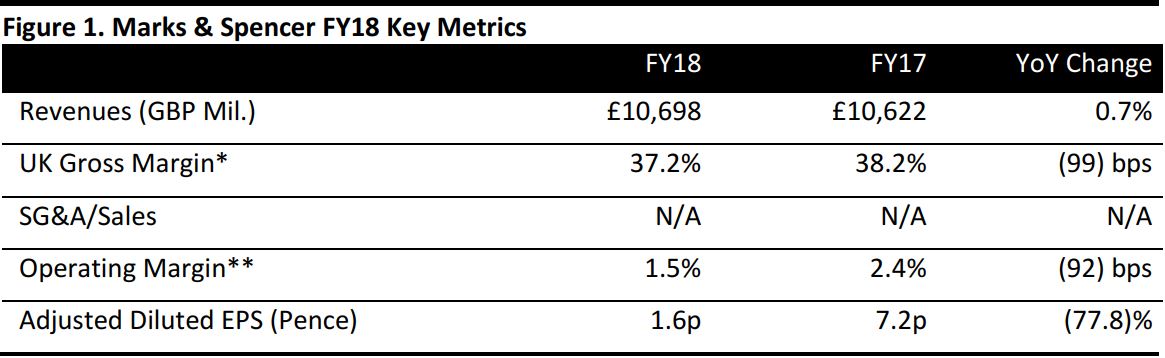

*Marks & Spencer does not report gross profit at a group level.

**Based on statutory operating profit.

Source: Company reports/Coresight Research

*Marks & Spencer does not report gross profit at a group level.

**Based on statutory operating profit.

Source: Company reports/Coresight Research

FY18 Results

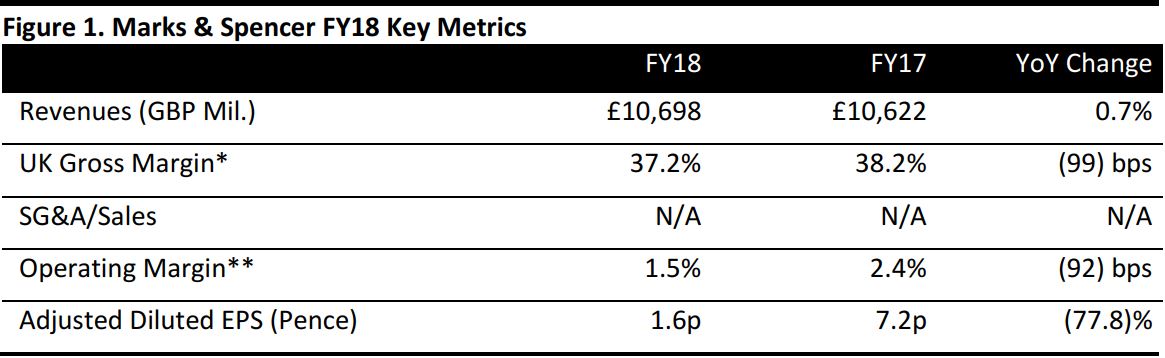

Food, clothing and home retailer M&S reported a slump in full-year profits, due largely to exceptional costs related to its ongoing turnaround plan. In FY18, ended March 31:

- Total group revenues climbed by 0.7% to £10.7 billion, behind the consensus estimate of £10.8 billion.

- UK Food revenues climbed by 3.9%, driven by new store openings. Food comparable sales were down by 0.3% in the year.

- UK Clothing and Home revenues fell by 1.4%, with comp sales down by 1.9% in the year.

- Statutory operating profit fell by 38% to £156.5 million. Excluding exceptional items, adjusted operating profit fell by 2.9% to £670.6 million; this was ahead of the consensus estimate of £657 million.

- Statutory pretax profit fell by 62% to £66.8 million. Excluding exceptional items, pretax profit fell by 5.4% to £580.9 million.

- Statutory net profit fell by 75% to £29.1 million.

These profit declines were against undemanding comparatives from FY17,

when the company also booked substantial exceptional items.

