Nitheesh NH

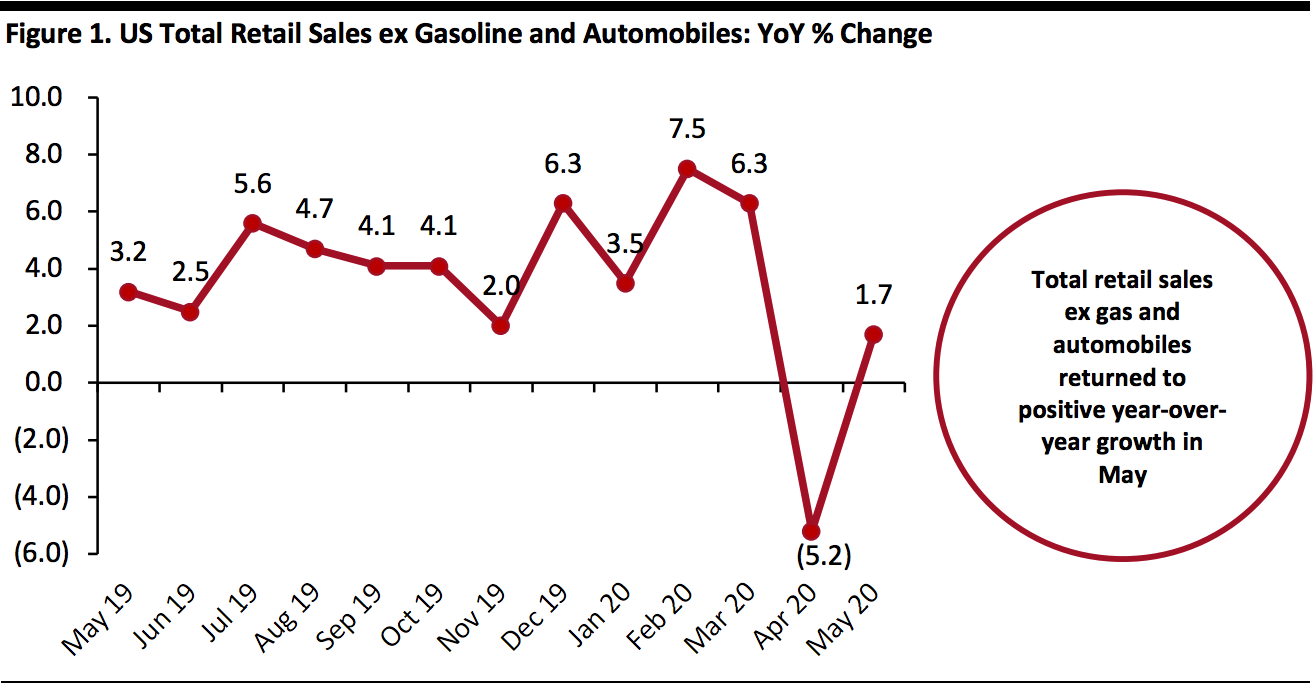

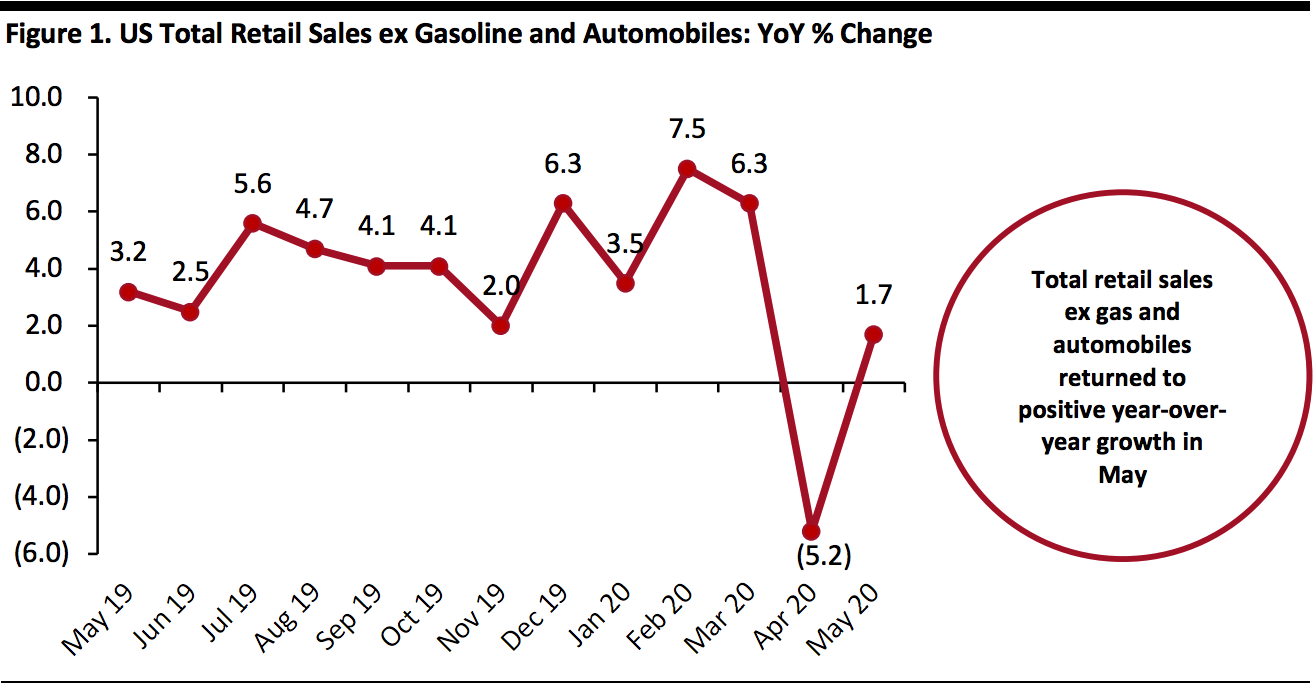

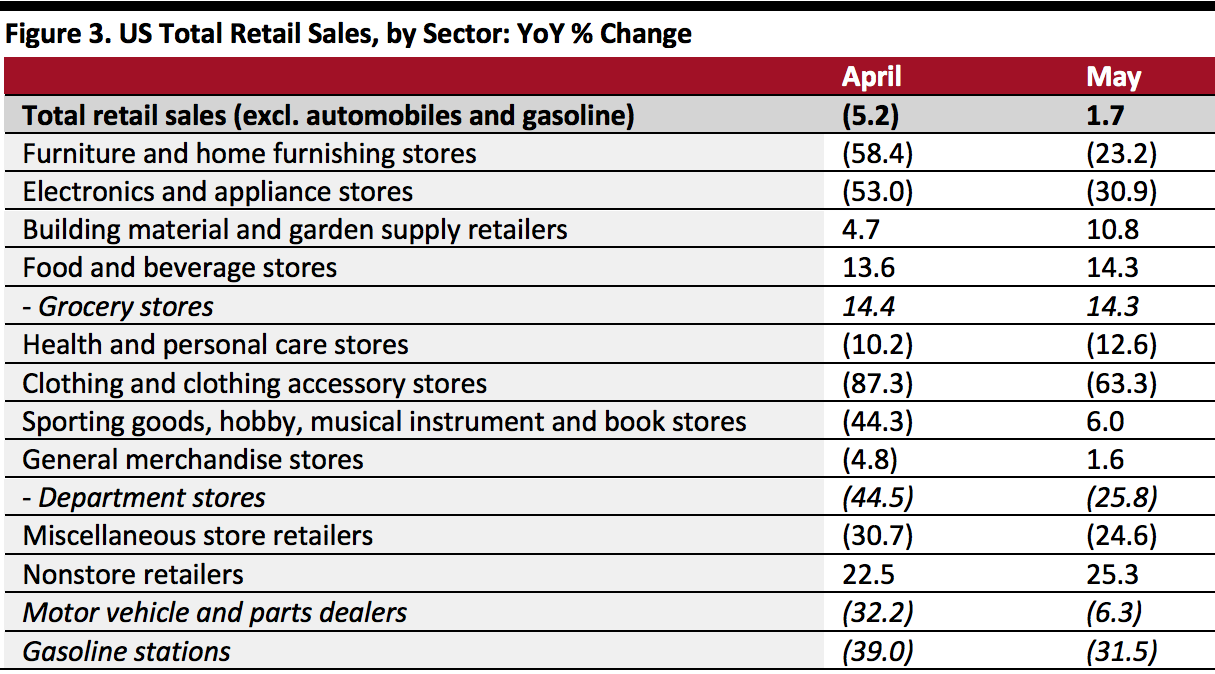

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric returned to positive in May at 1.7% after turning negative in April at (5.2)%, driven by double-digit growth at food stores, home-improvement retailers and nonstore retailers, as we discuss later.

In the US, temporary store closures began in the week of March 8–14 and peaked in the week of March 15–21. In May, stores began to reopen following the easing of Covid-19 lockdowns by states and local governments. The reopening of US retail stores peaked in early June.

[caption id="attachment_111535" align="aligncenter" width="700"] Data are not seasonally adjusted

