Source: Company reports/Coresight Research

1H19 Results

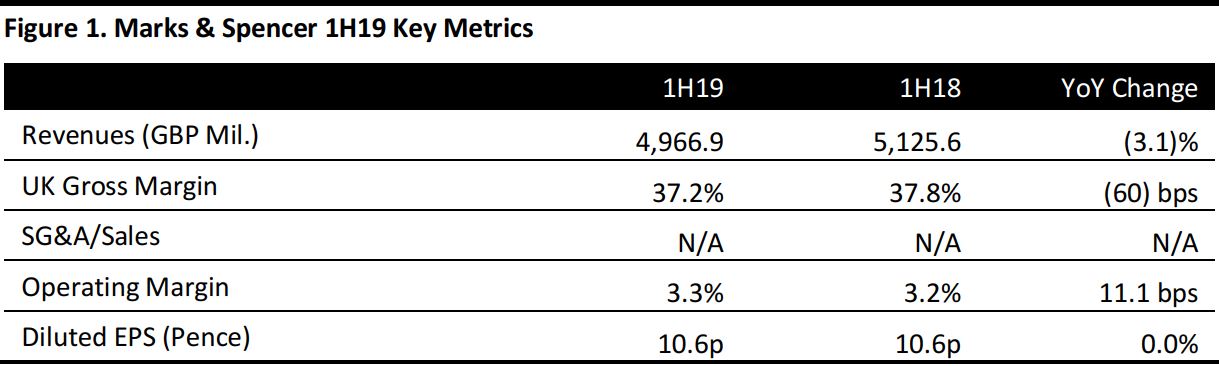

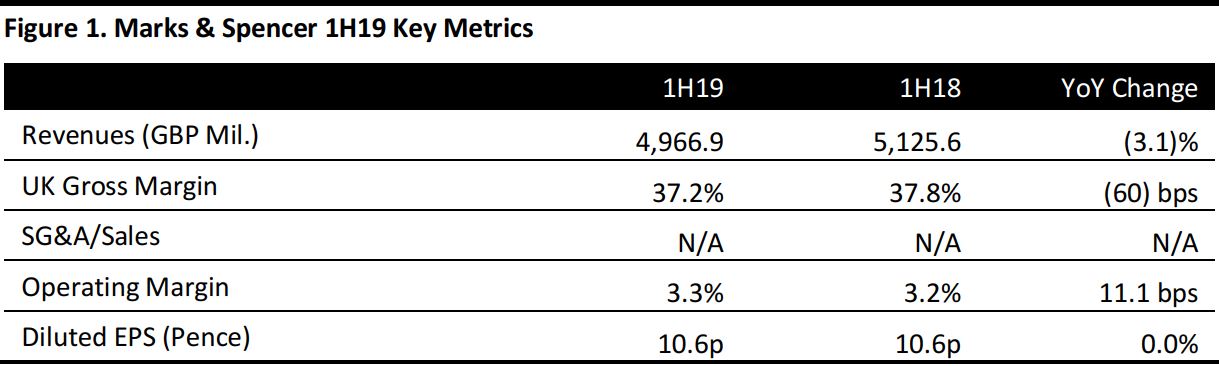

Food, clothing and home retailer M&S reported a mixed 1H19, with improvements in operating margins and net profit but an unexpectedly weak top-line performance in its previously faster-growing UK Food segment.

The company’s closely watched UK segments reported the following:

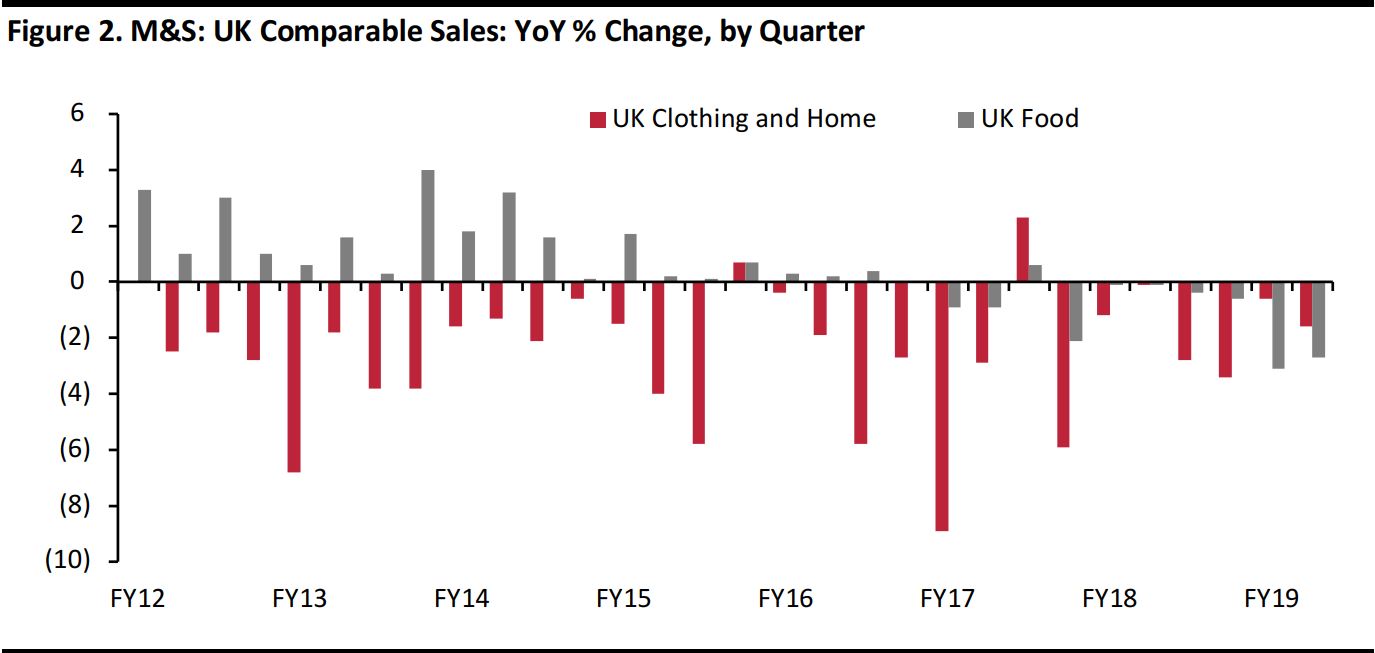

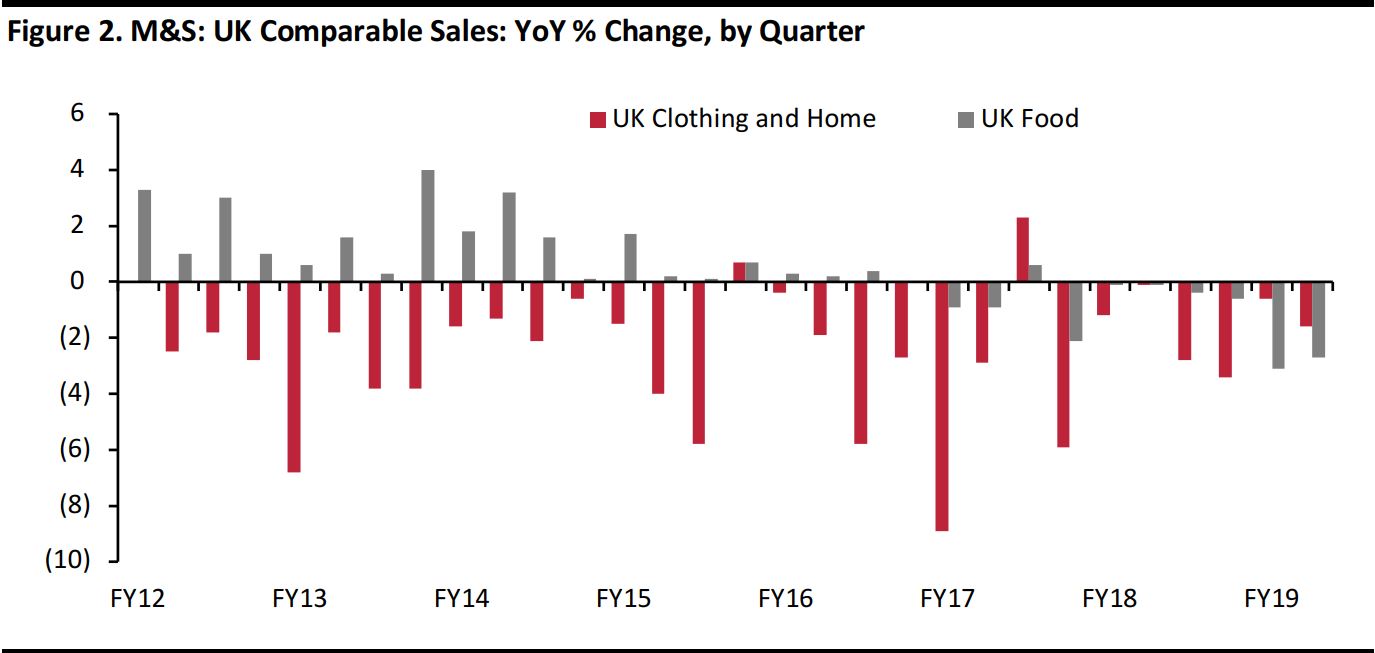

- UK Clothing & Home comparable sales were down 1.1% in the first half, versus consensus of a 1.7% decline according to StreetAccount and an improvement on a number of recent periods (see chart below) including the 1.9% decline reported in FY18. The 1H19 comp was split (0.6)% in 1Q19 and (1.6)% in 2Q19.

- UK Food comparable sales were down 2.9% in the first half, well below consensus of a 1.4% decline. The first half comp was split (3.1)% in 1Q19 and (2.7)% in 2Q19.

Source: Company reports/Coresight Research

Management noted that the UK Clothing & Home gross margin was down 20 basis points (bps), with the gross margin impacted by greater sell-through of sale stock. The UK Food gross margin was down 25 bps year over year, impacted by investments in lower prices which were partially offset by reduced spending on promotions.

In 1H19, international sales were down 18.4% in total, primarily due to the sale of its Hong Kong business to a franchise partner. Group revenues were down 3.0% in total.

Adjusted pretax profit came in at £223.5 million, up 2.0% year over year and ahead of the consensus estimate of £200.5 million recorded by StreetAccount. Adjusted net income of £174.3 million was up 0.7% year over year.

Management Commentary

In UK Clothing & Home, management noted that the business “has an ageing customer base, a very wide range, a weak supply chain and an ageing store portfolio.” It aims to reshape its clothing offering by: offering fewer options; buying more stylish and contemporary product in greater depth; and, delivering better value. Management believes that leveraging its strengths in denim, lingerie, back-to-school clothing and workwear will help it tilt its customer base back toward family-lifestage shoppers.

