Nitheesh NH

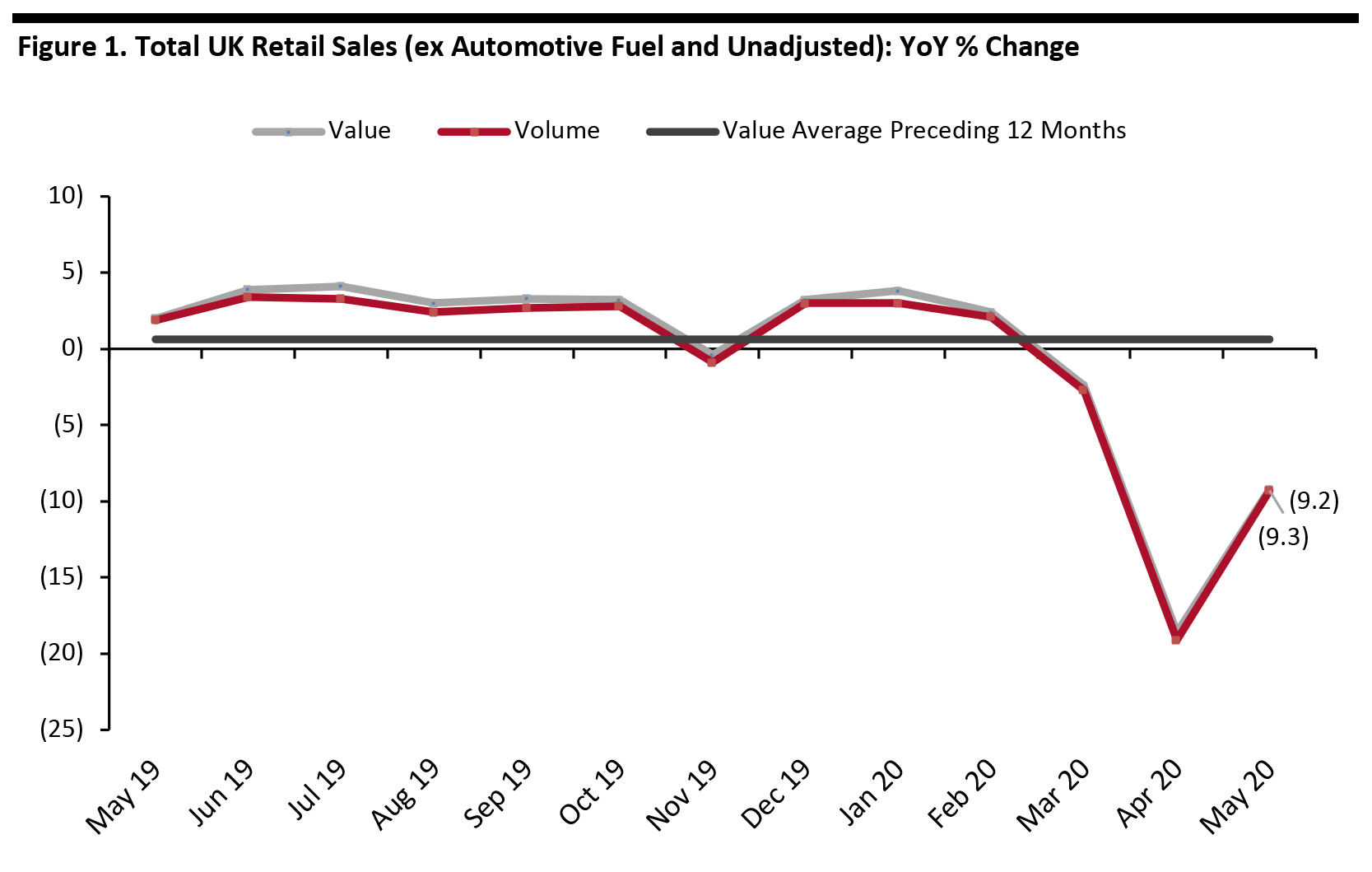

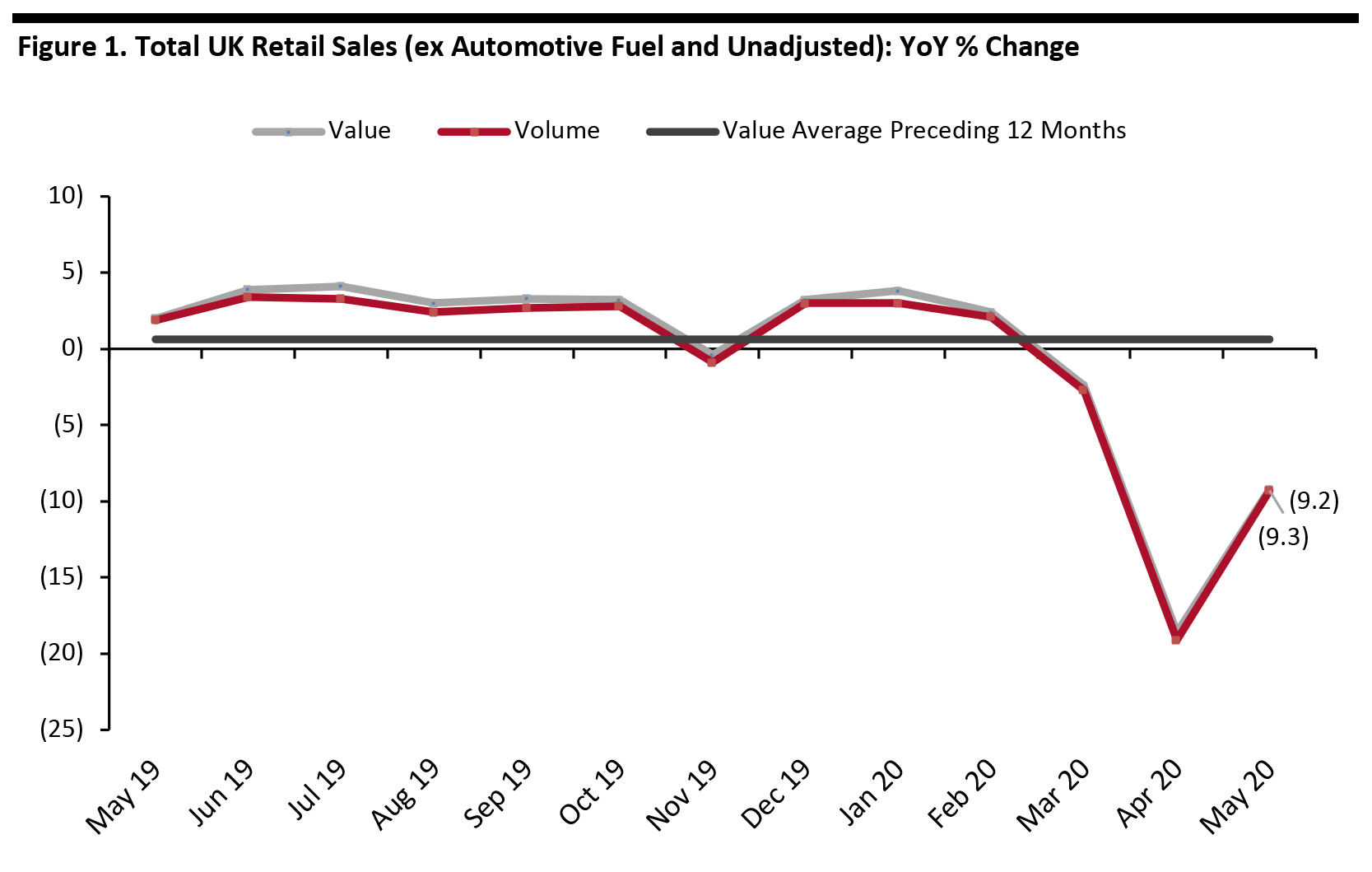

The contraction in UK retail sales eased in May as some lockdown restrictions were relaxed, with garden centers and furniture stores cleared by the government to restart trade in May. However, total sales dropped a still-sizable 9.2% versus the 18.6% contraction in April when the lockdown was in full force.

Online sales continued their growth momentum in May, although this will ease as nonessential stores reopen from June 15 in England and Northern Ireland.

[caption id="attachment_111865" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted

