*Not disclosed at group level.

Source: Company reports/Fung Global Retail & Technology

1H17 RESULTS

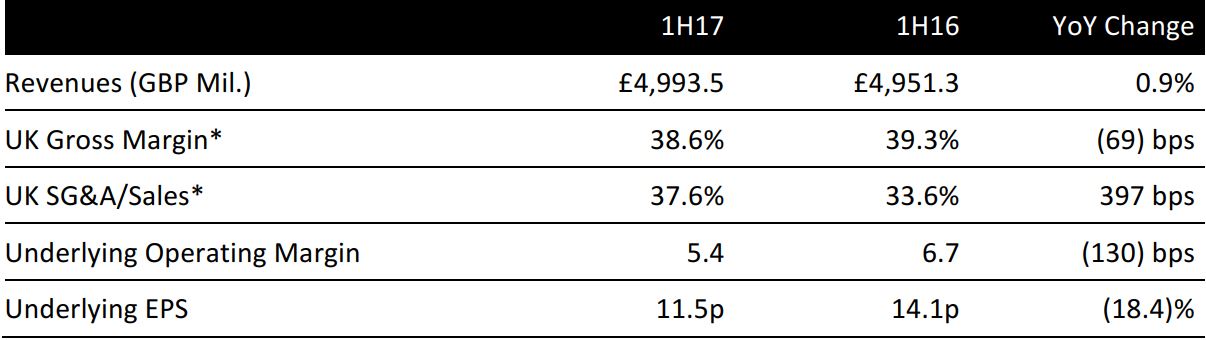

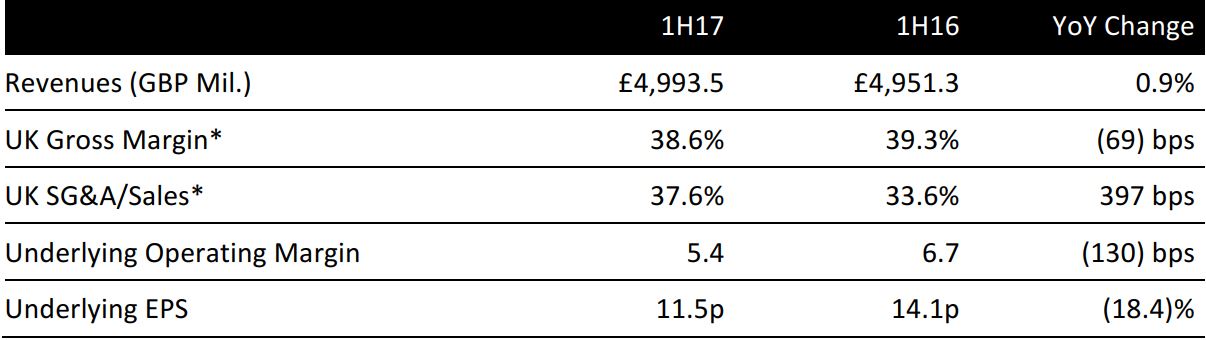

For 1H17, M&S beat consensus estimates on the top and bottom lines, but it was once again a story of falling comparable sales. The company reported total sales growth of 0.9%, total UK sales growth of 0.1% and total International sales growth of (1.0)% (at constant currency). Group revenue of £4,993.5 million came in above analysts’ expectations of £4,968.6 million.

UK comparable sales fell 3.0%, pulled down by a 5.9% fall in comps in the Clothing and Home division, mitigated somewhat by a 0.9% decline in comps in the Food division.

The closely watched Clothing and Home segment reported a sequential improvement in comps from (8.9)% in 1Q17 to (2.9)% in 2Q17. Food posted comps of (0.9)% in both 1Q17 and 2Q17, although M&S claimed this was a “continued good performance.”

Underlying operating profit declined 18.8% to £269 million. However, after exceptional items of £206 million, including a £154 million cost of changes to pay and pensions, operating profits slumped to £62.5 million.

Also including these one-off costs, profit before tax fell 88% to £25.1 million, while net profit fell 91% to £15.9 million.

Diluted EPS fell from 10.4 pence one year ago to 1.0 pence in 1H17. Underlying diluted EPS, which excludes the charges mentioned above, fell from 14.0 pence one year ago to 11.5 pence in 1H17; this was ahead of analysts’ expectations of 10 pence.

STRATEGIC UPDATE

M&S announced further changes to its business, as it seeks to turnaround performance:

- It will close all company-owned stores in 10 overseas markets: France (7 stores), Belgium (1), Estonia (2), Hungary (6), Lithuania (1), China (10), Netherlands (2), Poland (11), Romania (6) and Slovakia (7). It retains a company-owned presence in Ireland, Hong Kong and the Czech Republic, as well as joint ventures in India and Greece, and will continue to operate elsewhere through franchising. In FY16, company-owned international stores delivered a loss of £31.5 million.

- Over the next five years, M&S will reduce UK full-line store numbers by a net 60, resulting in a 10% fall in its Clothing and Home space; the company currently operates 304 full-line stores in the UK. Around 30 of these 60 stores will close, while a further 45 will be downsized or replaced by Simply Food stores, and some new full-line stores will be opened in underserved areas. M&S will continue to grow its Simply Food convenience-store numbers. In total, more than 100 stores, or 25% of UK space, will be impacted by the changes.

- It will rebalance space in the remaining UK Clothing and Home estate, by switching some space to the better-performing Food category. Across the UK division, the proportion of space allocated to Clothing and Home is likely to fall from 65% to 50%.

In addition, M&S had already announced a 10% cut in the number of clothing lines it offers. The company is also lowering prices on some clothing lines, and in its half-year results it noted “strong volume improvements, particular in opening price points.”

Citing Kantar data, M&S claimed its full-price market share increased from 10.7% in the 12 weeks ended September 25, 2015, to 11.1% in the same period this year. It also noted improving customer satisfaction levels, up to 70% in October 206, versus 57% in April 2013.

OUTLOOK

For FY17, the company guided the following:

- Sales will see a similar trend to FY16, when they rose 2.5%.

- Gross margins to change by 0–50 basis points compared to last year.

- Operating costs to be up 3.5%, weighted toward 2H17, as it makes investments in store staffing.

- Capital expenditure to be around £400 million.

For FY17, analysts expect the following:

- Revenues will decline by 0.3% in total.

- EBIT will decline by 12.1%.

- Normalized EPS will fall to 30 pence from 35 pence last year.

The company said that the costs of changing the UK store estate will be around

£50 million per year for the first three years.

CEO Steve Rowe said that M&S does not expect to pass on costs from the depreciating British pound to customers, which suggests the likelihood of some gross-margin compression into FY18.