Web Developers

Marks & Spencer (M&S) has posted an annual increase in pretax profits for the first time since 2011. Underlying pretax profits rose 6.1% to £661 million in the year ending March 28, 2015.

Profits were boosted slightly by an easing back on promotions and more so by greater efficiencies in the sourcing of general merchandise (GM)—mainly clothing, but also housewares. In particular, M&S is pushing for greater direct sourcing, having hired Mark and Neal Lindsey last year to bolster its sourcing capabilities.

At the same time, the company’s UK GM sales saw very modest growth recently, albeit for only one quarter so far. So, some analysts are proclaiming better times ahead for M&S shareholders as a combination of fatter margins and positive sales deliver profit uplifts. Are they right?

We remain unconvinced that a sustained upturn in GM sales has begun. As we discuss in our forthcoming Global Department Stores report, retailers such as M&S that sit at the very core of the midmarket are faltering across a number of Western markets.

We remain unconvinced that a sustained upturn in GM sales has begun. As we discuss in our forthcoming Global Department Stores report, retailers such as M&S that sit at the very core of the midmarket are faltering across a number of Western markets.

M&S is often cited as an outperformer in the grocery market, apparently benefiting from shoppers’ flight to quality and greater demand for convenience. However, the comparable store sales growth charted above is flattered by the maturing of relatively new store space, and M&S has been opening Simply Food convenience stores as it has sought to tap the convenience market. In 2013/2014, for instance, it grew its Simply Food store numbers by 7%, and these maturing stores were included in the comps for the year just reported.

M&S is often cited as an outperformer in the grocery market, apparently benefiting from shoppers’ flight to quality and greater demand for convenience. However, the comparable store sales growth charted above is flattered by the maturing of relatively new store space, and M&S has been opening Simply Food convenience stores as it has sought to tap the convenience market. In 2013/2014, for instance, it grew its Simply Food store numbers by 7%, and these maturing stores were included in the comps for the year just reported.