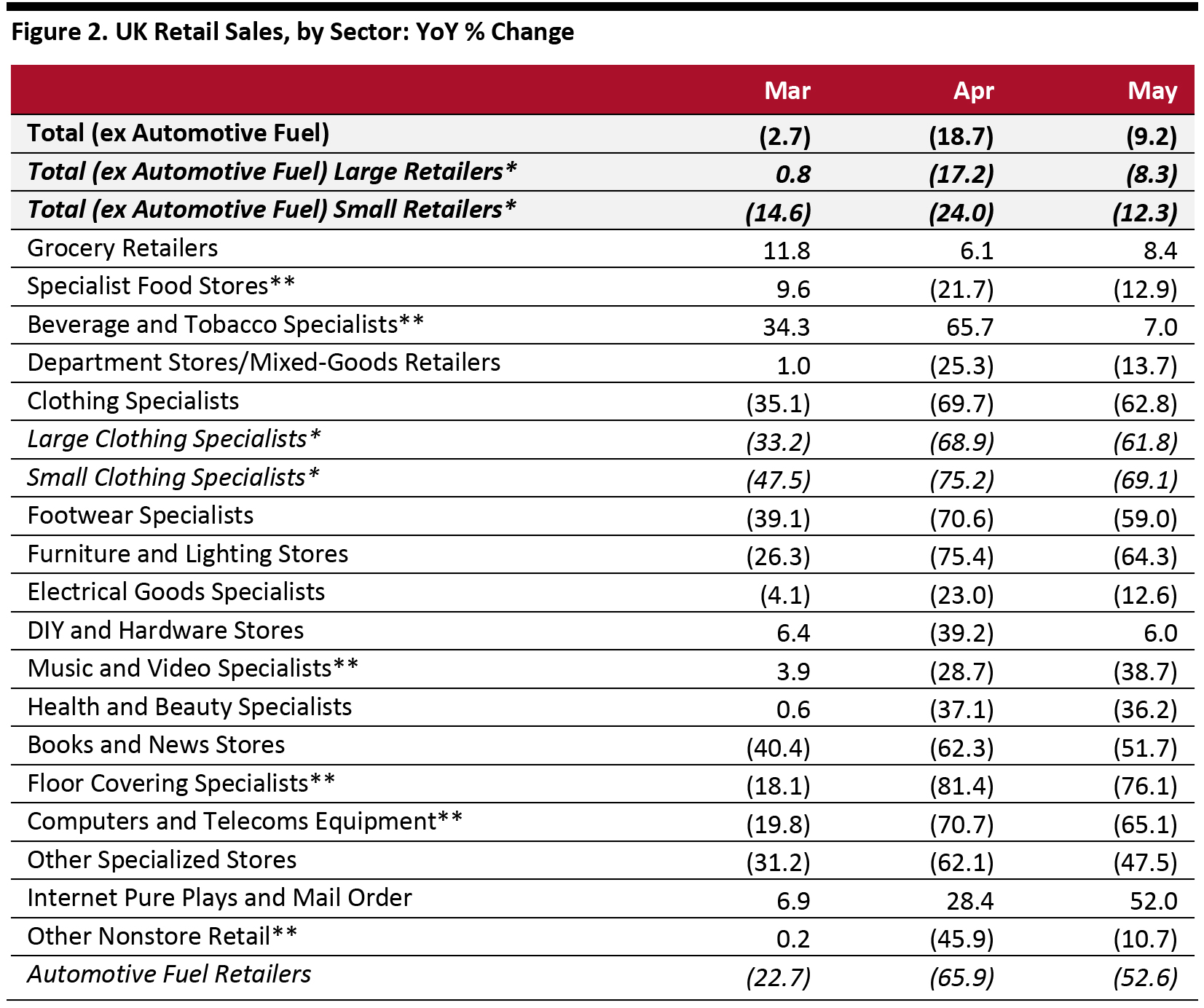

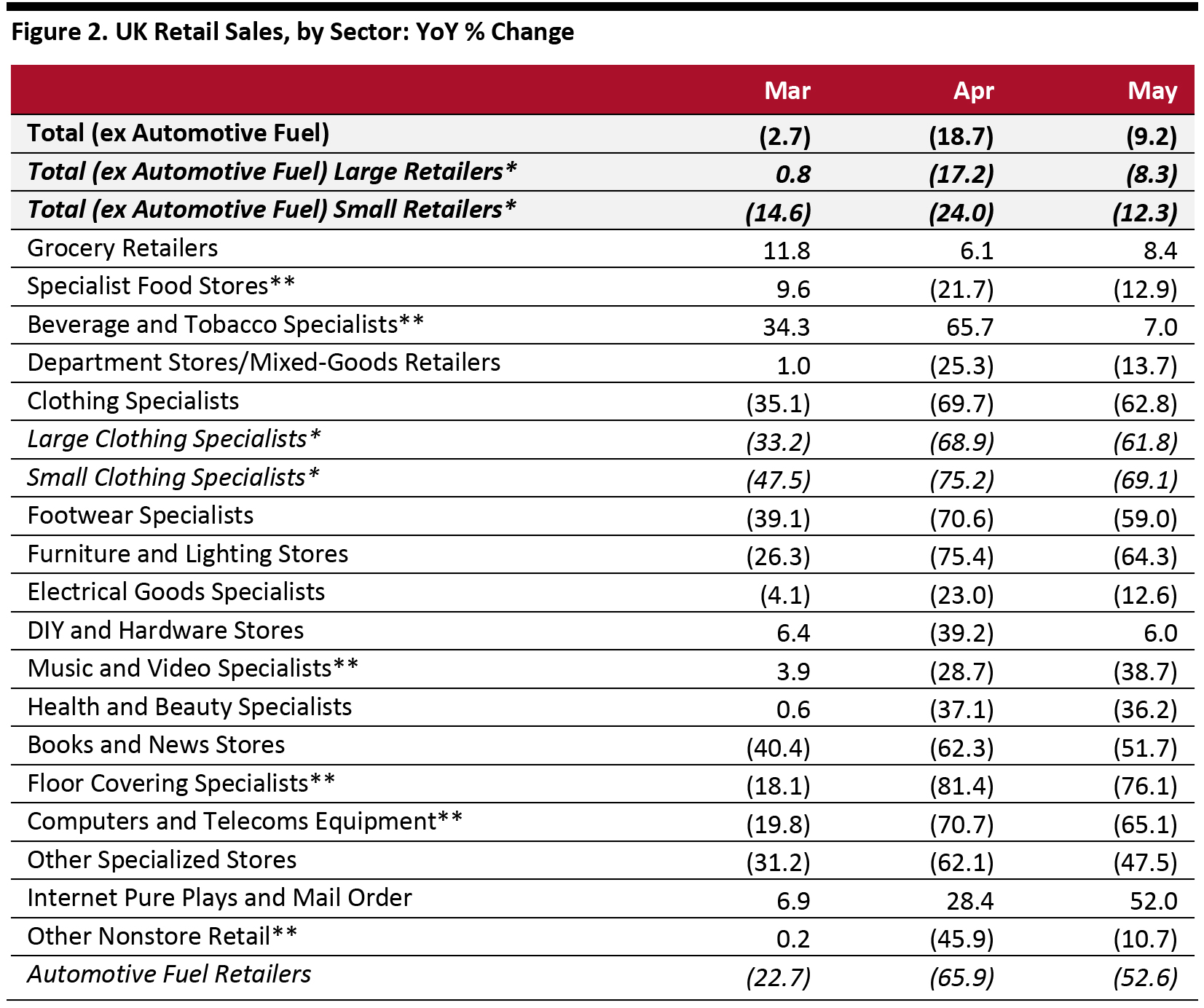

Source: ONS/Coresight Research[/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt the limit the spread of the coronavirus, temporarily closing all nonessential retail stores (DIY and hardware stores were classes as essential and could therefore remain open). The government announced on April 16 that it would extend the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that restrictions would be eased in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland, including department stores and small independent shops, would be allowed to reopen from June 15, given that they implement measures to meet the necessary social distancing and hygiene standards. Scotland and Wales have devolved governments that implemented different retail-reopening plans. We have seen mixed reopenings from large retailers. Major chains such as Next and John Lewis opened small tranches of stores on June 15, with more following thereafter. Debenhams reopened 90 of its stores in England on June 15, with a further 40 outlets set to reopen at a later date. Marks & Spencer reopened all its clothing and home stores on June 15. Retail Sales Growth by Sector Most sectors recorded a partial rebound in May—notably DIY and hardware stores, electrical goods specialists and department stores/mixed-goods retailers. Grocery-store sales increased by 8.4% in May, higher than the 6.1% in April and likely supported by consumers’ shift toward home cooking as food-service outlets remain closed. DIY and hardware stores recorded positive growth of 6.0% in May, compared to a 39.2% decline in April, supported by good weather during the May public holidays and likely fueled by