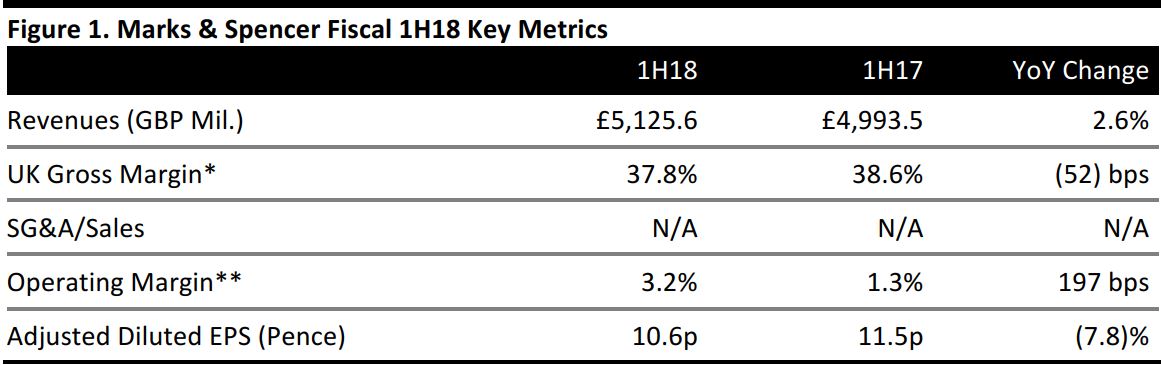

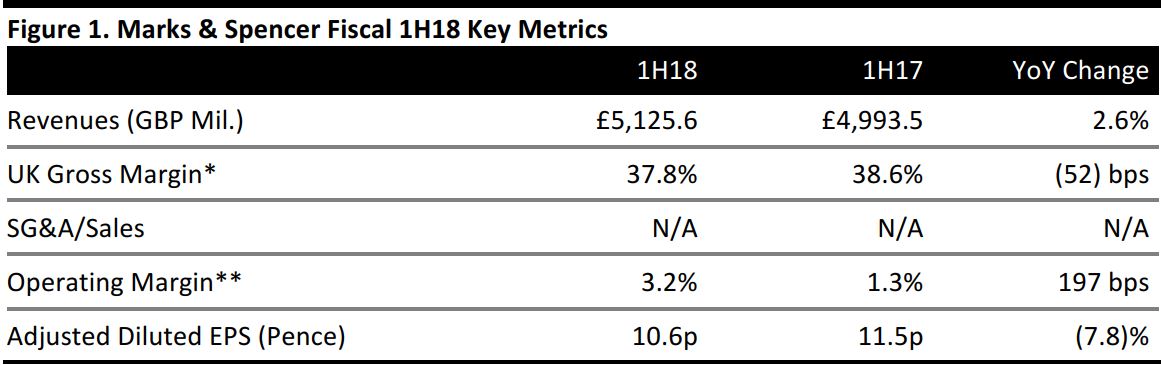

*Marks & Spencer does not report gross profit at a group level.

**Based on statutory operating profit.

Source: Company reports/FGRT

Fiscal 1H18 Results

Food, clothing and home retailer M&S reported robust half-year results that beat expectations on the bottom line. The company’s Clothing and Home segment turned in stronger-than-expected underlying growth and gross margins, which helped overall performance.

The company reported 1H18 group revenues of £5.13 billion, up 2.6% year over year and versus consensus expectations of £5.10 million.

