All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

Source: ONS/Coresight Research

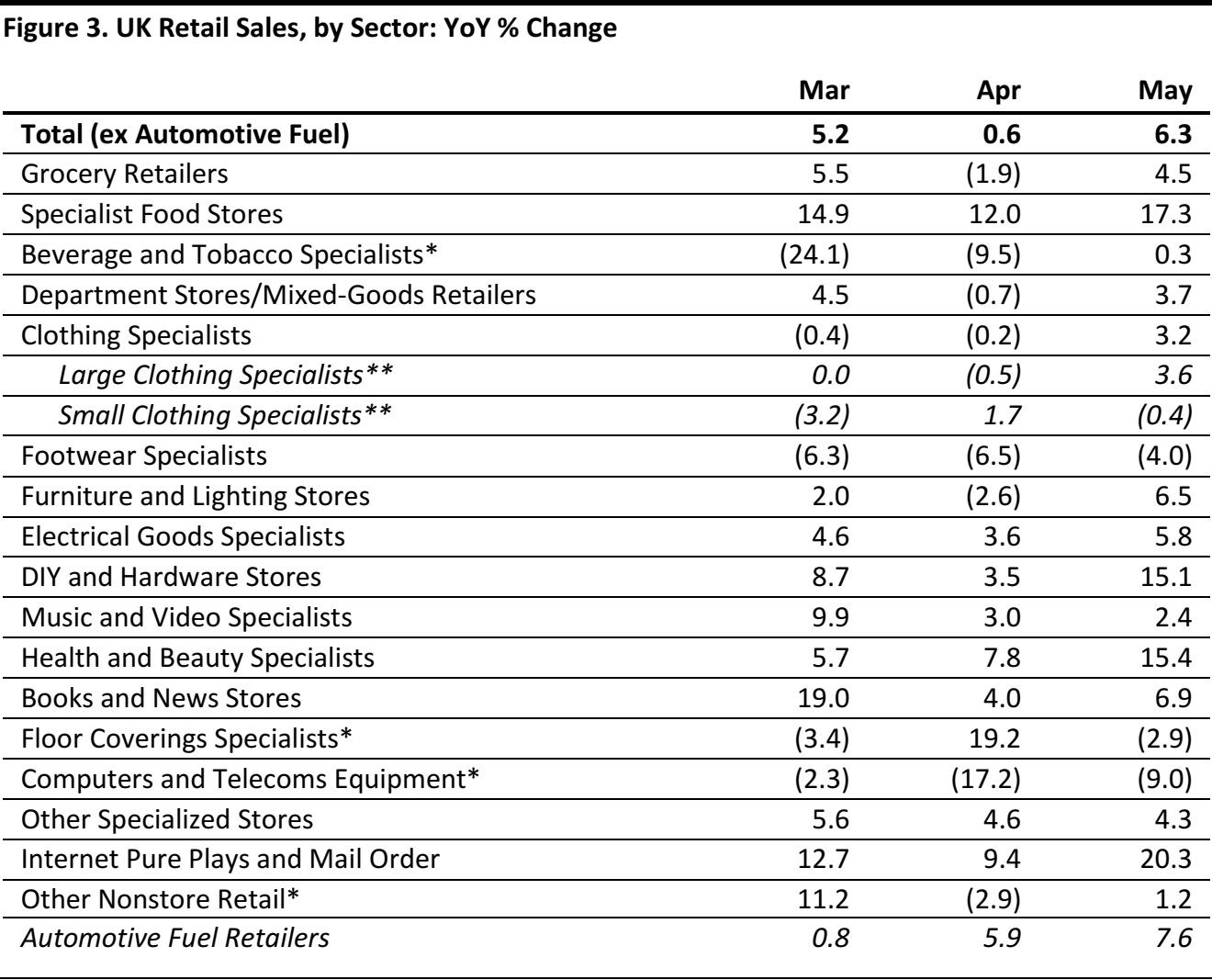

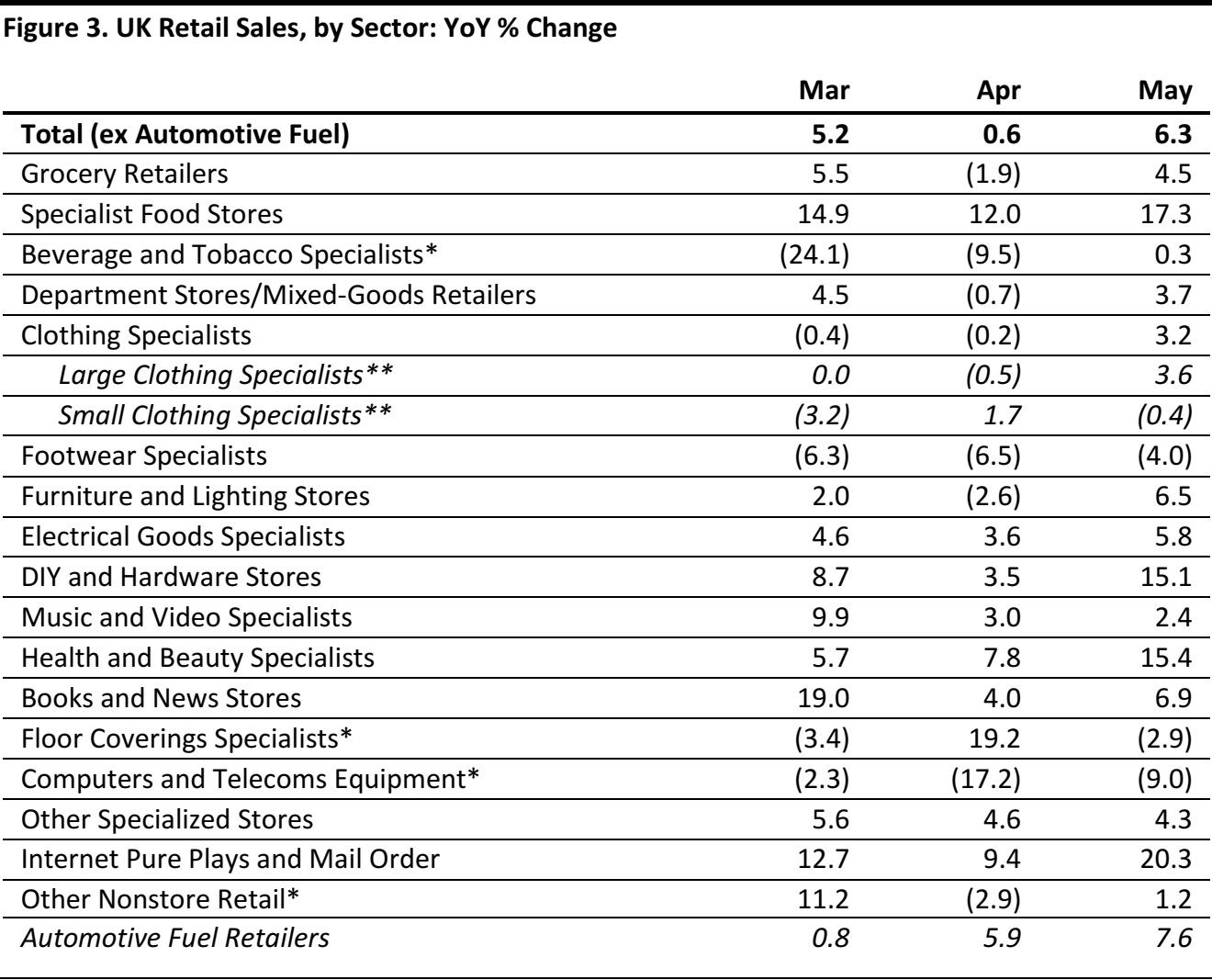

Retail Sales Growth by Sector

The good weather coincided with a Royal wedding to drive a feel-good factor in May, and this prompted consumers to flock to the shops to stock up on food for barbecues and picnics, summer clothing and outdoor-living products. Grocery stores, clothing specialists and DIY stores enjoyed a bumper month, according to the ONS. The month saw two public holidays—but it does so every year, so this has no direct impact on year-over-year growth.

While clothing stores made hay while the sun shone, their peers in the footwear sector endured what appears to be a structural decline, as nonspecialists and Internet-only retailers capture an ever-greater share of footwear spend.

Consumers were not only turning to physical stores during the good weather: Internet-only retailers and catalog operators enjoyed a 20.3% year-over-year jump in sales, marking a considerable sequential strengthening in growth.