GM MARGINS IMPROVE, COMPS RECOVER

UK GM Revenues Fall Below Those of Next

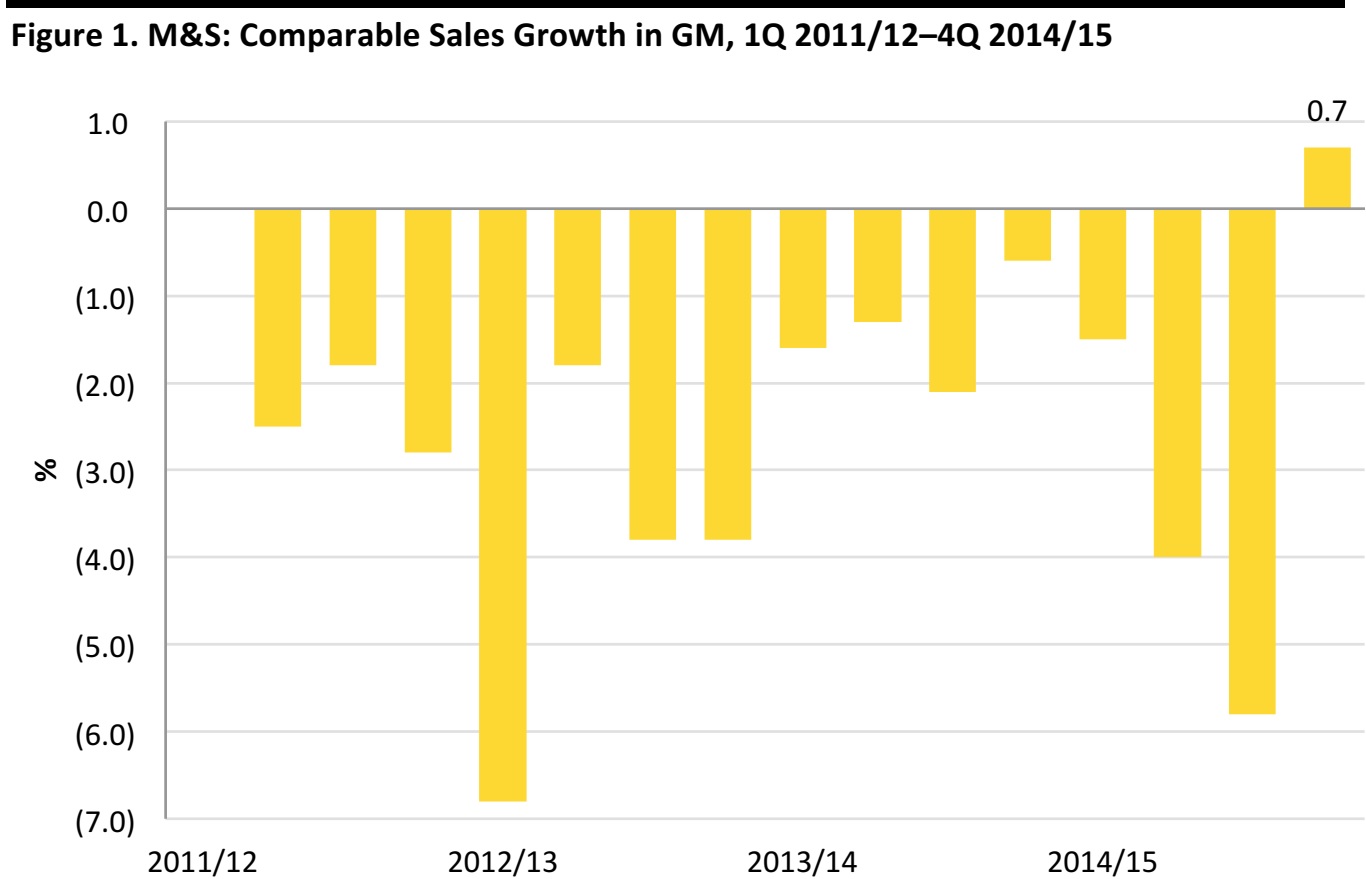

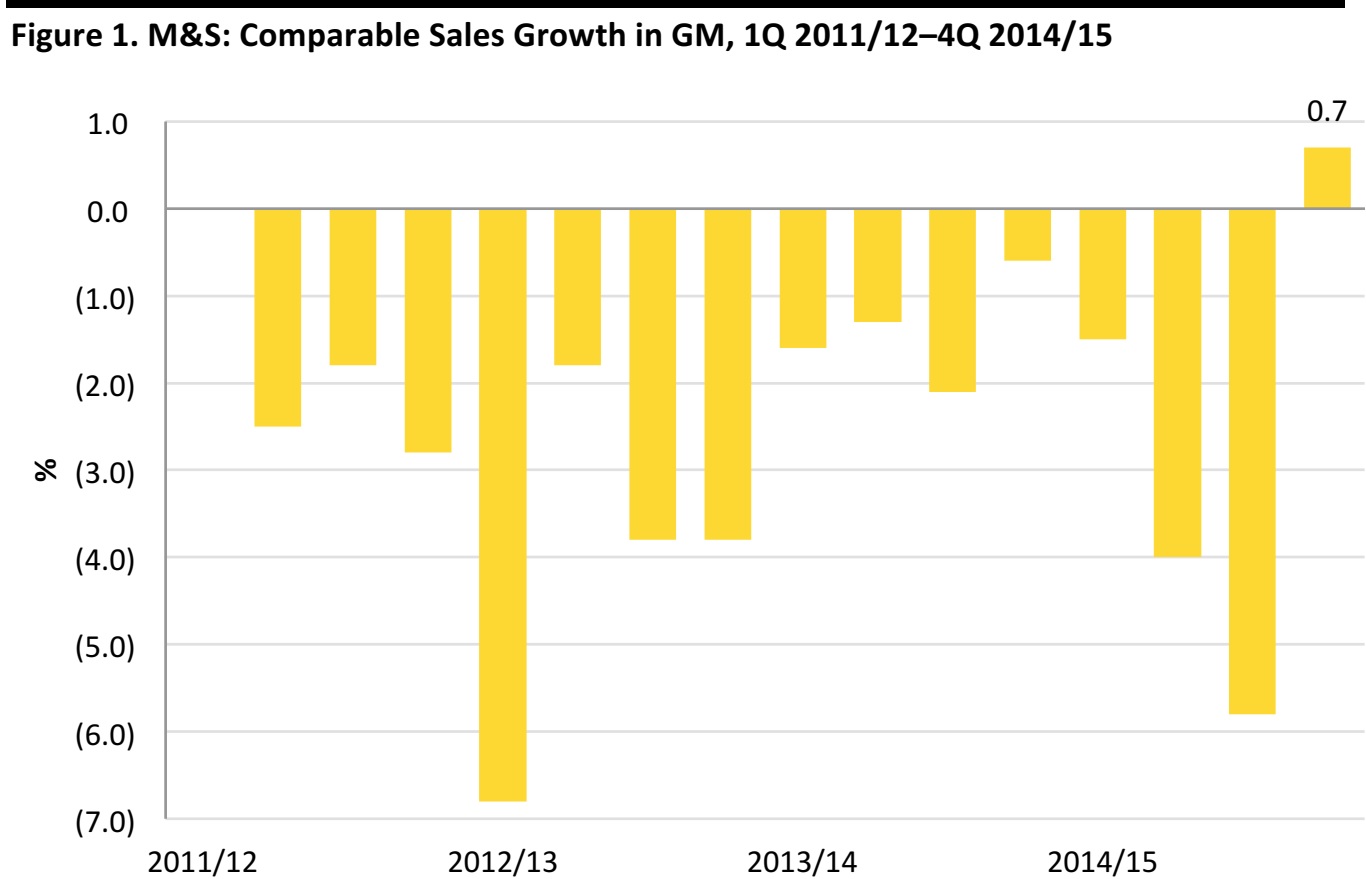

The story for M&S UK GM is one of improving margins but low—if any—sales growth. M&S posted 14 consecutive quarters of declining GM sales before it saw a very modest uptick in its most recent quarterly results. Given the deeply negative performance in previous quarters, it’s far from certain that this is the start of a recovery.