Data are not seasonally adjusted

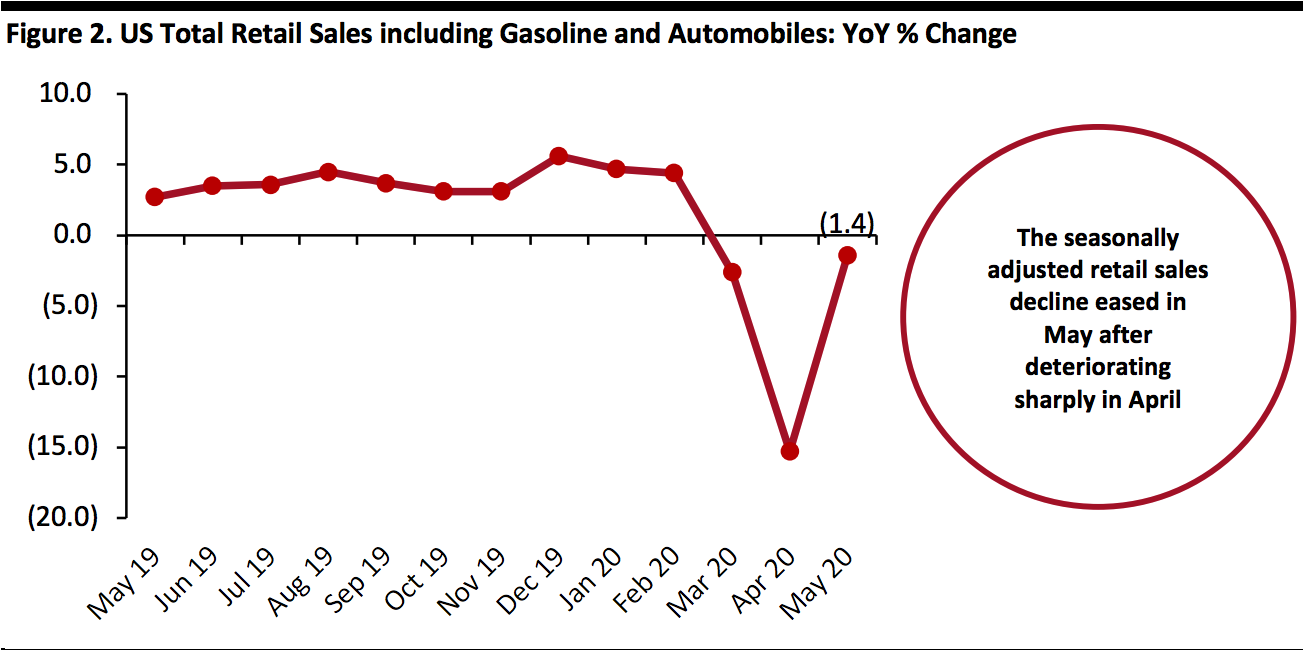

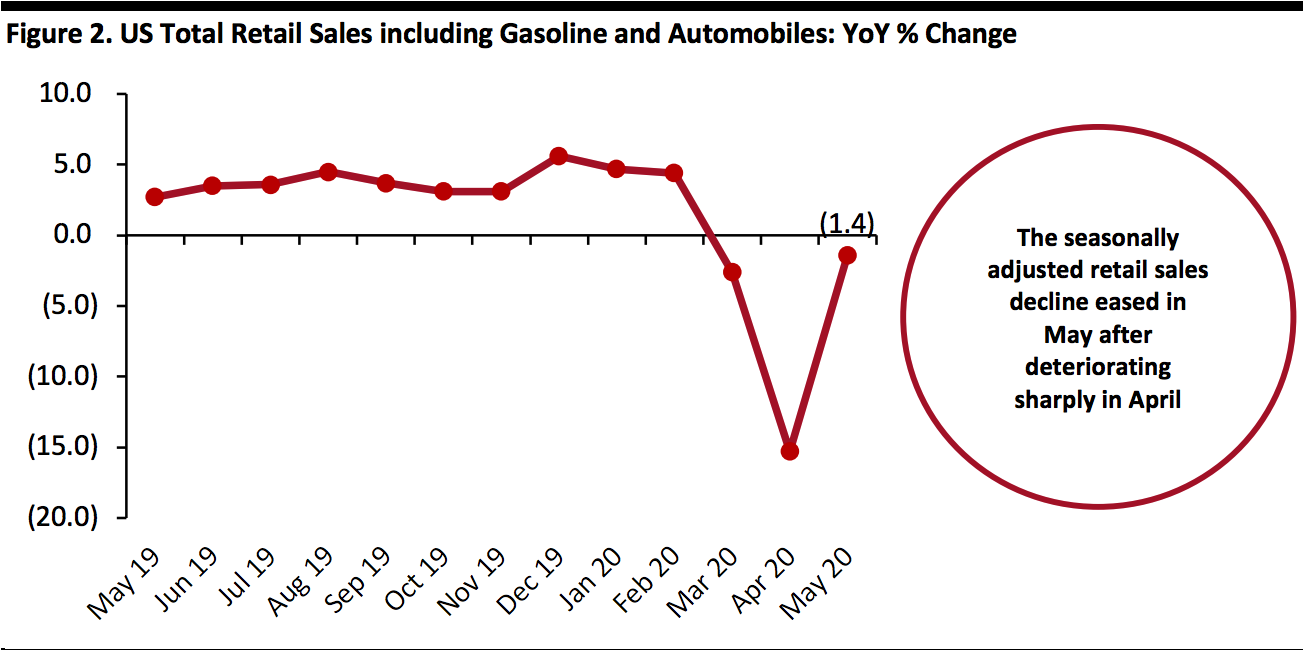

Source: US Census Bureau/Coresight Research[/caption] Retail Sales Surged Month over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure declined 1.4% year over year in May, following April’s 15.3% plunge. On a month-over-month basis and seasonally adjusted, retail sales surged 16.8% in May. [caption id="attachment_111536" align="aligncenter" width="700"] Data are seasonally adjusted