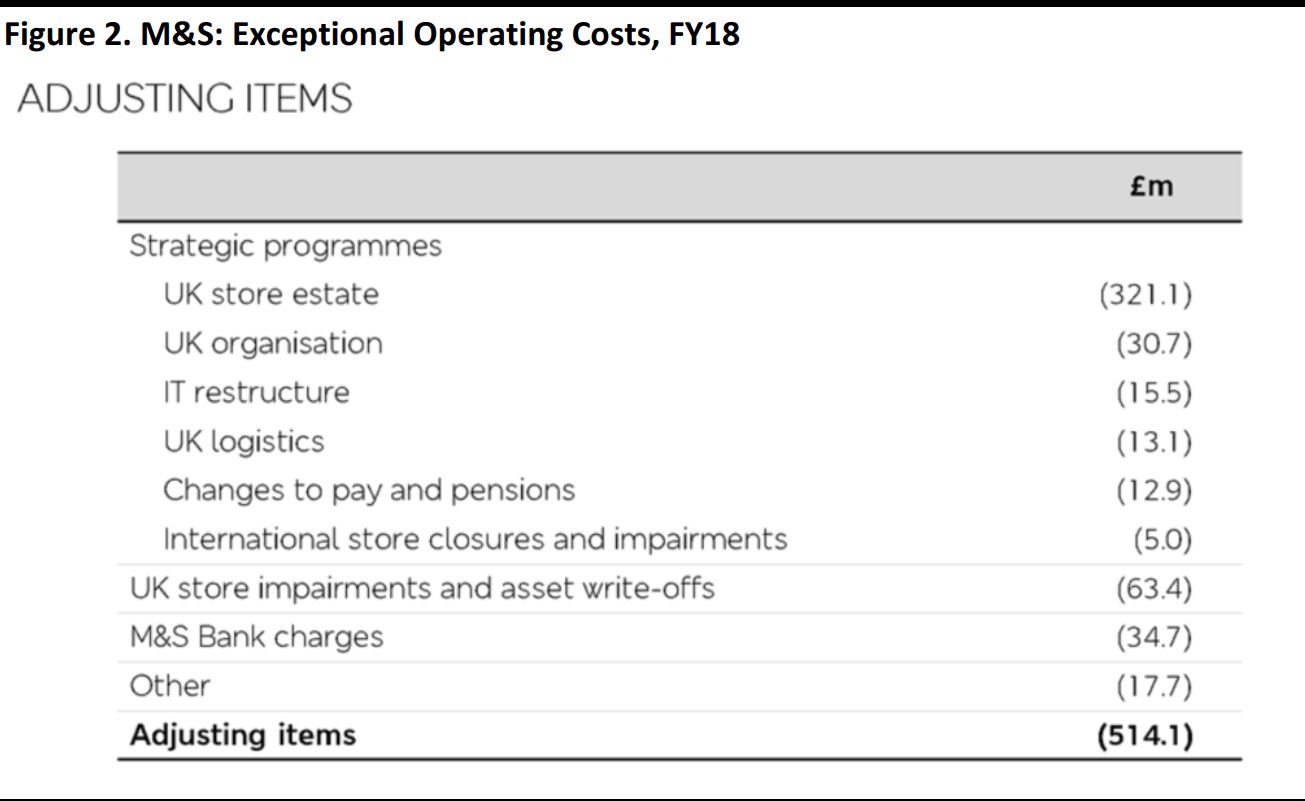

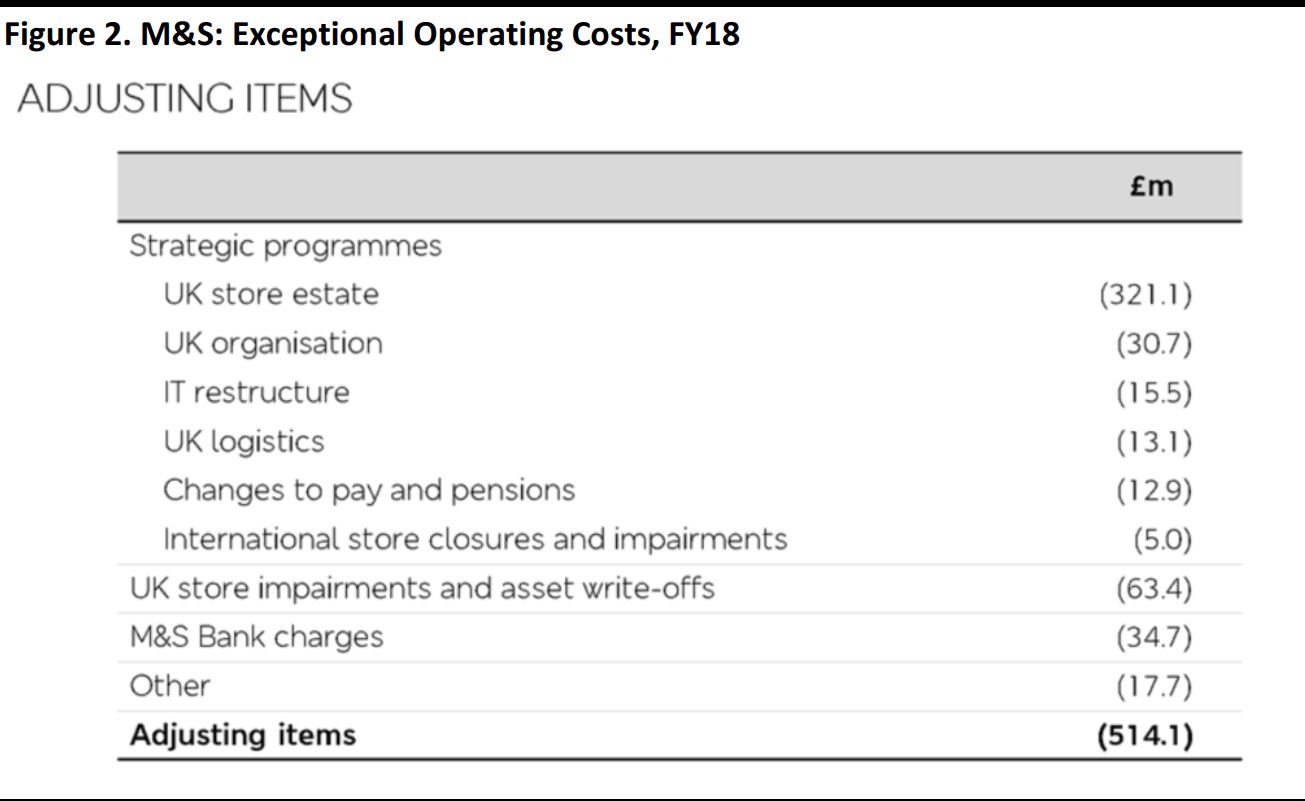

Exceptional items of £514.1 million were largely driven by costs associated with M&S’s now-accelerated store closure plan, with the retailer planning to close over 100 Clothing and Home stores by 2022. We show the breakdown of exceptional operating costs below.

