3Q18 Update

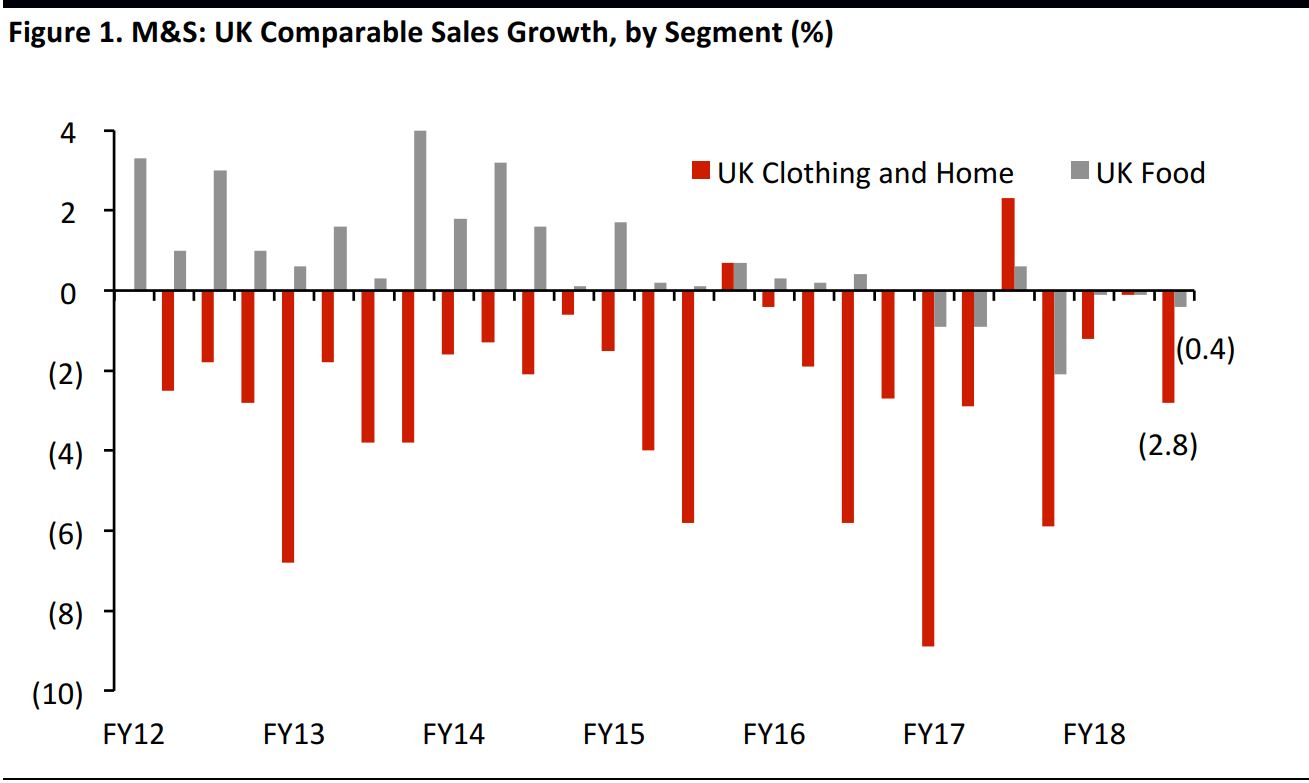

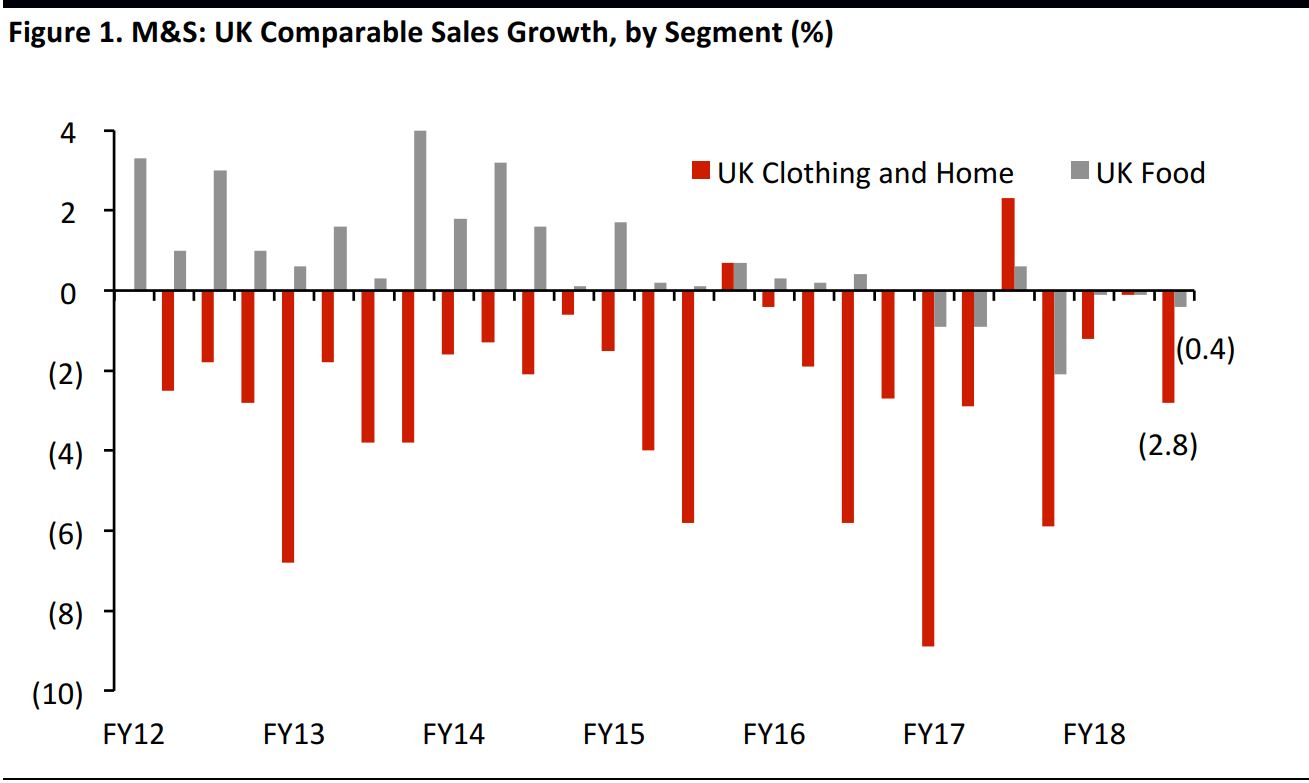

Food, clothing and homewares retailer M&S reported weakening growth in 3Q18, ended December 30. The company’s core UK segments reported the following underlying performances:

- The UK Clothing and Home segment reported a comp decline of 2.8% in 3Q18, down from a 0.1% fall in the prior quarter. 2Q18 comp results were unusual for being almost flat following a period of declines, as we chart below.

- The UK Food segment reported a comp decline of 0.4% in 3Q18, also down from a decline of 0.1% in the prior quarter and in the context of an inflationary UK grocery market. Major grocery retailers such as Tesco, Sainsbury’s and Morrisons reported solidly positive comp growth earlier this week.

Through 3Q18

Source: Company reports

Total UK comp growth came in at (1.4)% in 3Q18. Total group sales were down 0.1%, with international sales down 9.8% in constant currency, reflecting planned closures in some countries. Online sales were up by only 3.0% in the quarter.

CEO Steve Rowe said, “M&S had a mixed quarter, with better Christmas trading in both businesses going some way to offset a weak clothing market in October and ongoing underperformance in our Food like-for-like sales.” In clothing, Rowe pointed to “the impact of an unseasonal October,” which resulted in a revenue decline and meant that M&S carried more stock into its December sale.

- For more on M&S’s five-year turnaround plan, please see our coverage of the company’s 1H18 results.

Outlook

M&S’s full-year guidance remains unchanged. At the half-year point, management provided the following guidance for FY18, which closes at the end of March 2018:

- Food: an approximate 5% increase in space and a decrease of 75–125 basis points in gross margin.

- Clothing and Home: an approximate 1.5% decrease in space and an increase of 25–75 basis points in gross margin.

- An increase of 2.5%–3.5% in UK operating costs.

- Capital expenditure of £300–£350 million.

For FY18, analysts expect M&S to increase revenue by 1.0%, to £10.73 billion. The consensus estimate calls for EBIT to fall by 4.0% and for adjusted pretax profit to fall by 5.9%. Analysts expect M&S to generate GAAP EPS of 22.7 pence in FY18, versus 7.2 pence in the prior year. These estimates were collated before the latest results announcement.

The company will report full-year results on May 23.