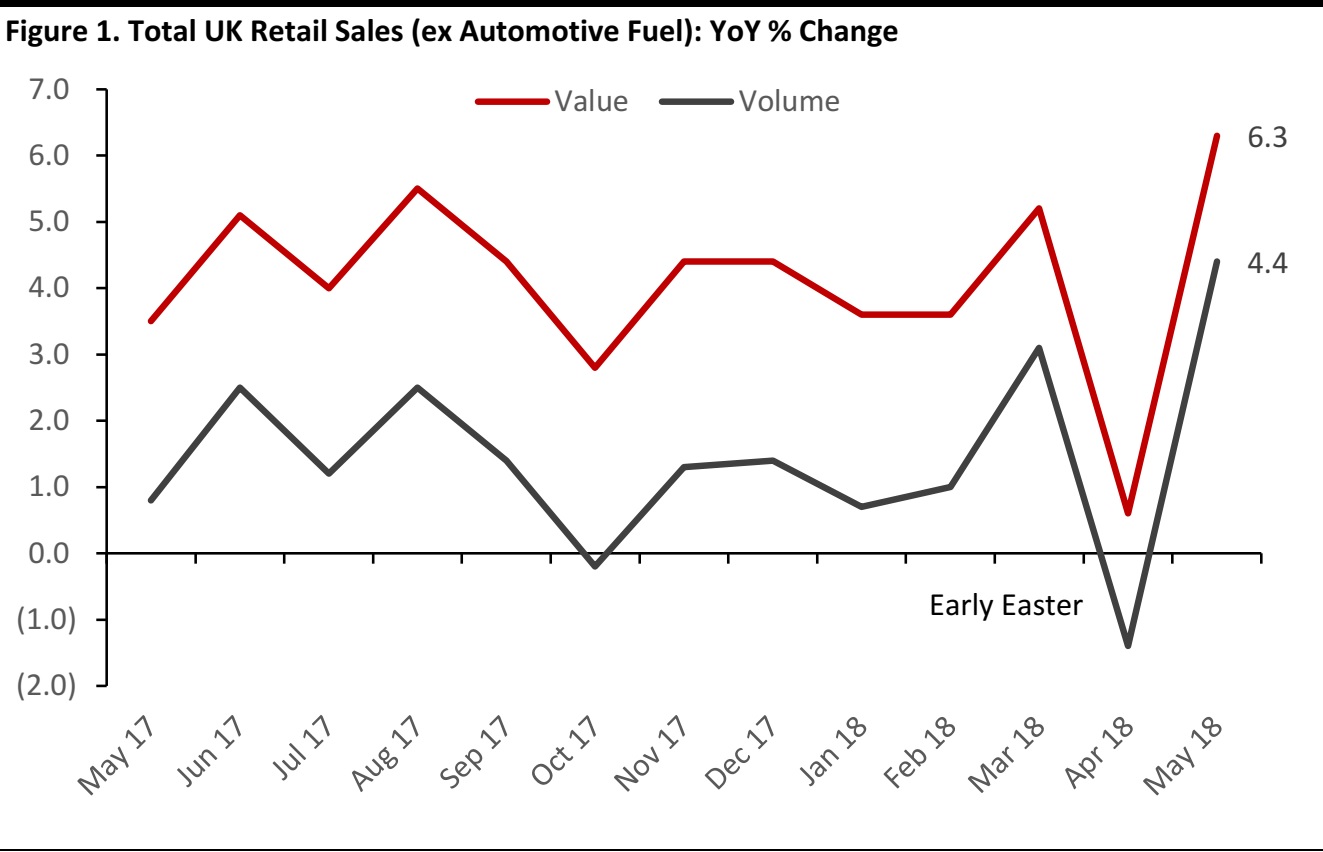

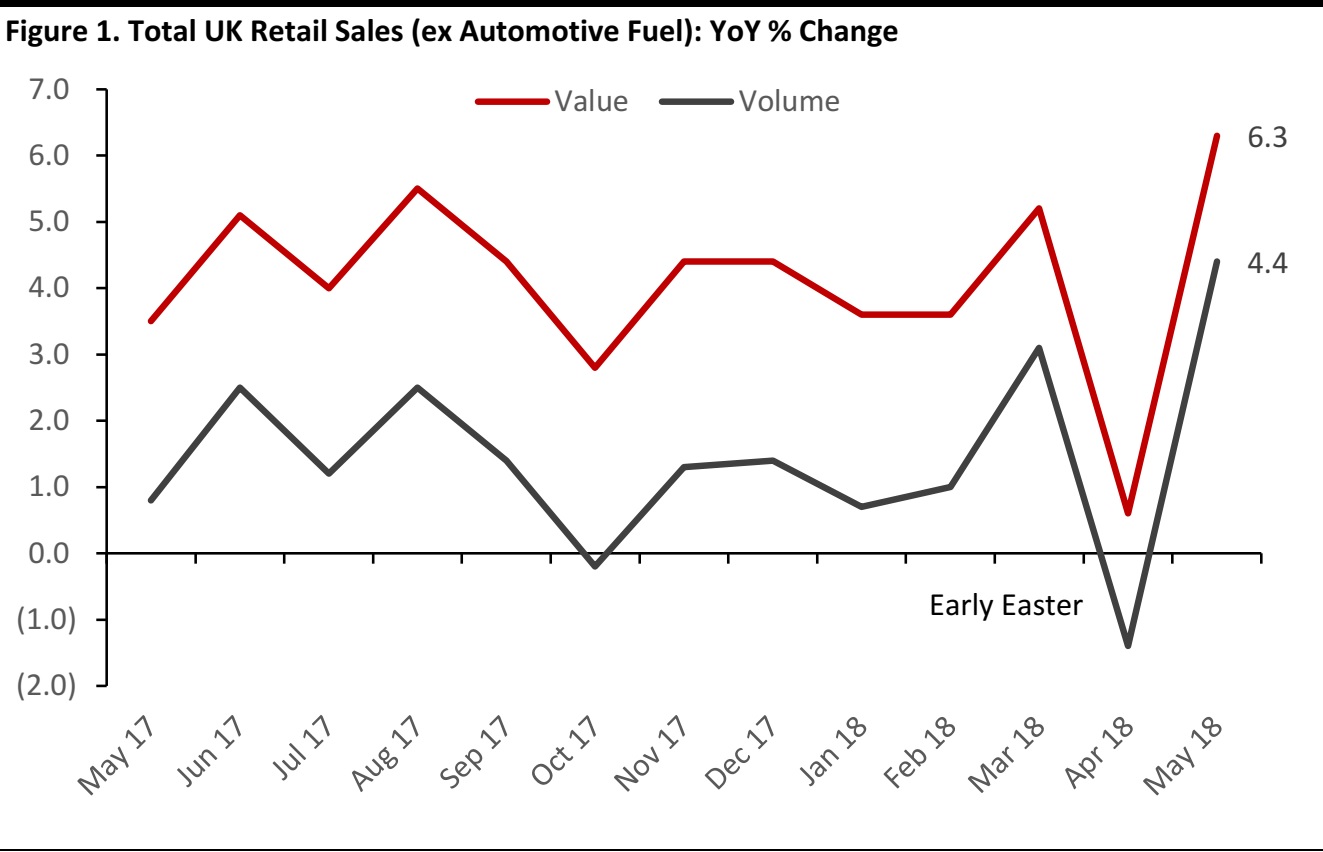

As we noted last month, April’s numbers had been weak on the back of an earlier Easter, which pulled some holiday spending into March.

The ONS reported that total shop-price inflation (ex automotive fuel) moderated to 1.8% in May, from 2.0% in April. This compares to a peak of 3.0% in September–November 2017. At food stores, inflation fell to 2.1% in May, from 2.3% in April. At nonfood retailers, inflation fell to 1.3% in May, from 1.7% the previous month. At automotive fuel retailers, inflation was 7.8% in May versus 3.2% in April.

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

Online Retail Sales Growth

Total Internet retail sales were up 20.5% year over year in May, versus 11.6% growth in April. In May, Internet sales grew by 20.8% at food retailers, 24.4% at nonfood retailers and 18.0% at nonstore retailers.

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

All data in this report are not seasonally adjusted.

Source: Office for National Statistics (ONS)/Coresight Research

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

Source: ONS