Source: Company reports

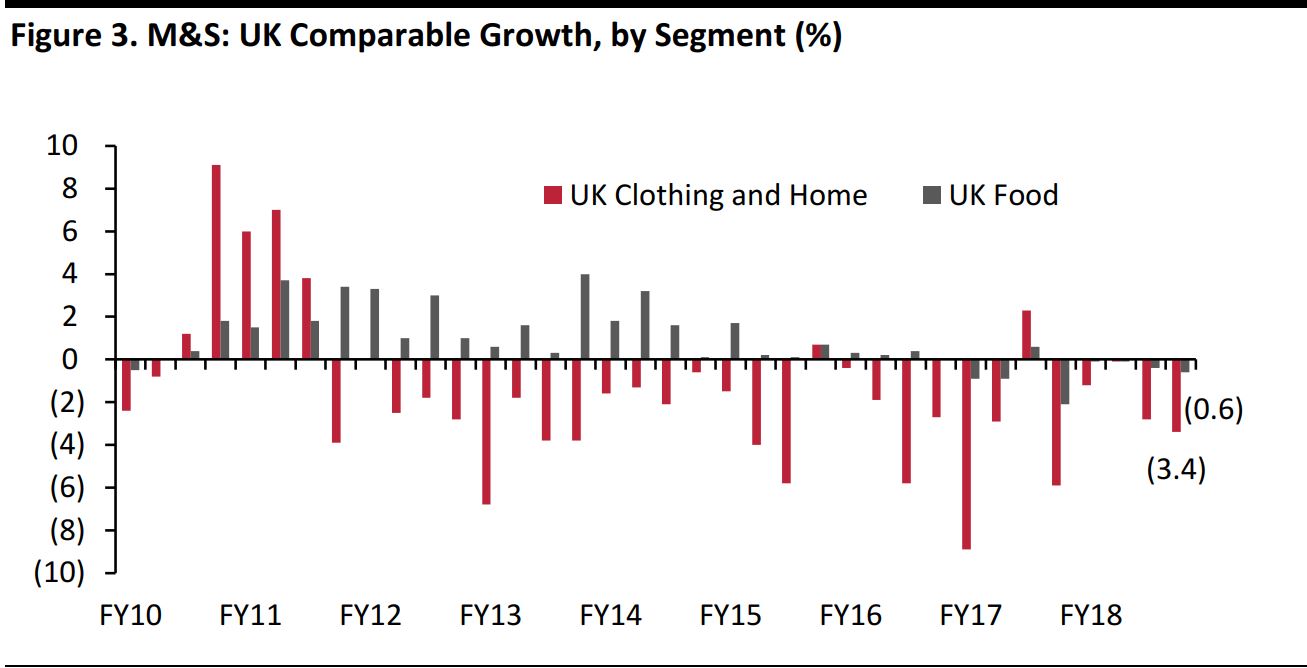

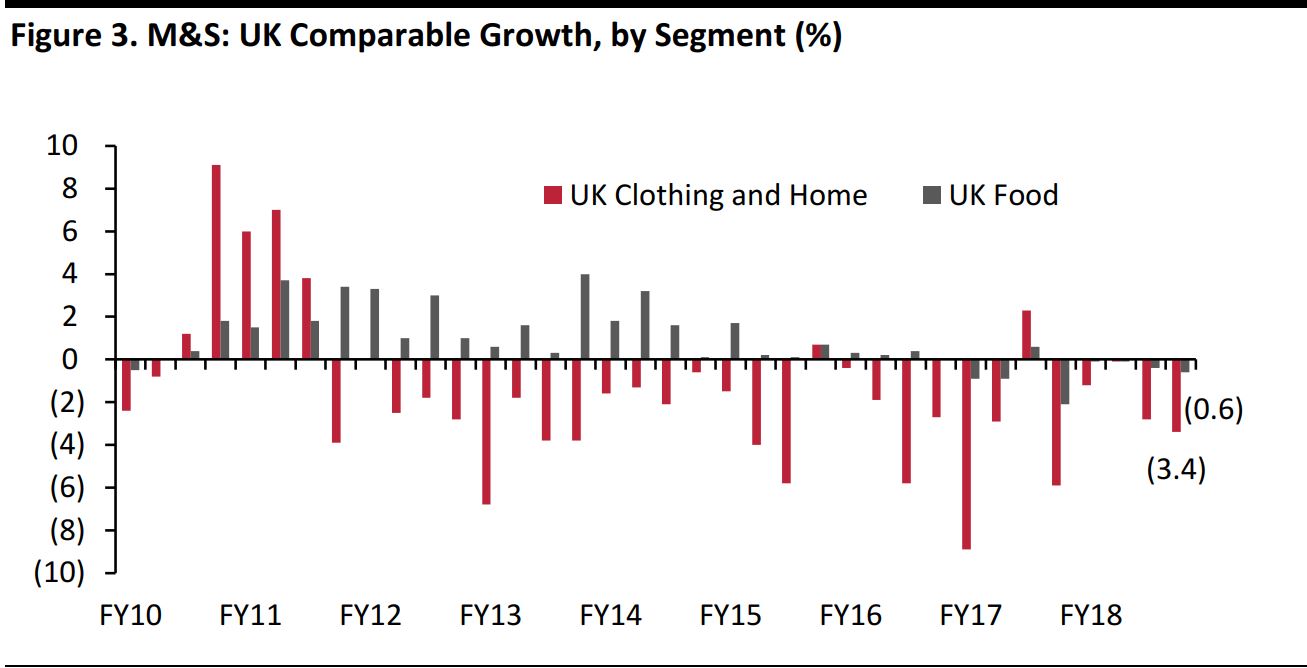

In the final quarter, the two most-closely-watched segments each reported a weakening in underlying performance:

- The UK Clothing and Home segment reported a comparable sales decline of 3.4% in 4Q18, versus a decline of 2.8% in the previous quarter.

- The UK Food segment reported a comp decline of 0.6% in 4Q18, versus a decline of 0.4% in the prior quarter.

The chart below shows the long-term performance of these segments.

Through 4Q18

Source: Company reports

Accelerating the Transformation Strategy

At the company’s analyst presentation, CEO Steve Rowe made the following observations:

- The current plan to turn around M&S is akin to a marathon, but the company is currently “only about three or four miles in.”

- The FY18 results show why M&S needs to transform its business. To “make M&S special again,” accelerating the pace of change is “the only option.”

- M&S will address the narrowing of its customer base, which it has seen over a number of years. It aims to attract more young families.

- M&S needs to continue to focus on value, while also communicating “the quality difference and provenance” in its merchandise.

M&S’s previously announced

five-year transformation plan includes:

- Focusing on becoming “the UK’s essential clothing retailer.”

