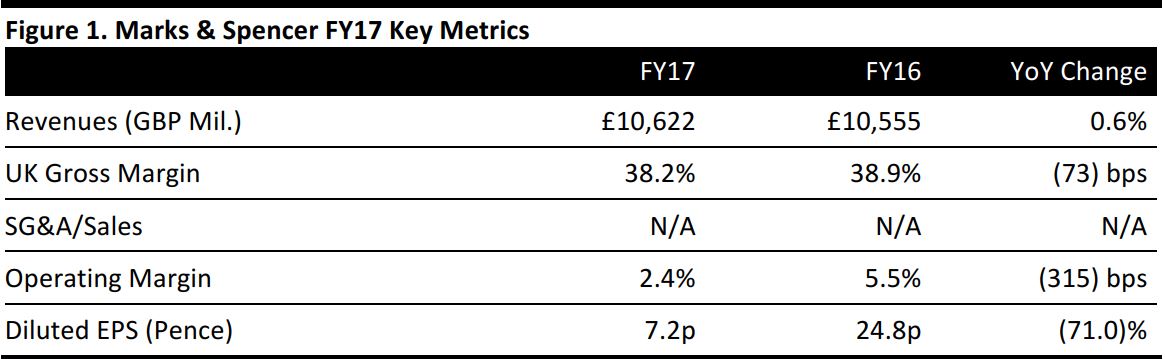

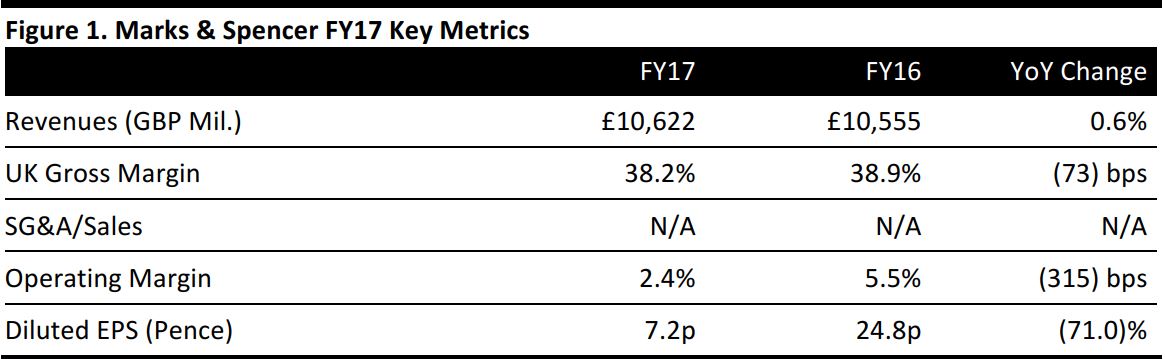

FY16 was 53 weeks. FY17 ended April 1; FY16 ended March 26. All data are after exceptional items

Source: Company reports/Fung Global Retail & Technology

FY17 Results

M&S’s FY16 was 53 weeks and the figures below are on a comparable 52-week basis.

UK clothing, homewares and food retailer M&S grew full-year sales by 2.2%, with UK sales up 1.3% and international sales up 10.7%, helped by currency effects. New space in the UK Food segment contributed to total growth.

- FY17 UK comps came in at (3.4)% in Clothing and Home and (0.8)% in Food.

- Full-year international comps were (0.1)% at constant currency.

Group revenue was marginally ahead of the £10.58 billion consensus. Diluted EPS of 7.2 pence was behind consensus of 8.7 pence.

UK Clothing and Home gross margin grew by 105 bps on the back of greater direct souring and more sales at full price. Group adjusted operating profit declined 11.2% and adjusted pretax profit fell 10.3%.

However, unadjusted pretax profit fell 63.5%, due to £437 million of exceptional costs. These costs included £156 million related to changes in pay and pensions, £24 million for changes in the UK organization, a £52 million writedown on UK store values and £132.5 million for international store closures and impairments.

4Q17 Trading

M&S reported a weak UK performance in the final quarter:

- Comps in Clothing and Home were down 5.9%, a meaningful weakening from a 2.3% increase in 3Q17. The company said the late timing of Easter and the timing of its December sale accounted for 3.8% of the 5.9% decline.

- Comps in Food were down 2.1%, weakening from a 0.6% increase in 3Q17. The company said the calendar effects noted above accounted for 1.9% of this decline.

Strategy Update

In his presentation to analysts, CEO Steve Rowe noted the following:

- M&S has grown full-price market share in UK clothing, as it has moved to discount less frequently.

- M&S recently posted a 91-day period without sales or promotions in clothing—the company’s longest period without discounting in 10 years.

- Its most-frequent customers and those customers who shop at its larger stores have registered upticks in Net Promoter Score.

- It has completed consultations on its international store closures.

- Just under 70% of its clothing products are now designed in-house.

- Rowe defended M&S’s typically long-lead-time model in apparel, noting that most of its apparel sales are in core products, and that it has some short-lead-time capabilities (four weeks) via sourcing in Portugal and Turkey.

Outlook

The company offered the following guidance for FY18:

- UK Food: Gross margin flat to (50) bps, with pressures from currency effects expected in 1H18. The company noted, however, that most of its Food sourcing is in British pounds. A 7% increase in space, with 90 new Simply Food stores in FY18.

- UK Clothing and Home: A gross margin change of 25 bps to (25) bps, with reduced discounting offsetting some currency effects. A 1%–2% decline in space.

The company expects UK operating costs to rise by between 2.5% and 3.5% and capex of £400 million in FY18.

Analysts expect M&S to grow revenues by 1.2% in FY18, but for EBIT to fall 2.3%. Consensus is for GAAP EPS of 27.1 pence.