Data are seasonally adjusted

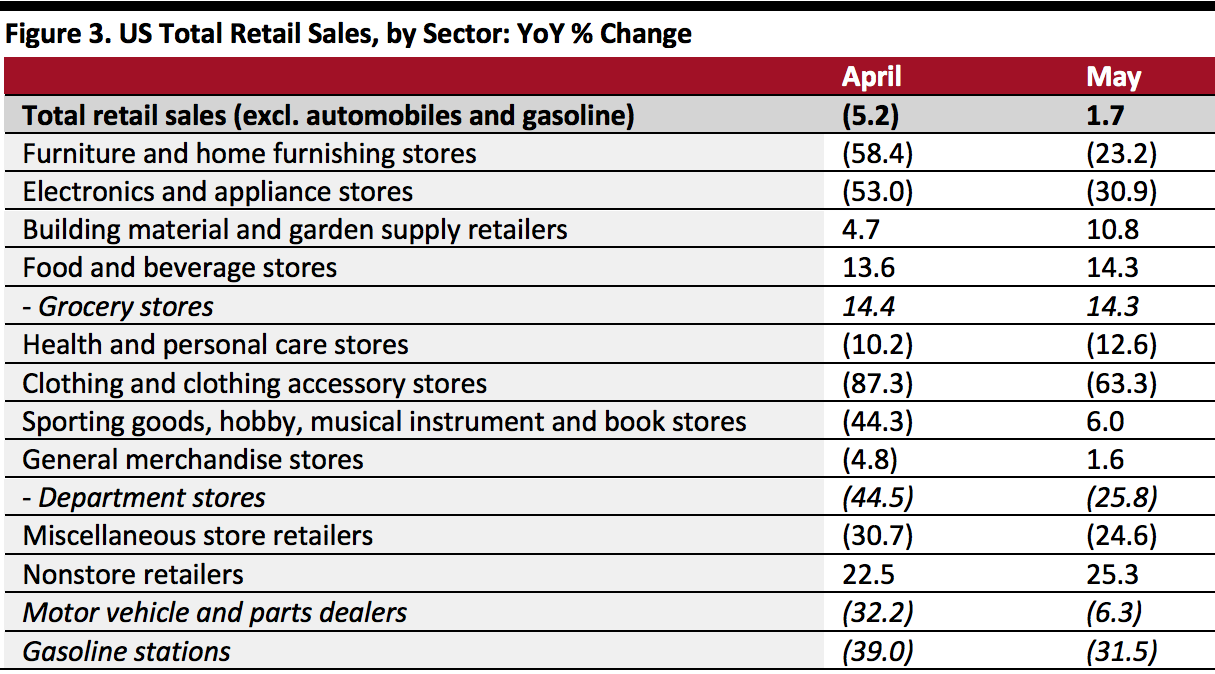

Source: US Census Bureau[/caption] Retail Sales Growth by Sector Most sectors witnessed an easing of sales declines in May—including furniture and home-furnishing stores, clothing stores, department stores, and electronics and appliance stores—as US consumers started to return to stores stores . Clothing-store sales recovered partially, with a decline of 63.3% in May after nosediving 87.3% in April, and a number of major retailers reported higher-than-anticipated sales productivity levels. However, the clothing-store sector saw a more slight sequential improvement than a number of other sectors: The improvement from 87.3% to 63.3% represents only a 27.5% increase. This compares to sequential improvements of 60.2% for furniture retailers and 42.1% for department stores, on the same basis. For 2020, we expect the clothing-store sector to underpace growth in consumer spending on apparel, so recent trends in this sector do not reflect broader category spending trends. Sales at department stores (a subset of general-merchandise stores and weighted toward apparel) declined 25.8% in May versus April’s 44.5% fall. Readers may wonder why department stores retained an implied 55.5% of sales in April, when all nonessential stores were closed. The Census Bureau told us the definition of department stores was such that it would include some companies classed as essential businesses. In turn, this implies that recent sector momentum is not representative of the major department-store chains, which closed their doors in April. Sales growth at grocery stores remained almost consistent at 14.3% in May, in line with the overall food sector’s growth. This sector has been supported by stockpiling (which will have long since eased) as well as the closure of food-service outlets and more people working, and so preparing food, at home. Health and personal care stores saw sales decline 12.6% in May after April’s 10.2% slide. This figure masks a polarization between essential retailers such as pharmacies and discretionary retailers such as beauty stores—which had shuttered stores from March and had not recovered in May despite lockdowns easing. Sales declines at furniture and home-furnishing stores and electronics stores eased, while sales growth at sporting-goods stores turned positive in May. Home-improvement stores (building-material and garden-supply retailers) saw an acceleration to double-digit growth, with major retailers such as Home Depot and Tractor Supply Company having previously pointed to strong growth into May. This impressive growth is broadly in line with our recent estimate of a strong recovery for the sector in May and supports our expectation that home-improvement retailers will be the fastest-growing store-based nonfood sector this year. Online-only retailers continued to gain momentum, including for essentials: Nonstore retailers, which include e-commerce firms, saw sales growth accelerate to 25.3% in May from 22.5% in April. Gasoline-station sales decline eased to 31.5% in May. [caption id="attachment_111537" align="aligncenter" width="700"] Data are not seasonally adjusted