- Accelerating the company’s UK Clothing and Home space rationalization plan.

- Repositioning M&S’s Food business, which includes slowing the opening rate of Simply Food stores.

- Becoming a digital-first organization, with the aim of generating one-third of Clothing and Home sales online by 2022.

- Reducing the cost base to become a lower-cost retailer.

Outlook

Management provided the following guidance for FY19:

- Food: No increase in space and gross margins flat to down 50 basis points.

- Clothing and Home: An approximate 5% net decrease in space and, like Food, gross margins flat to down 50 basis points. Management indicated that total, accumulated closures of underperforming stores, including those in FY18, would equate to a space decrease of around 10% by the end of FY19.

- UK operating costs: Flat to down 1%.

- Capital expenditure: £350–£400 million.

For FY19, analysts expect M&S to grow revenues by 0.8%, to £10.9 billion. Consensus calls for adjusted EBIT to decline by a further 6.2% to £616 billion, and for M&S to turn in full-year adjusted diluted EPS of 26.5 pence. These estimates were collated before the latest results.

*Marks & Spencer does not report gross profit at a group level.

**Based on statutory operating profit.

Source: Company reports/Coresight Research

*Marks & Spencer does not report gross profit at a group level.

**Based on statutory operating profit.

Source: Company reports/Coresight Research