The two most closely watched segments reported the following underlying performances:

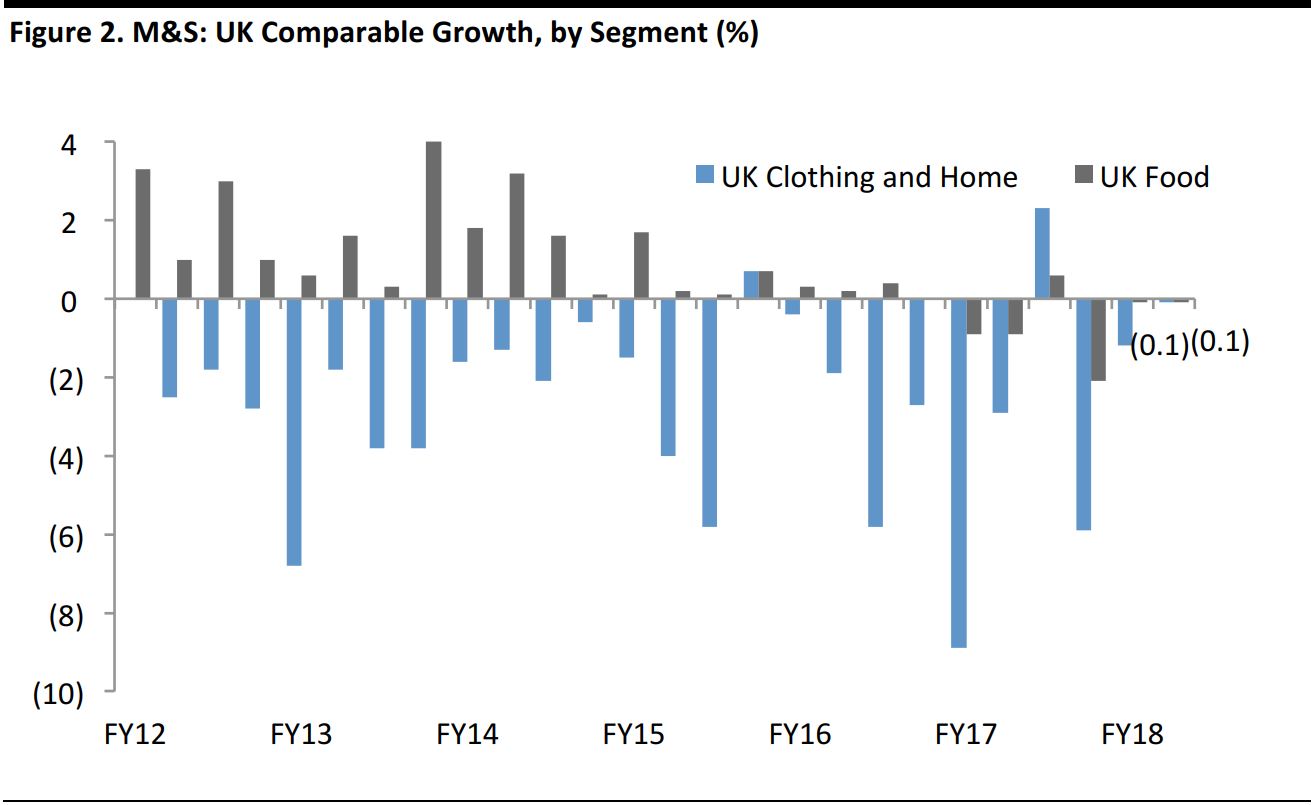

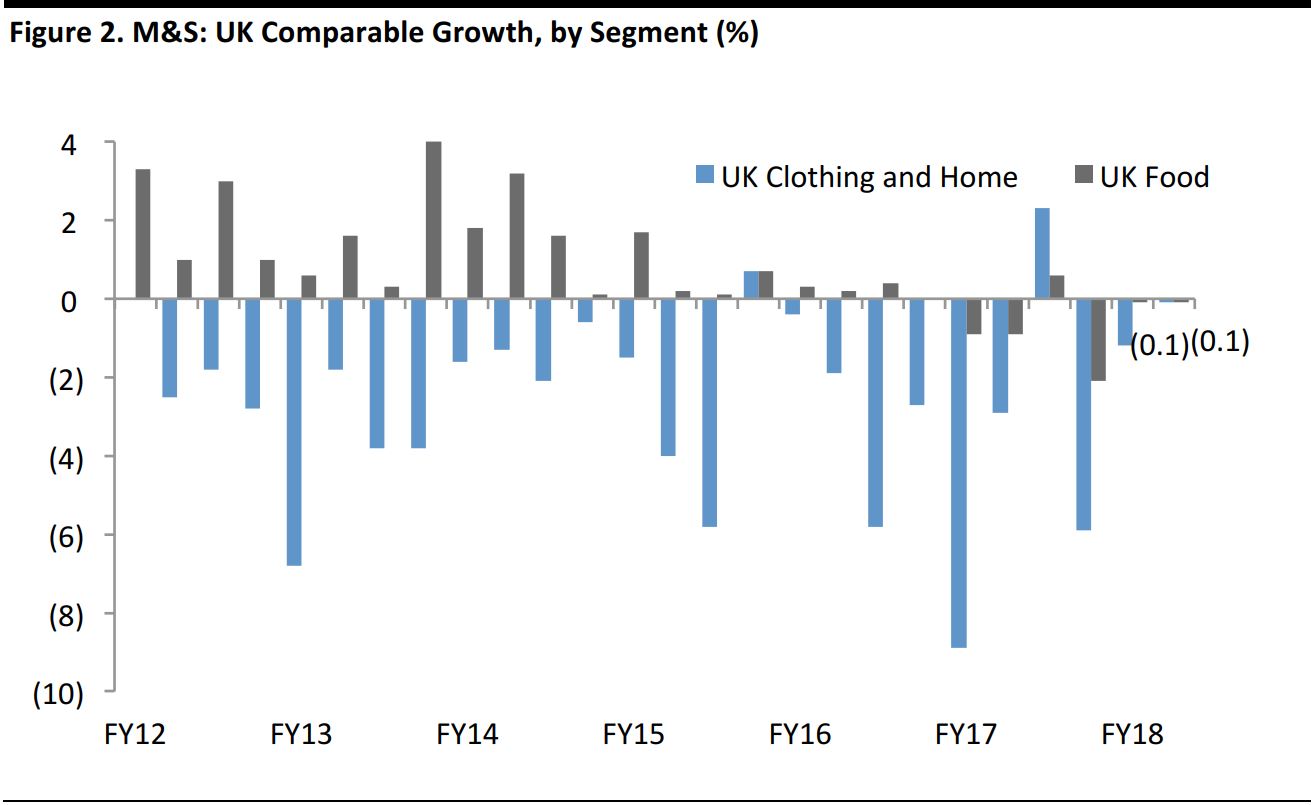

- The UK Clothing and Home segment reported comparable sales growth of (0.7)% in 1H18, split as (1.2)% in 1Q18 and (0.1)% in 2Q18. This segment has struggled to achieve underlying sales growth,and near-flat growth in the second quarter represents a significant sequential improvement.

- The UK Food segment reported comp growth of (0.1)% in 1H18, split evenly as (0.1)% in 1Q18 and (0.1)% in 2Q18. The performance was weak relative to a grocery market that is seeing inflation of around 3% and for a company segment that had outperformed the grocery market for a number of years.

The chart below shows the long-term performance of these segments, underscoring the relative strength of Clothing and Home and the weakness of Food in 2Q18.

Through 2Q18

Source: Company reports

Total UK comp growth came in at (0.3)% in 1H18. This was split as (0.5)% in 1Q18 and (0.1)% in 2Q18.

Helped by new Food store openings, M&S grew total UK sales by 2.7% in 1H18. International sales were up 2.3% as reported, but fell by 3.1% at constant exchange rates.

M&S delivered 1H18 adjusted operating profit of £266 million, down 1.0% year over year and ahead of consensus expectations of £241 million. Adjusted diluted earnings per share of 10.6 pence beat consensus expectations of 9.69 pence.

The company noted a decline of 130 basis points in the Food segment gross margin,to 31.3%, as M&S absorbed significant input cost inflation. Gross margin in Clothing and Home was up 140 basis points,to 58.1%, and came in ahead of expectations due to M&S improving its planning process to unlock better buying rates. The gross margin benefited from a planned reduction in promotions, too. In sourcing, M&S tendered a higher proportion of Clothing and Home orders and moved business to lower-duty locations.

