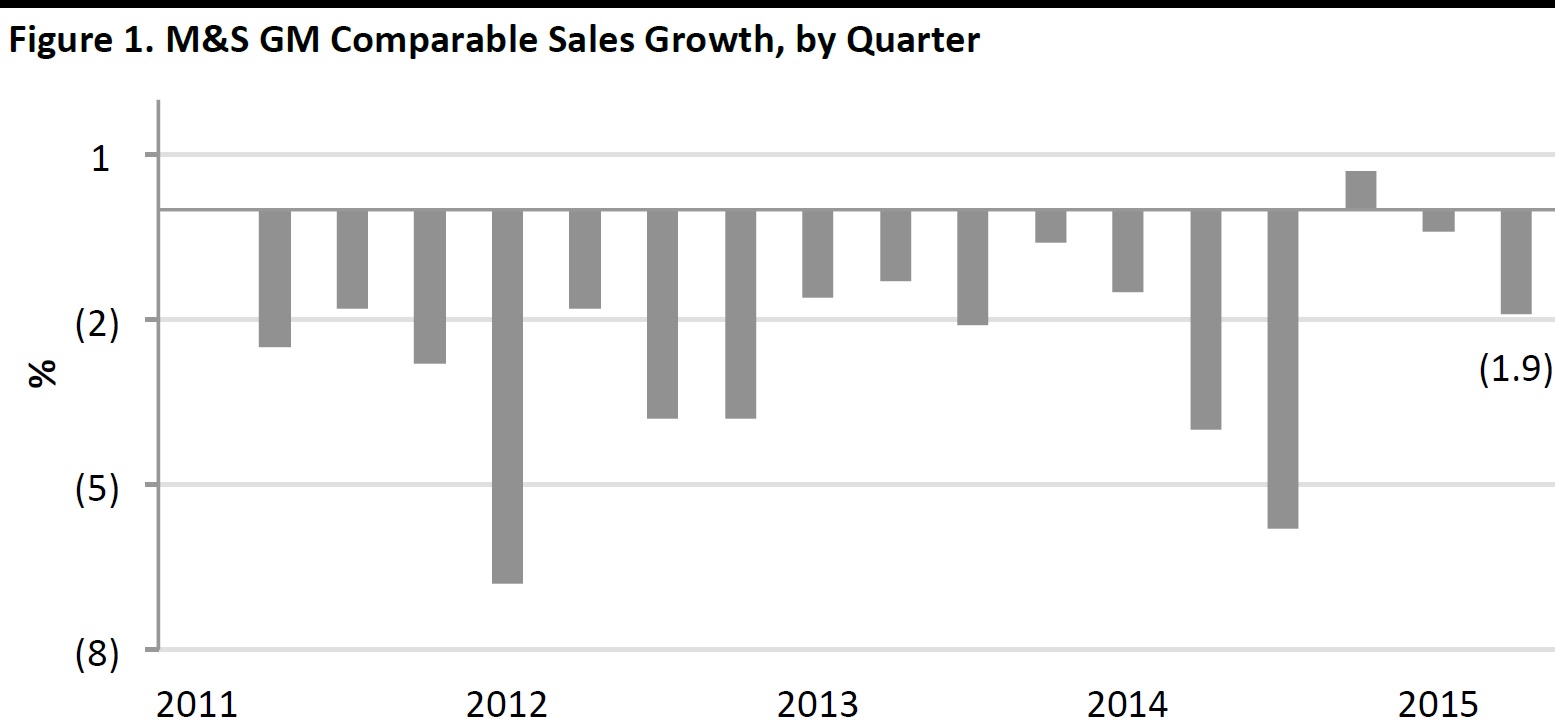

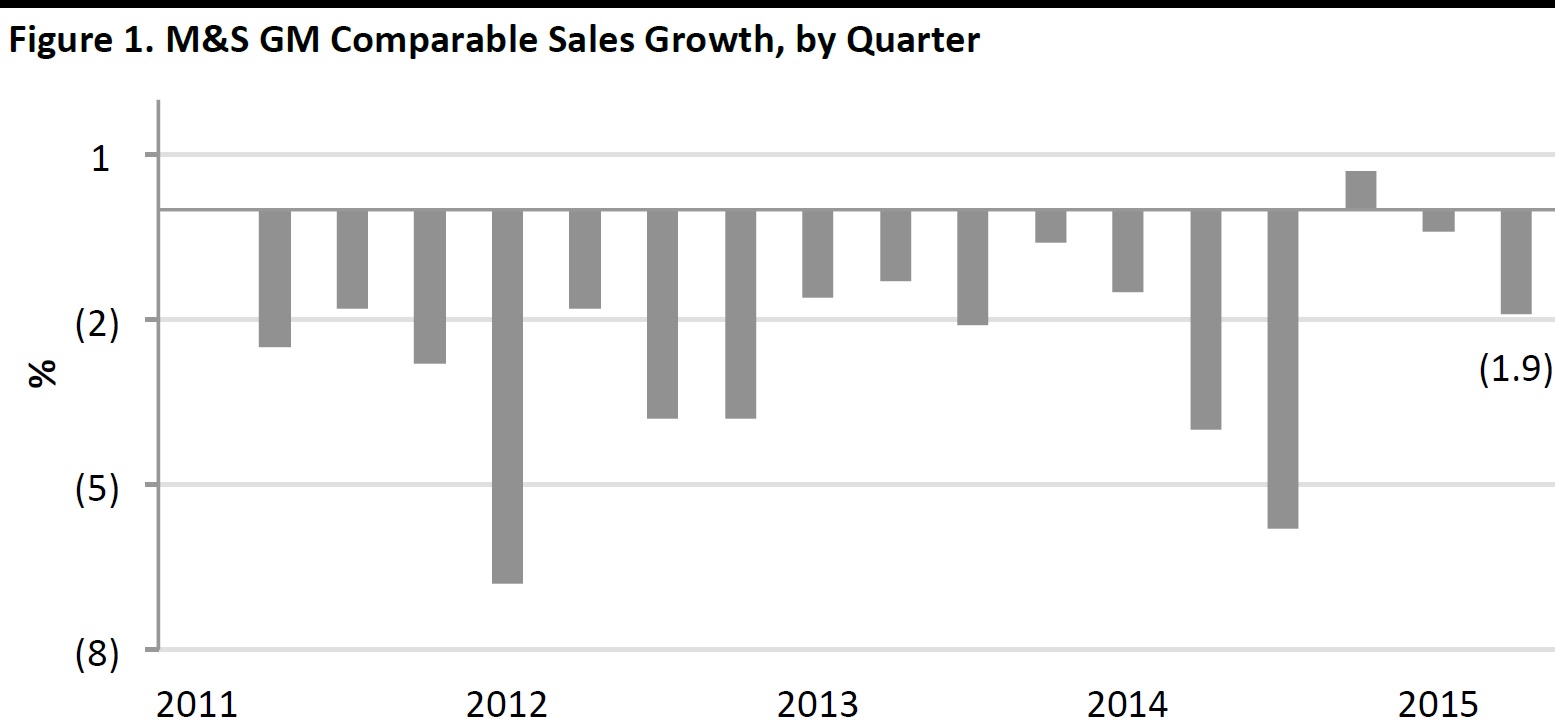

General Merchandise Disappoints Yet Again

First-half results dashed hopes that M&S could build on the positive growth in general merchandise (GM) that it posted six months earlier. M&S said that “unseasonal conditions,” coupled with reduced discounting, contributed to a weaker GM performance in the first half.

In the company’s results presentation, CFO Helen Weir noted that this “unseasonal” hit principally affected first-quarter results—yet GM performance was stronger in the first quarter than in the second quarter, which means the weather cannot be the principal reason for this first-half decline. The company had attributed weak performance in the comparable period of fiscal year 2014 to unseasonable conditions, too, and these undemanding comparatives should have been a base for growth.

While M&S remains the UK’s top apparel retailer, it is hard to deny its declining relevance—it is a midmarket behemoth losing share to more specialized, more focused retailers.

Source: M&S

The growth story for GM was yet again in gross margin, as M&S has been reworking its supply chain. The 285-basis-point gain in gross margin led the company to raise its full-year guidance for margin gains to 200–250 basis points.

