albert Chan

3Q19 Trading Update

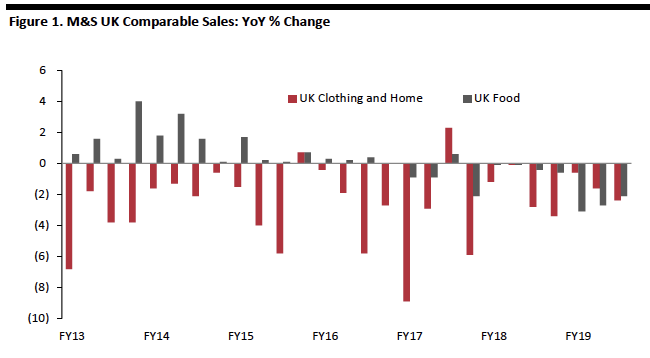

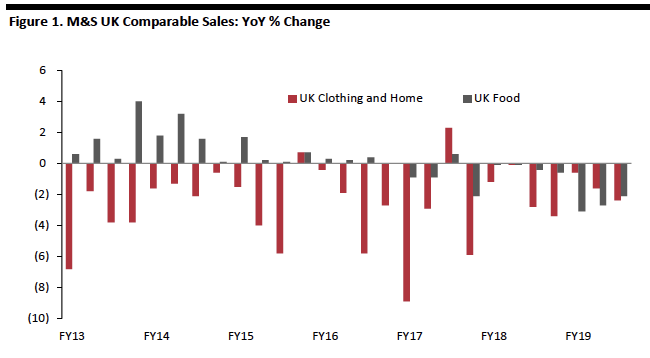

Food, clothing and homewares retailer M&S reported another quarter of declining comparable sales in 3Q19 (ended December 30). The company’s core U.K. segments reported the following underlying performance:

Source: Company reports[/caption]

International revenue declined 15.1% (down 1.4% if the impact of the sale and closure of some international stores is excluded). Total group revenues were down 3.9%.

Management Commentary

On the management call, CEO Steve Rowe noted that the third quarter was “challenging.” He said that “market conditions were tough, particularly in November when footfall and online visits both dropped significantly,” he said. Rowe said the sales growth was in line with the company’s expectations and was “steady” in the first half. The company reduced inventory volumes, resulting in 25% less stock going into the December sale. Rowe pointed to an increase in sales of entry-level clothing products, saying “customers are looking for value, and we're providing that.” The company lowered prices on 227 food products and stripped out “complex and confusing” promotions.

In the company’s trading update, management highlighted that performance remained steady across the period amidst difficult market conditions. Declines in Clothing and Home were compounded by lower footfall to stores, partly due to the increasing pace of store closures. Online sales increased 14%, driven by improvements to the proposition and operations. In the Clothing and Home division, the company said it is in the early stages of far-reaching changes in range, style, customer focus and channel mix.

In Food, management noted that the customers responded well to its Christmas ranges and promotions leading to solid volume growth over the Christmas period, with most Food stores delivering comparable sales growth. The Food division showed early signs of volume growth.

Outlook

The company maintained FY19 guidance given at the half-year:

Source: Company reports[/caption]

International revenue declined 15.1% (down 1.4% if the impact of the sale and closure of some international stores is excluded). Total group revenues were down 3.9%.

Management Commentary

On the management call, CEO Steve Rowe noted that the third quarter was “challenging.” He said that “market conditions were tough, particularly in November when footfall and online visits both dropped significantly,” he said. Rowe said the sales growth was in line with the company’s expectations and was “steady” in the first half. The company reduced inventory volumes, resulting in 25% less stock going into the December sale. Rowe pointed to an increase in sales of entry-level clothing products, saying “customers are looking for value, and we're providing that.” The company lowered prices on 227 food products and stripped out “complex and confusing” promotions.

