Web Developers

Source: Company reports

Source: Company reports

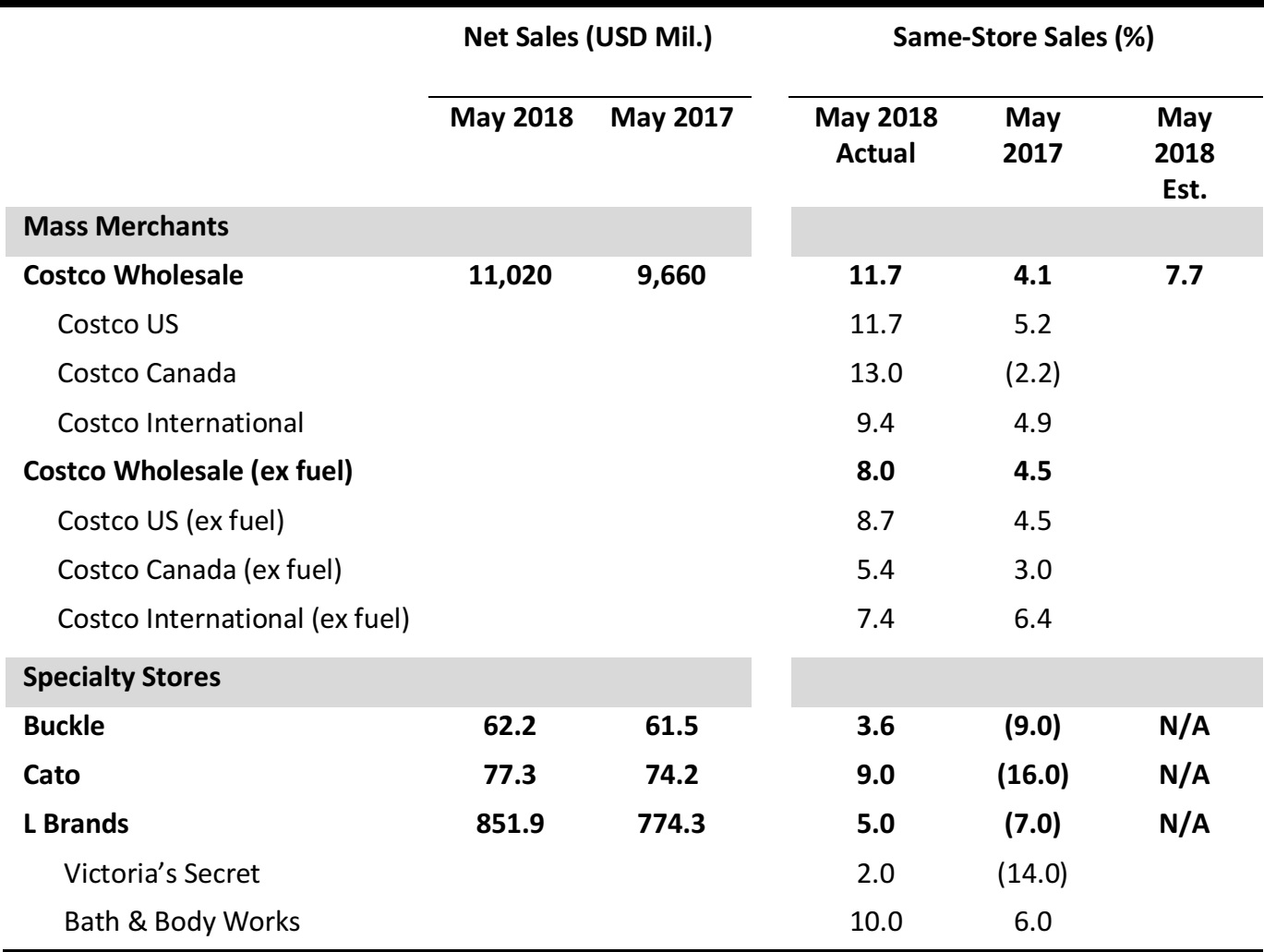

Costco Wholesale’s May Comps Showed Double-Digit Growth

- Costco’s May same-store sales were up by 11.7% year over year, beating the consensus estimate of 7.7%.

- Costco’s comp traffic or frequency for May was up 5.9% worldwide and 6.1% in the US.

- Within the US, the strongest sales regions were the Midwest, Texas and the Southeast. Internationally, in local currencies, the company saw the strongest results in Mexico, Japan and Taiwan.

- Cannibalization negatively impacted other international markets by slightly less than 100 basis points and negatively impacted the US market by slightly less than 50 basis points.

- Food and sundries were up by the mid- to high-single digits year over year. Departments with the strongest results were tobacco, sundries and coolers. Hardlines were up by the low to mid-teens year over year. Better-performing departments were majors, garden, office and sporting goods. Sales in majors were up over 20%, led by tablets, appliances and computers.

- Softlines were up by the mid-single digits. Better-performing departments included apparel, domestics and small appliances. Fresh foods were up by the low- to mid-single digits. Better-performing departments were bakery and service deli.

- Costco’s e-commerce sales for May were up by 34.4% year over year.

L Brands Reported Growth in Comps Overall and at the Brands Level

- L Brands’ comps increased 5.0% in May. Victoria’s Secret’s comps were up by 2.0% and Bath & Body Works’ comps were up by 10.0%.

- L Brands’ merchandise margin rate was down significantly compared to last year, driven by additional promotional activity.

- The 2.0% increase in comps for Victoria’s Secret was driven by growth in beauty and lingerie.

- At Bath & Body Works, comps were up by 10.0% year over year in May and the merchandise margin rate was down, as the company saw increased response to its offers, which were similar to last year, as well as accelerated growth in the direct channel.

Buckle Reported Positive Comps

- Teen retailer Buckle saw an overall comps increase of 3.6% year over year in May.

- Total sales were up by 9.0% year over year in the men’s business. Men’s represented 51.0% of total monthly sales versus 48.0% in May last year. Price points were down by 4.5%.

- Total sales for the women’s segment were down by 2.5%. The women’s segment accounted for 49.0% of total monthly sales versus 52.0% last May. Price points were down by 6.0%.

- May total sales for accessories were down approximately 0.5% year over year in comparison to the same 4-week period a year ago, while footwear sales were up about 10.0%. The two categories account for approximately 9.5% and 7.0%, respectively, of the current fiscal May net sales. Average accessory price points were up just slightly, and average footwear price points were up about 0.5% for May.

Cato’s Same-Store Sales Benefited from Favorable Weather

- Cato reported May sales of $77.3 million, a 4.0% increase year over year. Comps were up by 9.0% in the month.

- The company said that May comps exceeded expectations and attributed part of the increase to favorable weather conditions during the month.