The gain in gross margin is the reward for investors who have seen disappointing top-line growth in GM. But we think the company should take a longer-term view, and that more of these gains should be passed on to customers in the form of lower prices. The current strategy is for M&S to cut costs on sourcing without delivering those savings to its shoppers. While this benefits investors, we think it is shortsighted: it means the company may fail to deliver value for money and, in turn, see decreased volume sales and shopper loyalty.

Food: “Strong Performance,” but Weak Comps

M&S Food performed more strongly, with sales growth of 3.3%, which was helped by the opening of 32 new Simply Food stores. The division saw comps of 0.2% during the period, in the context of a deflationary grocery sector. But it was an unexceptional performance, particularly in light of CEO Marc Bolland’s emphasis that M&S Food’s “specialist positioning” sets it apart from all the regular supermarkets that are currently engaged in price wars. Food gross margin slipped 25 basis points due to extra wastage from poor summer weather.

International: Hit by External Factors

International sales were down 5.1% in British pounds (down 0.9% on a constant-currency basis). The company attributed this to two external factors: currency effects, as the pound had strengthened versus the euro, and macroeconomic issues in Turkey, Ukraine, Russia and the Middle East. The international business contributes just 10% of sales at M&S, so UK GM and UK food are by far the most important segments in driving revenues and profits.