Web Developers

Source: Company reports

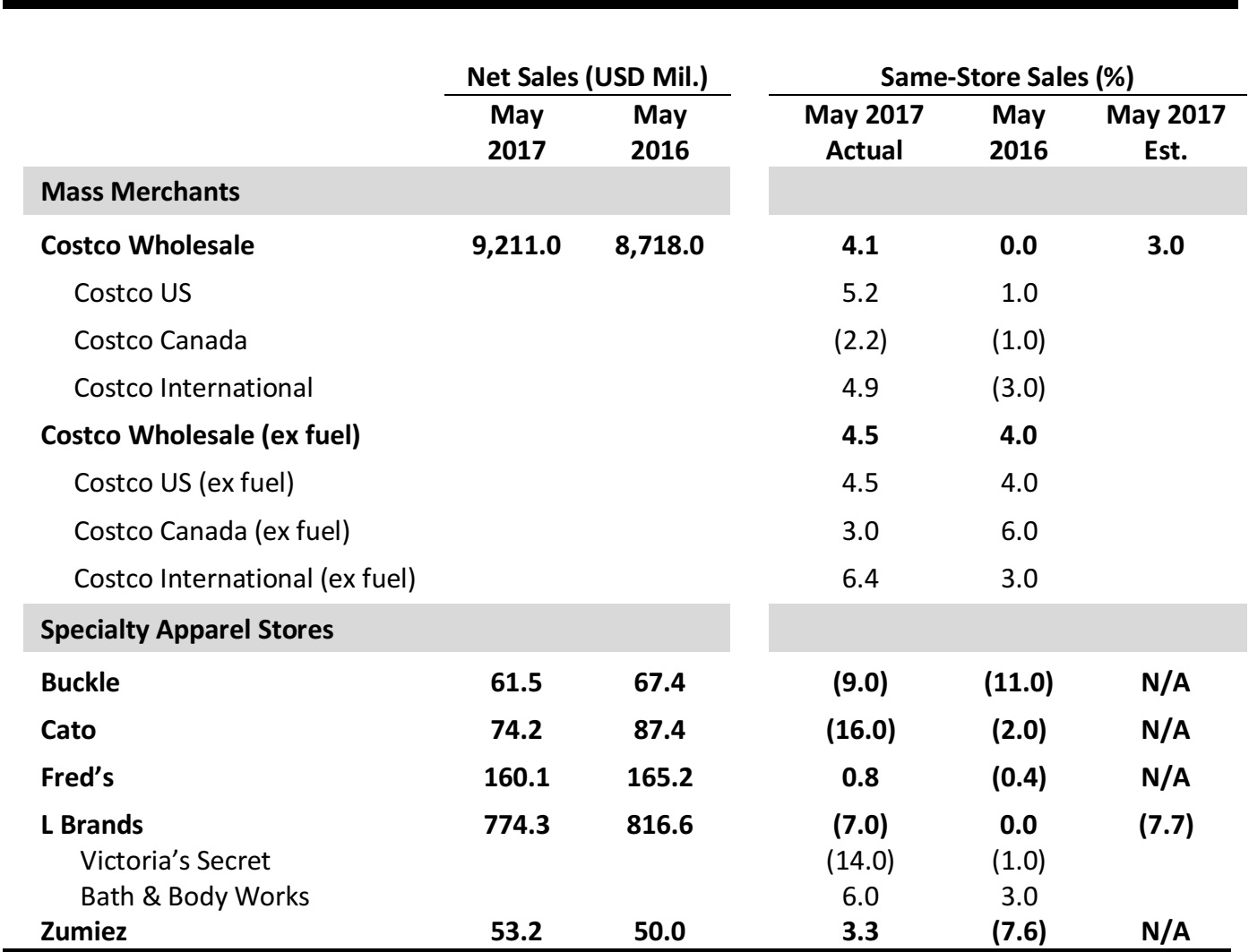

Costco’s US Comps Beat Expectations; Strong Traffic Trend

- Costco’s May same-store sales were up 4.1% year over year, beating expectations.