Data are not seasonally adjusted

Source: US Census Bureau/Coresight Research[/caption]

Data are not seasonally adjusted

Data are not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Surged Month over Month The Census Bureau’s core metric is seasonally adjusted retail sales including automobiles and gasoline. Sales by this measure declined 1.4% year over year in May, following April’s 15.3% plunge. On a month-over-month basis and seasonally adjusted, retail sales surged 16.8% in May. [caption id="attachment_111536" align="aligncenter" width="700"]

Data are seasonally adjusted

Data are seasonally adjustedSource: US Census Bureau[/caption] Retail Sales Growth by Sector Most sectors witnessed an easing of sales declines in May—including furniture and home-furnishing stores, clothing stores, department stores, and electronics and appliance stores—as US consumers started to return to stores stores . Clothing-store sales recovered partially, with a decline of 63.3% in May after nosediving 87.3% in April, and a number of major retailers reported higher-than-anticipated sales productivity levels. However, the clothing-store sector saw a more slight sequential improvement than a number of other sectors: The improvement from 87.3% to 63.3% represents only a 27.5% increase. This compares to sequential improvements of 60.2% for furniture retailers and 42.1% for department stores, on the same basis. For 2020, we expect the clothing-store sector to underpace growth in consumer spending on apparel, so recent trends in this sector do not reflect broader category spending trends. Sales at department stores (a subset of general-merchandise stores and weighted toward apparel) declined 25.8% in May versus April’s 44.5% fall. Readers may wonder why department stores retained an implied 55.5% of sales in April, when all nonessential stores were closed. The Census Bureau told us the definition of department stores was such that it would include some companies classed as essential businesses. In turn, this implies that recent sector momentum is not representative of the major department-store chains, which closed their doors in April. Sales growth at grocery stores remained almost consistent at 14.3% in May, in line with the overall food sector’s growth. This sector has been supported by stockpiling (which will have long since eased) as well as the closure of food-service outlets and more people working, and so preparing food, at home. Health and personal care stores saw sales decline 12.6% in May after April’s 10.2% slide. This figure masks a polarization between essential retailers such as pharmacies and discretionary retailers such as beauty stores—which had shuttered stores from March and had not recovered in May despite lockdowns easing. Sales declines at furniture and home-furnishing stores and electronics stores eased, while sales growth at sporting-goods stores turned positive in May. Home-improvement stores (building-material and garden-supply retailers) saw an acceleration to double-digit growth, with major retailers such as Home Depot and Tractor Supply Company having previously pointed to strong growth into May. This impressive growth is broadly in line with our recent estimate of a strong recovery for the sector in May and supports our expectation that home-improvement retailers will be the fastest-growing store-based nonfood sector this year. Online-only retailers continued to gain momentum, including for essentials: Nonstore retailers, which include e-commerce firms, saw sales growth accelerate to 25.3% in May from 22.5% in April. Gasoline-station sales decline eased to 31.5% in May. [caption id="attachment_111537" align="aligncenter" width="700"]

Data are not seasonally adjusted

Data are not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]