In UK Food, the company is in the early stages of reworking its offering to broaden its appeal and increase frequency of shopping. Management pointed to an over-reliance on promotions and “confusing” multibuy offers in recent years. The company has been lowering the prices on select food items, and management attributed the weak performance in its Food segment, in part, to “the pain of transition.”

Management also noted the following:

- It has transformed its leadership teams, with two-thirds of its most senior business leaders new in the last 18 months.

- It has begun restructuring to become a simpler accountable group of businesses. “The embedded M&S culture is siloed, slow and hierarchical,” noted management.

- Its efforts in becoming a digital-first leader include appointing a Chief Digital & Data Officer. It has taken “very early steps” to improve its website, but the website and its online fulfillment capability “remain well behind” those of competitors.

- The company is on track to close over 100 full-line stores and has closed 29 such stores in the UK.

- It is making “good progress” on cost savings.

- Its supply chains in Clothing & Home and Food are “well short of state of the art” and this has impacted on availability, markdowns and waste. It is undertaking “comprehensive programs” to implement end-to-end changes.

- The international business is emerging from a fundamental reshaping.

Outlook

Management noted that trading conditions remain challenging and offered the following updates to guidance for FY19:

- UK Clothing & Home space reduction of 4% (from 5% previously).

- UK Capital expenditure of £300–£350 million (versus £350–£400 million previously).

Management reiterated the following guidance for FY19:

- UK Clothing & Home gross margin flat to up 50 bps.

- UK Food gross margin flat to (50) basis points.

For FY19, analysts expect the company to report revenues down 1.1% in total and adjusted pretax profit down 6.2%.