- Traffic at Costco was up a little over 3% in May worldwide, and up 3.7% in the US.

- The average transaction value was up 1%, including foreign exchange and gas inflation.

- The average gas price per gallon was up 6% from last May.

- Within the US, the strongest sales regions were the Midwest, Northwest and Texas. Internationally, Mexico, Japan and South Korea were the better-performing countries, in local currencies.

- Cannibalization negatively impacted other international markets by 70 basis points and negatively impacted the US market by 40 basis points.

- Food and sundries comps increased by low single digits. Better-performing categories were frozen foods, liquor and deli.

- Consumer electronics comps were slightly positive for the month. TV and tablet sales were down year over year, but the declines were offset by solid increases in appliances and wireless phones.

- Softline comps were up slightly, rising by mid-single digits for the month. Better-performing categories included housewares, home furnishings and jewelry. Fresh foods were up by low to mid-single digits.

- The US business experienced slight inflation.

L Brands’ Victoria’s Secret Business Continued to Be Challenged; Results Were Partially Offset by Bath & Body Works Performance

- L Brands’ comps were down 7% in May. At Victoria’s Secret, comps were down 14% and at Bath & Body Works, comps were up 6%.

- The exit of the swim and apparel categories negatively impacted total company comps by 10 basis points and negatively impacted Victoria’s Secret’s comps by 14 basis points.

- The merchandise margin rate was up versus the same period last year. Inventories per square foot were down 12%.

- At Victoria’s Secret, where comps were down 14% for the month, growth in PINK was offset by a decline in the lingerie business.

- At Bath & Body Works, May comps were up 6%, driven by strong a Mother’s Day performance. The merchandise margin rate was roughly flat year over year. In June, the company will transition to its semiannual sales period, with the same time frame as last year.

- L Brands expects June total comps to be down by mid- to high single digits, including a negative impact of seven basis points from the exit of swim and apparel.

Buckle Comp Trends Continues to be Weak in May

- Teen retailer Buckle saw overall comps decline by 9.0% in May. Units per transaction were up 2.0% and average transaction value was down 4.0%.

- The women’s segment accounted for 52% of total monthly sales versus 53.5% last May. Total sales for the women’s segment were down 13%. Price points were down 8.5%.

- Sales for men’s categories were down 9.5% and men’s represented 48% of total sales versus 46.5% in the same month last year. Price points were down 5%.

- Accessories and footwear represented 9.5% and 6.5% of sales, respectively, versus 9.5% and 6.0%, respectively, in the year-ago period.The average accessory price point was up slightly and the average footwear price point was down 4.5%.

Fred’s Comps Suffered from Discontinued Inventory

- Fred’s reported a total sales decline of 3.1% in May, to $160.1 million. Same-store sales for the month increased by 0.8%. May comps included a (1.0)% impact related to the sale of low-productive discontinued inventory versus May of last year.

- The company’s retail pharmacy business continues to drive momentum, and adjusted script comps continue to trend positively.

Cato Continues to Be Hurt by Merchandise Assortment Issues

- Cato reported May sales of $74.2 million, down 15% from the same month last year. Same-store sales declined by 16%.

- May sales were impacted by the company’s merchandise missteps.

- Management expects current sales headwinds to continue as the company works through its merchandise assortment issues.

Zumiez Comps Showed Improvement

- Zumiez’s total net sales for May were up 6.5%, to $53.2 million, compared with $50 million last May. The company’s comparable sales increased by 3.3% compared with a decrease of 7.6% in the same month a year ago.

- Zumiez reported 1Q17sales of $181.2 million, up 4.7% from the same quarter last year. Same-store sales increased by 1.8% in the quarter.

- The increase in comps for May was driven primarily by an increase in transactions that was partially offset by a decrease in dollars per transaction. The decline in dollars per transaction was primarily due to a decrease in units per transaction that was partially offset by an increase in average unit retail.

- Men’s and juniors posted positive comps, while hard goods, accessories and footwear posted negative comps in May.

- The company now expects 2Q17 comps of 1%–3% and total sales of $185–$189 million.