Source: M&S/FBIC Global Retail & Technology

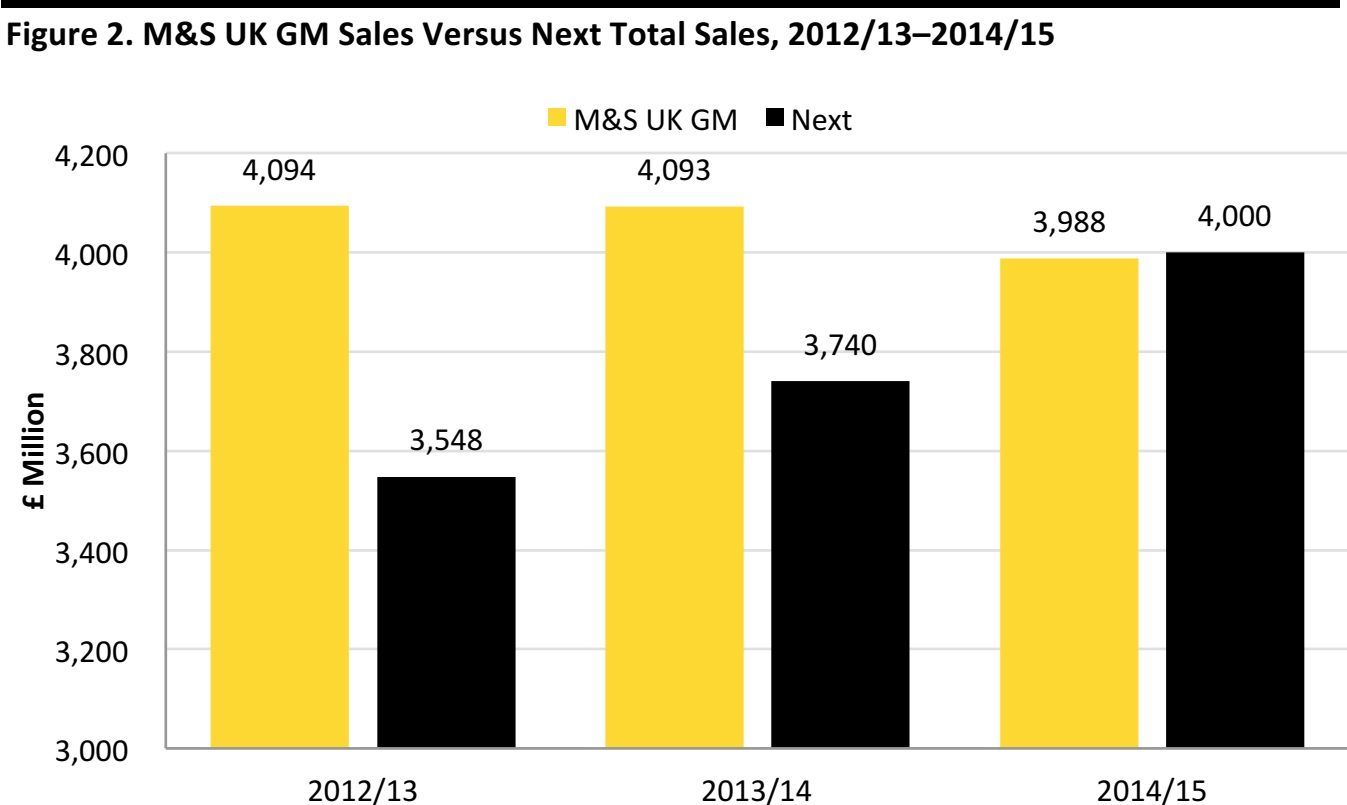

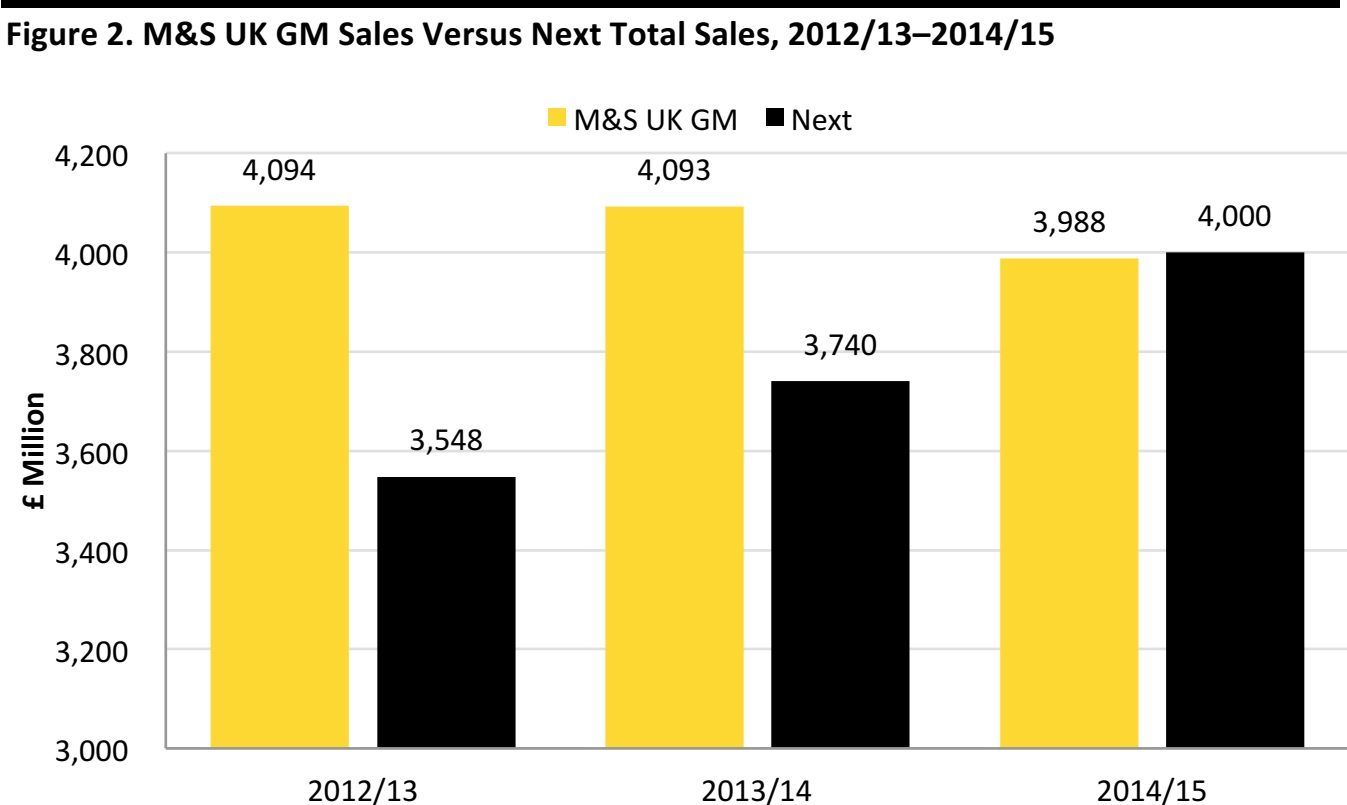

This recent positive growth wasn’t enough to stop M&S’s UK GM sales from falling below total revenues at archrival Next for the first time. This is something of a watershed event in UK retail and one not likely to be reversed in the near future.

Source: M&S/Next/FBIC Global Retail & Technology

CAN M&S REGAIN SALES MOMENTUM?

We remain unconvinced that a sustained upturn in GM sales has begun. As we discuss in our forthcoming Global Department Stores report, retailers such as M&S that sit at the very core of the midmarket are faltering across a number of Western markets.