lockdown orders: With fewer leisure and travel options available, many consumers used their newfound time to take on DIY projects and spruce up their homes. In addition, market leader B&Q reopened its stores at the end of April, following a period of closure. Kingfisher, which owns B&Q and Screwfix in the UK, reported comparable sales growth of 15.5% in the UK and Ireland in May. The retailer also reported a boost in online demand in the lockdown period. As we discuss later, online sales at household-goods retailers (which include DIY retailers) more than doubled in May, according to the ONS. Clothing stores saw a weak improvement compared to several other discretionary sectors, moving from a decline of 69.7% in April to a decline of 62.8% in May. This represents a 9.9% increase (a percentage on a percentage, not a percentage-point change), compared to a 45.8% increase between April and May at department stores/mixed-goods retailers, 14.7% at furniture stores and 45.2% at electrical goods retailers. Health and beauty also saw a minor improvement, reporting a decline of 37.1% in May compared to April’s 36.2% slide (equating to a 2.4% improvement). Department stores/mixed-goods retailers saw an easing of sales contraction since some of the mixed-goods stores in this sector sell a significant amount of essential goods, including food. This sector’s performance is not representative of the major department-store chains, which stayed close during the lockdown (although they continued to sell online). Garden centers, which were allowed to reopen from mid-May, are classified under Other Specialized Stores. [caption id="attachment_111867" align="aligncenter" width="700"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