In the company’s trading update, management highlighted that performance remained steady across the period amidst difficult market conditions. Declines in Clothing and Home were compounded by lower footfall to stores, partly due to the increasing pace of store closures. Online sales increased 14%, driven by improvements to the proposition and operations. In the Clothing and Home division, the company said it is in the early stages of far-reaching changes in range, style, customer focus and channel mix.

In Food, management noted that the customers responded well to its Christmas ranges and promotions leading to solid volume growth over the Christmas period, with most Food stores delivering comparable sales growth. The Food division showed early signs of volume growth.

Outlook

The company maintained FY19 guidance given at the half-year:

- Comparable sales in the U.K. Clothing and Home segment were down 2.4% in the quarter, below the consensus of 1.8% decline recorded by Street Account and worse than 2Q19’s 1.6% fall.

- The company’s U.K. Food segment reported a comp decline of 2.1% in 3Q19, ahead of the consensus 3.0% decline estimated by Street Account and the 2.7% fall the prior quarter, pointing to an improving trend in Food.

- The company’s total sales for U.K. were down 2.7% year over year, while total U.K. Food sales declined 1.2%, and total U.K. Clothing and Home Sales declined 4.8%.

Source: Company reports[/caption]

International revenue declined 15.1% (down 1.4% if the impact of the sale and closure of some international stores is excluded). Total group revenues were down 3.9%.

Management Commentary

On the management call, CEO Steve Rowe noted that the third quarter was “challenging.” He said that “market conditions were tough, particularly in November when footfall and online visits both dropped significantly,” he said. Rowe said the sales growth was in line with the company’s expectations and was “steady” in the first half. The company reduced inventory volumes, resulting in 25% less stock going into the December sale. Rowe pointed to an increase in sales of entry-level clothing products, saying “customers are looking for value, and we're providing that.” The company lowered prices on 227 food products and stripped out “complex and confusing” promotions.

In the company’s trading update, management highlighted that performance remained steady across the period amidst difficult market conditions. Declines in Clothing and Home were compounded by lower footfall to stores, partly due to the increasing pace of store closures. Online sales increased 14%, driven by improvements to the proposition and operations. In the Clothing and Home division, the company said it is in the early stages of far-reaching changes in range, style, customer focus and channel mix.

In Food, management noted that the customers responded well to its Christmas ranges and promotions leading to solid volume growth over the Christmas period, with most Food stores delivering comparable sales growth. The Food division showed early signs of volume growth.

Outlook

The company maintained FY19 guidance given at the half-year:

Source: Company reports[/caption]

International revenue declined 15.1% (down 1.4% if the impact of the sale and closure of some international stores is excluded). Total group revenues were down 3.9%.

Management Commentary

On the management call, CEO Steve Rowe noted that the third quarter was “challenging.” He said that “market conditions were tough, particularly in November when footfall and online visits both dropped significantly,” he said. Rowe said the sales growth was in line with the company’s expectations and was “steady” in the first half. The company reduced inventory volumes, resulting in 25% less stock going into the December sale. Rowe pointed to an increase in sales of entry-level clothing products, saying “customers are looking for value, and we're providing that.” The company lowered prices on 227 food products and stripped out “complex and confusing” promotions.

In the company’s trading update, management highlighted that performance remained steady across the period amidst difficult market conditions. Declines in Clothing and Home were compounded by lower footfall to stores, partly due to the increasing pace of store closures. Online sales increased 14%, driven by improvements to the proposition and operations. In the Clothing and Home division, the company said it is in the early stages of far-reaching changes in range, style, customer focus and channel mix.

In Food, management noted that the customers responded well to its Christmas ranges and promotions leading to solid volume growth over the Christmas period, with most Food stores delivering comparable sales growth. The Food division showed early signs of volume growth.

Outlook

The company maintained FY19 guidance given at the half-year:

- U.K. Clothing & Home space reduction of 4%.

- U.K. capital expenditure of £300–£350 million.

- U.K. Clothing & Home gross margin flat to up 50 bps.

- U.K. Food gross margin flat to (50) basis points.