rates are significant metrics because higher costs in these categories can impact discretionary spending. April saw US food-at-home inflation continue to accelerate, with food prices rising 10.8% from the previous year. Meanwhile, gas price inflation started to ease. The Biden administration has elected to utilize the Strategic Petroleum Reserve, releasing 1 million barrels of oil per day to boost supply. |

Consumer Prices for Food at Home and Gasoline: YoY % Change [caption id="attachment_148070" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

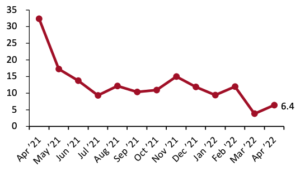

| Retail Sales: In April, total US retail sales, excluding gasoline and automobiles, were stronger than expected. After losing momentum in March, total retail sales grew 6.4% from the previous years as consumer spending continues to persevere through inflation. Still, the 6.4% year-over-year growth does not outpace inflation, and so, in real terms, sales were likely negative. |

Total Retail Sales ex. Automobiles and Gasoline: YoY % Change [caption id="attachment_148071" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

UK

| What’s New? | Trend Data | Positive or Negative* |

| Earnings vs. Inflation: In the UK, inflation continued to pick up speed in April. Consumer prices grew 7.8% year over year, up from the 6.2% growth in March. More positively, average weekly earnings growth sharply accelerated in March (latest available data). Average weekly earnings grew 9.9% from the previous year, outpacing inflation, reflecting real disposable income growth. |

Average Weekly Earnings vs. Consumer Prices: YoY % Change [caption id="attachment_148072" align="aligncenter" width="300"] Latest earnings data are for December; consumer prices are CPIH[/caption] Latest earnings data are for December; consumer prices are CPIH[/caption] |

|

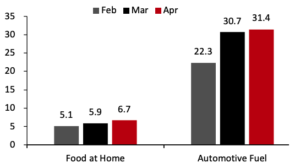

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In April, UK food price inflation continued its steady upward trend rising to 6.7%, up from March’s 5.9% year-over-year growth. Automotive fuel price inflation stayed high in April due to the economic consequences of the Russia-Ukraine war, with fuel prices growing 31.4% from a year earlier. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change [caption id="attachment_148073" align="aligncenter" width="300"]  Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

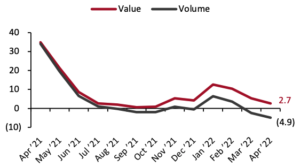

| Retail Sales: Total UK retail sales growth is losing momentum. In April, sales rose a modest 2.7% from the previous year. Furthermore, sales volume declines accelerated, with volumes declining by 4.9%, underscoring the impact of rising prices in the UK. |

Total Retail Sales ex. Automobiles and Automotive Fuel: YoY % Change [caption id="attachment_148074" align="aligncenter" width="300"] Data are not seasonally adjusted[/caption] Data are not seasonally adjusted[/caption] |

|

China

| What’s New? | Trend Data | Positive or Negative* |

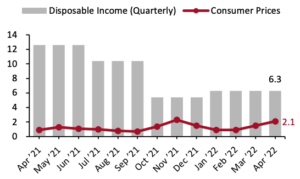

| Income vs. Inflation: In China, consumer price increases continued an upward trend while remaining healthy. Prices grew 2.1% from the previous year, up from March’s 1.5% year-over-year growth. Data on per capita disposable income are released quarterly. In the first quarter of 2021, disposable income per capita grew 6.3% from the previous year, picking up speed from the 5.4% growth in disposable income per capita in the fourth quarter of 2021. |

Per Capita Disposable Income vs. Consumer Prices: YoY % Change [caption id="attachment_148075" align="aligncenter" width="300"] Disposable income data are quarterly[/caption] Disposable income data are quarterly[/caption] |

|

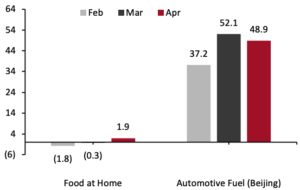

| Food and Fuel Prices: Higher costs for food and automotive fuel can impact discretionary spending. In April, China witnessed an end to food price deflation, with food prices growing by 1.9% year over year. While the price increase is slight, it reflects the first increase in food prices in China since November. Meanwhile, automotive fuel prices remained high, although slightly easing from March. |

Consumer Prices for Food at Home and Automotive Fuel: YoY % Change  |

|

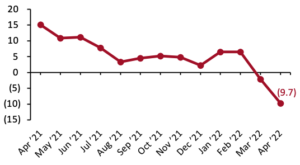

| Retail Sales: Total retail sales in China continue to be negatively affected by Covid-19 lockdowns. Sales declines accelerated in April. Total retail sales declined by 9.7%, compared to March’s 2.1% sales decline, representing the most significant decline in sales since March 2020. | Total Retail Sales ex. Food Service, incl. Automobiles and Gasoline: YoY % Change

[caption id="attachment_148077" align="aligncenter" width="300"] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated.[/caption] From December 2020, our China retail sales index excludes food-service sales; data in prior reports included food-service sales. Data for January and February 2021 are aggregated.[/caption] |