We remain unconvinced that a sustained upturn in GM sales has begun. As we discuss in our forthcoming Global Department Stores report, retailers such as M&S that sit at the very core of the midmarket are faltering across a number of Western markets.

- We think M&S’s GM store formats look outdated, despite recent investments. Unwieldy and ultimately unfashionable, M&S stores lack the aspirational feel of fashion rivals and department stores and do not position the retailer convincingly as a fashion specialist against the likes of Next.

- M&S’s long-standing position in the very middle of the market, designed to appeal to all, looks to be a vulnerability in an age of greater consumer individuality. More targeted, sometimes niche, players look to resonate with consumers as they shift away from middle-ground uniformity.

- Greater competition has only intensified this. Consumers now have a surfeit of choices, from Primark and Zara to Amazon and Zalando, so generalists such as M&S will struggle to give shoppers reasons to frequent their stores.

FOOD: OUTPERFORMING GM, BUT COMPS FLATTERED BY NEW SPACE

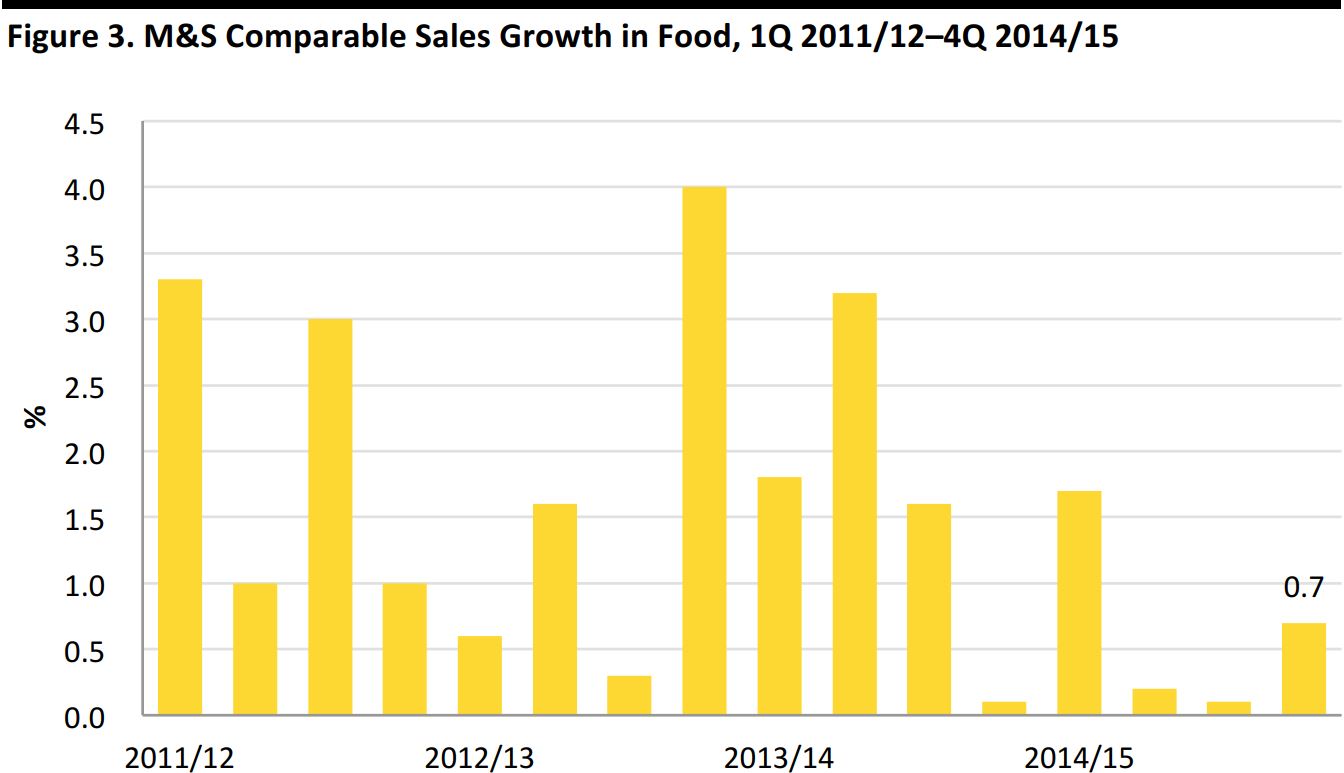

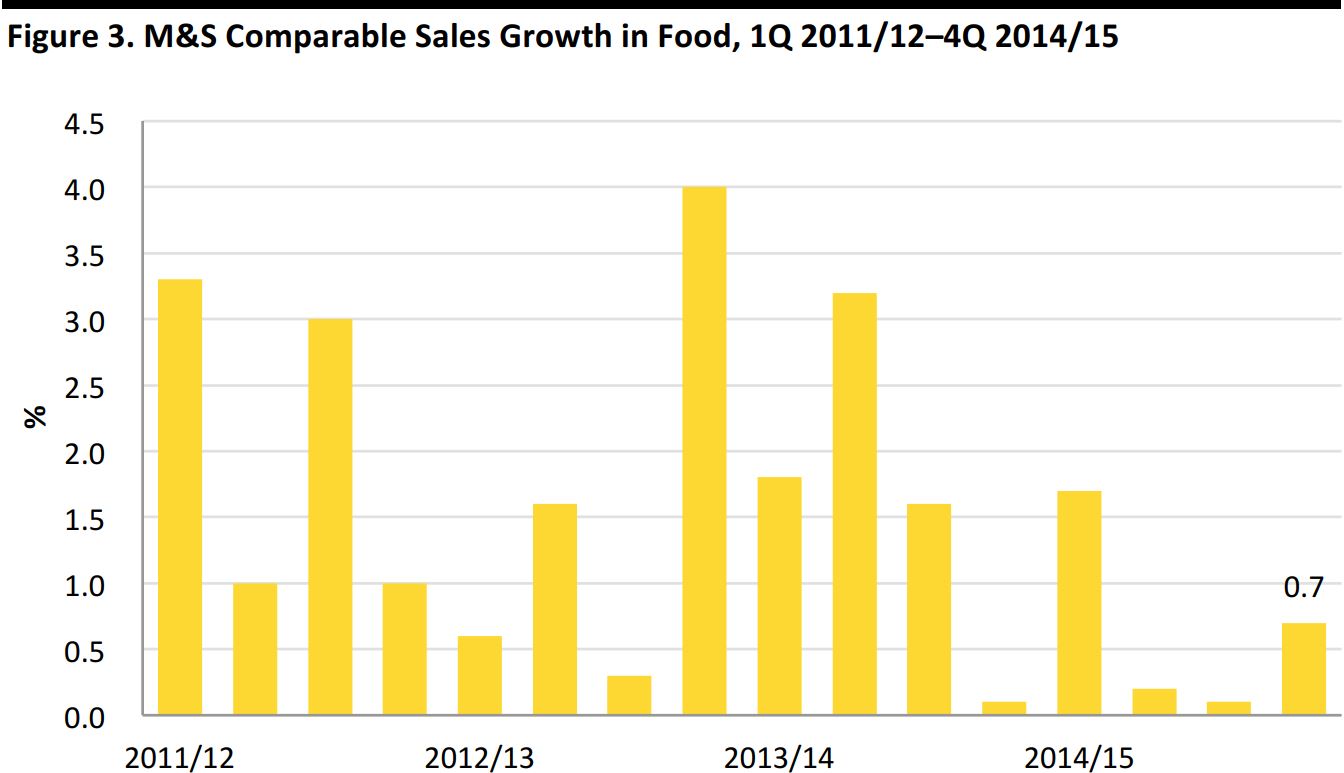

For some time, food has been the savior of M&S’s performance, posting positive comps even as GM sales slumped. Food’s sustained outperformance has been so strong that it now accounts for 57% of M&S’s UK sales, up from 51% in 2009/2010. Recently, comparable growth has weakened, in part due to a softening of input costs and greater price competition.

Source: M&S/FBIC Global Retail & Technology

M&S is often cited as an outperformer in the grocery market, apparently benefiting from shoppers’ flight to quality and greater demand for convenience. However, the comparable store sales growth charted above is flattered by the maturing of relatively new store space, and M&S has been opening Simply Food convenience stores as it has sought to tap the convenience market. In 2013/2014, for instance, it grew its Simply Food store numbers by 7%, and these maturing stores were included in the comps for the year just reported.

M&S is often cited as an outperformer in the grocery market, apparently benefiting from shoppers’ flight to quality and greater demand for convenience. However, the comparable store sales growth charted above is flattered by the maturing of relatively new store space, and M&S has been opening Simply Food convenience stores as it has sought to tap the convenience market. In 2013/2014, for instance, it grew its Simply Food store numbers by 7%, and these maturing stores were included in the comps for the year just reported.

