Nitheesh NH

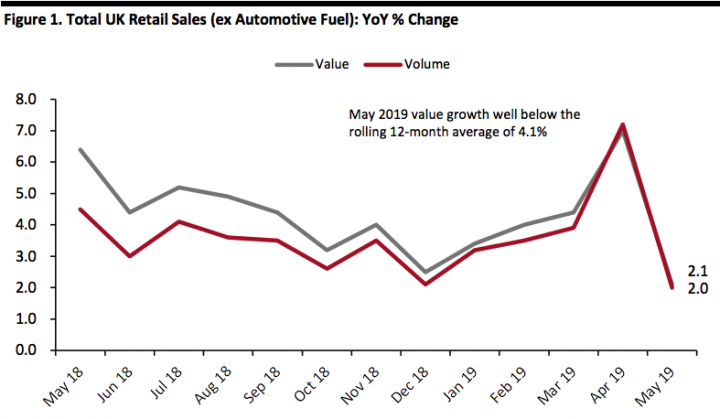

[caption id="attachment_91464" align="aligncenter" width="720"] Data in this report are not seasonally adjusted Source: ONS/Coresight Research[/caption]

[caption id="attachment_91465" align="aligncenter" width="720"]

Data in this report are not seasonally adjusted Source: ONS/Coresight Research[/caption]

[caption id="attachment_91465" align="aligncenter" width="720"] Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]

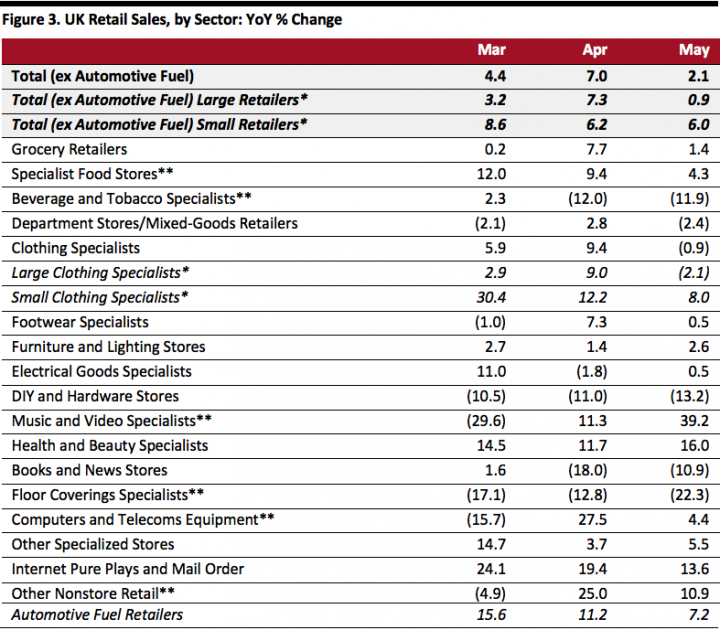

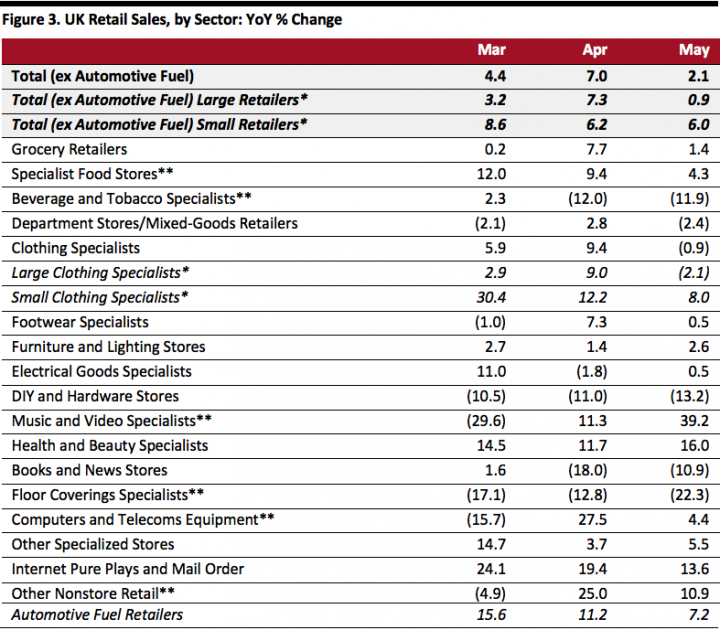

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption]

Data in this report are not seasonally adjusted Source: ONS/Coresight Research[/caption]

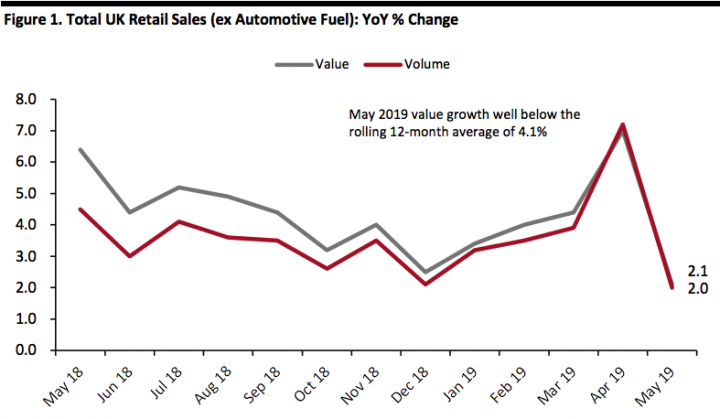

[caption id="attachment_91465" align="aligncenter" width="720"]

Data in this report are not seasonally adjusted Source: ONS/Coresight Research[/caption]

[caption id="attachment_91465" align="aligncenter" width="720"] Source: ONS/Coresight Research[/caption]

Source: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

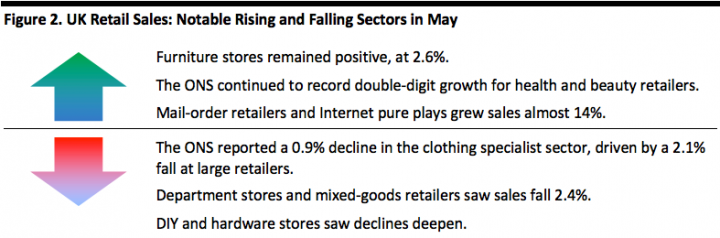

After Easter timing impacted March (negatively) and April (positively), May should have been “back to usual” — but it instead proved to be an exceptionally weak month, and even weaker once we focus on larger retailers, which form the core of most sectors. Grocery store sales were up marginally. We saw declines at clothing stores (with bigger declines at larger clothing retailers), department stores/mixed-goods retailers, and DIY stores. Poor May weather likely contributed to the weak performance, especially for clothing sales. The ONS recorded shop-price inflation of 0.1% in May, meaning almost all gains (where there were gains) were volume driven. [caption id="attachment_91466" align="aligncenter" width="720"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers**A relatively fragmented sector, in which reported figures have traditionally been volatile

Source: ONS[/caption]