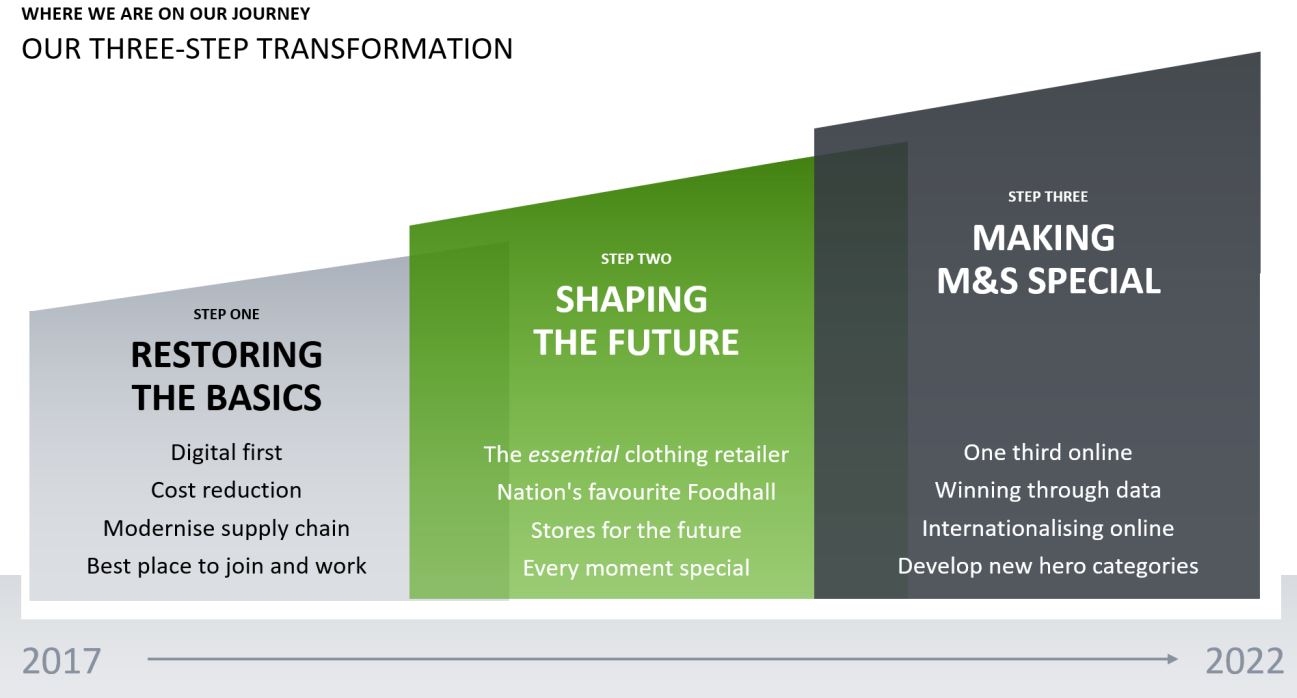

Accelerating the Transformation Strategy

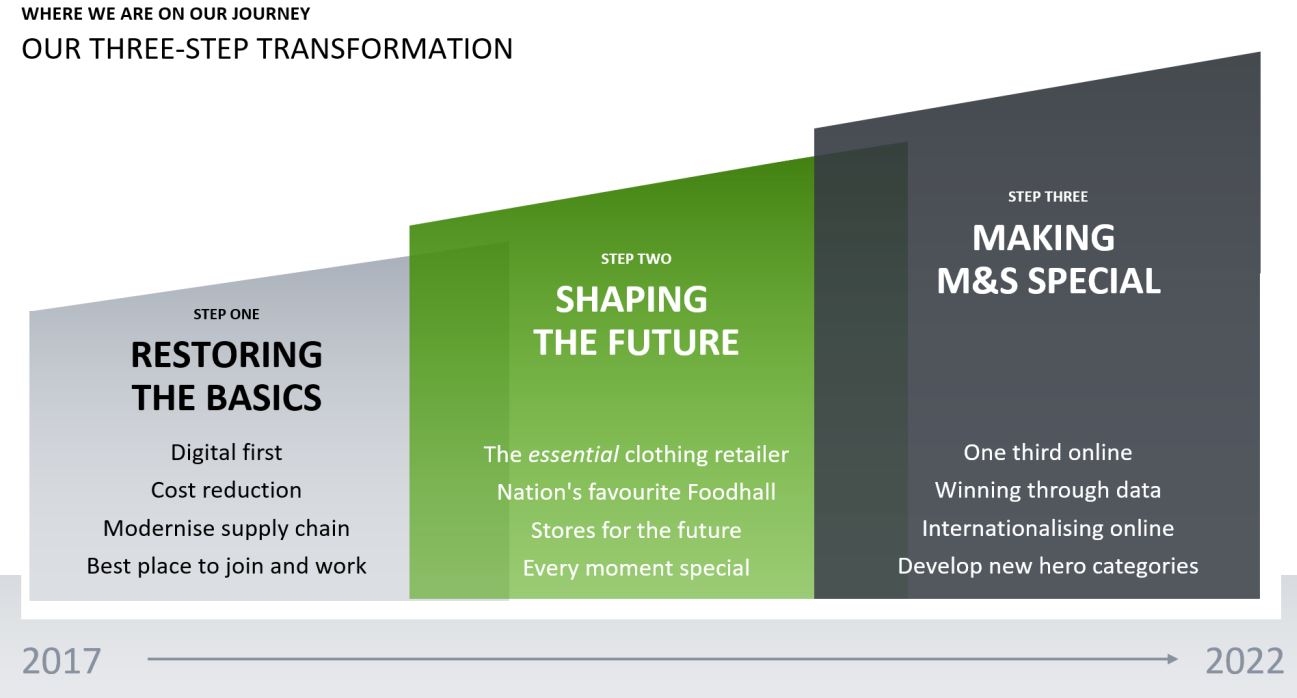

The FGRT team attended the company’s analyst presentation, at which M&S management announced a new five-year transformation plan designed to “make M&S special again.” This includes:

- Focusing on becoming “the UK’s essential clothing retailer.” CEO Steve Rowe said that he wants M&S to “regain its heritage as a value and volume retailer” by lowering prices.

- Accelerating the company’s UK Clothing and Home space rationalization plan. M&S had already announced plans to close, relocate or downsize 105 stores.

- Repositioning M&S’s Food business, which includes slowing the opening rate of Simply Food stores.

- Becoming a digital-first organization, with the aim of generating one-third of Clothing and Home sales online by 2022. Currently, 18% of Clothing and Home sales are made online.

- Reducing the cost base to become a lower-cost retailer.

Rowe said that M&S is currently at the stage of “putting out the fires” in its new five-year plan, and that it will move on to “restoring the basics.” Investors, analysts and observers may question why there are “fires” to put out, given that the company’s previous CEO, Marc Boll and,had implemented a three-year plan designed to transform M&S’s operations, and fortunes, between 2010 and 2013.

M&S’s new five-year transformation plan

Source: Company reports

Outlook

Management provided the following guidance:

- Food: an approximate 5% increase in space and a decrease of 75–125 basis points in gross margin.

- Clothing and Home: an approximate 1.5% decrease in space and an increase of 25–75 basis points in gross margin.

- An increase of 2.5%–3.5% in UK operating costs.

- Capital expenditure of £300–£350 million.

For the current fiscal year, analysts expect M&S to grow revenues by 1.5%, to £10.8 billion. Consensus calls for EBIT to decline by 5.3% and for M&S to turn in full-year adjusted diluted EPS of 28.09 pence versus 30.20 pence in the prior year.