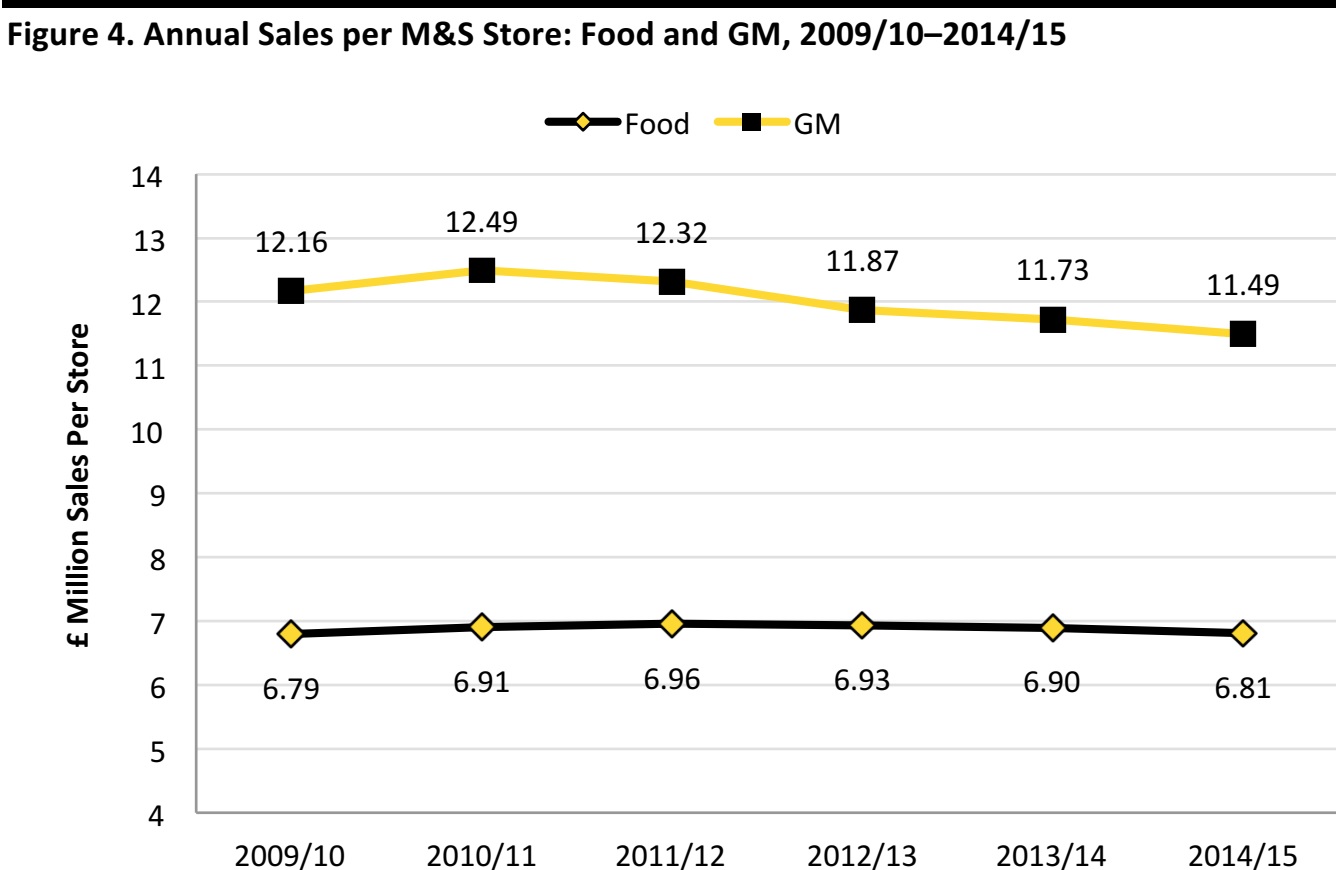

UNDERLYING GROWTH: GM SALES PER STORE FALL £1 MILLION IN FOUR YEARS

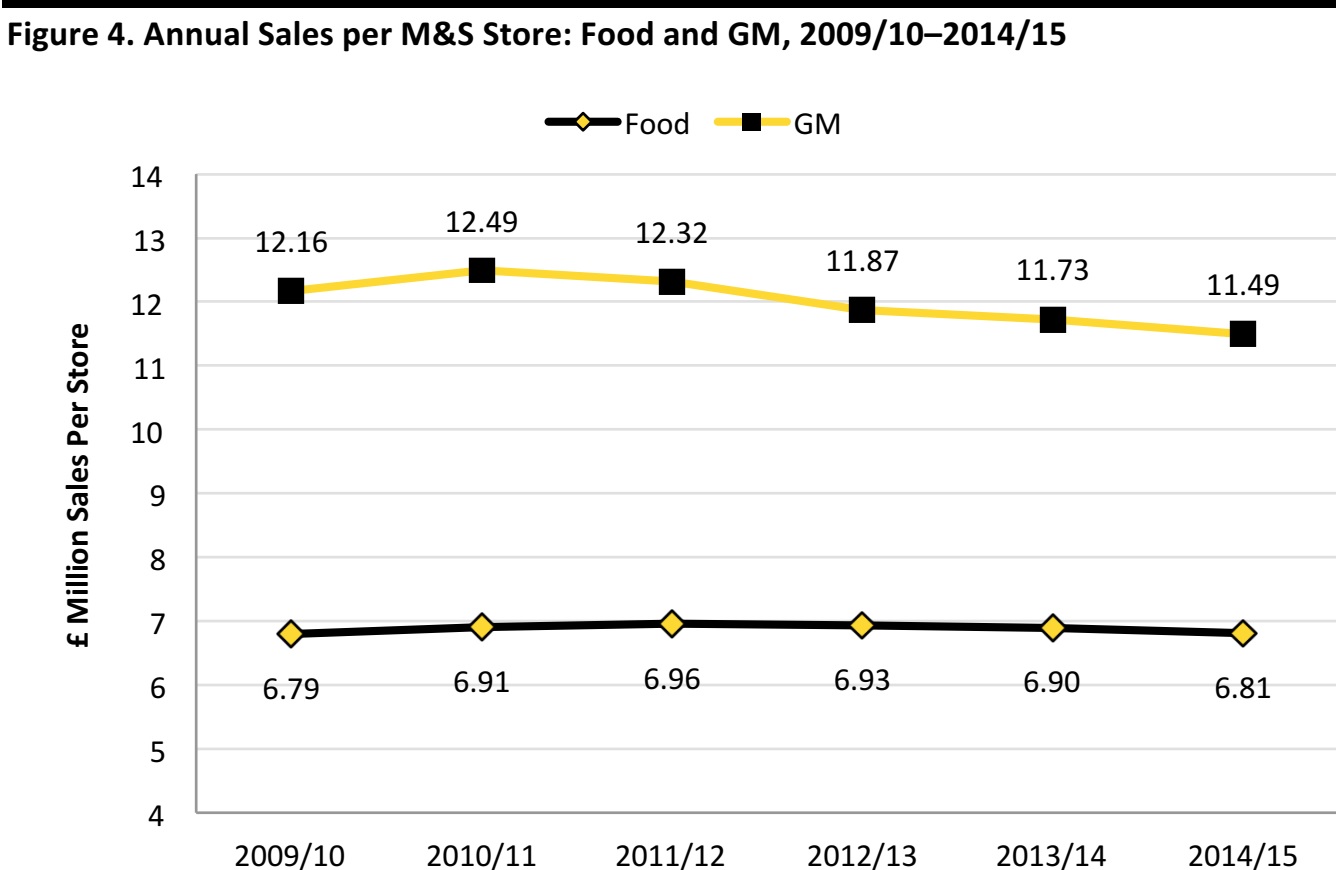

Average sales per store is another means of viewing underlying growth. By this measure, M&S’s annual sales per store in food have declined for the past three years as new stores have been opened. The underperforming GM division has seen much more dramatic falls: the average M&S GM store is now selling £1 million less per year than it was four years ago. Moreover, these figures do not strip out online sales, so real revenues transacted in store are likely to be lower.

Sales per store were calculated using totals for stores that sell food and GM, respectively, and using average annual store numbers. Source: M&S/FBIC Global Retail & Technology

THE OUTLOOK

- Some analysts are proclaiming better times ahead for M&S shareholders, as a combination of fatter margins and the return of positive sales in GM should boost profits.

- The bottom line may well be strengthened by margin gains in clothing, but we remain skeptical that sustained top-line momentum will be forthcoming, given the competitive threats in the clothing category. And bolstering profits amid falling sales is not the recipe for a sustainable business.

- Crucially, the competitive threats—from specialists and pure plays—look most likely to steal customers from the younger end of M&S’s customer base, leaving the retailer with long-term problems of customer renewal.