**A relatively fragmented[/caption] Online Retail Sales Surge to 33.4% of All Retail Sales Total Internet retail sales were up 59.0% year over year in May, versus 33.1% in April. For food retailers, Internet sales were up 127.2% in May, versus an 84.0% increase in April. In May, Internet sales were up 58.7% at store-based nonfood retailers, versus 34.8% in April, supported by the strong sales at household-goods retailers, which surged 118.9% (we noted strong demand for DIY retailers above). Online sales were up 43.5% at nonstore retailers. Online retail sales accounted for 32.8% of all retail sales in May, up from 30.1% in April. Online sales accounted for 11.2% of sales at food retailers (versus 9.4% in April). At store-based nonfood retailers, e-commerce accounted for 39.2% of sales in May (versus 43.6% in April).

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjusted Source: ONS/Coresight Research[/caption] Covid-19 Lockdown Timeline The UK was put into lockdown on March 23, initially for three weeks in an attempt the limit the spread of the coronavirus, temporarily closing all nonessential retail stores (DIY and hardware stores were classes as essential and could therefore remain open). The government announced on April 16 that it would extend the lockdown by another three weeks. On May 11, Prime Minister Boris Johnson announced that restrictions would be eased in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23. On May 26, the government announced that all nonessential retailers in England and Northern Ireland, including department stores and small independent shops, would be allowed to reopen from June 15, given that they implement measures to meet the necessary social distancing and hygiene standards. Scotland and Wales have devolved governments that implemented different retail-reopening plans. We have seen mixed reopenings from large retailers. Major chains such as Next and John Lewis opened small tranches of stores on June 15, with more following thereafter. Debenhams reopened 90 of its stores in England on June 15, with a further 40 outlets set to reopen at a later date. Marks & Spencer reopened all its clothing and home stores on June 15. Retail Sales Growth by Sector Most sectors recorded a partial rebound in May—notably DIY and hardware stores, electrical goods specialists and department stores/mixed-goods retailers. Grocery-store sales increased by 8.4% in May, higher than the 6.1% in April and likely supported by consumers’ shift toward home cooking as food-service outlets remain closed. DIY and hardware stores recorded positive growth of 6.0% in May, compared to a 39.2% decline in April, supported by good weather during the May public holidays and likely fueled by lockdown orders: With fewer leisure and travel options available, many consumers used their newfound time to take on DIY projects and spruce up their homes. In addition, market leader B&Q reopened its stores at the end of April, following a period of closure. Kingfisher, which owns B&Q and Screwfix in the UK, reported comparable sales growth of 15.5% in the UK and Ireland in May. The retailer also reported a boost in online demand in the lockdown period. As we discuss later, online sales at household-goods retailers (which include DIY retailers) more than doubled in May, according to the ONS. Clothing stores saw a weak improvement compared to several other discretionary sectors, moving from a decline of 69.7% in April to a decline of 62.8% in May. This represents a 9.9% increase (a percentage on a percentage, not a percentage-point change), compared to a 45.8% increase between April and May at department stores/mixed-goods retailers, 14.7% at furniture stores and 45.2% at electrical goods retailers. Health and beauty also saw a minor improvement, reporting a decline of 37.1% in May compared to April’s 36.2% slide (equating to a 2.4% improvement). Department stores/mixed-goods retailers saw an easing of sales contraction since some of the mixed-goods stores in this sector sell a significant amount of essential goods, including food. This sector’s performance is not representative of the major department-store chains, which stayed close during the lockdown (although they continued to sell online). Garden centers, which were allowed to reopen from mid-May, are classified under Other Specialized Stores. [caption id="attachment_111867" align="aligncenter" width="700"]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented[/caption] Online Retail Sales Surge to 33.4% of All Retail Sales Total Internet retail sales were up 59.0% year over year in May, versus 33.1% in April. For food retailers, Internet sales were up 127.2% in May, versus an 84.0% increase in April. In May, Internet sales were up 58.7% at store-based nonfood retailers, versus 34.8% in April, supported by the strong sales at household-goods retailers, which surged 118.9% (we noted strong demand for DIY retailers above). Online sales were up 43.5% at nonstore retailers. Online retail sales accounted for 32.8% of all retail sales in May, up from 30.1% in April. Online sales accounted for 11.2% of sales at food retailers (versus 9.4% in April). At store-based nonfood retailers, e-commerce accounted for 39.2% of sales in May (versus 43.6% in April).